Imagine a scenario where financial institutions operate in a world without anti-money laundering (AML) software. Transactions from suspicious entities would go unnoticed, and illicit money flows could destabilize economies globally. That’s the scenario AML software strives to prevent. In today’s digital age, financial crimes are evolving, and so must the tools used to combat them.

Anti-money laundering software has become a crucial line of defense, empowering banks, financial institutions, and governments to detect, monitor, and report suspicious activities. This article dives deep into the AML software landscape, exploring key milestones, market size, growth factors, and more.

Editor’s Choice

- Cloud-based AML solutions held between 40–60% market share.

- Integrated AML software accounted for 66.6% of deployments.

- AI in AML reduced false positives by over 50%.

- Banks and neobanks led the end-user segment with 36.8% share.

- Crypto AML segment poised for the highest growth rate.

Recent Developments

- FATF intensified scrutiny on AI-specific AML/CFT controls.

- Nasdaq Verafin spans 2,700 customers and 800 million entities.

- FICO AML scores reduce false positives by over 50%.

- Oracle Cloud AML automates scenario tuning for faster compliance.

- Privacy-preserving ML enables cross-institution collaboration.

- Crypto AML compliance market projected to grow 12-15% CAGR.

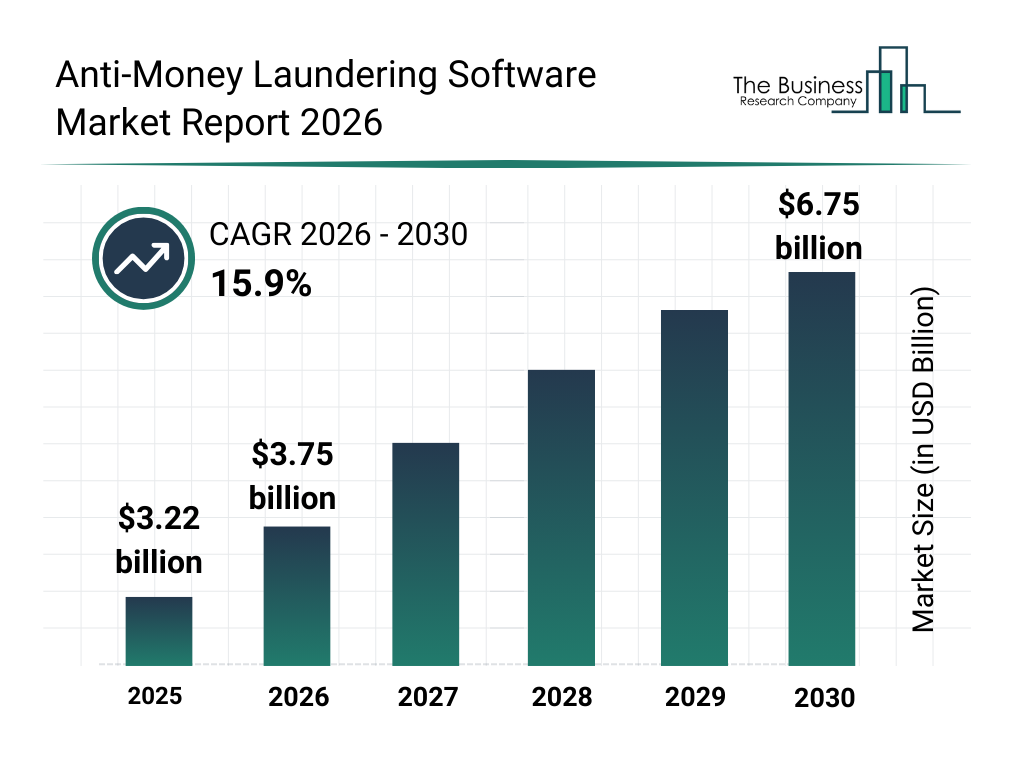

Anti-Money Laundering Software Market Growth Statistics

- The global AML software market was valued at $3.22 billion in 2025.

- The market is projected to grow to $3.75 billion in 2026, reflecting strong year-over-year expansion.

- Between 2026 and 2030, the market is expected to register a robust 15.9% CAGR.

- By 2030, the AML software market is forecast to reach $6.75 billion, more than doubling from mid-decade levels.

- The projected growth highlights accelerating regulatory compliance demands, increased financial crime monitoring, and rising adoption of AI-driven AML solutions across financial institutions

Deployment Insights

- On-premise deployments hold 68% market share.

- Cloud-based deployments capture 32% share.

- The hybrid segment is expected to have the fastest growth rate.

- Cloud adoption among SMEs grew 28%.

- Hybrid deployments are accelerating in regulated sectors.

End-use Insights

- Banking and neobanks hold 36.77% market share.

- Large enterprises account for 69.09% of deployments.

- BFSI sector is anticipated to grow at 19.8% CAGR.

- The insurance sector comprises 13.5% of the AML market.

- Fintech firms increased AML investment by 35% YoY.

- Government agencies represent 14% market share.

- The crypto segment is expected to have the highest CAGR growth.

- Retail adoption of AML tools up 10%.

- North America BFSI AML market is at $0.792 billion.

- SMEs’ focus drives 20.4% CAGR growth.

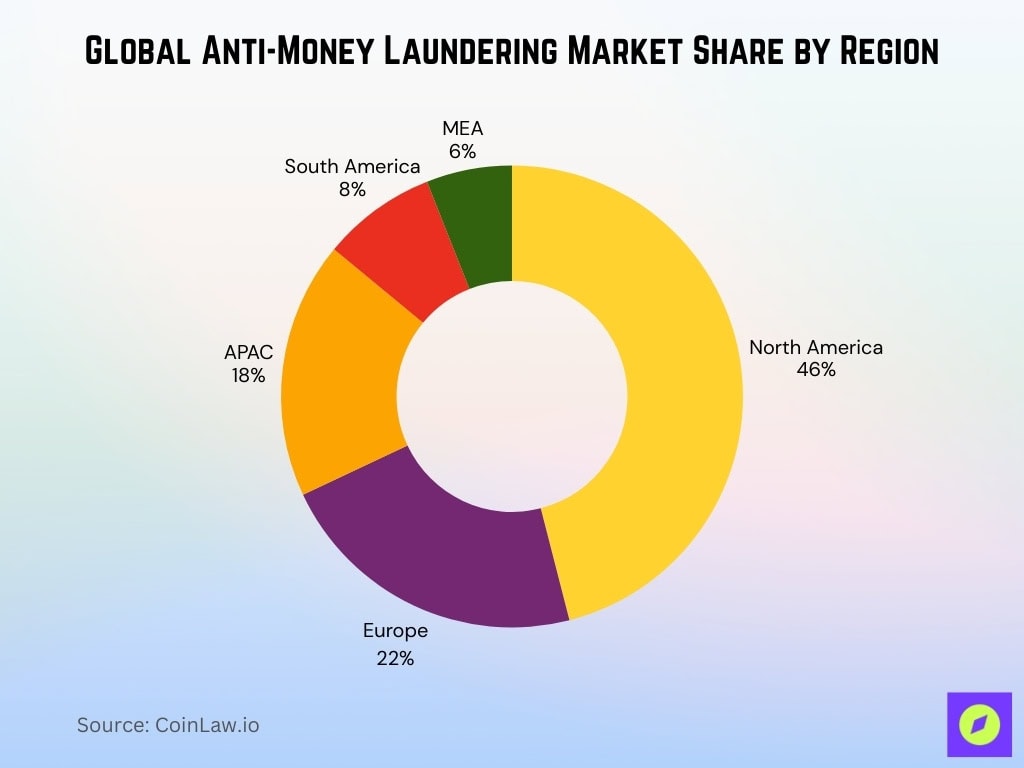

Global Anti-Money Laundering Market Share by Region

- North America holds the largest share at 46%.

- Europe accounts for 22% of the market.

- APAC region captures 18%, driven by regulatory growth.

- South America contributes 8%, with improving frameworks.

- MEA holds 6%, poised for expansion.

Component Insights

- Transaction monitoring systems account for 35% of the global AML market.

- Software components dominate with 70% market share.

- On-premise deployments hold 68% of the AML software market.

- KYC solutions are valued at part of a $7.8 billion market.

- Services contribute 30% to AML software revenue.

- Cloud deployments capture 32% market share.

- Transaction monitoring set to hold 34.1% share.

- Large enterprises control 60% of AML adoption.

- BFSI sector leads with 50% end-user share.

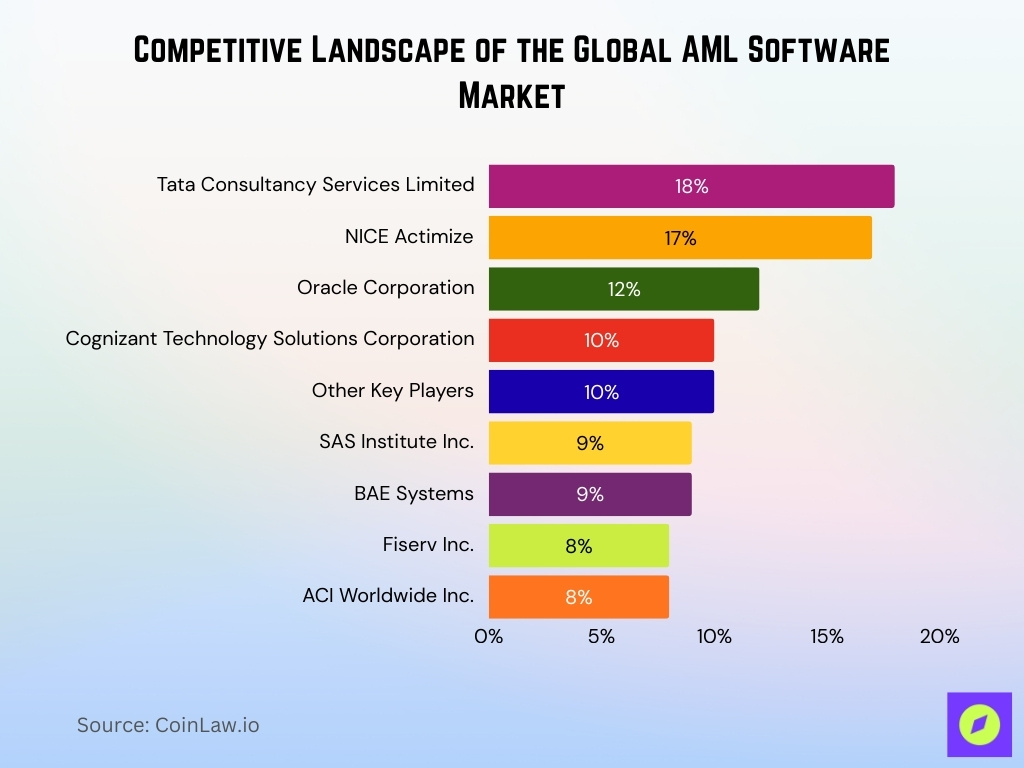

Competitive Landscape of the Global AML Software Market

- Tata Consultancy Services Limited leads the market with a commanding 18% market share, making it the largest player in the AML software space.

- NICE Actimize follows closely with 17% market share, solidifying its strong position among top-tier AML solution providers.

- Oracle Corporation holds 12% market share, reflecting its significant presence in enterprise-level compliance and risk management solutions.

- Cognizant Technology Solutions Corporation accounts for 10% of the global market, maintaining a solid competitive footprint.

- Other Key Players collectively represent 10%, indicating moderate market fragmentation beyond the leading vendors.

- SAS Institute Inc. and BAE Systems each capture 9% market share, highlighting their established roles in analytics-driven AML and financial crime prevention.

- Fiserv Inc. and ACI Worldwide Inc. each hold 8% market share, demonstrating strong participation in payment and transaction monitoring solutions.

- The top two companies alone control 35% of the market, underscoring a moderately concentrated competitive landscape.

Breakdown of Global Financial Crimes and Compliance Failures

- Drug trafficking accounts for 29.3% of global money laundering events.

- Financial fraud comprises 22.2% of money laundering-related activities.

- Direct money laundering offenses represent 17.6% of cases worldwide.

- Other criminal activities contribute 14.3% to laundering events.

- AML compliance failures make up 9.5% of incidents.

- Violations of AML laws account for 3.0% of cases.

- International sanctions are involved in 1.8% of money laundering cases.

- Regulatory breaches and reporting failures each at 1.2%.

- Drug trafficking 30–40% of global money laundering cases.

Technological Advancements in AML Software

- 62% of institutions use AI/ML for AML monitoring.

- AI/ML adoption expected to reach 90%.

- AI reduces false positives by up to 40%.

- Projected to grow to $15.38 billion by 2035.

- 14.7% CAGR for AI in AML 2026-2035.

- 70% of AML platforms embed ML algorithms.

- Biometric identity verification at $8.88 billion.

- Face matching detects 90% true positives.

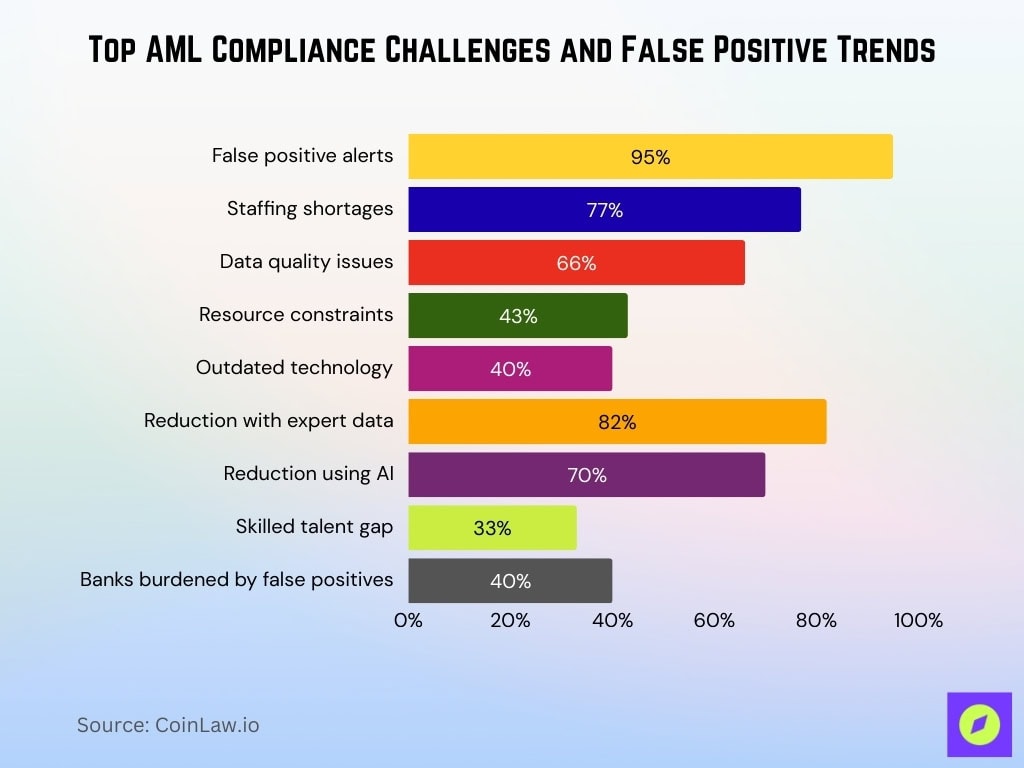

Challenges in AML Compliance and Implementation

- False positives comprise up to 95% of AML alerts.

- 77% cite staffing as the top AML challenge.

- 66% rank data quality/integration as the biggest barrier.

- 43% face resource constraints in AML efficiency.

- 40% point to outdated technology solutions.

- 82% false positive reduction with expert data.

- 70% false positive reduction using AI.

- 33% of teams report skilled professional shortages.

- 40% of banks face false positive burdens.

Frequently Asked Questions (FAQs)

AML software revenue (not services) is estimated at about $2.59 billion in 2026.

On-premise AML solutions account for about 68% of the market share.

Revenues are projected at about $3.75 billion globally for AML software in 2026.

Conclusion

As financial crimes evolve, so too must the software designed to combat them. Anti-money laundering software is at the forefront of this battle, providing essential tools for banks, fintechs, and governments worldwide. The AML software market is set to grow rapidly, driven by advances in AI, machine learning, and blockchain. While challenges such as false positives and data privacy remain, the future looks promising as technological innovations continue to reshape the landscape of financial compliance.