Big data is more than just a buzzword in today’s fast-paced financial ecosystem. It is revolutionizing financial institutions’ operations, helping them deliver smarter, more efficient services. Big data is at the heart of fintech’s most transformative trends, from predicting customer behavior to detecting fraud in real time. Today, understanding how fintech companies leverage big data is crucial for businesses, consumers, and regulators alike. In this article, we’ll explore the key statistics and developments shaping the future of fintech through the lens of big data.

Editor’s Choice

- Around 73% of financial institutions now use AI for fraud detection, with advanced systems typically achieving 87–94% detection accuracy and reducing fraud losses by roughly 30–40%.

- Financial institutions leveraging big data and analytics report around 23% higher profits compared to peers that have not adopted advanced analytics.

- Big data–driven real-time fraud stacks enable authorization decisions in under 100 ms and deliver 30–60% cost savings while reducing false positives.

- Roughly 70–75% of financial institutions report using AI or machine learning in key workflows, highlighting deep integration of big data in risk, fraud, and customer analytics.

- Nearly 78% of financial firms increased IT and cybersecurity spending in 2026, reflecting intensified investment in big data fraud and risk analytics.

Recent Developments

- The AI in fintech market stands at $36.61 billion and will reach $99.09 billion by 2031, growing at a 22.04% CAGR.

- The global fintech market will expand from $394.88 billion in 2025 to $460.76 billion in 2026 and grow at an 18.20% CAGR through 2034.

- The global regtech market will rise from about $14.7–23.4 billion in the mid-2020s to roughly $105–115 billion by the early 2030s, reflecting around 20% annual growth in compliance technology spending.

- North America generates over 40% of global regtech revenues, and U.S. AI investment across industries will reach the hundreds of billions of dollars by the mid-2020s.

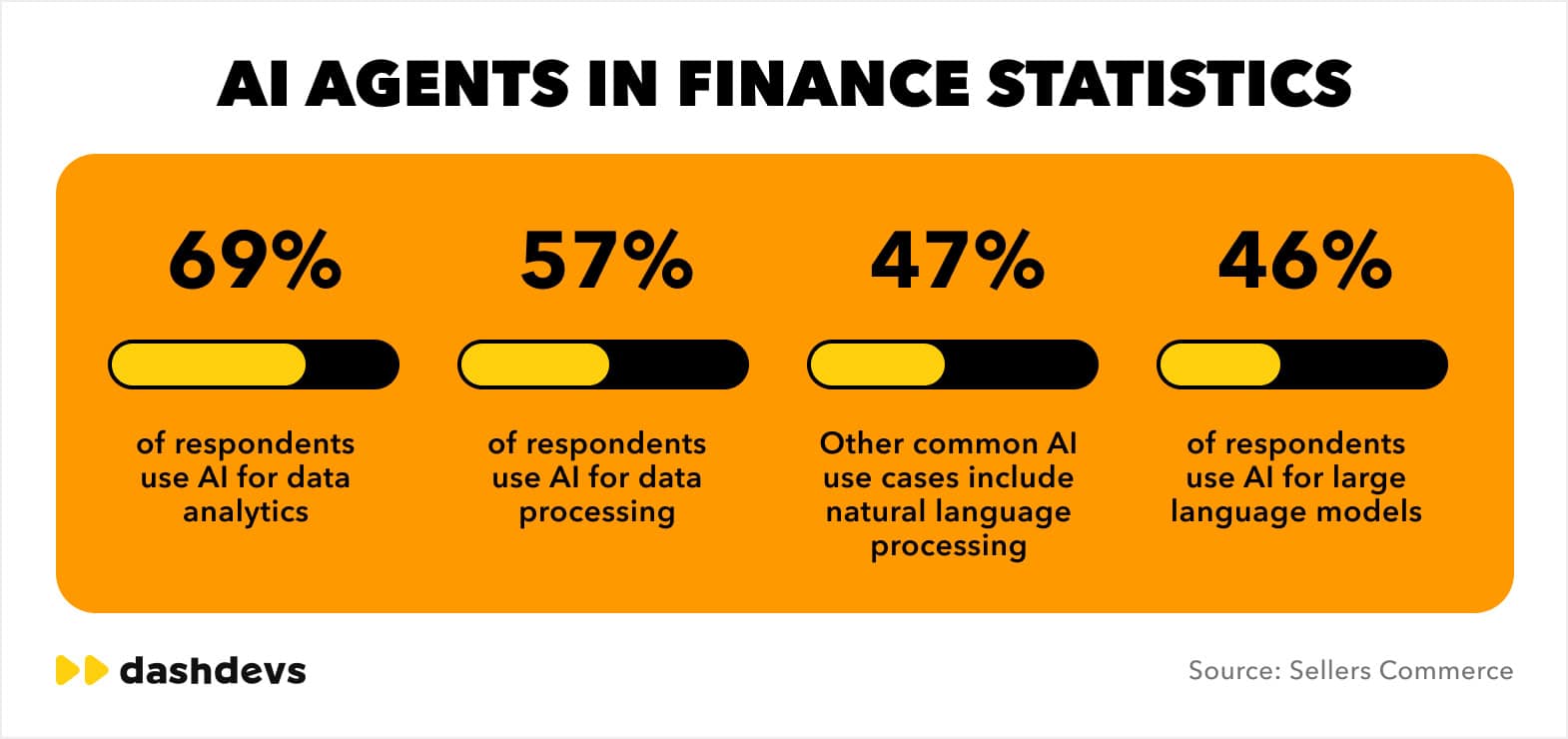

AI Agents in Finance Adoption Statistics

- 69% of respondents use AI for data analytics, making it the most common AI application in finance.

- 57% of respondents leverage AI for data processing, highlighting strong adoption in operational workflows.

- 47% of respondents use AI for natural language processing (NLP), supporting automation in text analysis, reporting, and compliance monitoring.

- 46% of respondents rely on large language models (LLMs), signaling rapid integration of generative AI tools in financial services.

- The gap between data analytics (69%) and LLM adoption (46%) suggests firms prioritize structured data optimization before deploying advanced generative AI systems.

- More than half of financial organizations (57%) are already embedding AI into core back-end processing functions.

Big Data’s Role in Fintech

- 89% of financial executives say big data gives a competitive edge by uncovering new revenue streams.

- Deploying big data and AI in credit processes can shorten loan decision times by 30–40%, improving customer experience and enabling faster approvals.

- $1.13 trillion in global consumer lending is influenced by big data analytics for faster, more accurate credit decisions.

- Processing unstructured data with big data has improved risk modeling in 52% of financial institutions.

- Fintechs using big data report a 15% reduction in customer churn through better client understanding.

- Using big data in product development accelerates time-to-market for new financial services by 24%.

- Quantum-enabled big data processing in fintech is forecast to be 50x faster, transforming analytics speed.

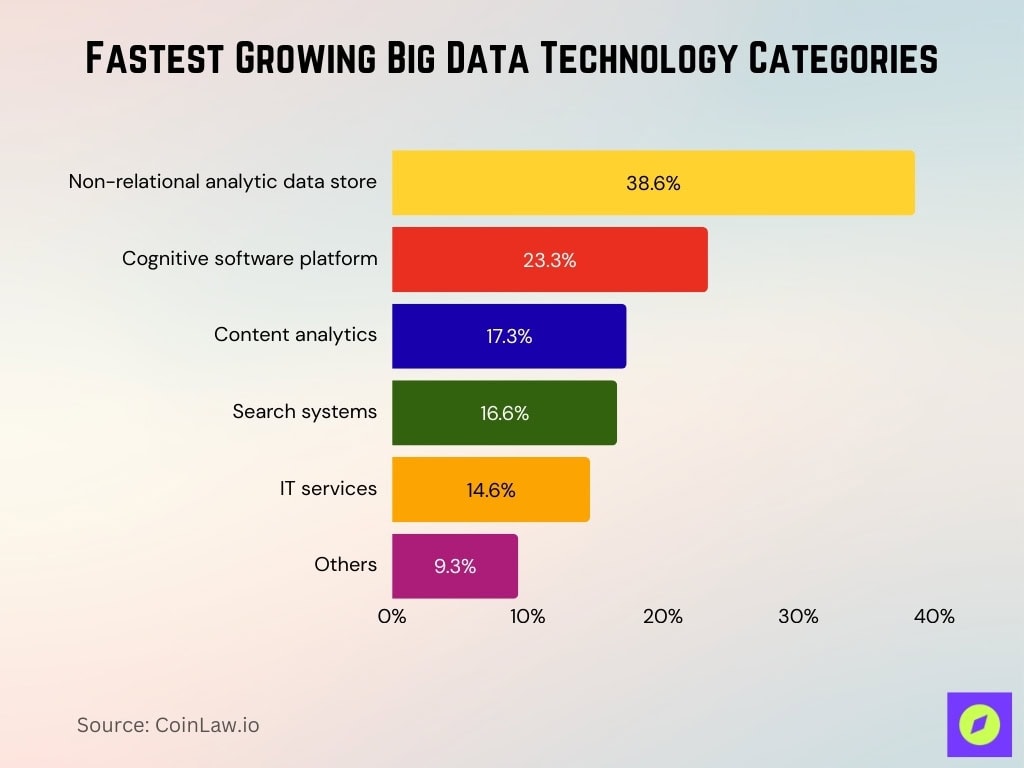

Fastest Growing Big Data Technology Categories

- Non-relational analytic data stores lead growth with a remarkable 38.6% CAGR, driven by demand for scalable, high-performance data infrastructure.

- Cognitive software platforms follow at 23.3% CAGR, reflecting the expanding use of AI-driven decision systems and automation tools.

- Content analytics is growing at 17.3% CAGR, fueled by the surge in unstructured data from text, images, and multimedia sources.

- Search systems show strong expansion at 16.6% CAGR, highlighting the importance of real-time information retrieval in data-intensive environments.

- IT services related to big data are increasing at 14.6% CAGR, indicating sustained enterprise investment in implementation and support.

- The “Others” category grows at 9.3% CAGR, representing niche or emerging big data technologies with slower adoption.

- The gap between the top segment (38.6%) and the lowest (9.3%) underscores how foundational data storage technologies are outpacing auxiliary services.

Enhances Fraud Detection and Security Protocols

- Advanced AI‑powered fraud systems in banking typically achieve around 87–94% detection accuracy while operating in near real time, significantly reducing successful fraud attempts.

- $32 billion annual US banking fraud losses prevented through big data-driven detection.

- Fraud detection time reduced by 64% using big data analytics for suspicious patterns.

- Machine learning on big data boosts fraud detection accuracy by 40% in institutions.

- Big data identifies internal fraud, cutting operational losses by 20% from insiders.

- Big data fraud systems block unauthorized transactions with 97% success rate.

- Leading banks reduce fraud losses by 40-60% via big data strategies.

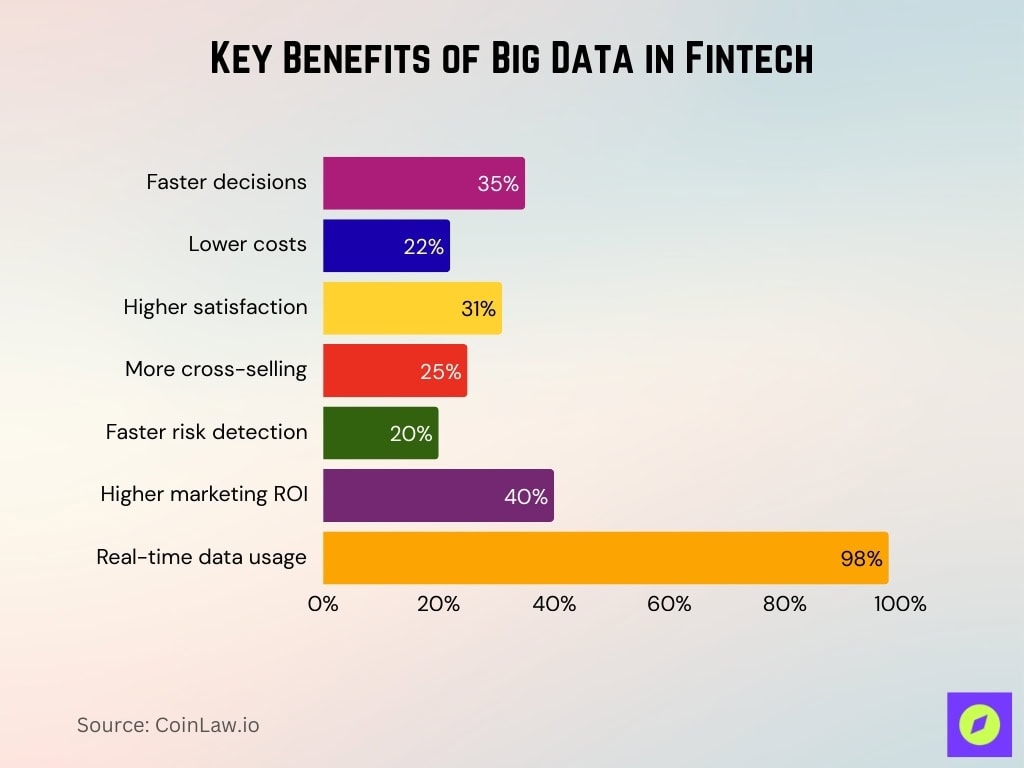

Benefits of Using Big Data in Fintech

- 35% reduction in decision-making time for financial institutions responding to market changes.

- Predictive analytics with big data cuts operational costs by 22%.

- Customer satisfaction improves by 31% with big data personalization.

- Big data insights boost cross-selling opportunities by 25%.

- Big data risk systems identify risks 20% faster than traditional methods.

- Big data marketing analytics increase ROI by 40%.

- 98% of large institutions rely on real-time big data for decisions.

Big Data and Credit Risk Scoring in Fintech

- 92% of fintech lenders use alternative data like utility payments and social media for enhanced credit assessments.

- Alternative data improves evaluations for 68% of customers previously underserved.

- Big data analytics reduces default rates by 18% through accurate risk assessments.

- Big data-powered credit models boost loan approval rates by 26%.

- Real-time big data scoring cuts loan decision time by 40%.

- 72% of enterprises use ML with big data for credit scoring.

- AI credit scoring reduces defaults by over 30%.

- Alternative data expands scoring to 33 million more consumers.

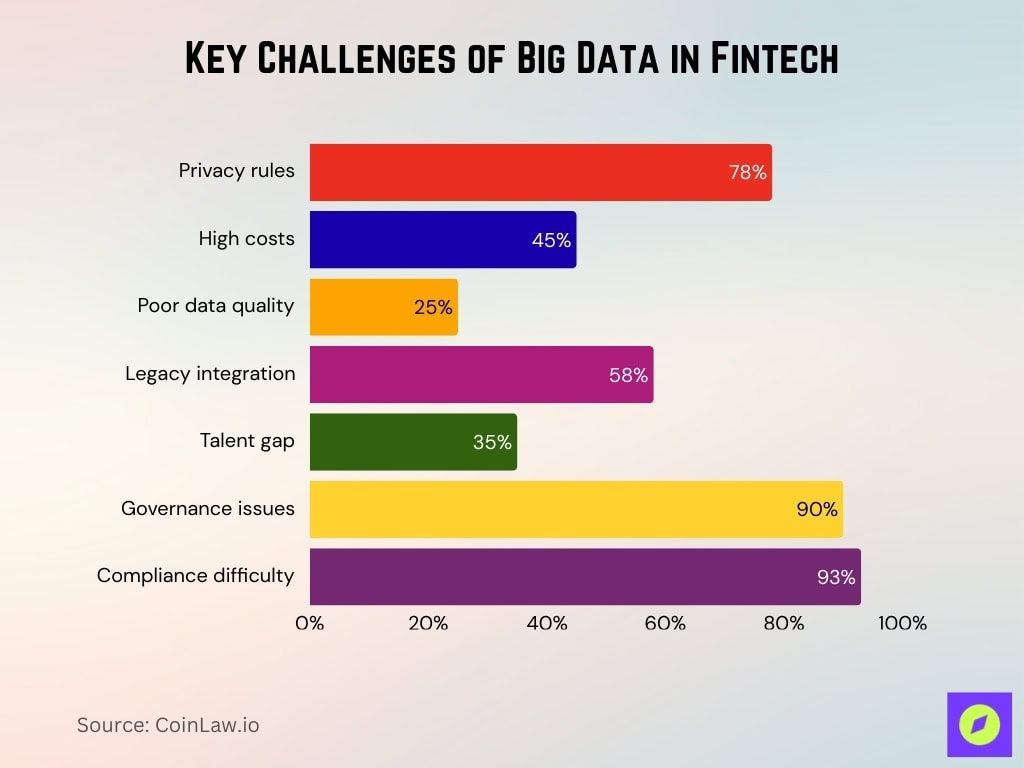

Challenges and Risks of Big Data in Fintech

- 78% of fintech companies struggle with data privacy regulations like GDPR and CCPA.

- 45% of fintech startups cite high costs for big data infrastructure and talent as barriers.

- 25% of fintech companies face data quality issues, leading to flawed insights.

- 58% of financial institutions encounter legacy system integration difficulties.

- 35% of fintech firms report talent shortages in data science.

- 90% of fintech firms are expected to face data governance challenges.

- 93% of fintech companies find compliance regulations difficult.

Big Data Applications in Fintech Startups

- 92% of fintech startups rely on big data for a competitive advantage via personalized products.

- Fintech startups using big data grow 45% faster than those without data strategies.

- 45% of fintech startups report that big data reduces customer acquisition costs.

- Blockchain and big data integration boost operational efficiency by 30% in startups.

- 80% of fintech startups will incorporate AI/ML driven by big data.

- Big data-powered robo-advisors are used by 35% of fintech startups.

- 81% of Gen Z consumers value big data personalization in fintech startups.

- 70% of fintech operations are powered by cloud-based big data platforms.

Frequently Asked Questions (FAQs)

Institutions utilizing big data report 23% higher profits compared to those without advanced analytics.

Big data fraud detection systems typically achieve 87–94% accuracy in identifying risks, up from 97.5% two years prior.

Big data has reduced loan approval times by 30%, improving customer satisfaction.

Conclusion

It’s clear that big data will continue to play a transformative role in fintech. From enhancing customer segmentation to improving fraud detection and credit risk scoring, the potential of big data is vast. While challenges remain, the benefits of adopting advanced data analytics far outweigh the risks. Fintech companies that embrace big data will not only thrive but will also lead the way in shaping the future of financial services.