Cathie Wood’s ARK Invest made its first Nvidia stock purchase in over three months, seizing the opportunity after a surprising price dip followed strong earnings.

Key Takeaways

- ARK Invest bought 93,374 Nvidia shares worth about $17.5 million on November 20, its first NVDA purchase since August 4.

- Nvidia reported strong Q3 results, with a 62 percent year-on-year revenue jump to $57 billion, beating market expectations.

- Despite the earnings beat, Nvidia shares dropped 3.15 percent amid broader market weakness and reduced Fed rate cut hopes.

- ARK Innovation ETF now holds 505,395 Nvidia shares, making it the fund’s 23rd largest position.

What Happened?

Cathie Wood’s investment firm ARK Invest took advantage of a post-earnings dip in Nvidia’s stock price to reenter its position in the AI chipmaker. The move comes after Nvidia delivered a blowout third-quarter earnings report but still saw its stock decline in regular trading.

Cathie Wood’s Ark Invest just made a significant rotation into Nvidia, buying $17M in $NVDA shares while selling competitor AMD. This move from the influential tech investor signals a strong conviction shift in the chip space ahead of anticipated earnings reports.

— Ryxel (@ryxelai) November 21, 2025

ARK Reenters Nvidia After Earnings Volatility

On November 20, ARK Invest’s flagship fund ARK Innovation ETF purchased 93,374 shares of Nvidia, valued at approximately $17.5 million. This marks the first time ARK has bought Nvidia shares since August 4.

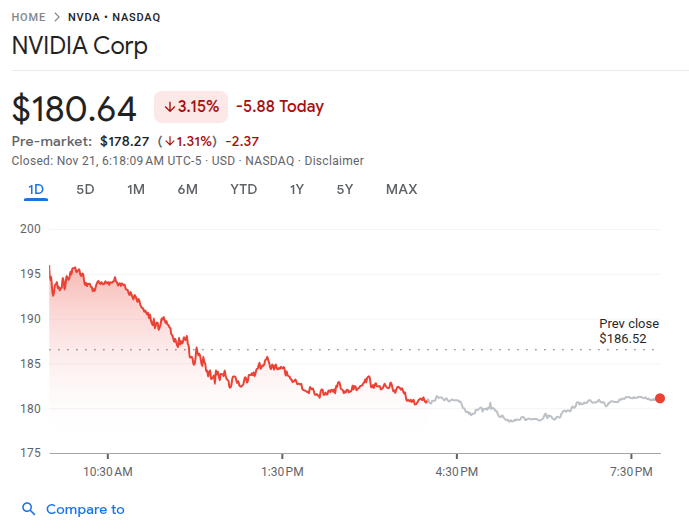

The timing followed Nvidia’s Q3 earnings release, which showed a 62 percent year-over-year revenue surge to $57 billion, beating Wall Street’s forecasts. Nvidia shares initially jumped more than 5 percent in after-hours trading, but market sentiment quickly shifted.

By the next day’s close, Nvidia stock had fallen 3.15 percent to $180.64, dragged down by overall market weakness and waning investor hopes for a December interest rate cut by the Federal Reserve.

Despite the drop, Cathie Wood saw the moment as a buying opportunity. As of November 20, ARK Innovation ETF held 505,395 Nvidia shares, positioning it as the 23rd largest holding in the fund’s portfolio.

Portfolio Moves Beyond Nvidia

The Nvidia buy was part of a broader day of activity for ARK Invest. The firm also made significant moves in other sectors:

- Crypto Stocks: ARK purchased shares in multiple crypto-related companies, including:

- 363,081 shares of Bitmine Immersion Technologies.

- 241,991 shares of Bullish.

- 134,650 shares of Circle Internet.

- Electric Aviation: ARK acquired 971,423 shares of Archer Aviation, a developer of electric vertical takeoff and landing aircraft.

- Biotech Sector: ARK expanded into life sciences, buying:

- 496,586 shares of Recursion Pharmaceuticals.

- 290,617 shares of Pacific Biosciences.

- 78,243 shares of CRISPR Therapeutics.

- 70,685 shares of Illumina.

Trimming Other Positions

While adding to Nvidia and other growth plays, ARK was also actively reducing certain holdings:

- It sold 14,087 shares of Advanced Micro Devices (AMD) across its ETFs.

- The firm also offloaded 932,161 shares of Exact Sciences after Abbott Laboratories announced a $21 billion acquisition of the cancer diagnostics company.

CoinLaw’s Takeaway

I find this move classic Cathie Wood. In my experience watching her strategies, she often buys into volatility and uses dips as buying opportunities, especially for high-conviction names like Nvidia. The stock’s dip despite stellar earnings reflects broader market nervousness rather than company fundamentals. Personally, I think ARK’s confidence in Nvidia, even amid macro uncertainty, signals that Wood still sees major upside in the AI boom. If anything, this may mark the beginning of a more aggressive return to big tech for ARK.