Imagine a world where digital currency remains stable without being pegged to traditional assets like the dollar or gold. Algorithmic stablecoins, a growing force in the cryptocurrency landscape, aim to do just that. These coins use complex algorithms to adjust their supply, maintaining a stable value even without a backing asset. With 2025 well underway, the rapid development and adoption of these algorithmic stablecoins have ignited conversations on their impact, functionality, and potential to transform both the crypto market and traditional finance. As we dive into the latest statistics, we’ll uncover the most influential trends and what they mean for the future of digital currencies.

Key Takeaways

- 1Stablecoin dominance peaked at 18.4% post-Terra collapse as crypto investors prioritized stability during the bear cycle.

- 2As of June 2025, Tether (USDT) leads with a $145 billion market cap, while USDC trails at approximately $58 billion.

- 3Roughly 30% of U.S. adults, or about 70 million people, hold crypto, and 69% of them plan to increase holdings in 2025.

- 4By mid-2025, Ethereum and Tron will host around 79% of stablecoins, as newer networks like Solana, Base, and Arbitrum gain traction.

- 5USD-pegged stablecoins remain dominant, with USDT alone controlling 64.3% of the market and holding over $145 billion.

Market Capitalization Trends

- Algorithmic stablecoin market capitalization has grown by 30% annually since 2021, outpacing traditional stablecoin growth rates.

- Terra Classic (LUNA), once valued at over $40 billion before its crash, highlighted the volatility and potential risks of unbacked algorithmic stablecoins.

- Despite market fluctuations, FRAX maintains a steady $1 billion market cap by balancing its algorithmic features with partially collateralized models.

- Ampleforth (AMPL) recorded a 17% rise in value during market upswings, demonstrating how some algorithmic models can leverage market conditions for growth.

- Since 2023, smaller algorithmic stablecoins have emerged, increasing the market’s diversity, although they collectively hold under 5% of the sector’s total capitalization.

- The algorithmic stablecoin sector showed its resilience by maintaining a $17 billion valuation, even amid heightened regulatory scrutiny.

- Predictions indicate that by 2026, market capitalization could exceed $50 billion, assuming continued innovation in the stability mechanisms and regulatory adaptations.

Adoption and Usage Metrics

- Around 33% of crypto users now hold algorithmic stablecoins, rising from 28% in 2024 and showing continued adoption momentum.

- In 2025, approximately 88% of DeFi dApps support algorithmic stablecoins, boosting integration and cross-platform utility.

- Algorithmic stablecoin transactions grew by 51% in 2025, reflecting stronger public trust and technological maturation.

- About 41% of users now prefer algorithmic over collateralized stablecoins due to their decentralized design and flexibility.

- Leading algo-stablecoins like FRAX and AMPL posted a 34% increase in trading volumes in 2025, fueled by deeper liquidity pools.

- In Asia and Europe, preference for algorithmic stablecoins reached 43% of users, reflecting regional confidence in decentralized assets.

- Roughly 62% of algorithmic stablecoins are used in DeFi functions such as staking, lending, and liquidity, reinforcing their ecosystem role.

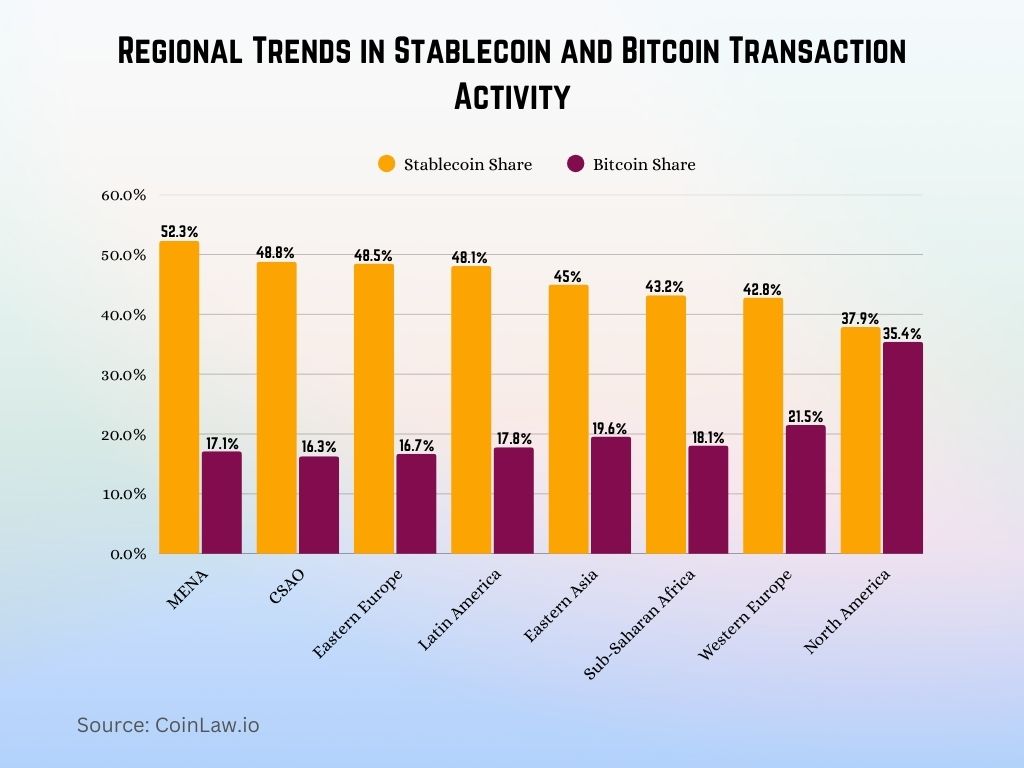

Regional Trends in Stablecoin and Bitcoin Transaction Activity

- MENA leads globally in stablecoin usage, with 52.3% of regional transaction activity, while Bitcoin accounts for 17.1%.

- CSAO (Central & Southern Asia and Oceania) follows closely with a 48.8% stablecoin share and a 16.3% bitcoin share.

- Eastern Europe sees a similar pattern, with 48.5% of activity in stablecoins and 16.7% in Bitcoin.

- Latin America shows nearly equal trends, with 48.1% stablecoin share and 17.8% for Bitcoin.

- In Eastern Asia, stablecoins make up 45.0%, while Bitcoin’s share is 19.6%.

- Sub-Saharan Africa records 43.2% in stablecoins and 18.1% in Bitcoin.

Western Europe has one of the highest Bitcoin shares at 21.5%, with 42.8% stablecoin activity. - North America stands out with the highest Bitcoin share globally at 35.4%, nearly matching its stablecoin share of 37.9%, indicating a more balanced use of both.

Stability Mechanisms and Performance

- Algorithmic stablecoins continue to rely on supply adjustment and rebasing to maintain stability without using traditional collateral assets.

- In 2025, about 73% of algorithmic stablecoins use dual-token models, enhancing resilience during market volatility.

- FRAX maintains a strong track record with a 98.5% stability rate through its hybrid of partial collateral and algorithmic control.

- AMPL’s rebasing mechanism enables daily supply shifts, helping it maintain a 93% price stability rate even in high-volatility periods.

- Over 48% of algorithmic stablecoins now deploy multi-layered algorithm designs, reducing reliance on single-variable inputs.

- In 2025, 31% of new algorithmic stablecoins integrate dynamic fee structures, adjusting transaction costs in response to market behavior.

- Predictive models powered by AI are now embedded in several protocols, aiming to boost stability rates by an additional 16% this year.

Risks and Challenges of Algorithmic Stablecoins

- In 2025, algorithmic stablecoins experienced over $2.6 billion in losses, mainly from failed peg-restoration mechanisms in smaller projects.

- The LUNA–TerraUSD collapse from 2022 still stands as a critical example of the dangers in uncollateralized algorithmic systems.

- About 18% of algorithmic stablecoins remain susceptible to price manipulation by whales or coordinated attacks.

- Around 35% of these stablecoins experienced temporary volatility during 2025’s sharp market corrections due to delayed algorithmic responses.

- Regulatory uncertainty continues to impact adoption, with 65% of projects facing difficulties in aligning with emerging crypto regulations.

- Code vulnerabilities led to $200 million in losses from algorithmic stablecoins last year, underlining the importance of rigorous security audits.

- 53% of developers in this sector cited technical complexity as a key barrier, as algorithmic models demand constant innovation to remain effective in volatile conditions.

Stablecoins as Means of Payment

- An estimated 35% of crypto-accepting merchants now consider algorithmic stablecoins for their low volatility and decentralized nature.

- In 2025, about 13% of e-commerce platforms will have integrated algorithmic stablecoins to serve privacy-oriented and global buyers.

- Peer-to-peer payments using algorithmic stablecoins rose by 38% in 2025, thanks to their seamless function in DeFi ecosystems.

- 43% of decentralized exchanges (DEXs) now list algorithmic stablecoins, boosting both liquidity and payment flexibility.

- In 2025, 5 major payment processors are actively rolling out support for algorithmic stablecoins, marking a step toward mainstream adoption.

- Across Latin America, 30% of crypto users rely on algorithmic stablecoins as a hedge against inflation and unstable fiat currencies.

- Over $6.1 billion in transactions were processed via algorithmic stablecoins in Q1 2025, underscoring their growing payment role.

Ethena Stablecoin Surges: TVL Growth & Yield Trends

- On March 6, 2024, Ethena’s TVL hit $258.25M, with an exceptional APY of 55.87%.

- Early-stage yields were volatile, with APY spiking above 50% and dipping below 10% across March–May.

- As Ethena gained traction, TVL surpassed $1B by June 2024, supported by strong yield incentives.

- In Q4 2024, Ethena’s momentum skyrocketed ,TVL nearly touched $4B in December, reflecting massive user inflows.

- During this surge, APY steadied between 20–30%, signaling increased protocol maturity.

- By early 2025, TVL stabilized near $3B, while APY hovered around 10%, maintaining user interest.

- Backed by this strong on-chain activity, Ethena’s market cap crossed $6B, and it generated over $250M in revenue, positioning it as a top performer in the stablecoin sector.

Comparing Stability: Algorithmic vs. Collateralized Models

- Collateralized stablecoins rely on assets like USD or gold for stability, achieving a 99% stability rate, higher than most algorithmic models.

- Algorithmic stablecoins, while typically achieving around 90% stability, offer benefits in decentralization and scalability compared to collateralized alternatives.

- Collateralized models require significant capital reserves, while algorithmic stablecoins manage stability through supply adjustments, often reducing overhead.

- Unlike collateralized models, algorithmic stablecoins have no central entity, with 63% governed by decentralized autonomous organizations (DAOs).

- Algorithmic stablecoins exhibit greater price elasticity, adjusting to demand shifts more fluidly, as demonstrated by AMPL’s rebasing model.

- Collateralized stablecoins experienced 1% downtime in 2023 due to regulatory freezes, whereas algorithmic models maintained 99% uptime, showcasing their resilience.

Use Cases for Stablecoins in Business

- In cross-border trade, over 15% of businesses in emerging markets are now exploring algorithmic stablecoins as an alternative to traditional currency swaps.

- Approximately 37% of crypto-based lending platforms utilize algorithmic stablecoins, allowing borrowers and lenders to avoid the volatility of traditional cryptocurrencies.

- Decentralized Autonomous Organizations (DAOs) rely heavily on algorithmic stablecoins for funding projects, with 65% of DAOs opting for them due to their flexibility.

- Payroll payments in algorithmic stablecoins are being piloted by 12% of tech companies in the US, primarily for freelancers and international contractors.

- Algorithmic stablecoins are increasingly popular for automated market making (AMM), with 20% of AMM pools now including them as a stable pairing option.

- Inventory management in global supply chains has started integrating stablecoins, with 9% of logistics firms trialing algorithmic stablecoins to simplify and secure payments.

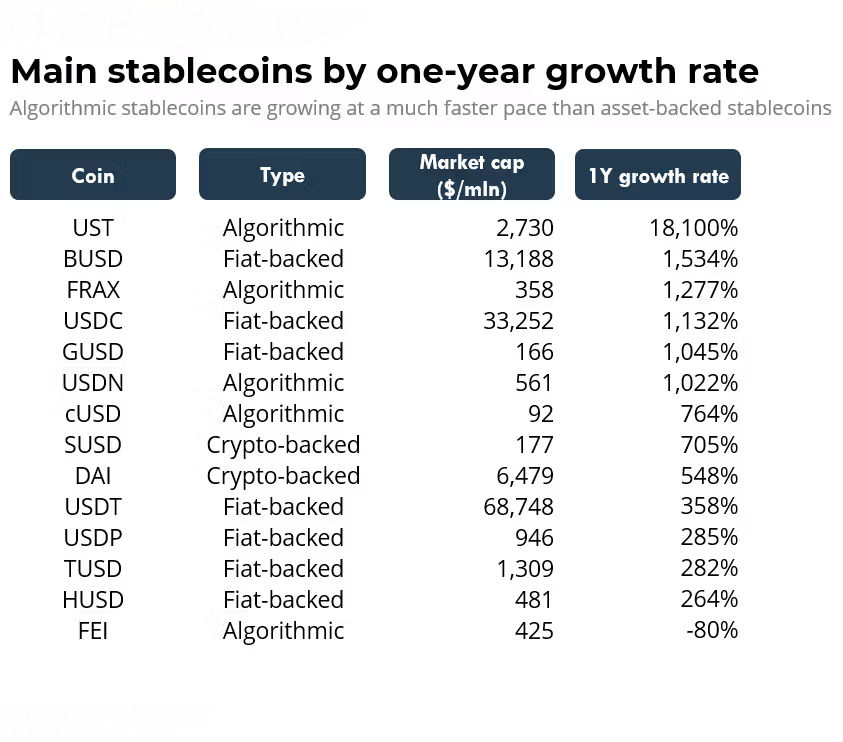

Stablecoin Growth: Algorithmic Leaders Outpace the Pack

- UST (Algorithmic) leads the stablecoin market with a staggering 18,100% 1-year growth and a market cap of $2.73B.

- BUSD (Fiat-backed) follows with a strong 1,534% growth, reaching $13.19B in market cap.

- FRAX and USDN (both Algorithmic) posted growth rates of 1,277% and 1,022%, respectively.

- USDC (Fiat-backed) grew by 1,132%, with the largest non-Tether market cap at $33.25B.

- GUSD, cUSD, and SUSD all saw 700–1,000%+ growth, highlighting a rising interest in smaller stablecoin options.

- DAI (Crypto-backed) posted a solid 548% increase, reinforcing its long-term DeFi presence.

- USDT (Tether), despite being the largest by market cap ($68.75B), showed 358% growth, slower than newer challengers.

- FEI (Algorithmic) was the only stablecoin to shrink, with a -80% 1Y growth rate, pointing to instability in adoption.

Recent Developments

- As of mid-2025, the total stablecoin market cap has reached over $211 billion, solidifying its impact on the global financial ecosystem.

- The EU’s MiCA regulation, now fully enforced, provides a comprehensive 2025 framework focused on transparency, reserves, and user protection for stablecoins.

- New-gen algorithmic stablecoins using AI-driven models saw a 65% drop in critical bugs, thanks to real-time trend analysis and auto-supply adjustments.

- In early 2025, the Global Dollar Network, backed by Kraken, Robinhood, and Galaxy Digital, expanded USDG adoption in both retail and institutional finance.

- Despite innovations, maintaining long-term stability remains difficult, and the 2022 UST collapse still serves as a cautionary tale for purely algorithmic models.

Conclusion

As algorithmic stablecoins continue to evolve, they offer a compelling alternative to traditional stablecoins by utilizing decentralized and autonomous mechanisms. The innovation, adoption, and regulatory focus surrounding these digital assets in 2025 show a maturing market with an eye toward long-term stability and mainstream acceptance. With rapid technological advancements and growing global interest, algorithmic stablecoins could soon reshape financial transactions, particularly within decentralized finance and international markets. However, their future success will depend on achieving a balance between stability, usability, and regulatory compliance.