Bitcoin staking today marks early yet meaningful progress toward turning idle BTC into yield-generating capital. Though staking remains limited, recent developments hint at growing integration into DeFi and institutional portfolios. Two real‑world scenarios illustrate this shift:

- Liquid staking tokens like LBTC are already unlocking $2.5 billion of BTC for decentralized finance applications.

- Institutional interest continues to grow, as Bitcoin increasingly appears in treasury strategies and corporate holdings.

Let’s explore the details in the full article.

Editor’s Choice

- Bitcoin’s liquid staking market is around $2.5 billion, still early-stage.

- Ethereum’s liquid staking leads with about $38 billion locked.

- Approximated Bitcoin staking ratio: 0.29%, or about 58.5K BTC staked.

- Estimates suggest the BTC staking market may approach $6.5–$7 billion, depending on valuation methods

- Bitcoin staking reward rate remains 0.00%, indicating no direct yield.

- Proof-of-Stake consensus models use over 99% less energy than PoW.

Recent Developments

- Bitcoin liquid staking stands at $2.5 billion, a small fraction of Ethereum’s $38 billion staking market.

- The sector is gaining attention from policymakers and institutions focused on moving from PoW to more sustainable systems.

- PoS is becoming the preferred model across the crypto landscape, cited for scalability and sustainability.

- Bitcoin’s staking ratio shows modest participation, only 0.29%, or 58,500 BTC.

- No yield is earned via staking (0.00% rewards), but liquidity plays and derivatives offset this.

- Market cap for staked BTC approximated at $11 billion.

- The major crypto market cap is increasing steadily, suggesting growing liquidity and participation.

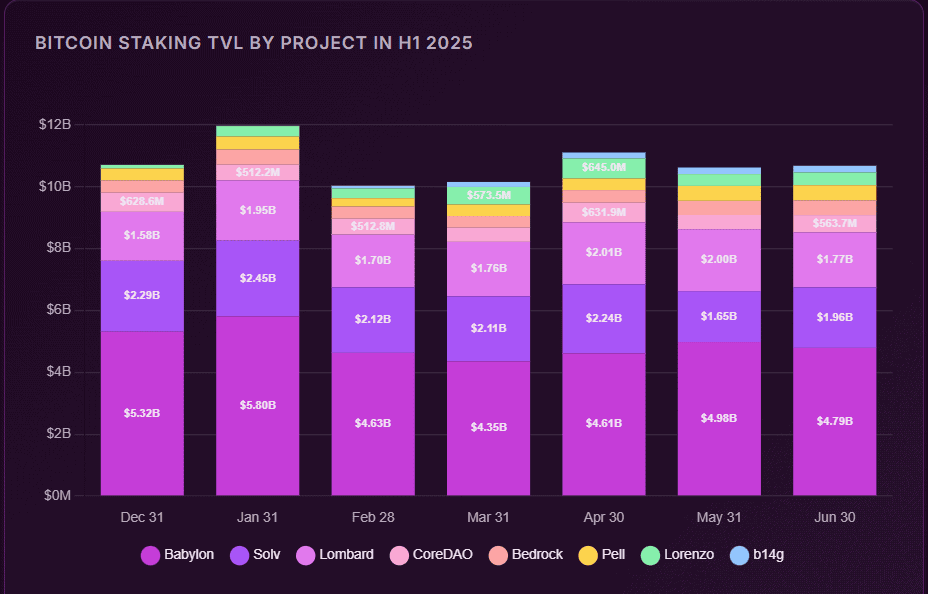

Bitcoin Staking TVL Highlights

- Babylon remained the dominant project, with TVL ranging from $5.32 billion in Dec 2024 to $4.79 billion in Jun 2025, showing consistent leadership.

- Solv held strong as the second-largest, peaking at $2.45 billion in Jan 2025 before moderating to $1.96 billion in Jun 2025.

- Lombard grew steadily, climbing from $1.58 billion in Dec 2024 to $2.01 billion in Apr 2025, before easing to $1.77 billion in Jun 2025.

- CoreDAO contributed between $512 million and $632 million, maintaining a steady share across H1 2025.

- b14g spiked in Apr 2025 with $645 million, marking its highest visible inflow.

- Overall Bitcoin staking TVL across these projects peaked in Jan 2025 at nearly $11 billion, before stabilizing around $10 billion by mid-year.

Can You Stake Bitcoin?

- Technically, no, Bitcoin does not support native staking or validator incentives.

- Yes, but only via derivatives or tokens like LBTC, wrapped BTC, or emerging layer‑2 systems.

- Staking ratio is a modest 0.29%, representing the small extent of BTC currently deployed in staking-like instruments.

- Reward rates remain 0.00%, so direct BTC holding yields no traditional staking returns.

- Participation is gaining traction in DeFi and institutional circles via these synthetic mechanisms.

- Bitcoin staking remains experimental; adoption depends on tool maturity and regulatory clarity.

Bitcoin Staking Market Overview

- Bitcoin liquid staking reaches approximately $2.5 billion in total.

- Ethereum’s liquid staking dwarfs it at around $38 billion.

- Total crypto market cap climbed from $3 trillion to $3.7 trillion in 2025.

- Only 0.29% of Bitcoin appears in staking derivatives, about 58,500 BTC.

- PoS continues to increase traction across crypto networks thanks to ~99% energy savings vs. PoW.

- Growth in staking is largely driven by tokenized models, not native BTC.

- Institutional perception is shifting, with more firms exploring staking strategies and treasury use cases.

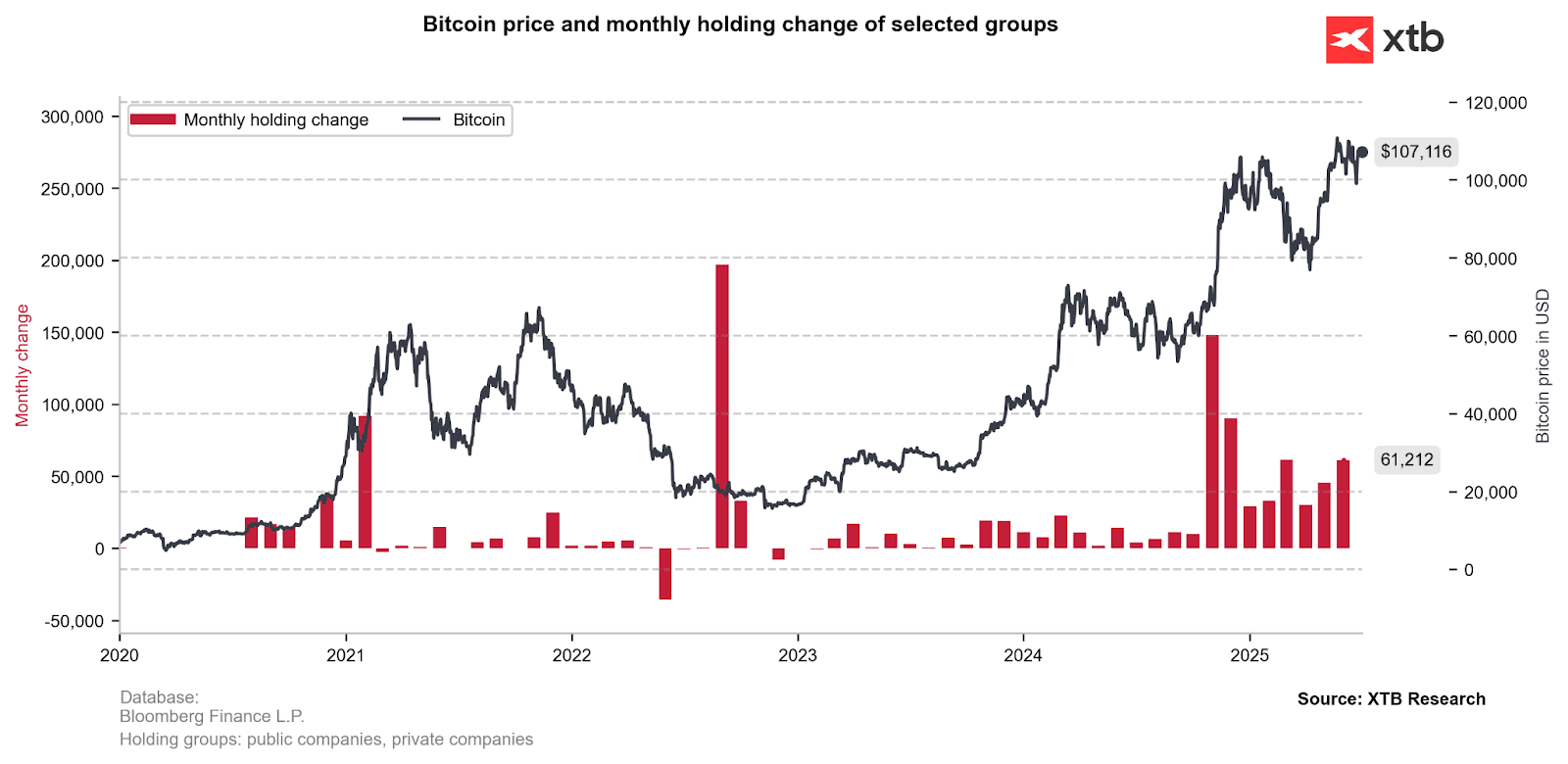

Bitcoin Price and Holding Change

- In 2020, Bitcoin traded near $10,000, with monthly holdings increasing by about 20,000 BTC as institutions began accumulating.

- By the 2021 peak, Bitcoin surged to $65,000, while holdings rose sharply with a 120,000 BTC monthly gain, showing strong corporate entry.

- In mid-2022, prices dropped to around $20,000, accompanied by a 20,000 BTC monthly outflow, signaling selling pressure.

- In early 2023, despite Bitcoin dipping to $16,000, holdings spiked with a 200,000 BTC monthly increase, the largest accumulation in the period.

- During the 2024 rally, Bitcoin climbed back to about $70,000, while monthly holding changes stabilized at roughly 60,000 BTC.

- As of 2025, Bitcoin reached a new high of $107,116, with holdings growing by 61,212 BTC in the most recent month.

Bitcoin Staking Ratio and Market Cap

- 0.29% of Bitcoin is currently deployed in staking derivatives, approximately 58,500 BTC.

- The asset market cap used for comparison is $3.7 trillion.

- Even with low adoption, this underscores early but tangible interest in liquid staking models for BTC.

- For context, Ethereum’s liquid staking is orders of magnitude larger, $38 billion, highlighting how nascent BTC staking remains.

- As Bitcoin’s total supply grows steadily, a slight rise in the staking ratio signals incremental user participation.

- Institutional interest and new platforms may boost the staking ratio through derivatives and token-wrapping.

- Overall, BTC staking volume remains very modest relative to total holdings, but shows early, measurable traction.

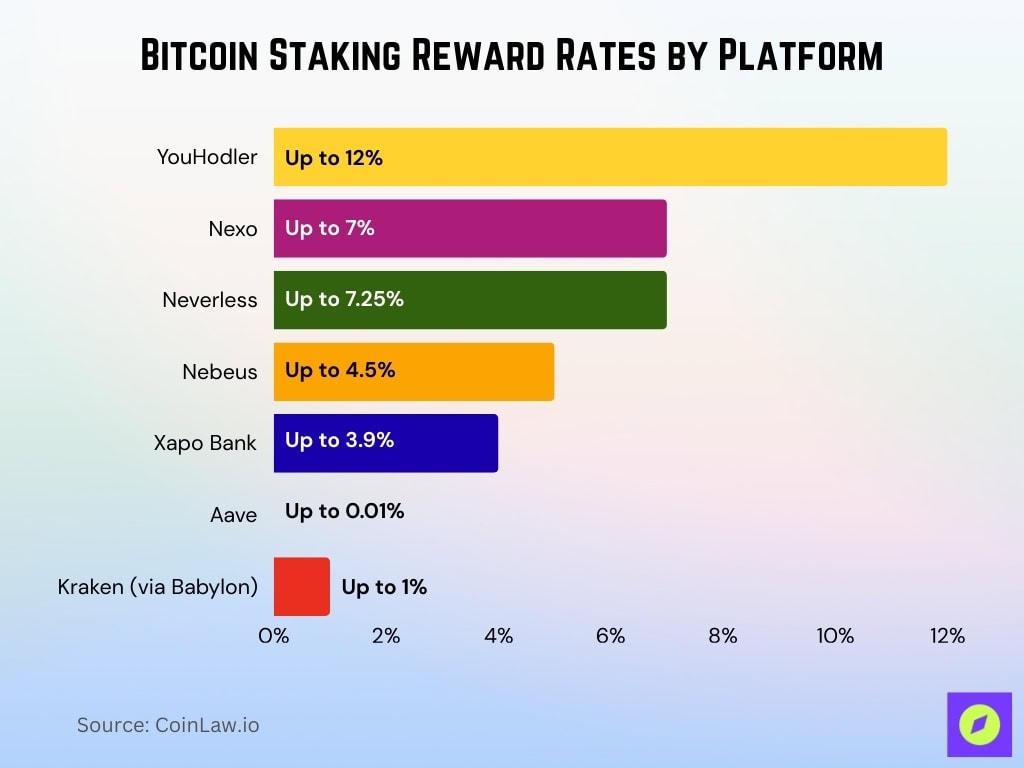

Bitcoin Staking Reward Rates

- The estimated reward rate for holding staked BTC is 0.00% APY, meaning no native yield is generated.

- Many “staking” models simply reflect token holding, not yield generation.

- However, some platforms offer lending-like yields, with advertised rates up to 12% APY.

- Sample platforms and their rates include:

- YouHodler: up to 12% APY.

- Nexo: up to 7% APY.

- Neverless: up to 7.25% APY.

- Nebeus: up to 4.5% APY.

- Xapo Bank: up to 3.9% APY.

- Aave: up to 0.01% APY.

- Kraken offers BTC staking via the Babylon protocol, paying yields in $BABY tokens, up to 1%, without custody loss.

Bitcoin Staking Through Layer‑2 Solutions

- These presale or experimental L2 models are high-yield but bear higher risk and low regulatory maturity.

- L2 intends to enable DeFi within Bitcoin’s ecosystem, trading scalability for speculative yield.

- Liquid Staking Tokens (LSTs) allow BTC exposure and liquidity while participating in yield protocols.

- Some L2 solutions enable “restaking”, staking tokenized BTC across multiple protocols for layered returns.

- These innovations remain theoretical or early-stage in BTC’s ecosystem compared to more established L2 models on Ethereum.

- Yield sources are often speculative token rewards or fees, not network consensus rewards.

- In summary, L2-based BTC staking offers bold yield potential but lacks mainstream adoption or long-term stability.

Wrapped Bitcoin Staking Statistics

- Wrapped Bitcoin (WBTC) enables BTC to be used on Ethereum and other networks, facilitating indirect staking.

- While there is no dedicated statistic for BTC-specific wrapped staking, Ethereum’s LST market, with over $50 billion in assets across Lido, Rocket Pool, suggests the scale of derivative staking.

- BTC wrapped on such networks contributes to the total staked crypto value, but remains a small part of the overall picture.

- Comparatively, Cosmos, Polkadot, and Solana hold substantial wrapped or native staking volumes.

- BTC as a wrapped asset in DeFi yields interest via borrowing/lending pools, not via staking itself.

- The lack of transparent, aggregated data makes precise figures elusive.

- Overall, WBTC enables access to staking-like mechanisms, but BTC’s presence in wrapped staking remains minimal vs other PoS tokens.

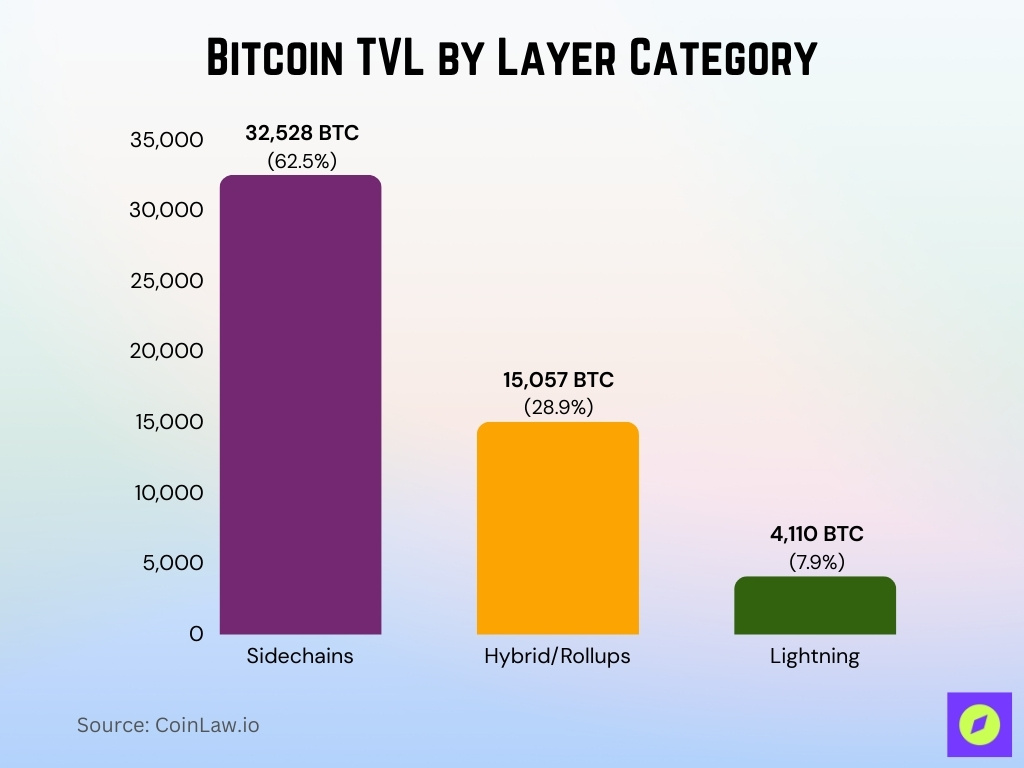

Bitcoin TVL by Layer Category

- Sidechains dominate with 32,528 BTC, representing 62.5% of the total locked value.

- Hybrid/Rollups account for 15,057 BTC, or 28.9%, highlighting their growing role in BTC scaling.

- Lightning Network holds 4,110 BTC, making up 7.9%, reflecting its niche focus on payments and microtransactions.

DeFi Yield Strategies for Bitcoin

- BTC can earn yield through lending platforms, liquidity provision, or token derivatives, not true staking.

- Platforms offer up to 12% APY on BTC holdings, for example, YouHodler.

- Some protocols offer token incentives, like $BABY on Kraken, for supplying BTC liquidity.

- DeFi strategies like liquid staking derivatives enable BTC exposure while earning yield elsewhere.

- Leverage staking, repeated re-staking of liquid derivatives, can amplify yields on other chains, though not yet mainstream for wrapped BTC.

- DeFi yields vary widely, depend on platform reliability, and include smart contract and liquidity risks.

- Investors must weigh yield against risks like slashing, liquidation cascades, and token volatility.

- In summary, DeFi strategies enable BTC to generate yield indirectly, but options remain limited and experimental relative to PoS networks.

Institutional Adoption of Bitcoin Staking

- Institutions are showing increasing interest in digital assets, though BTC staking remains peripheral to investment strategies.

- Institutions favor yield-generating PoS assets like Ethereum, not BTC. For example, $33 billion in ETF inflows to ETH vs $1.17 billion outflows from BTC.

- Bitcoin’s market dominance decreased from 65% to 59% between May and August 2025.

- BTC’s diminishing share signals institutional pivot toward altcoins and staking-rich ecosystems.

- Though institutions hold large BTC stakes, native staking remains nonexistent; any yield must come through third-party products.

- Institutional adoption of BTC staking remains very limited, with most activity focused on collateral, treasury holdings, and speculative investment, not yield generation.

Bitcoin Staking Platforms and Protocols

- While data is limited, Gate is considered a market frontrunner among BTC staking services.

- Traditional staking platforms now insure over $28 billion in assets and incorporate anti-slashing features.

- Staking pools and DPoS systems serve over 38% of retail stakers in 2025, offering lower fees and smoother user experiences.

- Although those platforms center largely on PoS assets, the statistics reflect broader staking infrastructure maturity.

- Risk mitigation, such as insurance coverage, is becoming a core feature of reputable staking services.

- Transparency and security are clear priorities as staking gains traction across platforms and asset types.

- Overall, Bitcoin staking platforms remain narrow in scope, yet they benefit from growing industry best practices.

Regulatory Developments Impacting Bitcoin Staking

- Direct data on BTC staking regulation remains scant due to its derivative nature.

- In Q1 2025, security incidents tied to staking prompted losses near $200 million globally, raising regulatory concerns.

- The push for platform insurance and stronger protections suggests a regulatory tilt toward safeguarding stakeholders.

- Concerns over consumer protection have prompted regulators to act; for instance, the UK’s FCA proposed banning retail borrowing to invest in crypto.

- Regulatory focus now includes clarity, transparency, and limiting leverage in emerging staking products.

- The shift to require insurance coverage and anti-slashing protocols reflects evolving oversight expectations.

- Regulatory regimes are slowly aligning to encourage sustainable staking innovations while managing risk.

- Still, Bitcoin staking products reside in a gray area, as they span derivatives, platforms, and DeFi, calling for nuanced policy approaches.

Risks and Considerations for Bitcoin Staking

- In Q1 2025, staking-related security incidents resulted in approximately $200 million in global losses.

- Platform reliability, smart-contract vulnerabilities, and hack exposure remain top investor concerns.

- Even across broader staking systems, risk mitigation via insurance and anti-slashing tools is only just becoming standard.

- Regulatory proposals targeting leverage and retail protections may restrict uninformed participation.

- Institutional adoption prioritizes risk controls, sustainable staking rather than chasing high yield.

- Liquid staking derivatives (LSDs) introduce complexity, and leveraged staking amplifies returns but also risk of liquidation and contagion.

- For BTC holders, staking through derivatives adds layers of exposure, platform, smart contract, regulatory, and market risks.

User Participation and Demographics

- Detailed BTC-specific user demographics remain scarce, given the experimental and derivative nature of staking.

- Still, over 38% of retail stakers use staking pools or DPoS systems in 2025, hinting at democratized access and engagement.

- Institutional frameworks are maturing; 78% of institutional investors now report formal crypto risk management, $16 billion is spent annually on custodial solutions.

- Risk compliance ranks high; 84% of institutions list it as their top priority.

- 48% of institutions have integrated DeFi risk protocols, up from 21% in 2023.

- Institutional skepticism of Bitcoin staking yields means participation tends toward stable, regulated products rather than speculative strategies.

- Demographic growth may reflect increased interest, but direct figures on the BTC staking user base remain elusive.

- Overall, interest is rising, but cautious, framed by mature risk management and infrastructure expectations.

Recent Trends in Bitcoin Staking

- Gate’s rise as a top BTC staking platform in 2025 reflects growing service sophistication and yield offerings.

- Investment in staking infrastructure continues, with over $28 billion in insured assets, and 38% of retail stakers in pools / DPoS.

- Institutions are gravitating toward staking strategies that prioritize compliance over high yields.

- The ecosystem is boosting user trust via insurance and anti-slashing tools.

- Regulatory scrutiny, such as the FCA’s proposals, signals forthcoming oversight on staking mechanics.

- The contrast between BTC’s derivative staking and native PoS models (e.g., Ethereum) remains pronounced.

- Overall momentum suggests measured adoption, framed by risk awareness and infrastructure development.

Notable Bitcoin Staking Milestones

- Platforms now offer insurance on over $28 billion in assets, a major step toward ensuring product safety.

- Retail staking services (pools/DPoS) now account for more than 38% of staking participation.

- Institutional adoption of crypto risk frameworks climbs to 78%, with custodial spend reaching $16 billion in 2025.

- $200 million lost in staking-related security issues spurs greater institutional and regulatory focus.

- UK’s FCA moves to ban retail crypto borrowing, a major regulatory signal.

- Rise of leverage staking via LSDs is noted academically, highlighting both innovation and risk.

- These milestones reflect a turning point in the maturity of BTC-based yield strategies.

Comparative Yield vs Other Crypto Assets

- Native Bitcoin staking yields 0.00%, versus much higher returns on PoS networks like Ethereum (~4–5% APY).

- Broader crypto staking markets offer 3–15% APY, depending on asset and platform.

- Cloud mining ROI stands between 5–10%, overlapping with staking returns but with distinct risks.

- DeFi staking (especially via derivatives like LSDs) can outperform conventional staking, although institutional thesis now favors sustainability over yield chase.

- BTC staking remains uncompetitive yield-wise compared to native PoS and DeFi staking protocols, except in specialized or experimental scenarios.

- Risk-adjusted comparison shows BTC derivative staking sits between safe (PoS) and speculative (cloud mining) options.

Conclusion

Bitcoin staking today remains niche, rooted in derivative and liquid staking models rather than native consensus. Platforms like Gate lead the market with notable yields, but yield comes with significant security, regulatory, and counterparty risks. While broader staking infrastructure, such as insurance coverage and risk frameworks, is improving, institutional participation remains cautious, favoring regulated, sustainable strategies. For now, BTC staking provides limited yield opportunities, better suited for informed, risk-aware users. As infrastructure matures and regulation evolves, the ecosystem may expand, but for now, Bitcoin staking remains experimental and specialized.