The US insurance industry is a vast and complex ecosystem that touches nearly every aspect of American life. From life insurance to property and casualty coverage, the industry provides a safety net for individuals and businesses alike. As economic shifts, digital transformation, and climate risks continue to reshape the landscape, understanding the key trends and figures is crucial. This article delves into the most up-to-date statistics, offering insights into the size, scope, and ongoing developments in the US insurance market.

Editor’s Choice

- The U.S. insurance industry recorded $3.3 trillion in net premiums written, with property/casualty accounting for 53.1% and life/annuity plus health for 46.9%.

- The U.S. insurance industry employs approximately 3.02 million people across carriers, agencies, and brokerages.

- There were about 4,700 licensed insurers in the U.S., including 2,684 P&C, 717 life/annuity, and 1,331 health insurers.

- Millennials and Gen Z together are projected to exceed 70% of the global workforce by mid‑decade, intensifying insurers’ need to modernize talent strategies.

- Industry studies estimate nearly 400,000 U.S. insurance professionals will retire by 2026, creating a substantial replacement talent gap.

- Surveys indicate that around 40% of U.S. consumers acknowledge a need for additional life insurance coverage, leaving a large protection gap.

Recent Developments

- Homeowners’ insurance premiums averaged $1,952 for new policies, up 8.5% year over year amid climate impacts.

- U.S. P&C premium growth expected to slow to 3% as market balances.

- Commercial P&C premiums forecasted at 3-4% growth amid softening competition.

- 76% of insurance carriers now deploy AI in at least one function.

- P&C industry ROE projected at 12% with stable underwriting profits.

- NAIC requires climate risk filings through 2026 for enhanced disclosures.

- The average home insurance cost reached $2,110 annually for $300K dwelling coverage.

- P&C net combined ratio median estimated at 92.1%.

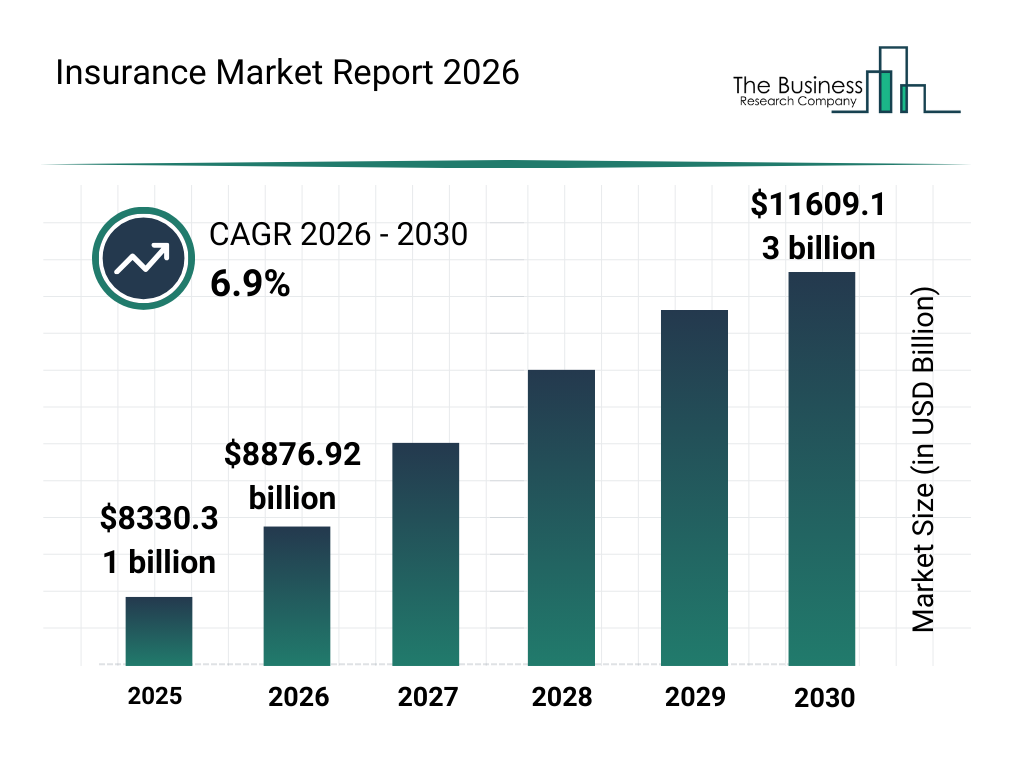

Global Insurance Market Size Outlook

- The global insurance market was valued at $8,330.31 billion in 2025, reflecting the industry’s strong baseline scale before accelerated growth.

- In 2026, the market size is projected to increase to $8,876.92 billion, supported by rising premiums across life, health, and property insurance.

- The market is projected to reach approximately $9,460 billion in 2027, driven by expanding digital insurance adoption and emerging market demand.

- By 2028, the global insurance market size is expected to climb to around $10,040 billion, crossing the $10 trillion milestone.

- In 2029, the market is forecast to grow further to about $10,610 billion, fueled by climate risk coverage, health insurance expansion, and regulatory reforms.

- By 2030, the insurance market is projected to reach $11,609.13 billion, marking a significant long-term expansion.

- The insurance industry is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2026 to 2030, highlighting sustained global demand and sector resilience.

U.S. Insurance Companies by Advertising Spend

- GEICO led with $2.16 billion in ad spending, topping U.S. insurers.

- Progressive invested $1.95 billion, securing second place.

- State Farm spent $1.17 billion on competitive campaigns.

- Allstate allocated $929 million, ranking fourth.

- The insurance advertising market reached $15.6 billion globally.

- Progressive hit a record $3.5 billion in 2024, up 187%.

- State Farm’s 2024 ad budget was $1.11 billion.

- Financial services digital ad spend is growing steadily into 2026.

Number Of Insurance Companies In America

- 4,700 total insurance companies operate in the US.

- 2,684 property and casualty insurers focus on homes, cars, and businesses.

- 717 life insurers are active, down from previous peaks.

- 1,331 health insurers provide coverage nationwide.

- Over 200 reinsurers support primary insurers.

- The top 10 P&C companies hold 55% market share by premiums.

- 228,224 insurance establishments reported in Q1 2025.

- 93 largest insurers dominate key market segments.

- 2.98 million employees work in the insurance industry.

- Top 10 control ~50% of total premiums written.

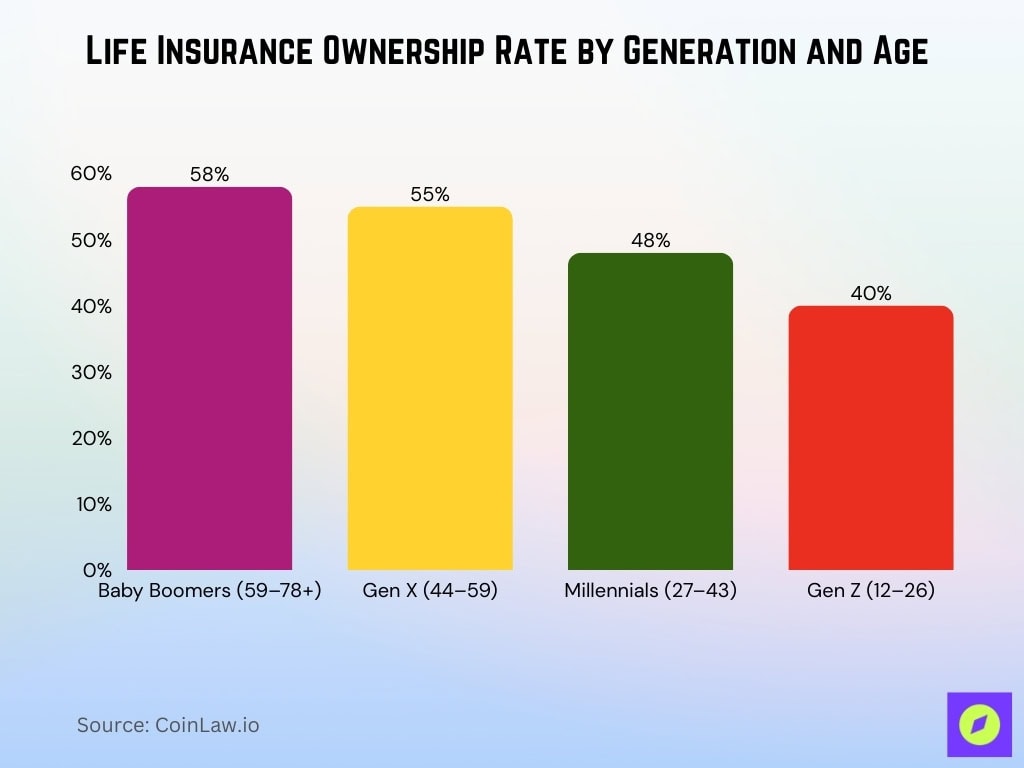

Life Insurance Coverage by Generation

- 58% of Baby Boomers (59-78+) have life insurance.

- 55% of Gen X (44-59) own life insurance policies.

- 48% of Millennials (27-43) are covered by life insurance.

- 40% of Gen Z (12-26) hold life insurance.

- 54% of Gen X claim strong coverage participation.

- 50% of Millennials have financial preparation via policies.

- 36% of Gen Z have the lowest coverage among generations.

ACA Marketplace Insurers Are Raising Rates

- ACA insurers propose a median premium increase of 18%.

- Among 312 insurers, premium changes range from -10% to 59%.

- 125 insurers request hikes of 20% or more.

- Average benchmark silver premium rises 17% in state exchanges.

- Healthcare.gov benchmark premiums increase 30% on average.

- 4 insurers propose premium decreases.

- Weighted average unsubsidized increase reaches 25.5% nationally.

- Most changes fall between 12% and 27% (25th-75th percentile).

- Insurers cite 10% annual claims cost rise.

Premiums and Revenue Breakdown

- Total US insurance premiums projected at $3.3 trillion, up 6% YoY.

- Life insurance premiums grow 2-6% to around $600 billion.

- Health insurance premiums rise 9% in the employer market.

- ACA Marketplace average premiums up 26%, unsubsidized.

- Auto insurance premiums increase 1% to $285 billion.

- Property insurance has a national average of $2,424 for $300K coverage.

- Commercial health premiums expected up 9%.

- The cyber insurance market is valued at $16-20 billion.

- Non-life premiums rise 5.6% globally.

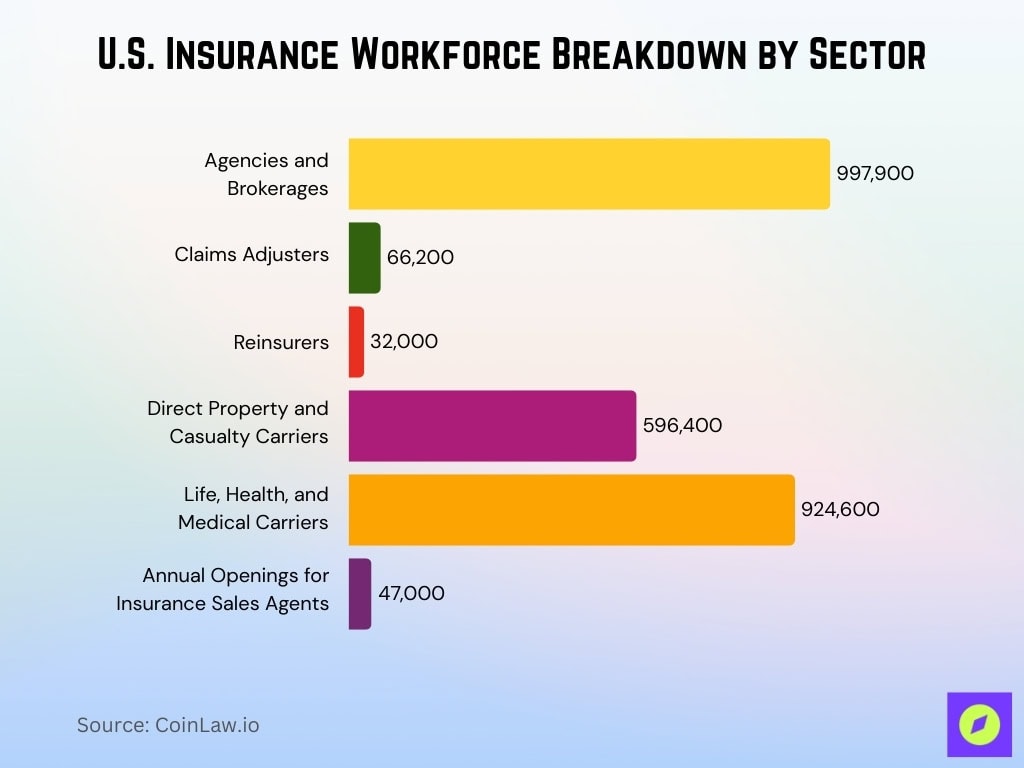

U.S. Insurance Industry Statistics by Employment

- Agencies and brokerages employ 997,900 individuals.

- Claims adjusters total 66,200 jobs.

- Reinsurers employ 32,000 professionals.

- Direct P&C carriers have 596,400 employees.

- Life/health/medical carriers employ 924,600.

- 47,000 annual openings for insurance sales agents.

- Total insurance employment reaches 3.02 million.

- Actuaries earn a median of $125,770 annually.

- Claims adjusters’ employment is expected to decline 5% through 2034.

Life Insurance Statistics

- 52% of U.S. adults own life insurance, covering ~170 million individuals.

- New annualized premiums forecasted to grow 2%-6%.

- 51%-52% ownership rate, with 102 million adults having a coverage gap.

- Term life accounts for 19% of new premiums.

- Whole life leads at 36% of new premium sales.

- Indexed universal life at 24% of individual market premiums.

- 37% of adults plan to buy within 12 months.

- The mortality protection gap is at $414 billion annually in premium terms.

Health Insurance Statistics

- 92% of Americans have health insurance coverage.

- Employer-sponsored plans cover 49% of the population.

- ACA Marketplace enrollment at 22.8-23 million.

- Average employer health premium $17,496 per employee, up 6%.

- Family employer premiums reach $26,993, up 6%.

- Employer health costs projected to rise 6.7% to $18,500 per employee.

- Health care spending rose 7.2% in 2024.

- ACA gross premiums up 26% average.

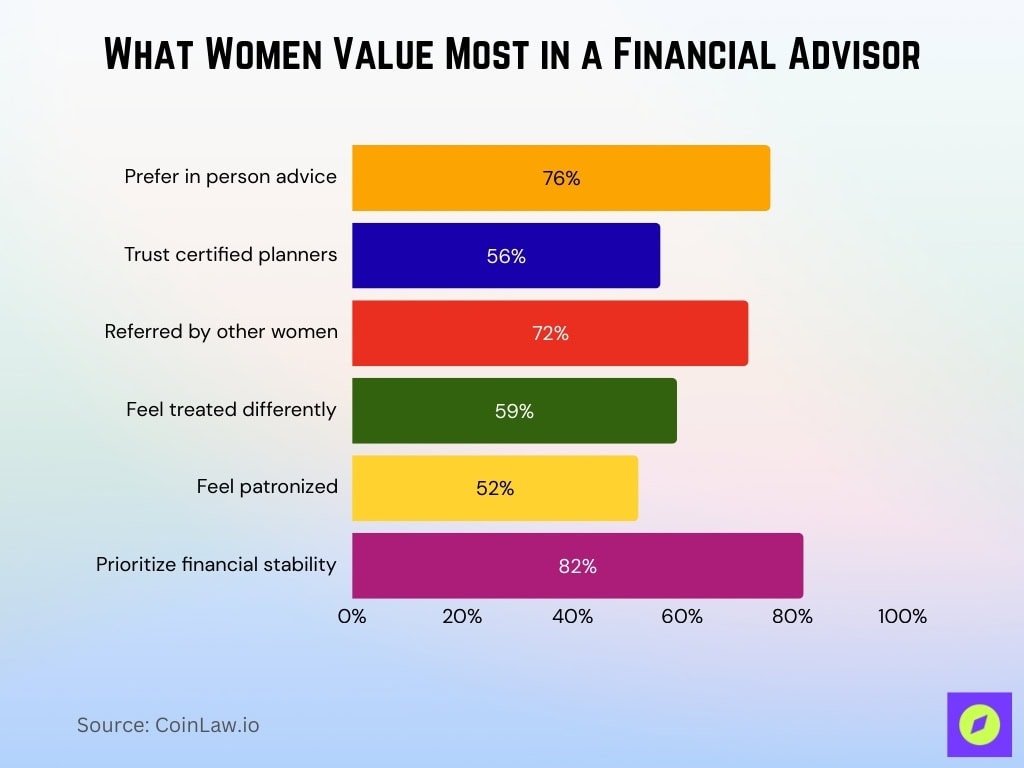

Key Traits Women Look for in a Financial Advisor

- 76% of women seek in-person advice.

- 56% trust certified financial planners most.

- 72% of referred women clients are from other women.

- 59% feel treated differently by advisors.

- 52% feel patronized in financial conversations.

- 82% prioritize financial stability.

Car/Auto Insurance Statistics

- Average full coverage premium $2,144 in 2025, projected $2,158 end-2026.

- Auto premiums fell 6% in 2025 after prior rises.

- Florida averages $3,884 annually, the most expensive state.

- 13.6% uninsured drivers nationally in 2022.

- EV insurance is 20-25% higher than that of gas cars due to repair costs.

- Telematics adoption exceeds 35% market penetration.

- Nevada leads with full coverage at $335 monthly.

- 4.2 collision claims per 100 drivers annually.

- Louisiana averages $327 monthly for full coverage.

Insurance Industry Statistics by Types of Insurance

- P&C premiums grow 4% to ~$1.05 trillion.

- Workers’ compensation premiums are up 4.9% average statewide.

- Homeowners average $2,110 annually for $300K coverage.

- Renters insurance averages $151 yearly or $13 monthly.

- Commercial premiums soften with increased competition.

- Cyber insurance premiums are stable, fluctuating ±5%.

- Specialty insurance is valued at $13.28 billion in 2025.

- P&C combined ratio median 92.1%.

Impact of Digital Transformation and Insurtech

- US insurtech market is valued at $327.17 billion.

- Global insurtech projected $50.03 billion.

- AI cuts underwriting time from 3 days to 3 minutes.

- 36.4% auto policyholders use telematics.

- 58% insurers plan increased blockchain investment.

- 47% policies were purchased digitally.

- AI underwriting adoption to reach 70% in 3 years.

- Embedded insurance is at $116.5 billion.

Frequently Asked Questions (FAQs)

Pie Insurance surpassed 55,000 policies in force, up 25% YoY.

U.S. P&C premiums are expected to grow by about 3% in 2026.

The NAIC covers Property & Casualty, Title, Life, Fraternal, and Health insurance segments.

Conclusion

The US insurance industry is a dynamic and evolving landscape. As digital transformation, climate change, and shifting consumer preferences shape the market, insurers are adapting to meet new challenges. With strong growth across sectors like health, life, and auto insurance, as well as emerging segments like cyber insurance, the industry remains a critical component of the US economy. Looking ahead, sustainability and technology will continue to play pivotal roles in shaping the future of insurance.