The asset management industry has experienced tremendous growth over the past few decades, transforming how wealth is managed globally. The industry is navigating through a period marked by significant innovations, increasing market complexities, and a growing emphasis on sustainability.

Whether you’re an institutional investor, a private client, or a financial advisor, understanding the latest trends and developments in the asset management space is crucial. As we explore the landscape, we’ll dive deep into market sizes, key trends, and emerging forces shaping the future of asset management.

Editor’s Choice

- The United States remains the global leader in asset management, holding ~54% of total AUM, followed by Europe at ~30%, and Asia-Pacific at ~13%.

- Sustainable investment funds grew by 16.7%, as ESG-driven portfolios now account for $45.61 trillion globally.

- The rise of passive investing continues, with ETFs making up ~40% of the total managed asset market.

- Artificial Intelligence (AI) and machine learning tools are now used by 70% of asset managers for risk modeling and portfolio optimization.

- Private equity and alternative assets grew by 12-15% year-over-year, as institutional investors shift toward non-public assets.

- Digital transformation remains a top priority, with 82% of asset management firms adopting cloud infrastructure for scalability and cybersecurity.

Recent Developments

- BlackRock‘s AI Infrastructure Partnership acquired Aligned Data Centers in a $40 billion deal to fuel AI data center expansion.

- Vanguard UCITS ETF range attracted $5.1 billion in net inflows in January, driven by equity and fixed income funds.

- Goldman Sachs hosted its Energy Conference, highlighting nuclear and AI power demand trends.

- Fidelity Investments handled over 37.5 million service calls and 4.4 million daily trades amid rising digital engagement.

- JP Morgan Asset Management closed its Forest & Climate Solutions Fund II at $1.5 billion for sustainable timberland investments.

- State Street Global Advisors continues strengthening its passive ETF offerings through strategic integrations.

- Morgan Stanley plans to launch a digital wallet for tokenized assets, including private equity, in H2.

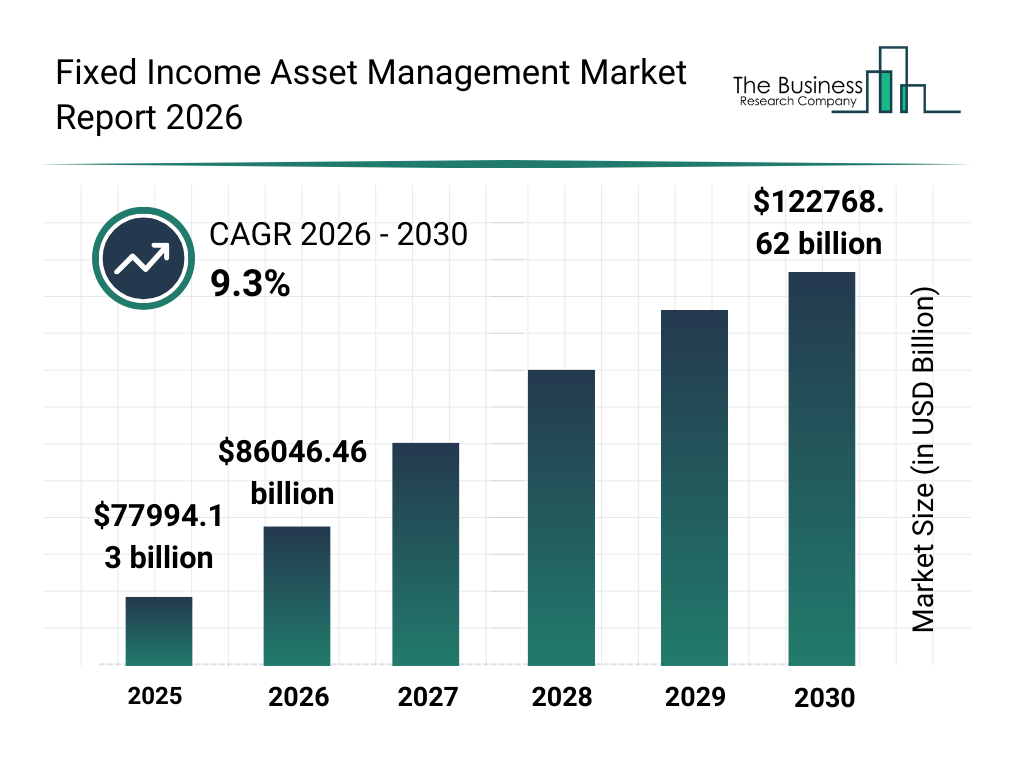

Fixed Income Asset Management Market Statistics

- The global Fixed Income Asset Management Market was valued at $77,994.13 billion in 2025.

- The market is projected to reach $86,046.46 billion in 2026, reflecting strong year-over-year expansion.

- By 2030, the market size is expected to grow to $122,768.62 billion, highlighting sustained long-term growth.

- The market is forecast to expand at a CAGR of 9.3% from 2026 to 2030, indicating steady momentum across the forecast period.

- Between 2025 and 2030, the industry is projected to add over $44,774 billion in incremental market value, demonstrating significant capital inflows into fixed income strategies.

- The consistent upward trajectory from 2025 through 2030 signals increasing investor demand for income-generating and lower-volatility investment products.

Market Concentration and Characteristics

- The top 10 global asset management firms control over $70 trillion in AUM, accounting for ~42% of the global market.

- BlackRock remains the world’s largest asset manager, overseeing $12.5 trillion in assets, followed by Vanguard at $10.1 trillion.

- Boutique asset managers in alternatives and ESG achieved compound annual growth exceeding 12% over recent years.

- Mergers and acquisitions in asset management contributed to global M&A totaling $3 trillion in deal value.

- Average management fees declined to 0.40%, driven by passive fund dominance and robo-advisors.

- Only ~30% of actively managed equity funds outperformed benchmarks, boosting passive shift.

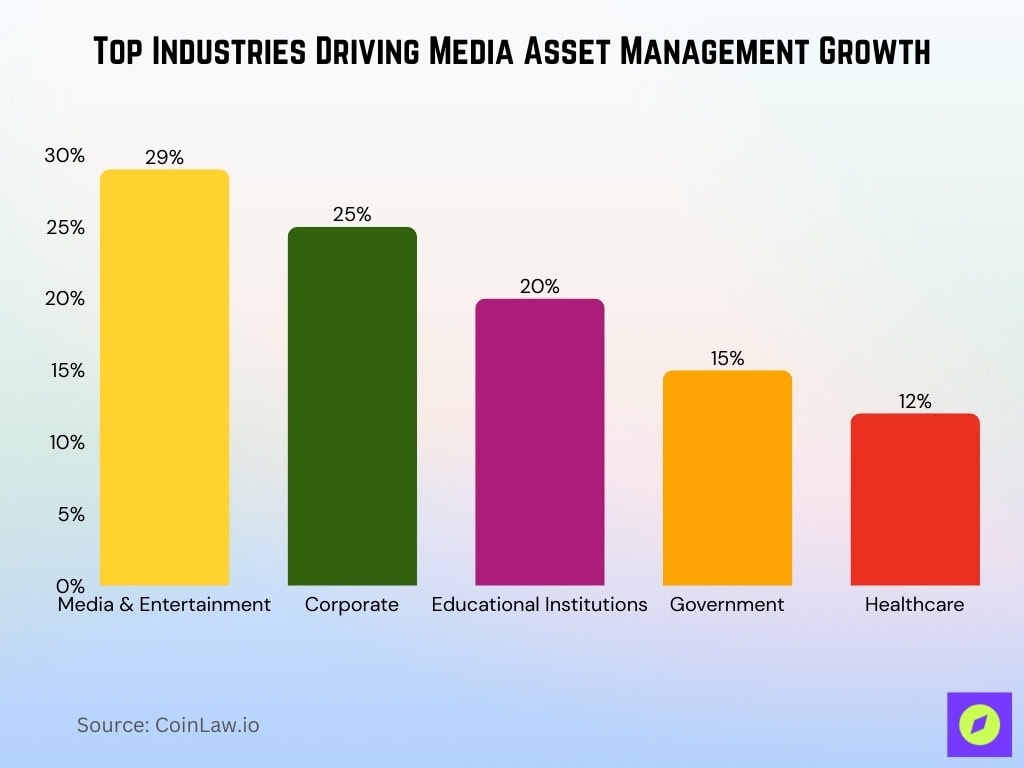

Media Asset Management Market Share by Industry

- The Media and Entertainment sector holds the largest share of the global media asset management market at 29%.

- The Corporate industry accounts for a significant portion, contributing ~25% to the market.

- Educational institutions make up ~20% of the market, driven by digital learning content needs.

- The Government sector represents 15% of the market for secure media storage.

- Healthcare contributes ~12%, reflecting digital media use in diagnostics and training.

Outlook for Alternative Asset Managers

- Private equity AUM expected to reach $11.12 trillion, reflecting a 14.8% CAGR.

- Venture capital funds AUM of approximately $1.5 trillion, led by top firms like Andreessen Horowitz at $74.7 billion.

- The hedge fund industry holds $4.2 trillion in AUM, projected to reach $5 trillion by 2027.

- Real assets are projected to grow at a CAGR of ~9%, with infrastructure leading.

- Real estate investment managers oversee ~$14.5 trillion in AUM amid strong demand.

- Private debt surged to $1.7 trillion under management, projected to $2.6 trillion by 2029.

- Impact investing AUM reached ~$2.5 trillion, driven by ESG mandates.

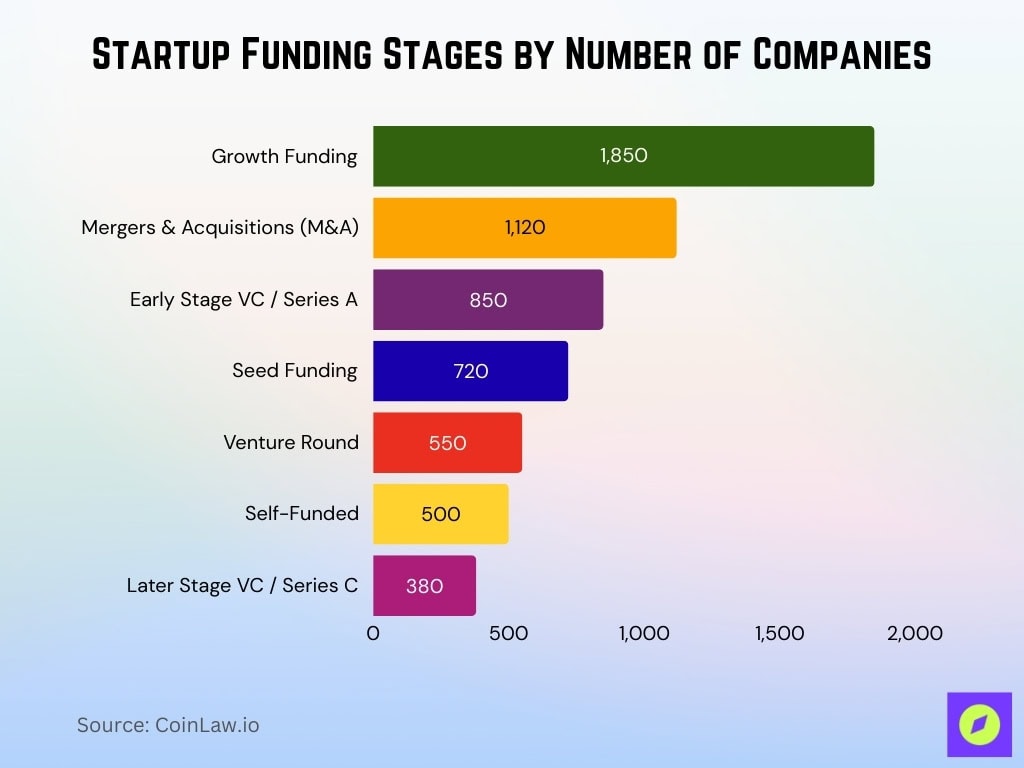

Company Distribution by Funding Stage

- Growth Funding dominates with 1,850 companies.

- Mergers & Acquisitions (M&A) account for 1,120 companies.

- Early Stage VC / Series A includes 850 companies.

- Seed funding supports 720 companies.

- Venture Round involves 550 companies.

- Self-funded businesses represent 500 companies.

- Later Stage VC / Series C includes 380 companies.

Asset Management Market Size and Trends

- North America leads with $88.2 trillion in AUM among top firms; Asia-Pacific grows fastest at 6.8% CAGR.

- Institutional clients account for ~65% of total AUM, retail ~35%.

- The alternative investment market stands at $14.5 trillion globally.

- Sustainability-linked products represent ~22% of total AUM.

- Robo-advisory platforms manage $1.4 trillion, projected to $3.2 trillion by 2033 at 10.5% CAGR.

- EU green finance directs $10.9 trillion into climate strategies.

Top Asset Classes Expected to Deliver High Returns

- Private Debt/Credit: Cited by 82% of private wealth professionals planning to increase allocations for strong returns.

- Private Equity: Chosen by 86% of private wealth professionals, topping portfolio optimization drivers.

Component Insights

- The software solutions segment grows at a CAGR of 12.4%, reaching $10.4 billion by 2033.

- Portfolio management tools contribute ~37% of software growth, driven by AI analytics.

- Compliance software demand surged ~25%, fueled by SFDR and AML regulations.

- Blockchain is used by 15% of firms for tokenization and administration.

- Artificial Intelligence is integrated into 70% of asset management software solutions.

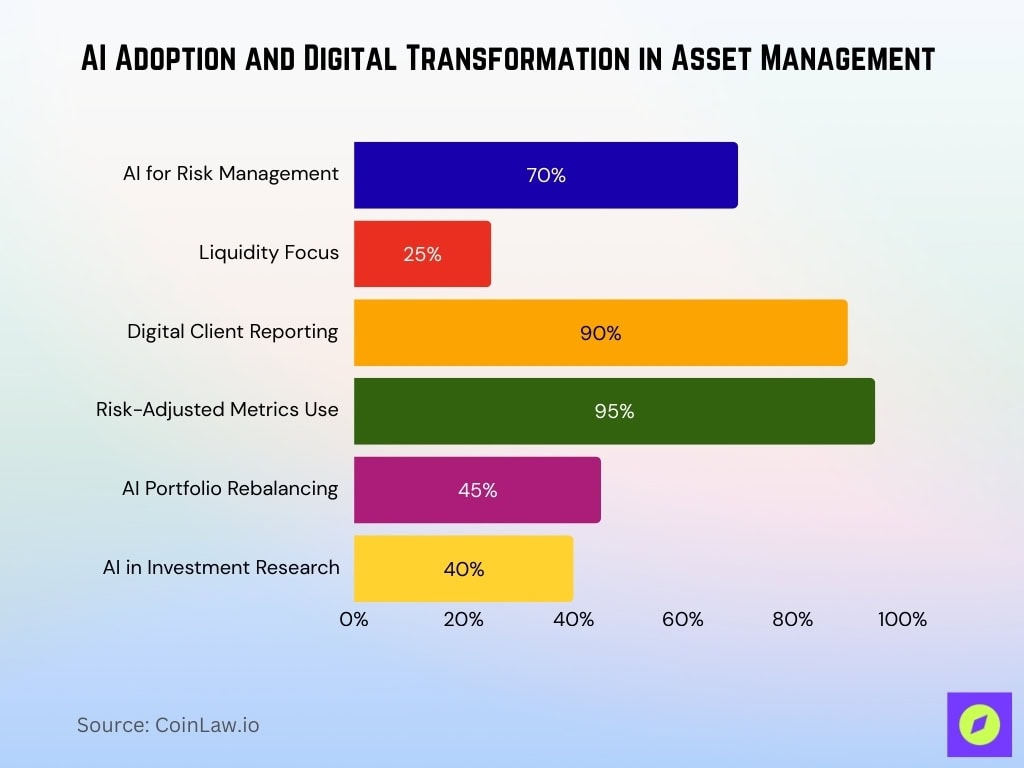

Function Insights

- 70% of firms use AI for risk management automation and prediction.

- 25% of institutional investors prioritize liquidity management in volatile markets.

- 90% of asset managers implement digital tools for real-time client reporting.

- 95% of asset managers use risk-adjusted metrics like Sharpe and Sortino ratios.

- 45% of portfolios are rebalanced via AI-driven automated solutions.

- 40% of investment research is conducted with AI-powered data analysis tools.

Asset Type Insights

- Equities comprise ~46% of global AUM, fixed-income ~32%.

- Real estate investments reached $13.5 trillion in AUM, with $144 billion in institutional deployment.

- Private equity AUM hit $1.6 trillion in deal value, up 23% YOY.

- Commodities surge, supported by supply shortages in copper, aluminum, and energy.

- Infrastructure investments grow at a CAGR of ~8%.

- Hedge funds total $397 billion for top firms like Citadel.

Regional Insights

- North America holds 54.2% of global AUM with 6.2% CAGR.

- Europe manages 29.7% of total AUM, ESG at 27.4%.

- Asia-Pacific at 13.1% of AUM, fastest-growing at 6.8% CAGR.

- China’s market holds $20.55 trillion in AUM, up double-digits.

- Latin America reached $2.7 trillion in AUM, led by Brazil and Mexico.

- Middle East and Africa at $2.3 trillion AUM, up 13%.

- Global cross-border flows were reshaped by 165,000 millionaire migrations.

Frequently Asked Questions (FAQs)

BlackRock ~$12.5 trillion, Vanguard ~$10.1 trillion, Fidelity ~$5.52 trillion (approx).

Passive strategies account for 39.0 % of total AUM among the world’s largest managers.

Active ETFs AUM grew by 68 % from $502 billion to $843 billion.

Conclusion

The asset management industry is poised for substantial growth, driven by technological innovation, evolving investor preferences, and the expansion of alternative investments. As AI, blockchain, and ESG investments reshape the landscape, asset managers will need to stay agile and adapt to these emerging trends.

The global market is expected to continue expanding, offering both opportunities and challenges. Firms that embrace digital transformation, prioritize sustainability, and offer customized solutions will be best positioned to thrive in the years ahead. Investors, whether institutional or retail, are likely to benefit from a more dynamic and transparent asset management ecosystem.