You’re in line at Shanghai’s subway, phone in hand, scanning a QR code like millions every day, welcome to a world where mobile wallets are as essential as breath. In China’s cashless saga, Alipay and WeChat Pay have become the everyday tools shaping commerce, social life, and even global travel. This story is not just numbers; it’s the pulse of digital finance.

Key Takeaways

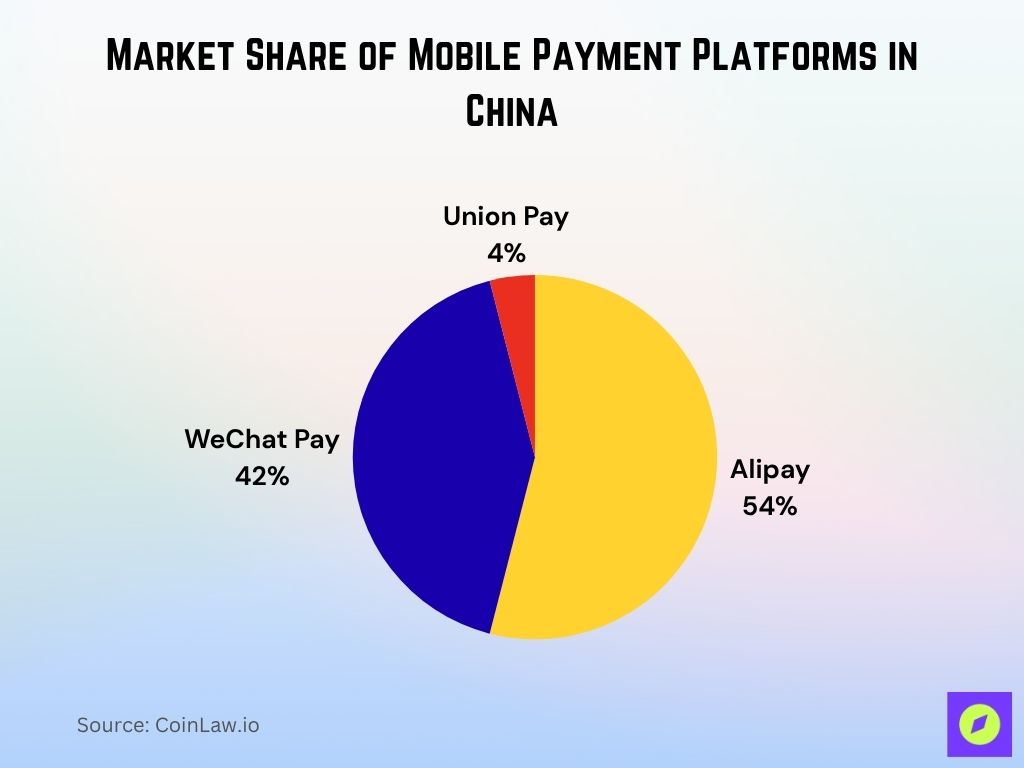

- 1Alipay holds about 53% market share, with WeChat Pay at roughly 42% in China.

- 2Total mobile transaction volume reached an estimated $20.1 trillion through Alipay in 2025.

- 3Combined, they account for over 90% of China’s mobile payments market.

- 4WeChat totals 1.38 billion global monthly active users, with the majority in China using its Pay service.

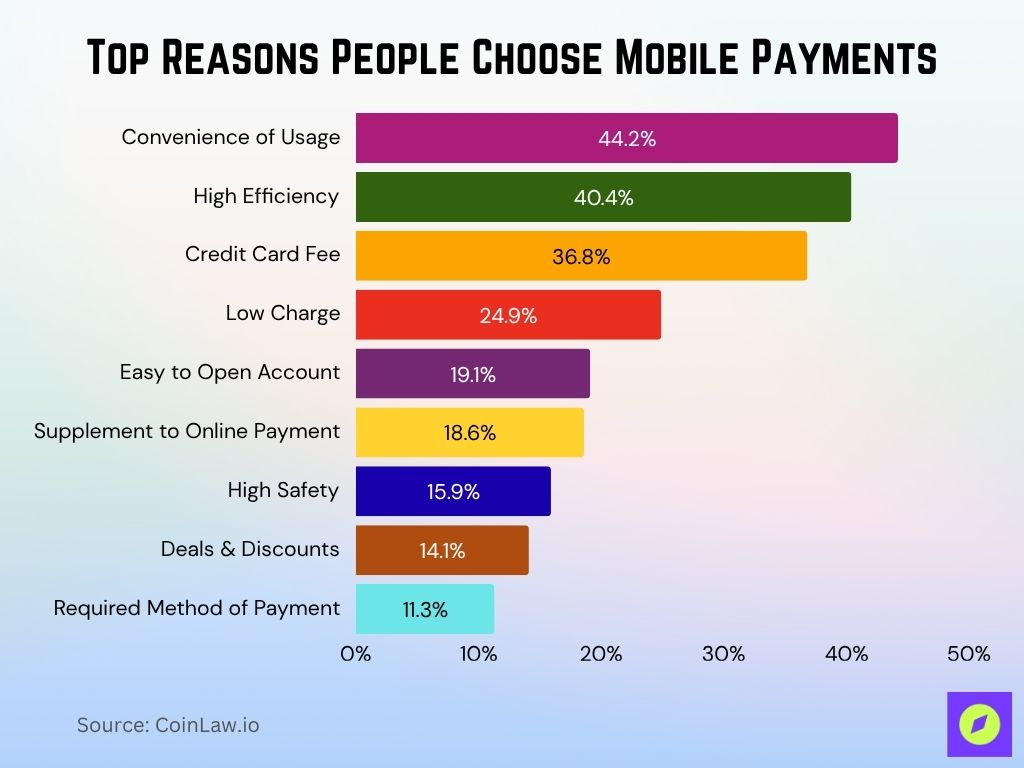

Top Reasons People Choose Mobile Payments

- Convenience of usage leads the list, with 44.2% of users citing it as their main reason.

- High efficiency motivates 40.4% of mobile payment users.

- Credit card fee savings attract 36.8% of users to mobile payments.

- Low charges are a deciding factor for 24.9% of users.

- Easy account opening influences 19.1% of users.

- 18.6% use it as a supplement to online payment methods.

- High safety is valued by 15.9% of users.

- Deals and discounts appeal to 14.1% of mobile payment adopters.

- Required method of payment drives 11.3% of usage cases.

Transaction Volume Comparison

- Alipay processed around $20.1 trillion in total volume in 2025.

- WeChat Pay handles over 1 billion transactions daily, putting annual totals in the trillions of dollars.

- Combined, they processed more than $80 trillion in 2024, continuing steady growth.

- Alipay’s daily transaction count surpassed 120 million, up 15% from the previous year.

User Numbers and Growth

- Alipay’s global monthly active users reached 1.4 billion in 2025.

- WeChat recorded 1.38 billion monthly active users, with about 935 million using WeChat Pay in China.

- WeChat Pay’s active user base grew from roughly 800 million in 2019 to 935 million in 2023.

Monthly Active Users

- Alipay: 1.4 billion monthly active users worldwide.

- WeChat: 1.38 billion monthly active users, with most Chinese users adopting its Pay service.

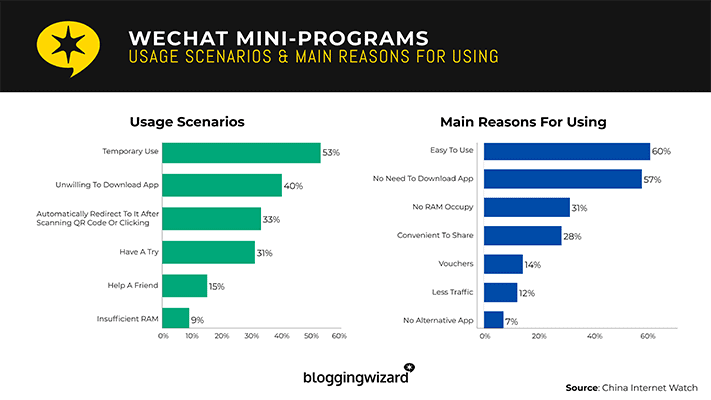

Why Users Prefer WeChat Mini-Programs

Usage Scenarios:

- 53% use it for temporary needs, avoiding full app installations.

- 40% are unwilling to download an app, making mini-programs a go-to option.

- 33% are automatically redirected to it after scanning a QR code or clicking a link.

- 31% use it to simply “have a try” without long-term commitment.

- 15% access it through a friend’s recommendation or sharing.

- 9% choose it due to insufficient RAM on their devices.

Main Reasons for Using:

- 60% prefer it because it’s easy to use.

- 57% appreciate the no-download requirement.

- 31% are motivated by low RAM usage.

- 28% find it convenient to share with others.

- 14% are drawn by voucher offers.

- 12% choose it due to less traffic and faster access.

- 7% use it because there’s no alternative app available.

Demographic & Regional Penetration (including Rural vs Urban Usage)

- By mid‑2024, nearly 92% of Chinese respondents reported using Alipay, and 85% used WeChat Pay.

- Mobile payment penetration reached 968.9 million people, or about 38% of the population.

- Urban users tend to favor Alipay for its e‑commerce links, while rural adoption of both services continues to rise.

- In tier‑3 and tier‑4 cities, WeChat Pay’s popularity benefits from its social‑network features.

Mobile Payment Penetration in China

- Mobile payment penetration in China is among the highest globally, with usage rates exceeding 85% in urban areas.

- Rural penetration is rising steadily, reaching an estimated 65% in 2025.

- Younger consumers, particularly those aged 18–35, have adoption rates above 95%.

- Penetration in the over‑50 demographic has doubled in the past five years, driven by government initiatives and simplified app features.

- Digital wallets are now the primary payment method for everyday purchases in more than two‑thirds of Chinese households.

- Contactless QR code usage accounts for more than 90% of mobile payment transactions.

- Cross‑platform integration has made it easier for smaller cities to catch up with first‑tier cities in mobile payment adoption.

Market Share of Mobile Payment Platforms in China

- Alipay dominates the market with a 54% share, making it the most widely used mobile payment platform.

- WeChat Pay follows closely with 42% market share, maintaining a strong position among Chinese consumers.

- Union Pay holds a smaller portion of the market at 4%, serving as a niche payment option.

Industry Adoption and Merchant Coverage

- Over 95% of physical merchants in China accept both Alipay and WeChat Pay.

- E‑commerce acceptance is nearly universal, with both platforms embedded in major retail and marketplace apps.

- Street vendors and small‑scale merchants in rural markets now adopt mobile payments as their default method.

- Restaurants, cafés, and food delivery services report mobile payment usage exceeding 90% of transactions.

- Public transportation systems in over 300 cities support both platforms for ticketing and access.

- The hospitality sector, including hotels and travel agencies, integrates mobile payments for both domestic and international customers.

- Large chain retailers often run exclusive promotions tied to either Alipay or WeChat Pay, influencing consumer choice at checkout.

Usage by Sector or Industry

- In retail, mobile payments account for over 85% of in‑store transactions in tier‑1 cities.

- Online travel agencies report that more than 80% of bookings are paid via mobile wallets.

- The food and beverage sector sees mobile payments dominate, with over 90% usage in quick‑service restaurants.

- Utility bill payments via Alipay and WeChat Pay have grown by more than 20% year‑on‑year.

- Mobile payments account for nearly all peer‑to‑peer transfers among younger users.

- Education services, including tuition and online courses, have embraced mobile wallets as a primary payment channel.

- Entertainment sectors, such as cinemas and streaming subscriptions, see more than 75% of payments through Alipay or WeChat Pay.

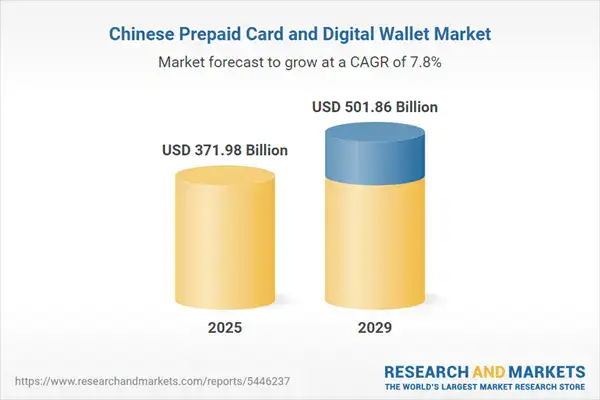

Chinese Prepaid Card and Digital Wallet Market Outlook

- The market is projected to grow at a CAGR of 7.8%.

- In 2025, the market value is expected to reach USD 371.98 billion.

- By 2029, it is forecasted to rise to USD 501.86 billion.

- This growth reflects the increasing adoption of digital payment solutions in China.

Cross‑Border and Overseas Usage

- Alipay is accepted in over 220 countries and regions, with direct partnerships in more than 50 currencies.

- WeChat Pay’s overseas reach covers 20+ countries, with a strong presence in Asia‑Pacific travel corridors.

- Both platforms are widely used by Chinese tourists abroad, particularly in Japan, Thailand, and Singapore.

- Overseas retailers targeting Chinese shoppers often integrate both payment methods for competitive advantage.

- Partnerships with foreign payment gateways have made it easier for merchants to process cross‑border QR transactions.

- Mobile payment use by Chinese travelers abroad has rebounded strongly following the easing of travel restrictions.

- Alipay’s “Tour Pass” and WeChat’s “Overseas Wallet” services make foreign spending seamless for visitors.

Supported Currencies and Devices

- Alipay supports payments in over 50 currencies, with real‑time exchange rate conversion.

- WeChat Pay handles transactions in dozens of major world currencies through linked international cards.

- Both platforms are compatible with a wide range of smartphones, from budget Android models to premium iPhones.

- Wearable integration includes smartwatches and fitness bands for contactless payments.

- QR code payment remains the dominant method, though NFC support is increasing.

- Payment functionality extends to tablets and some smart TV systems for in‑app purchases.

- Voice‑activated payments are emerging through integration with smart home devices.

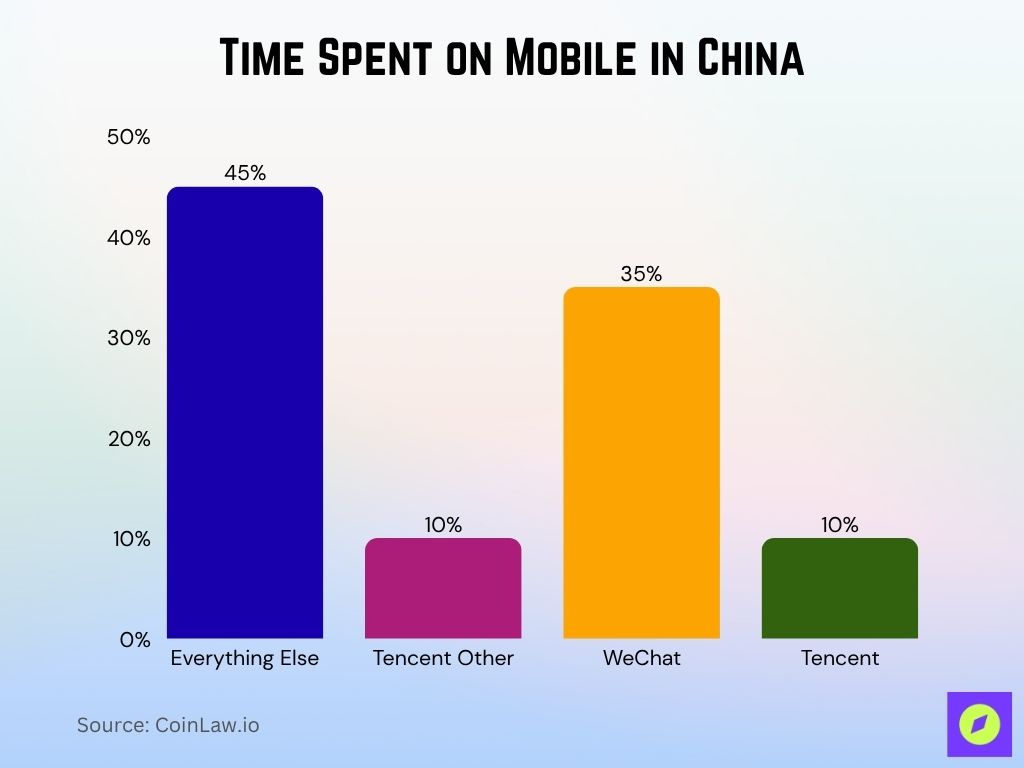

Time Spent on Mobile in China

- 45% of mobile time is spent on everything else outside Tencent platforms.

- WeChat takes up 35% of total mobile usage time, showing its dominance in daily digital life.

- Tencent Other apps account for 10% of time spent on mobile.

- Tencent standalone usage (excluding WeChat and other Tencent apps) also represents 10% of total mobile activity.

Payment Scenarios and Use Cases

- Every day, retail purchases remain the top use case for mobile wallets.

- Taxi and ride‑hailing services integrate both Alipay and WeChat Pay for seamless booking.

- Food delivery apps link directly to mobile wallets for instant checkout.

- Bill splitting among friends is streamlined through built‑in transfer functions.

- Public transit fare payment via QR code is routine in most Chinese cities.

- Charitable donations through both platforms have become increasingly popular during national campaigns.

- Medical services, including hospital registration and consultation fees, are increasingly processed via mobile wallets.

Fees and Limits Comparison

- Alipay typically charges merchants a transaction fee averaging around 0.6%.

- WeChat Pay fees are comparable but vary slightly based on merchant agreements.

- Peer‑to‑peer transfers are usually free within a set monthly limit.

- Both platforms charge small fees for credit card repayments over certain limits.

- Cash‑out to bank accounts may incur a percentage‑based service fee after free thresholds are exceeded.

- High‑volume merchants often negotiate discounted transaction rates.

- Daily transaction limits for individuals can exceed ¥200,000 depending on account verification level.

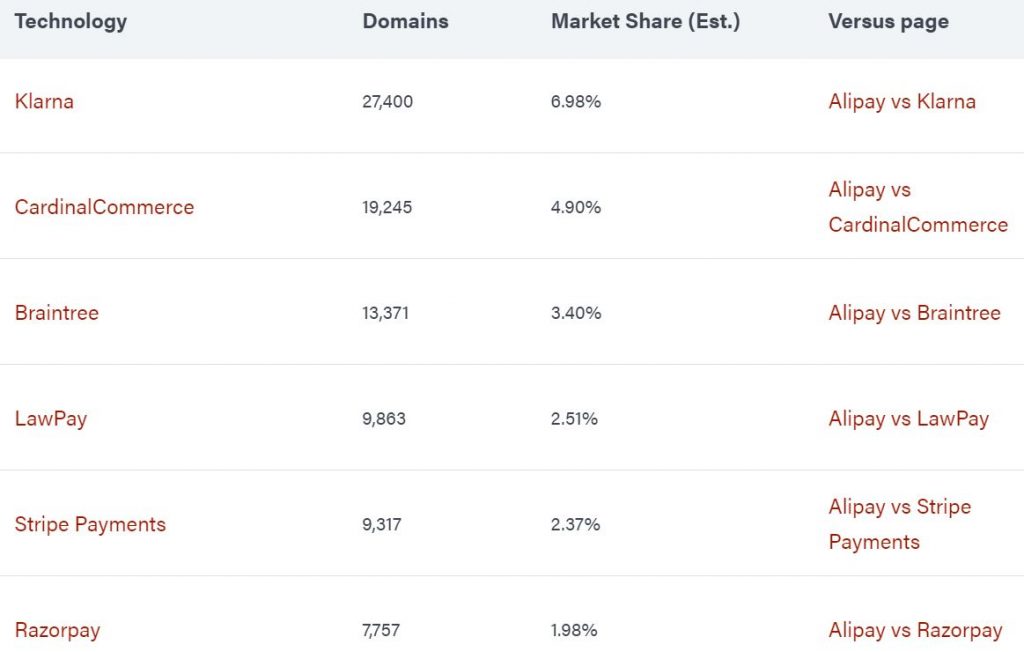

Leading Competitors of Alipay

- Klarna leads competitors with 27,400 domains and a 6.98% estimated market share.

- CardinalCommerce follows with 19,245 domains and 4.90% market share.

- Braintree holds 13,371 domains and 3.40% market share.

- LawPay operates with 9,863 domains, capturing 2.51% of the market.

- Stripe Payments manages 9,317 domains, holding 2.37% market share.

- Razorpay has 7,757 domains, accounting for 1.98% of the market.

Consumer Preferences and Adoption Rates

- Surveys show that consumers often use both platforms interchangeably.

- Alipay tends to be preferred for e‑commerce, while WeChat Pay is dominant in social and in‑chat transactions.

- User loyalty is often driven by rewards programs, such as coupons and cashback offers.

- Many consumers link multiple bank accounts and credit cards to a single mobile wallet for flexibility.

- Seasonal campaigns, such as Lunar New Year promotions, significantly boost transaction volumes.

- Adoption rates remain highest among younger demographics but are steadily increasing among older users.

- Consumer trust in security and fraud prevention is a major factor in continued adoption.

Growth in E‑commerce Transactions

- E‑commerce transactions through mobile wallets have grown more than 15% year‑on‑year.

- Mobile payments now account for over 90% of all online retail transactions in China.

- Integration with live‑streaming e‑commerce platforms has driven significant spending growth.

- Social commerce, where purchases occur directly within chat or social media platforms, is expanding rapidly.

- Major shopping festivals, such as Singles’ Day, see record‑breaking transaction volumes each year.

- Cross‑border e‑commerce payments via Alipay and WeChat Pay have surged with international retail growth.

- Buy‑now‑pay‑later services integrated into mobile wallets are fueling higher average transaction values.

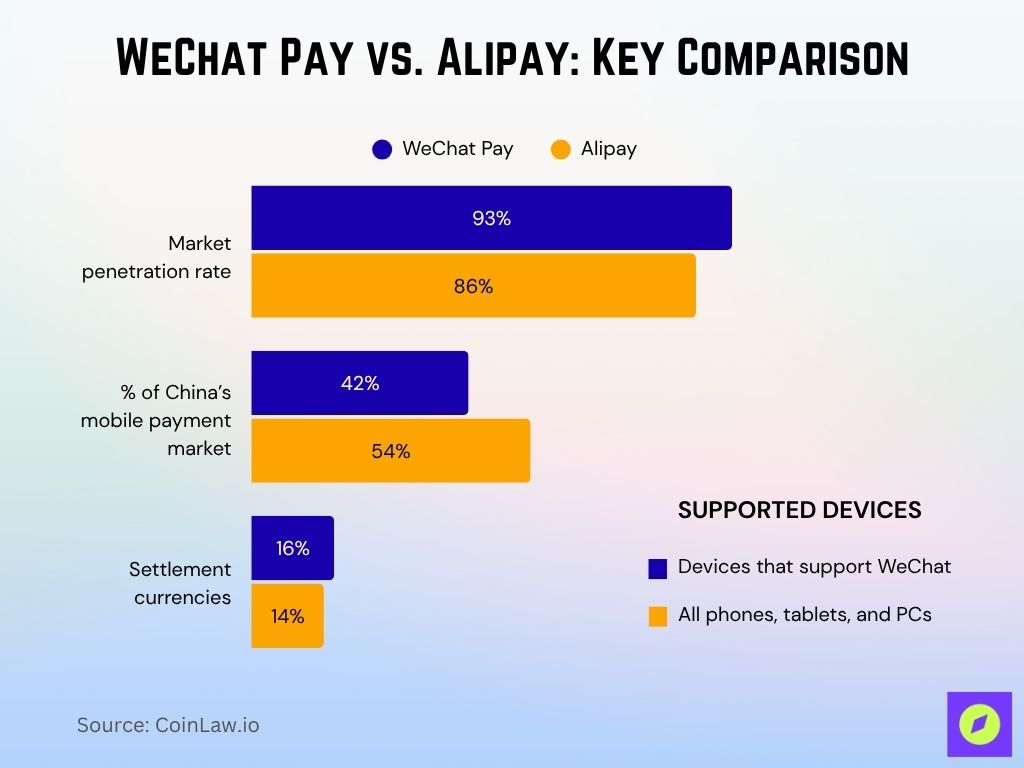

WeChat Pay vs. Alipay: Key Comparison

- WeChat Pay has a higher market penetration rate at 93%, compared to Alipay’s 86%.

- Alipay leads in China’s mobile payment market share with 54%, while WeChat Pay holds 42%.

- WeChat Pay supports 16 settlement currencies, slightly more than Alipay’s 14.

- WeChat Pay works on devices that support WeChat, while Alipay is available on all phones, tablets, and PCs.

Ecosystem Services & Financial Integration

- Alipay offers integrated services for wealth management, small business loans, and insurance.

- WeChat Pay connects users to investment products and microloans within its app ecosystem.

- Both platforms allow utility bill payments, government service fees, and traffic fine settlements.

- Integration with public services, such as healthcare and education payments, has expanded in recent years.

- In‑app mini‑programs make it possible to book travel, shop, and manage finances without leaving the platform.

- Digital IDs are increasingly linked to payment accounts for streamlined verification.

- Loyalty programs and gamified rewards keep users engaged beyond payments.

Technological Innovations (e.g., QR‑code, facial recognition)

- QR code technology remains the backbone of mobile payment transactions in China.

- Facial recognition payment terminals are now common in retail and transit stations.

- AI‑driven fraud detection helps prevent unauthorized transactions in real time.

- Voice‑activated payment capabilities are emerging through smart assistant integration.

- NFC technology is being integrated alongside QR for faster in‑person transactions.

- Both platforms are experimenting with biometric authentication beyond facial recognition, such as fingerprint and palm vein scanning.

- Offline payment modes allow transactions even without active internet connectivity.

Regulatory and Policy Impact

- The People’s Bank of China has tightened oversight of fintech platforms since 2021.

- New rules in 2025 set stricter limits on non‑bank payment institutions’ leverage in lending.

- Data protection laws require stronger encryption and localized data storage.

- Both platforms must comply with anti‑money‑laundering and know‑your‑customer requirements.

- Cross‑border transactions are subject to foreign exchange regulations and monitoring.

- Regulatory scrutiny has slowed some high‑risk product launches in the fintech space.

- Compliance costs have risen as regulatory frameworks become more complex.

Implications for Digital Yuan Adoption

- Both Alipay and WeChat Pay have integrated support for the digital yuan.

- Pilot programs show high user willingness to adopt the digital currency for small transactions.

- Government incentives encourage merchants to accept the digital yuan alongside mobile wallets.

- Integration could shift some transaction volume away from private platforms to the state‑issued currency.

- The coexistence of digital yuan and private wallets may reshape transaction fee structures.

- Increased transparency from digital yuan transactions may impact consumer privacy expectations.

- The platforms’ role as distribution channels makes them key players in the national digital currency rollout.

Recent Developments

- In April 2025, Ant Group acquired a controlling Hong Kong securities firm for about $362 million, expanding Alipay’s finance capabilities.

- Alipay now supports payments in over 220 countries and regions, with access to more than 50 currencies.

- WeChat Pay expanded into more than 20 countries, targeting Chinese tourists and expatriates.

- Ant Group invested 21.19 billion yuan (around $2.9 billion) in R&D and AI innovation in 2023 and continued into 2025.

- Alipay strengthened its integration with financial services such as lending, investment, and insurance.

- WeChat deepened its mini program and AI-driven features to increase user engagement beyond payments.

- Regulatory oversight intensified in 2025, particularly in data privacy and fintech operations.

Future Outlook & Projections

- Mobile payment penetration in China is expected to exceed 90% of the population by 2028.

- Alipay and WeChat Pay will likely maintain a combined market share above 85% for the foreseeable future.

- Growth opportunities lie in cross‑border commerce and remittances.

- Integration of AI and predictive analytics will improve user targeting and fraud prevention.

- Biometric payments could surpass QR codes as the dominant in‑person payment method by 2030.

- The rise of digital yuan adoption could shift the competitive balance in domestic payments.

- New regulatory frameworks will continue to shape innovation and expansion strategies.

Conclusion

Alipay and WeChat Pay remain the undisputed leaders of China’s mobile payment landscape. Their dominance is built on deep ecosystem integration, near‑universal merchant acceptance, and relentless innovation. While they compete fiercely, both platforms also work in parallel to expand payment convenience domestically and abroad. Looking forward, their influence is set to grow, not only in shaping consumer payment habits but also in defining the very future of digital finance in China and beyond.