Imagine a world where international payments are as seamless as sending a text message. Wise Payments Limited, a trailblazer in the financial technology industry, has been transforming how individuals and businesses transfer money globally. Founded to simplify cross-border transactions, Wise’s journey has been marked by innovation, transparency, and growth. In this article, we’ll explore the company’s remarkable milestones, user base expansion, and financial evolution that highlight its role in redefining global financial connectivity.

Editor’s Choice: Key Milestones

- $11 billion valuation in 2025 positions Wise as a dominant force in global fintech.

- 20 million active users in 2025 marks a 25% growth from the previous year.

- $105 billion processed in cross-border payments in 2025 shows accelerating global usage.

- Services expanded to 65 countries, boosting Wise’s international accessibility.

- Wise Platform API will be used by 22,000+ businesses by 2025 for seamless payment integration.

- Achieved net-zero carbon footprint in 2025 through sustainable operations.

- Named Top 5 Global Fintech Company to Watch in 2025 by a leading industry publication.

User Base and Growth Statistics

- Wise recorded a 25% growth in user sign-ups, with 4 million new customers joining.

- Its mobile app downloads surpassed 30 million, reflecting a 35% year-over-year increase.

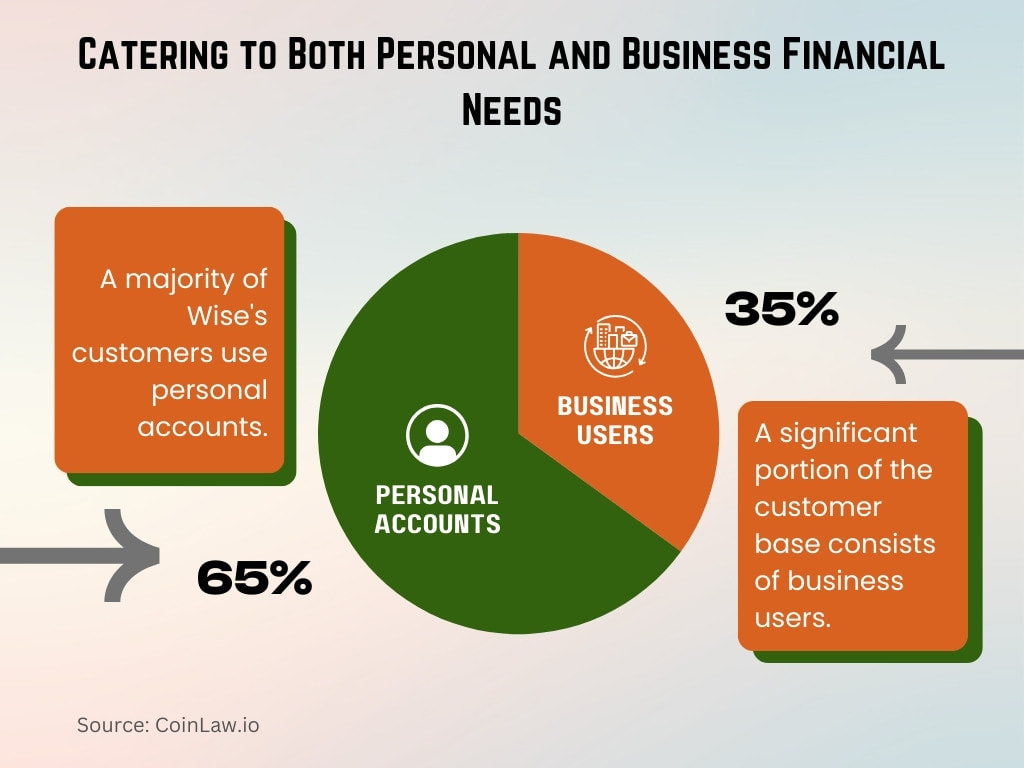

- 65% of Wise’s customers use personal accounts, while 35% are business users, reflecting its balanced growth.

- The United States accounts for 20% of its user base, followed by the UK at 18%.

- Retention rates are high, with 87% of users continuing to use Wise after their first transaction.

- Wise is particularly popular among millennials, with 60% of users aged 25-40.

- Wise saw an 18% increase in corporate clients, emphasizing its growing presence in the B2B segment.

Revenue and Financial Performance

- $1.9 billion revenue generated in 2025 shows continued strong financial growth from prior years.

- Net profit margin rose to 18% in 2025, driven by improved operational efficiency and leaner scaling.

- Monthly transaction volumes reached $9.2 billion in 2025, showcasing high user engagement.

- Average transfer fees dropped to 0.38%, keeping Wise highly competitive against traditional banks.

- $250 million invested in tech initiatives in 2025 to accelerate AI automation and infrastructure.

- Revenue from emerging markets surged 48% in 2025, with rapid expansion in Asia and Latin America.

- $1.3 billion total funding secured by 2025, reflecting continued investor trust and market positioning.

Wise Account Holdings: Growth Highlights

- Customer count surged from 12.8 million in FY 2024 to 15.5 million in FY 2025, reflecting a growing user base for Wise.

- Total customer holdings rose to £21 billion in FY 2025, up from £16 billion in FY 2024, signaling increased trust and engagement with the platform.

- Customer balances alone climbed from £13 billion to £17 billion, showing a notable rise in how much users are holding in their Wise accounts.

- Investments in Wise Assets increased from £3 billion in FY 2024 to £4 billion in FY 2025, indicating growing adoption of Wise’s investment offerings.

- The data highlights that more users are not only joining Wise but also keeping and investing more money through its platform year-over-year.

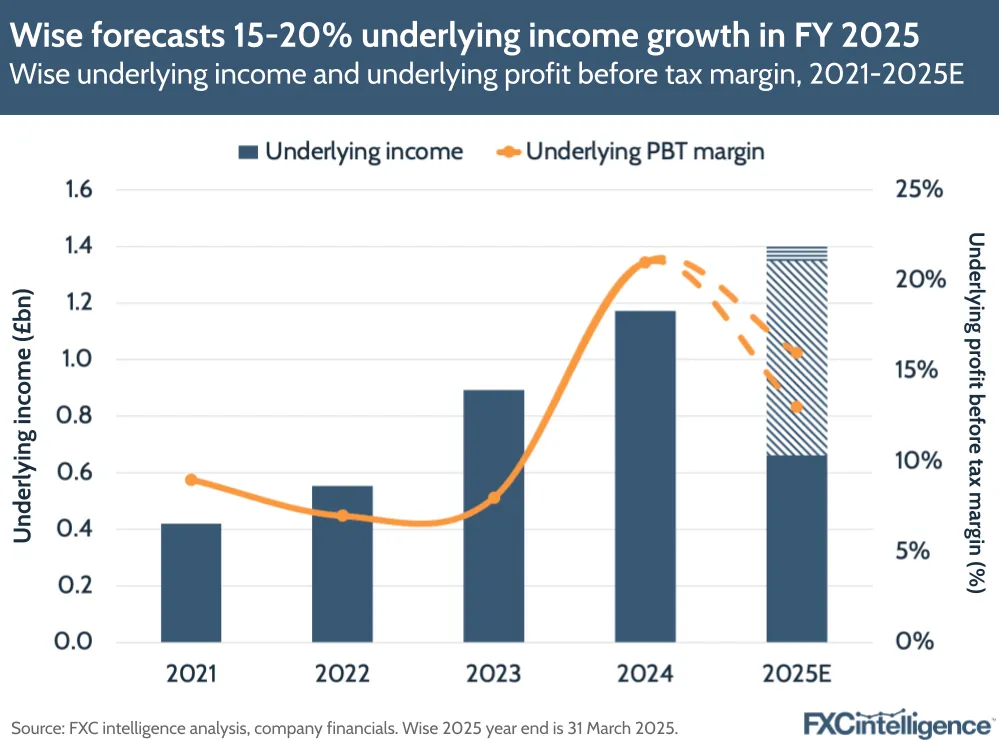

Wise Underlying Income & Profit Forecast (2021–2025E)

- FY 2025 income is expected to grow 15–20%. This projection highlights Wise’s confidence in maintaining strong financial momentum.

- Underlying income rose from £0.45bn in 2021 to £0.55bn in 2022. The growth was modest during this period.

- In 2023, income jumped significantly to £0.9bn. This marked a strong post-pandemic recovery phase.

- By 2024, income will have further increased to £1.2bn. This shows consistent year-on-year expansion.

- 2025E projects income above £1.4bn, shown with a striped forecast bar. It indicates potential for continued robust growth.

- The underlying PBT margin fell from 13% in 2021 to 8% in 2022. Profitability dipped even as income rose.

- Margins stayed around 8% in 2023, showing a flat trend. This may reflect rising costs or strategic reinvestment.

- In 2024, the PBT margin recovered sharply to 22%. This reflects a strong improvement in operational efficiency.

- For 2025E, the margin is forecasted between 15% and 18%. Though lower than 2024, it’s still a strong performance indicator.

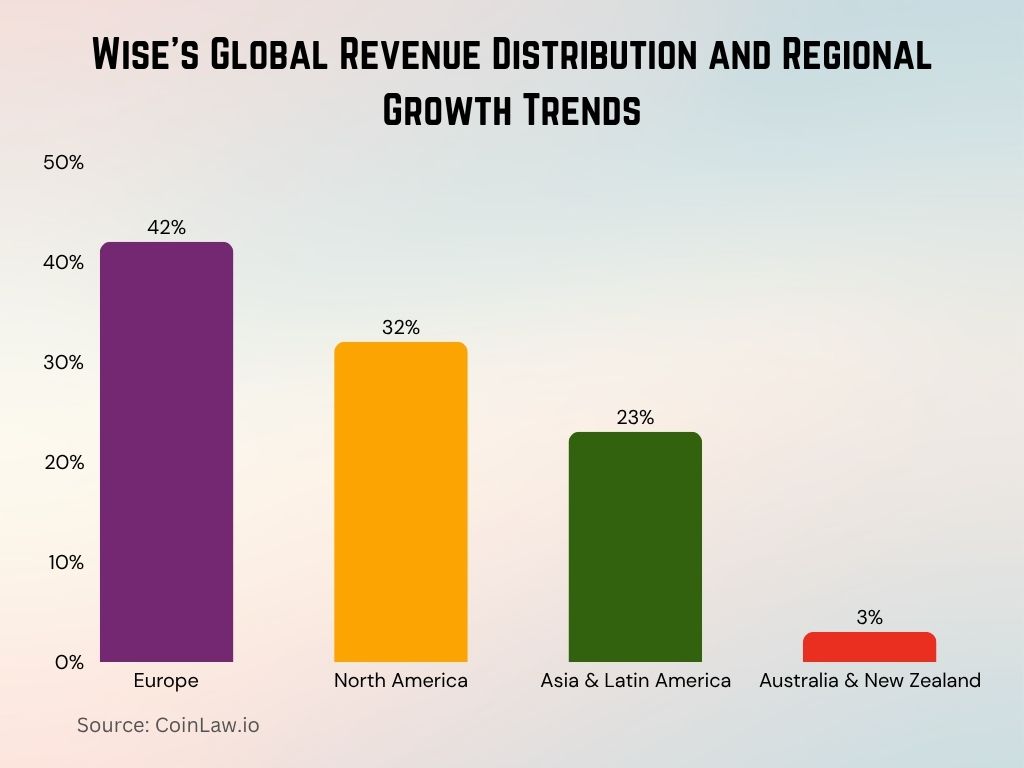

Regional Revenue Distribution

- Europe contributed 42% of total revenue in 2025, with strong performance in Germany, France, and Spain.

- North America rose to a 32% share in 2025 after a 28% year-over-year growth in remittance and SME segments.

- Asia and Latin America made up 23% of revenue in 2025, following a 50% surge in cross-border volume.

- Australia and New Zealand held steady at 3% in 2025 as Wise expanded regional partnerships.

- The UK remained the top market with $520 million in revenue, up from the previous year.

- Africa posted 60% growth in 2025 revenue, driven by digital wallet tie-ups and fintech alliances.

- Double-digit growth achieved in 14 new countries in 2025, boosting Wise’s global revenue footprint.

Business and Personal Account Metrics

- Over 10 million personal accounts were active, a 22% increase from the previous year.

- Business accounts saw a 30% year-over-year growth, reaching 5.5 million accounts.

- The average transaction value for business accounts is $25,000, compared to $1,500 for personal accounts.

- Wise’s multi-currency accounts reached 5 million users, allowing individuals and businesses to hold funds in 40+ currencies.

- 85% of business users rate Wise’s platform as “excellent” for its speed and low fees.

- New features for business accounts, such as bulk payment tools, contributed to a 50% increase in corporate adoption.

Technological Developments and Innovations

- Wise invested $200 million in technology R&D, focusing on AI-driven fraud detection and automation.

- The Wise Platform API handled over 100 million API calls monthly, enabling seamless third-party integrations.

- Its mobile app achieved a 4.8-star rating on major app stores, becoming a top-ranked app in the fintech category.

- Enhanced its user experience with real-time payment tracking, reducing customer inquiries by 20%.

- Introduced biometric login features, boosting security and ease of access for 80% of users.

- Wise implemented blockchain technology for certain transactions, cutting processing times by 15%.

- Innovations in cloud computing helped Wise reduce operational costs by 12%, ensuring faster and more reliable services.

WISE’s Key Outputs

- $105 billion in cross-border transactions facilitated in 2025, rising from the previous year’s momentum.

- 1.9 million businesses used Wise in 2025, marking a 27% year-over-year increase in B2B adoption.

- Average payment completion time dropped to 9 seconds in 2025, maintaining industry-leading speed.

- $1.9 billion saved in customer fees in 2025 compared to traditional banking methods.

- Over 26 million transactions processed monthly in 2025, showing rapid operational growth.

- Zero-transfer fee campaigns boosted user activity by 32% across targeted high-volume regions in 2025.

- Partnered with 65+ financial institutions globally in 2025 to scale reach and product integration.

Program Areas and Data Elements

- The multi-currency account program reached 5 million users, enabling storage and exchange in 40+ currencies.

- Wise’s business bulk payments program facilitated $10 billion in payouts, benefiting over 2 million users.

- The Wise Rewards Program reported a 50% user participation increase, incentivizing frequent users with discounts.

- Integration with accounting tools like QuickBooks and Xero saw a 40% rise in adoption among business users.

- Wise’s data dashboard for businesses introduced real-time analytics, leading to 25% more informed financial decisions.

- A new fraud prevention module reduced fraudulent activities by 15%, ensuring secure transactions.

- Transaction transparency tools enabled users to track payments with real-time updates, decreasing queries by 20%.

Wise Offers Local Account Details in Multiple Currencies

- Wise supports 10 major currencies for receiving and sending money globally.

- You can get local account details (like IBAN, sort code, BSB, etc.) in British Pound (GBP), Euro (EUR), and US Dollar (USD).

- Australian Dollar (AUD) and New Zealand Dollar (NZD) accounts include BSB/account numbers for local transfers.

- Singapore Dollar (SGD) and Romanian Lei (RON) accounts come with a bank code, bank name, and account number.

- For the Canadian Dollar (CAD), Wise provides the institution number, transit number, and account number.

- Hungarian Forint (HUF) and Turkish Lira (TRY) accounts offer account numbers and IBAN/bank names.

This setup allows users to hold, convert, and send money like a local in each supported country.

Recent Developments

- 800,000 transactions joined Wise’s Carbon Offset Program in 2025, doubling eco-conscious user participation.

- Expanded Visa partnership enabled 35+ countries to access 30% faster transfers in 2025.

- Integrated with top crypto exchanges in 2025 to support real-time fiat-to-crypto transactions for users.

- Zero-Fee Day campaign lifted transaction volume by 24% across 2025’s promoted regions.

- Biometric two-factor authentication adoption reached 88% of Wise users by 2025, enhancing platform security.

- Wise Ventures invested $130 million in 2025 into fintechs advancing digital payments and inclusion.

- Launched 3 new innovation hubs in 2025, including Brazil, Singapore, and the US, to drive global product R&D.

Conclusion

Wise Payments Limited continues to break barriers in global financial technology with its customer-first approach. By leveraging technology-driven innovations, expanding into new markets, and emphasizing cost savings, Wise has established itself as a leader in cross-border payments. Its focus on transparency, user empowerment, and environmental responsibility ensures it remains ahead in an evolving financial landscape. As Wise marches forward, its trajectory is poised to redefine international payments, creating a more connected and inclusive global economy.