The Wilshire 5000 stands as one of the most comprehensive gauges of the U.S. equity markets, aiming to represent the full spectrum of publicly traded U.S. companies by market value. Investors, economists, and policymakers alike watch its movements to understand the broad health of the American stock market. For example, financial advisors may benchmark retirement portfolios against the Wilshire 5000’s performance, and macro analysts often use its market capitalization relative to GDP to assess valuation levels. We explore key data, trends, and methodology insights that underline this index’s role in financial markets.

Editor’s Choice

- The Wilshire 5000 reached an all‑time high closing level of 64,699.20 points in August 2025.

- As of late December 2025, its market cap reached $69.1 trillion on Dec 26.

- The index’s broad coverage spans large‑, mid‑, and small‑cap stocks across the U.S. market.

- The Wilshire 5000’s design aims to include nearly 100% of U.S. investable equities.

- Record highs set in August 2025 marked a significant milestone in investor sentiment.

- The index’s float‑adjusted methodology enhances liquidity relevance.

- Broad, total‑market ETFs and mutual funds mimic this index for diversified exposure.

Recent Developments

- Updated FT Wilshire 5000 methodology published August 15, expanded an interactive index tool with performance, sector tilting, and attribution analytics for institutional users.

- The FT Wilshire 5000 is defined as a comprehensive, float‑adjusted US market measure designed to capture essentially 100% of the investable US equity universe.

- Modular FT Wilshire 5000 segments now allow discrete analysis of mega, large, mid, small, and micro‑cap stocks in a unified series for benchmarking.

- Quarterly rebalancing and methodology reviews for the FT Wilshire 5000 now sit within Wilshire’s global benchmark platform, supporting portfolio construction and risk management workflows.

- Institutional products like the FT Wilshire 5000 Index Portfolio (WFIVX) track the index with a net expense ratio around 0.56% and maintain tight alignment to benchmark returns.

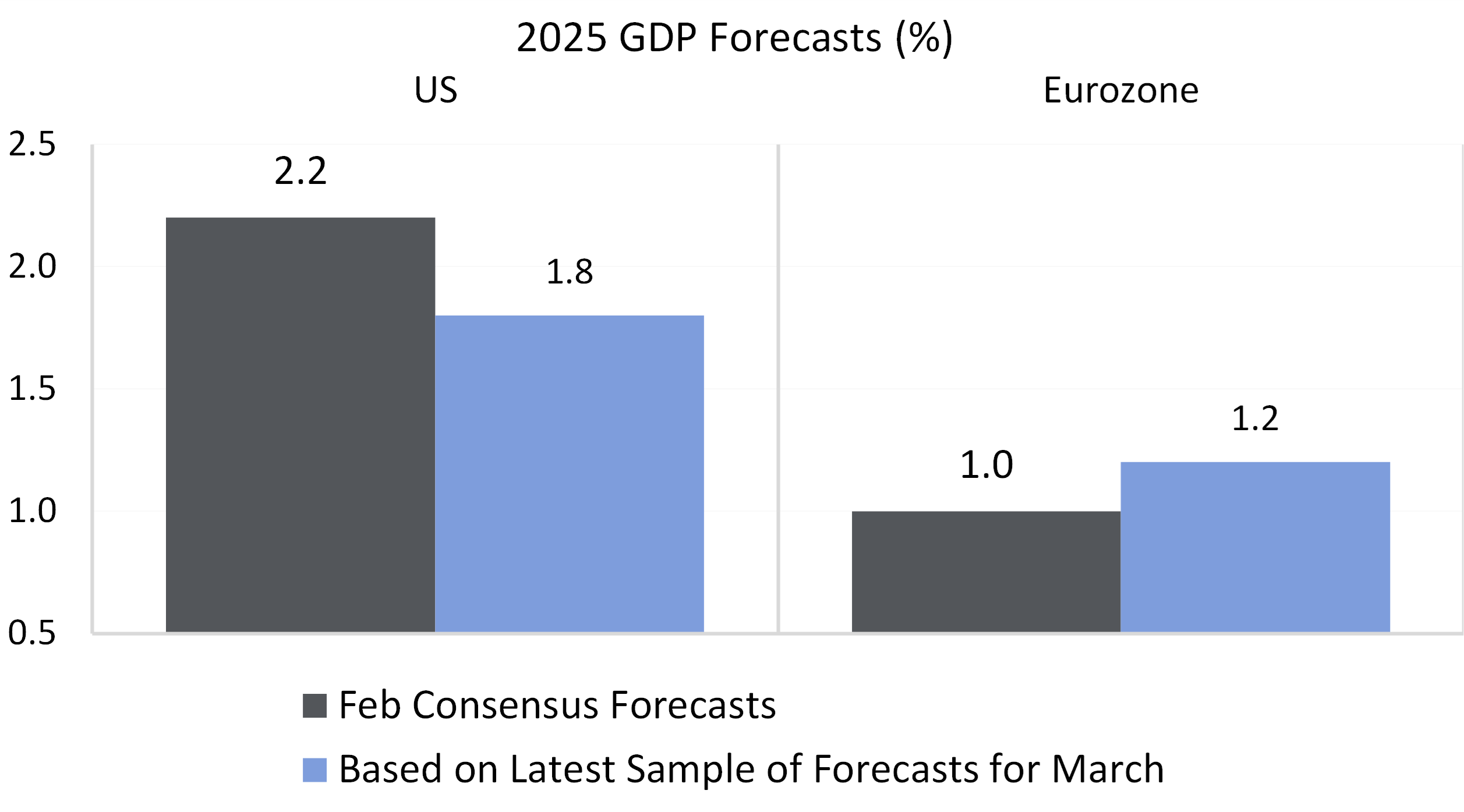

Wilshire 5000 Economic Growth Context and Market Implications

- U.S. GDP growth forecast eased from 2.2% to 1.8%, signaling slower economic momentum that can temper earnings growth for Wilshire 5000 constituents.

- Eurozone GDP expectations improved from 1.0% to 1.2%, offering modest support for multinational firms within the Wilshire 5000 with overseas revenue exposure.

- The downward revision in U.S. growth highlights rising sensitivity of the Wilshire 5000 to interest rates, inflation trends, and consumer demand.

- Stronger relative U.S growth versus Europe still reinforces the Wilshire 5000’s long-term advantage as a broad U.S. equity benchmark.

- Macro growth forecasts directly influence valuations, sector leadership, and total return expectations across the Wilshire 5000 index.

Wilshire 5000 Index Explained

- The Wilshire 5000 measures virtually all publicly traded U.S. equities with price data available.

- It uses market capitalization weighting, meaning larger firms have a bigger influence.

- Originally launched in 1974 with about 5,000 stocks.

- The name “5000” no longer reflects the current number of constituents.

- As of the latest data, the index contains approximately 3,400 to 4,000 companies.

- It is frequently used as a broad benchmark for the U.S. stock market.

- Wilshire’s float‑adjusted calculation considers only shares available to public investors.

- This broad coverage makes it distinct from narrower measures like the S&P 500.

Index Methodology and Construction

- Float adjustment excludes restricted shares held by insiders, capturing 100% of the investable US equity market.

- Index updates occur continuously during US trading hours with monthly reconstitutions for new listings.

- FT Wilshire series segments the market into mega, large, mid, small, and micro-cap brackets by percentile ranks.

- Methodology documentation updated August 15, 2025, detailing rules-based eligibility and rebalancing.

- Sector breakdowns follow standardized systems with quarterly reviews to refine segment definitions.

- Rebalancing caps the largest firms at 4.7% individual weight to prevent concentration risks.

- Public methodology enables easy replication with scaling factor α tying index points to $1 billion market cap changes.

- Index aims for 98% coverage of US equities excluding penny stocks and limited partnerships.

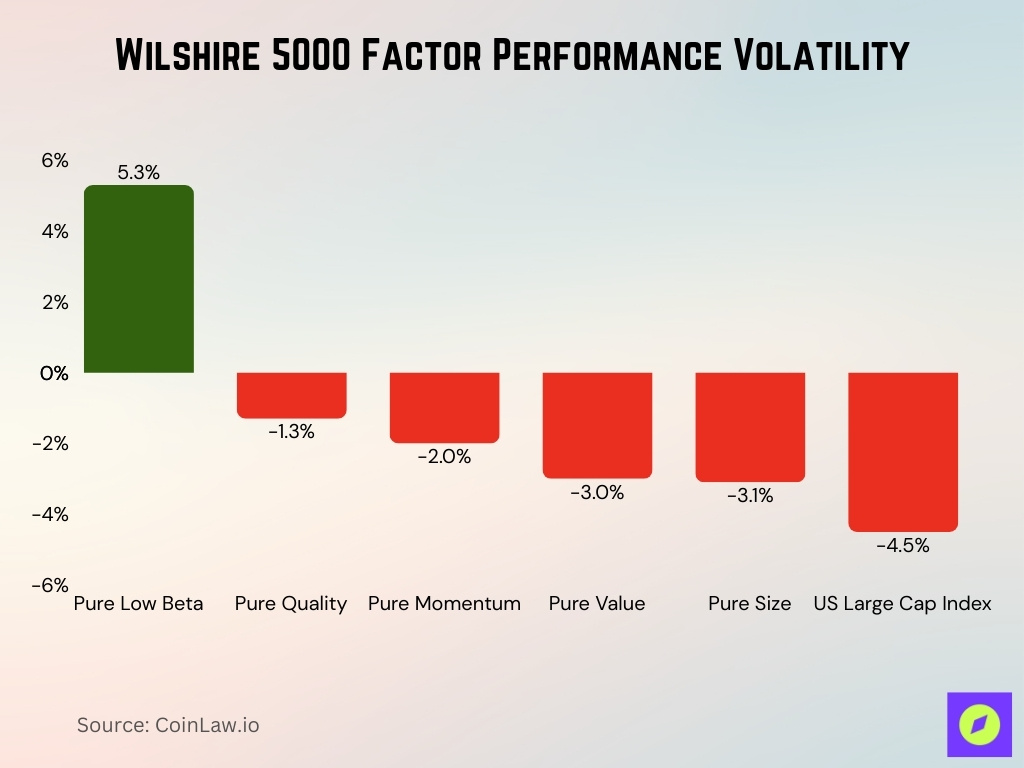

Wilshire 5000 Factor Performance During Q1 2025 Volatility

- Low Beta stocks delivered a strong 5.3% return, highlighting defensive factor strength within the Wilshire 5000 during market volatility.

- Quality factor declined by 1.3%, showing mild downside but still outperforming the broader large-cap benchmark.

- Momentum stocks fell 2.0%, reflecting reduced risk appetite and weaker trend persistence across Wilshire 5000 constituents.

- Value factor posted a 3.0% loss, signaling continued pressure on cyclical and rate-sensitive segments of the index.

- The size factor dropped 3.1%, indicating that smaller-cap stocks underperformed during heightened uncertainty.

- The US Large Cap Index declined 4.5%, confirming that most Wilshire 5000 factor strategies outperformed the broader market baseline.

Eligibility Criteria and Inclusion Rules

- Wilshire 5000 requires U.S. headquartered companies with readily available price data on major exchanges like the NYSE or NASDAQ.

- Wilshire 5000 uses float-adjusted market cap weighting across ~3,400 components as of late 2025.

- Securities must trade primarily on U.S. exchanges, excluding bulletin board and penny stocks.

- ADRs and limited partnerships face exclusion to ensure consistent market representation.

- REITs qualify fully, comprising part of the 98% U.S. equity market coverage.

- Constituents need regular pricing data, with delistings after 10 consecutive non-trading days.

- Eligibility updates occur monthly via reconstitutions for IPOs, spin-offs, and cessations.

- 3,687 stocks included as of December 2021, down from the historical peak of over 7,500 in 1998.

Number of Constituents Over Time

- Historically, the index has included over 7,500 stocks at its peak, illustrating market breadth before consolidation.

- After its launch in 1974, the index reached close to 5,000 constituents before the market expansion of the 1990s.

- Since 2000, the total number of companies has declined as large-cap firms dominate the U.S. market.

- The reduction in smaller listings partly reflects fewer IPOs and increased M&A activity in later decades.

- Semi‑annual rebalances can adjust constituent counts based on liquidity and listing changes.

- Size segments (mega‑cap to micro‑cap) within the series help capture shifts in market capitalization distribution.

- Inclusion requirements for trading venues and liquidity also impact the count in each review period.

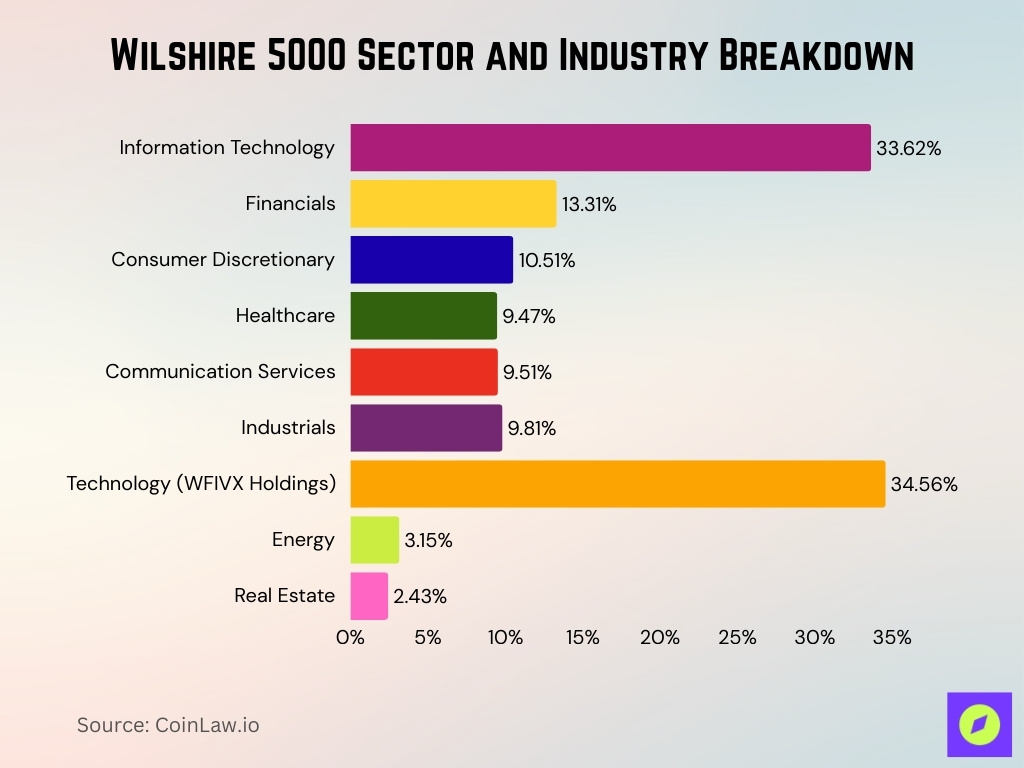

Sector and Industry Breakdown

- Information Technology holds 33.62% weight in the Wilshire 5000 tracking portfolio as of October 31.

- Financials comprise 13.31% of total sector allocation with strong banking exposure.

- Consumer Discretionary accounts for 10.51%, driven by retail and auto segments.

- Healthcare represents 9.47% of biotech and pharma contributions.

- Communication Services weighs 9.51%, boosted by media and telecom firms.

- Industrials make up 9.81% with manufacturing and aerospace leaders.

- The technology sector reached 34.56% in the latest WFIVX holdings breakdown.

- Energy sector limited to 3.15% amid transition to renewables.

- Real Estate contributes 2.43% through REIT inclusions.

Total Market Capitalization Statistics

- Wilshire 5000 total market capitalization hit $52.88 trillion on May 31 after rising 0.73% from the prior session.

- The index market cap grew 24.52% year-over-year to $52.88 trillion from $42.46 trillion.

- Full cap price index reached 59,614.18 as of June 20, up from a historical median of 10,792.5.

- Wilshire 5000 to GDP ratio crossed 200% for the first time, signaling elevated valuations.

- U.S. equities in the Wilshire 5000 represent 98% of the investable market, dwarfing the S&P 500’s 80% share.

- Large-cap tech firms drove over 40% of total cap gains amid post-COVID recovery trends.

- Market cap averaged an 11.03% annual growth rate historically through mid-year peaks.

- Buffett Indicator shows valuations 76.62% above the historical average per total cap metrics.

- Total cap scaling ties index points to $1 billion per Wilshire methodology increments.

Wilshire 5000 Price and Level History

- FT Wilshire 5000 Index closed at 68,921.59 on December 24 after hitting an intraday high of 69,192.92.

- Index reached 68,695.38 close on December 23, up from 68,222.90 in the prior session.

- Full Cap Price Index stood at 59,614.18 on June 20, reflecting 9.4% year-over-year growth.

- Index traded at 68,011.76 on December 26, down 0.07% from the prior close.

- Historical median value rests at 10,792.5 with a long-term average of 35,987.57.

- A record high reached 61,616.59 was reached amid a decade-long bull market progression.

- YTD change shows a 15.69% gain through mid-December tracking data.

Dividend Yield and Income Metrics

- WFIVX tracking fund shows an average 2.81% dividend yield through late December.

- Forward dividend yield stands at 0.69% with the last payout of $0.26 per share.

- Trailing 12-month dividend yield reaches 2.62% on $0.91 annual payout.

- YTD total return hit 17.24% including dividend reinvestment for WFIVX.

- 1-year total return measured 16.76% with dividends boosting price gains.

- FT Wilshire 5000 YTD total return achieved 17.26% through December close.

- Historical dividend yield ranged from 2.38% minimum to 8.35% maximum.

- 5-year average annual return stands at 13.37% incorporating income metrics.

Annual and Long‑Term Return Statistics

- Long‑term nominal and real returns on the Wilshire 5000 have exceeded 7% annualized over 5‑, 10‑, and 20‑year periods.

- Growth stocks within the index have historically outpaced value over extended horizons.

- Total returns incorporating dividends significantly enhance long‑term performance.

- Mutual funds tracking the index show YTD total returns above ~17% in 2025.

- Multi‑year average returns for vehicles like WFIVX often align with broad market trends (~13%-21% over several years).

- Yearly returns vary widely with economic conditions but trend positively over decades.

- Total return statistics highlight the benefit of dividend reinvestment.

- Consistent long‑term gains support the index’s role as a core market benchmark.

Volatility and Risk Metrics

- Wilshire 5000 annualized volatility measured 15.2% over the past 12 months through late December.

- Sharpe ratio for FT Wilshire 5000 tracking fund WFIVX averaged 0.78 on a 3-year basis.

- The index standard deviation reached 18.4% during Q1 market stress periods.

- Maximum drawdown hit -12.7% from the August peak before year-end recovery.

- 30-day historical volatility stood at 14.9% as of December 24 close.

- Beta versus S&P 500 registered 1.00, reflecting broad market alignment.

- Sortino ratio captured 1.12, emphasizing downside risk protection metrics.

- VIX correlation showed 0.85 during elevated volatility episodes.

- Long-term standard deviation averaged 16.3% since 1974 inception.

Drawdowns and Bear Market Periods

- Wilshire 5000 suffered a -49.1% peak-to-trough drawdown during the 2007-2009 Global Financial Crisis.

- Tech bust from 2000-2002 caused a -49.0% decline over 31 months before full recovery.

- COVID-19 crash dropped index -33.9% from February to March 2020 lows.

- 10%+ corrections occurred 12 times since 1980, averaging 4.2 months duration.

- 2022 bear market saw a -25.4% drawdown amid inflation and rate hike pressures.

- Average maximum annual drawdown stands at -16.8% over the 50-year historical record.

- Recovery from the 2009 lows took 49 months to surpass prior peak levels.

- -12.7% intra-year drawdown hit August 2025 before a late rebound to new highs.

- Bear markets average 14.5 months with a median recovery time of 22 months since inception.

Inflation‑Adjusted and Real Return Data

- Wilshire 5000 delivered an average of 3.2% real return over 6 inflation pulse periods since 1978.

- Inflation-adjusted total return from 1970-2013 scaled 7,917 vs price-only 2,311 growth.

- Long-term annualized real return averaged 6.8% exceeding CPI inflation by 3.5% annually.

- Nominal returns compounded 11.03% historically, while real gains preserved purchasing power.

- During high inflation episodes, equities maintained a positive 3.2% average real performance.

- Dividend reinvestment boosted inflation-adjusted cumulative returns by 243% over the price index.

- Real returns outpaced bonds by 4.1% annually across multi-decade horizons.

- CPI-adjusted calculator shows 15.2% YTD real gain through late December levels.

- Historical median real return rests at 7.1% underscoring equity inflation hedging.

Recent Performance and 2025 YTD Returns

- As of Dec 29, 2025, the Wilshire 5000 price index stands near 69,099 close on Dec 26, a new all-time high.

- The 52‑week range for the index spanned approximately 49,561 to 69,136, showing strong upward trends.

- YTD performance for 2025 has been substantial, with some data noting around 15‑17% returns.

- Returns reflect broad U.S. stock market optimism supported by technology and growth sectors.

- Many funds tracking the index report double‑digit YTD gains, highlighting robust market appreciation.

- Recent performance has outpaced typical long‑term averages, reflecting a continuation of post‑pandemic growth momentum.

- Investors monitor such gains against volatility indicators to manage risk exposure.

- Comparisons with benchmarks like the S&P 500 offer perspective on broader market strength.

Fund and ETF Products Tracking the Index

- The Wilshire 5000 index itself doesn’t have widely recognized ETFs that track it directly.

- Instead, mutual funds like FT Wilshire 5000 Index Portfolio (WFIVX) aim to replicate its performance.

- WFIVX reported YTD returns around 16‑17% in 2025, with diversified exposure across market caps.

- The fund’s expense ratio and structure influence net returns and tracking quality.

- Although ETFs directly tied to the index are limited, many broad‑market ETFs closely correlate with its performance trends.

- Such products are popular with investors seeking total U.S. market exposure in a single vehicle.

- Tracking error and liquidity characteristics vary by product type and market conditions.

- Mutual funds remain a primary practical implementation for Wilshire 5000 exposure.

Use of Wilshire 5000 as a Market Benchmark

- Wilshire 5000 benchmarks $1.2 trillion in institutional assets through Wilshire TUCS tracking.

- FT Wilshire 5000 served as a U.S. equity proxy, rising 17.46% over 12 months ending September.

- Index captures 98% of the U.S. investable equity market for comprehensive performance gauging.

- Portfolio managers reference the Wilshire 5000 for broad market alpha evaluation across 3,400+ stocks.

- Retirement plans use it as a core benchmark with a 9.59% median gross return alignment.

- Economic studies employ Wilshire data showing a 14.18% 1-year change through late December.

- Analysts compare it to the S&P 500, revealing 100% market coverage vs a narrower 500-stock focus.

- Historical depth spans 50+ years supporting regime-based risk and allocation models.

- Wilshire 5000 underpins large plans ($1 billion+ assets), achieving 9.85% YTD through Q3.

Frequently Asked Questions (FAQs)

The Wilshire 5000 Full Cap Price Index was about 69,136 points as of late December 2025.

The index hit a record closing high of 64,699.20 points on August 22, 2025.

The 52‑week range for the Wilshire 5000 was roughly 49,561 to 69,136 points.

Conclusion

The Wilshire 5000 remains a cornerstone benchmark for U.S. equities, offering unmatched breadth and a detailed lens on market performance. Its long history of drawdowns and recoveries, coupled with enduring long‑term returns that include dividends, illustrates both risk and reward for diversified investors. Recent data highlight strong market gains, while inflation‑adjusted insights reaffirm equities’ role in preserving real purchasing power. With mutual funds like WFIVX providing practical exposure and the index serving as a key benchmark, the Wilshire 5000 continues to guide portfolio strategy and market analysis.