Bitfarms is raising $500 million through convertible notes, but the move sent its stock tumbling more than 18 percent in a single day.

Key Takeaways

- Bitfarms priced a $500 million convertible senior notes offering due 2031, up from the initial $300 million plan.

- The notes convert at $6.86 per share, a 30 percent premium over Bitfarms’ closing price of $5.28 on October 16.

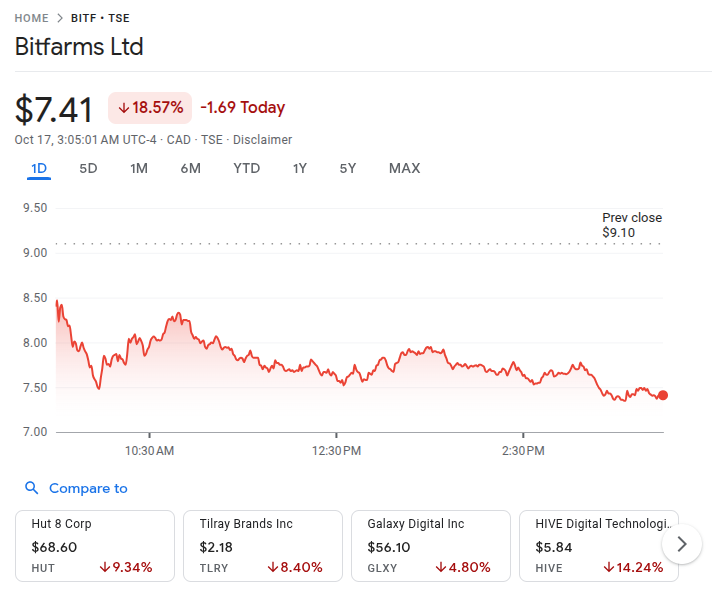

- Stock plunged more than 18 percent following the announcement, despite a 530 percent gain over the past six months.

- Capped call transactions were introduced to limit dilution, with a cap set at $11.88 per share.

What Happened?

Bitfarms Ltd., a cryptocurrency mining and digital infrastructure company, announced it would raise $500 million through convertible senior notes. This figure was significantly increased from the originally announced $300 million. Despite this being framed as an “opportunistic capital raise,” the market reacted swiftly, sending the company’s stock down over 18 percent on Thursday.

Convertible Notes Offering Details

The convertible notes will carry a 1.375 percent interest rate and mature on January 15, 2031. Investors will have the option to convert the notes into Bitfarms common stock at a price of $6.86 per share, representing a 30 percent premium over the October 16 Nasdaq closing price of $5.28.

- Initial purchasers also received a 13-day option to buy an additional $88 million in notes.

- The offering is expected to close around October 21, 2025, pending Toronto Stock Exchange approval.

- Interest payments begin July 15, 2026, and are payable semi-annually.

To manage shareholder dilution, Bitfarms executed capped call transactions with financial institutions. These allow the company to offset the dilutive impact of note conversion by capping the share price at $11.88, which is 125 percent above the stock’s current price.

The offering is targeted only to qualified institutional buyers and is not registered under the U.S. Securities Act. Bitfarms says the proceeds will be used for general corporate purposes.

Investor Reaction and Market Context

Despite its explosive performance earlier this year with the stock rising over 530 percent in six months, the sudden move to issue convertible debt shook investor confidence.

- Shares fell sharply following the announcement, undoing recent gains.

- Technical indicators had already signaled overbought conditions, increasing vulnerability to a pullback.

The company’s current ratio of 3.11 points to healthy short-term liquidity, but investor concerns appear centered on potential dilution and timing of the offering.

Strategic Growth and Financial Strength

Bitfarms continues to evolve from a traditional Bitcoin miner into a broader digital infrastructure player. It operates vertically integrated data centers and a 1.3 gigawatt energy pipeline, with more than 80 percent based in the U.S.

Other key points about its growth strategy include:

- 42 percent revenue growth over the last twelve months.

- Analyst expectations that Bitfarms may achieve profitability this year.

- A recently secured $300 million project-specific financing facility with Macquarie Group for its data center campus in Panther Creek, Pennsylvania.

These developments suggest the company is positioning itself to benefit from rising demand in high-performance computing and AI-focused infrastructure, even as market sentiment reacts cautiously to new financing moves.

CoinLaw’s Takeaway

I get why this news rattled investors. Anytime a company that just posted monster gains suddenly says it needs to raise a massive chunk of money, it makes people nervous. But from where I sit, Bitfarms is playing a long game. They are using this moment of strength to secure capital, hedge dilution with capped calls, and scale into AI and high-performance computing infrastructure. In my experience, this kind of forward-looking capital strategy can pay off big if the company delivers. The market might be overreacting now, but I’d keep a close eye on how they deploy this cash.