In 2025, a significant segment of the global population remains unbanked, lacking access to basic financial services like savings accounts, credit, and online banking. Imagine living in a world where cash is the only option, no credit cards, no online payments, and no financial safety net. For over a billion people worldwide, this is not just an inconvenience but a reality that restricts their economic opportunities and financial security. The unbanked population represents a pressing issue for policymakers, businesses, and society, as it directly ties into economic inequality and financial inclusion.

This article explores the unbanked population statistics for 2025, delving into the factors contributing to this issue, its demographic breakdown, and potential solutions.

Editor’s Choice

- 96% of adults now have a bank or mobile account. Additionally, 55% of bank customers primarily use mobile banking apps to manage their accounts.

- Approximately 1.4 billion adults worldwide remain unbanked, lacking access to formal financial services.

- The gender gap in account ownership in developing countries narrowed from 9 to 6 percentage points.

- In low-income countries in Africa, such as Ivory Coast, Gabon, and Zimbabwe, more than 50% of the female population now have access to mobile money accounts.

- Over 6% of underbanked U.S. households owned cryptocurrencies, compared to 4.8% of fully banked households.

- Nearly half (48.3%) of banked U.S. households used mobile banking as their primary method of account access.

- 10% of adults aged 18–29 were unbanked, the highest rate among all age groups.

Understanding the Unbanked

The term “unbanked” refers to individuals who do not have an account at a formal financial institution. This group often relies on alternative financial services, which are usually more expensive and less secure than traditional banking. In 2024, the unbanked population remains a global challenge, concentrated in low-income regions, rural areas, and marginalized groups.

- 17% of adults worldwide are unbanked, with higher rates in regions like Sub-Saharan Africa and South Asia.

- Rural areas house 55% of the global unbanked population, despite advancements in mobile banking infrastructure.

- Lack of education is a major contributor: 30% of unbanked adults have not completed primary school.

- In high-income countries, the unbanked population is typically concentrated among immigrants and low-income households.

- Digital banking has reduced barriers, yet 40% of unbanked individuals cite a lack of access to technology as a challenge.

- Studies indicate that 60% of unbanked adults have access to mobile phones, presenting a key opportunity for financial inclusion.

- Unbanked women face unique challenges, with 25% citing cultural barriers as a reason for exclusion from financial systems.

| Demographic/Challenge | Percentage/Value |

| Global unbanked adults | 17% |

| Unbanked rural populations | 55% |

| Unbanked adults without primary education | 30% |

| Lack of access to technology (global) | 40% |

| Women citing cultural barriers | 25% |

| Mobile access among unbanked adults | 60% |

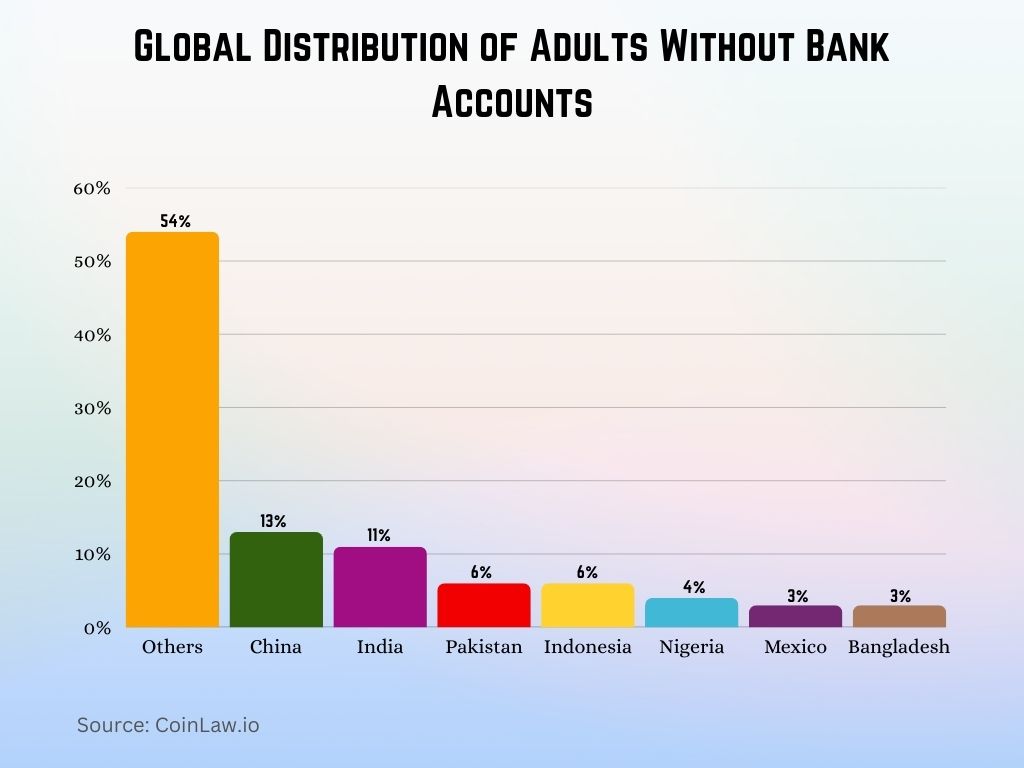

Global Distribution of Adults Without Bank Accounts

- The majority of unbanked adults (54%) are located in the Rest of the World, outside of the top eight countries listed.

- China accounts for 13% of the global adult population without bank accounts, making it the largest single-country contributor.

India follows closely with 11%, highlighting a significant gap in financial inclusion.

Pakistan and Indonesia each represent 6% of the world’s unbanked adult population. - Nigeria contributes 4%, pointing to ongoing challenges in financial accessibility.

- Mexico and Bangladesh round out the list, each with 3% of the global unbanked population.

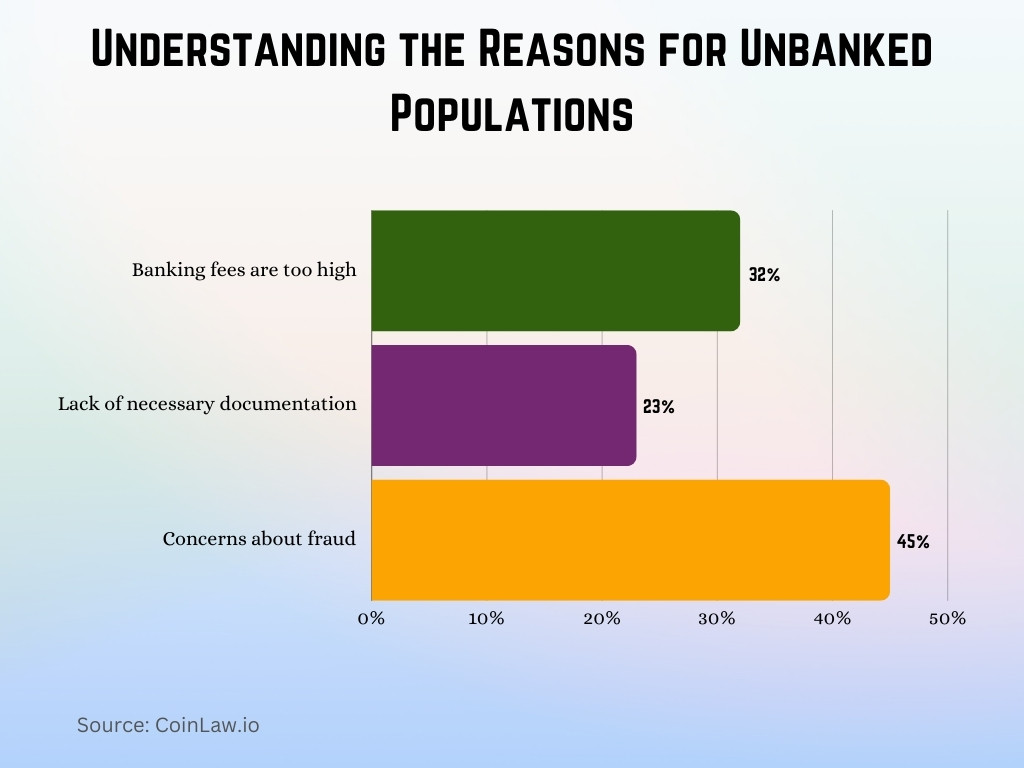

Reasons for Not Having a Bank Account

Understanding why individuals remain unbanked is crucial for designing effective solutions. Barriers range from logistical challenges to socio-economic factors, with many citing cost and trust issues.

- 32% of unbanked adults globally report that banking fees are too high.

- 23% of unbanked individuals state they lack the necessary documentation to open an account.

- Trust in financial institutions remains a significant barrier, with 45% of unbanked individuals expressing concerns about fraud.

- Cultural factors play a role, with 15% of unbanked women citing restrictions tied to gender norms.

- Rural unbanked populations often face limited access to banking facilities, with 1 in 4 living more than 30 kilometers from the nearest bank.

- Low income is a major deterrent, with 60% of unbanked households earning below $2 per day.

- In the US, 14% of unbanked households cite credit issues as the primary reason for being excluded from traditional banking services.

Unbanked Rate by Demographics

Demographics play a crucial role in determining the rate of financial exclusion. Factors such as gender, location, and socio-economic status significantly impact whether individuals can access financial services.

- Globally, women are 9% more likely to be unbanked compared to men, highlighting persistent gender inequalities.

- In Sub-Saharan Africa, 75% of rural women lack access to a formal bank account.

- Urban-rural disparities are stark: in developing countries, 45% of rural adults are unbanked, compared to 28% in urban areas.

- Immigrants and undocumented individuals represent a significant portion of the unbanked population in high-income countries.

- In the US, Black and Hispanic households are twice as likely to be unbanked compared to White households.

- The unbanked rate among individuals with primary or no education is 3.5 times higher than those with tertiary education.

- In South Asia, 60% of unbanked adults are women, a figure driven by cultural and systemic barriers.

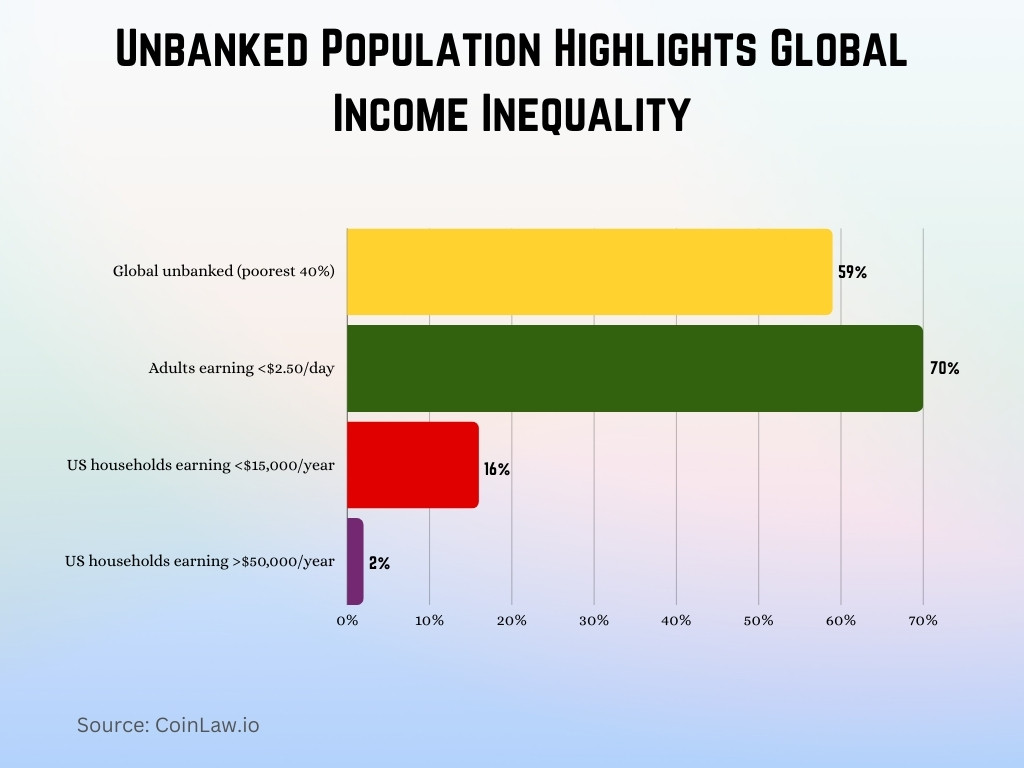

Unbanked Rate by Family Income

Income levels are a major determinant of access to banking services. Lower-income households are disproportionately excluded from financial systems, further perpetuating economic inequality.

- 59% of the global unbanked population comes from the poorest 40% of households.

- In developing countries, 70% of adults earning less than $2.50 per day are unbanked.

- Among US households with an annual income below $15,000, 16% are unbanked, compared to just 2% of households earning over $50,000.

- Financial exclusion often correlates with income volatility; 35% of unbanked adults globally cite irregular income as a barrier to banking access.

- High banking fees disproportionately affect low-income families, with 40% citing this as a reason for avoiding formal banking.

- Informal savings methods dominate in low-income households, with 30% relying on cash-only systems for daily transactions.

- Digital solutions are making a difference: 10 million low-income families in East Africa adopted mobile banking in the past year alone.

Unbanked Rate by Age

Age is another critical factor influencing unbanked rates, with younger and older populations facing unique challenges in accessing banking services.

- Young adults aged 15-24 represent 20% of the global unbanked population, primarily due to limited financial literacy and lack of documentation.

- In the US, 8% of individuals under 30 are unbanked, compared to 3% of those aged 60 and above.

- Elderly populations in rural areas are disproportionately unbanked, with 70% of individuals over 60 in Sub-Saharan Africa lacking a bank account.

- Financial literacy programs targeting youth have shown promise: 15% of young adults in developing countries opened their first account after participating in such initiatives.

- In Southeast Asia, digital banking adoption among individuals aged 18-25 grew by 35% in the last year.

- Older adults often face barriers related to technology, with 25% of seniors globally citing a lack of digital skills as a reason for financial exclusion.

- Youth-targeted savings accounts introduced in Latin America increased financial inclusion rates among individuals aged 15-20 by 10% in 2023.

Unbanked Rate by Race

Racial disparities in financial inclusion are evident globally, reflecting broader socio-economic inequalities.

- In the US, 11% of Black households are unbanked, compared to 3% of White households.

- Indigenous populations globally face some of the highest rates of financial exclusion, with over 80% unbanked in regions like Australia and the Americas.

- Hispanic households in the US are 2.5 times more likely to be unbanked than White households, largely due to language barriers and trust issues.

- In South Africa, 55% of unbanked adults belong to historically disadvantaged racial groups.

- Targeted outreach programs for minorities have improved access: in 2023, bank account ownership among Native American households in the US increased by 8%.

- Digital financial inclusion has made strides: mobile wallet adoption among African Americans grew by 20% in 2023.

- Education plays a key role: among Hispanic Americans with a college degree, the unbanked rate drops to 3%, matching the national average.

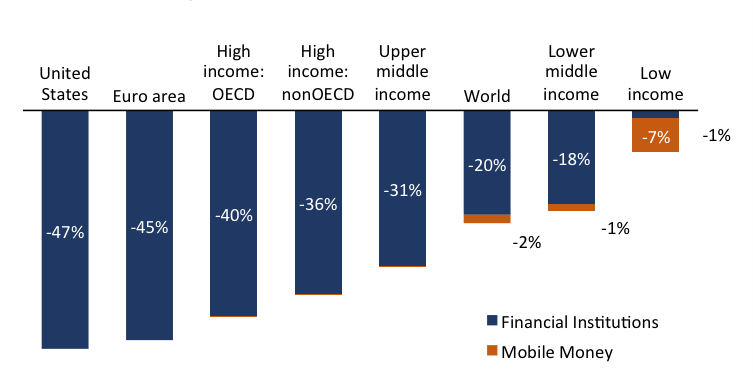

Global Decline in Unbanked Adults

- The United States saw the largest reduction in unbanked adults, with a 47% decrease, driven by traditional financial institutions.

- The Euro area followed closely with a 45% drop, reflecting expanded access to banking services.

- High-income countries (OECD and non-OECD) experienced significant declines: 40% and 36%, respectively.

- In upper-middle-income nations, the number of unbanked adults decreased by 31%, mainly through financial institutions.

- At the global level, there was a 20% decline, with 2% attributed to mobile money.

- Lower-middle-income countries had an 18% reduction, with 1% from mobile money solutions.

- In low-income countries, mobile money played a major role, contributing to 7% of the total 8% reduction in unbanked adults.

Economic Impacts of Being Unbanked

The lack of access to banking services has far-reaching economic consequences, affecting both individuals and society as a whole. It limits financial stability, increases costs, and hinders economic growth.

- Being unbanked costs individuals up to $3,000 annually in fees for alternative financial services like check cashing and payday loans.

- Globally, financial exclusion reduces GDP growth by an estimated 1-2% annually, particularly in low-income countries.

- Unbanked households in the US spend 10% of their income on financial transaction fees, compared to just 1% for banked households.

- A lack of credit access prevents unbanked individuals from pursuing opportunities, with 20% of small businesses worldwide unable to scale due to financial exclusion.

- In Africa, the inability to access formal financial services results in $12 billion in lost potential earnings annually.

- Unbanked populations are more vulnerable to financial shocks, with 70% unable to manage an unexpected expense of $400.

- The World Bank estimates that universal access to banking services could lift 1 billion people out of poverty by 2030.

Unbanked Households’ Use of Prepaid Cards and Nonbank Payment Apps

Without access to traditional banking, unbanked individuals often turn to prepaid cards and nonbank payment apps to manage their finances.

- 25% of unbanked households in the US use prepaid debit cards for financial transactions.

- The global market for nonbank payment apps, such as PayPal and Cash App, reached $1.5 trillion in transactions in 2023.

- Among unbanked adults globally, 35% rely on mobile wallets for basic financial transactions.

- Prepaid cards are particularly popular among unbanked millennials, with 50% citing convenience and ease of use as primary benefits.

- In Latin America, nonbank apps account for 40% of digital transactions, driven by high smartphone penetration.

- Fraud risk is a concern for users of nonbank apps, with 20% of unbanked individuals reporting security-related hesitations.

- Digital financial services have grown rapidly, with 60% of unbanked adults in Asia adopting mobile-based solutions in the last two years.

Nonbank Check Cashing and Money Orders

For many unbanked individuals, nonbank check cashing and money orders provide necessary, albeit costly, financial services.

- Nonbank financial institutions charge 2-5% of the check amount for cashing services, significantly more than traditional banks.

- 30% of unbanked adults in the US use nonbank check cashing services regularly.

- In low-income areas, check cashing services are often the only option, with 70% of users citing proximity and convenience.

- The average cost of a money order in the US is $1.65, but unbanked households often rely on multiple orders, increasing their expenses.

- Nonbank financial services represent a $6 billion industry in the US, fueled by the unbanked population.

- In Sub-Saharan Africa, informal money transfer systems handle 50% of remittances, exposing users to higher risks and fees.

- Programs promoting access to low-cost checking accounts reduced reliance on nonbank financial services by 15% in targeted communities in 2023.

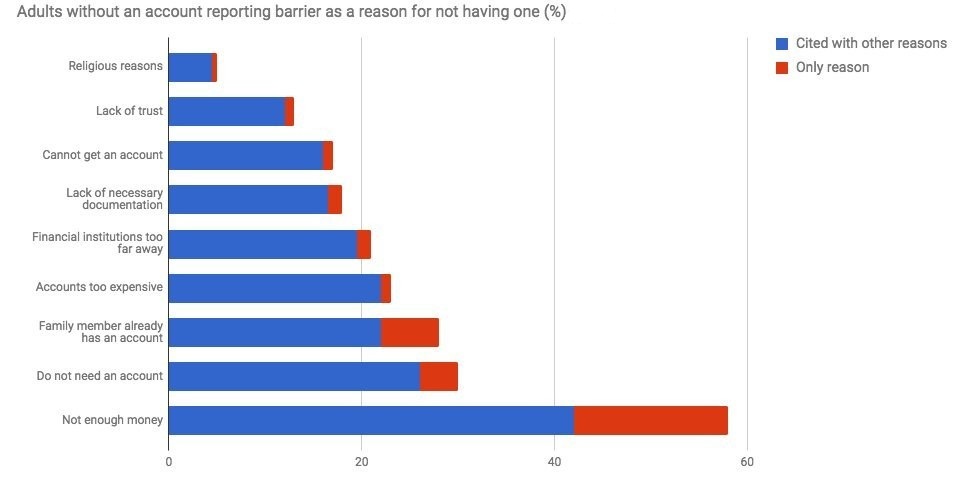

Top Barriers to Having a Bank Account

- The most common reason adults gave for not having an account was “Not enough money”, cited by nearly 60%, with ~18% stating it as the only reason.

- About 30% of respondents said they “do not need an account”, with ~6% listing it as the sole reason.

- 16% reported that a family member already had an account, including ~4% who said it was the only reason.

- High costs were a barrier for ~17%, including ~3% who cited it exclusively.

- Distance from financial institutions and lack of necessary documents were each reported by ~12% of adults.

- Inability to open an account and lack of trust were cited by under 10%.

- Religious reasons were the least cited, accounting for only about 2% of responses.

Technological Solutions and Financial Inclusion Initiatives

Technology is playing a pivotal role in bridging the financial inclusion gap, offering scalable solutions for the unbanked population.

- Mobile banking services have reached 70% of adults in Sub-Saharan Africa, making the region a global leader in digital financial inclusion.

- Blockchain technology is being piloted to provide secure digital identities for unbanked individuals in developing countries.

- In India, the Aadhaar program has enabled over 1.3 billion people to access financial services through biometric identification.

- Partnerships between telecom providers and banks increased mobile wallet penetration by 30% in East Africa in 2023.

- Cryptocurrency adoption among the unbanked grew by 15% globally, with users citing low transaction costs and ease of access.

- 40 million low-income individuals in Asia gained access to microloans through fintech platforms in the past year.

- The introduction of digital financial literacy programs increased account ownership by 10% in targeted regions in 2023.

Initiatives to Help the Unbanked

Governments, non-profits, and private organizations are implementing initiatives to address financial exclusion and support the unbanked population.

- The World Bank’s Universal Financial Access 2025 initiative aims to provide financial services to 1 billion unbanked adults globally.

- In the US, the Bank On initiative helped create low-cost checking accounts for 2 million unbanked households in 2023.

- Microfinance institutions globally disbursed loans worth $140 billion to low-income individuals last year.

- Fintech startups focused on financial inclusion raised over $3 billion in funding in 2023, signaling strong interest in scalable solutions.

- Community banks and credit unions in the US expanded operations in underserved areas, reducing unbanked rates by 5% in rural regions.

- The introduction of “Know Your Customer” (KYC) reforms simplified account opening processes, benefiting 25% of the unbanked population in Asia.

- Mobile financial service providers in Latin America have committed to reducing transaction fees by 30% by 2025, improving affordability for unbanked users.

Recent Developments

- Global Unbanked Population: As of 2021, approximately 1.4 billion adults worldwide remained unbanked, lacking access to formal financial services.

- United States Unbanked Rate: In 2023, the unbanked rate in the U.S. declined to 4.2%, representing about 5.6 million households, marking the lowest level since surveys began in 2009.

- Underbanked Households: Despite progress, 14.2% of U.S. households were considered underbanked in 2023, indicating reliance on alternative financial services alongside traditional banking.

- Digital Financial Inclusion Initiatives: The Edison Alliance achieved its goal of connecting 1 billion people to digital financial services by 2024, enhancing access to essential financial tools globally.

- Gender-Focused Financial Inclusion: Efforts led by organizations like Women’s World Banking aim to provide nearly 1 billion unbanked women with financial services, addressing significant gender disparities in financial access.

Conclusion

Addressing financial exclusion is a complex but critical goal for ensuring equitable economic opportunities globally. While progress has been made through technological advancements and targeted initiatives, significant gaps remain. By leveraging digital solutions, fostering public-private partnerships, and addressing systemic barriers, we can work towards a future where everyone has access to the financial tools they need to thrive.