Wallets tied to the TRUMP memecoin project transferred nearly $94 million in USDC to Coinbase in December, raising fresh concerns about liquidity transparency and insider gains.

Key Takeaways

- TRUMP token wallets linked to its deployers transferred $94 million USDC to Coinbase throughout December.

- $33 million of that was routed via Fireblocks to Coinbase on December 30 alone.

- The TRUMP token has fallen over 90 percent from its January 2025 peak of $75.

- Insiders reportedly generated more than $320 million from trading fees and liquidity structures.

What Happened?

A cluster of wallets associated with the Official Trump (TRUMP) memecoin on Solana executed a large stablecoin exit in December, transferring a combined $94 million in USDC to wallets labeled as belonging to Coinbase. These movements, verified by blockchain data platforms including Arkham and Solscan, have renewed questions about who controls these wallets and the motivation behind such large-scale liquidity withdrawals.

Deployer Wallets Convert TRUMP Into USDC

According to on-chain analysts, the funds originated from single-sided liquidity pools on Meteora, where wallets supplied TRUMP tokens without pairing them with stablecoins. As trades occurred within a set price range, TRUMP was converted into USDC, which was later transferred off-chain.

The Official $TRUMP Meme Team wallet withdrew another 33M $USDC from the liquidity pool and deposited it into #Coinbase today.

— Lookonchain (@lookonchain) December 31, 2025

Over the past month, the $TRUMP meme team has withdrawn a total of 94M $USDC from the liquidity pool and deposited it into #Coinbase.… pic.twitter.com/jFDePaaK0L

This method of gradually converting tokens into stablecoins before moving them to centralized exchanges like Coinbase has been used consistently throughout 2025. Wallets tied to both TRUMP and related projects such as MELANIA have deployed similar liquidity operations.

- In June 2025, TRUMP-linked wallets sent 3.53 million tokens worth $32.8 million to Binance.

- Earlier in the year, another 12.54 million tokens, valued near $150.7 million, were distributed across major exchanges.

- The most recent batch included $33 million moved on December 30, routed through the Fireblocks custody platform.

These patterns suggest a coordinated financial strategy rather than isolated transactions, reinforcing criticism about the lack of transparency in how the project handles its liquidity.

A Brutal Year for TRUMP Token

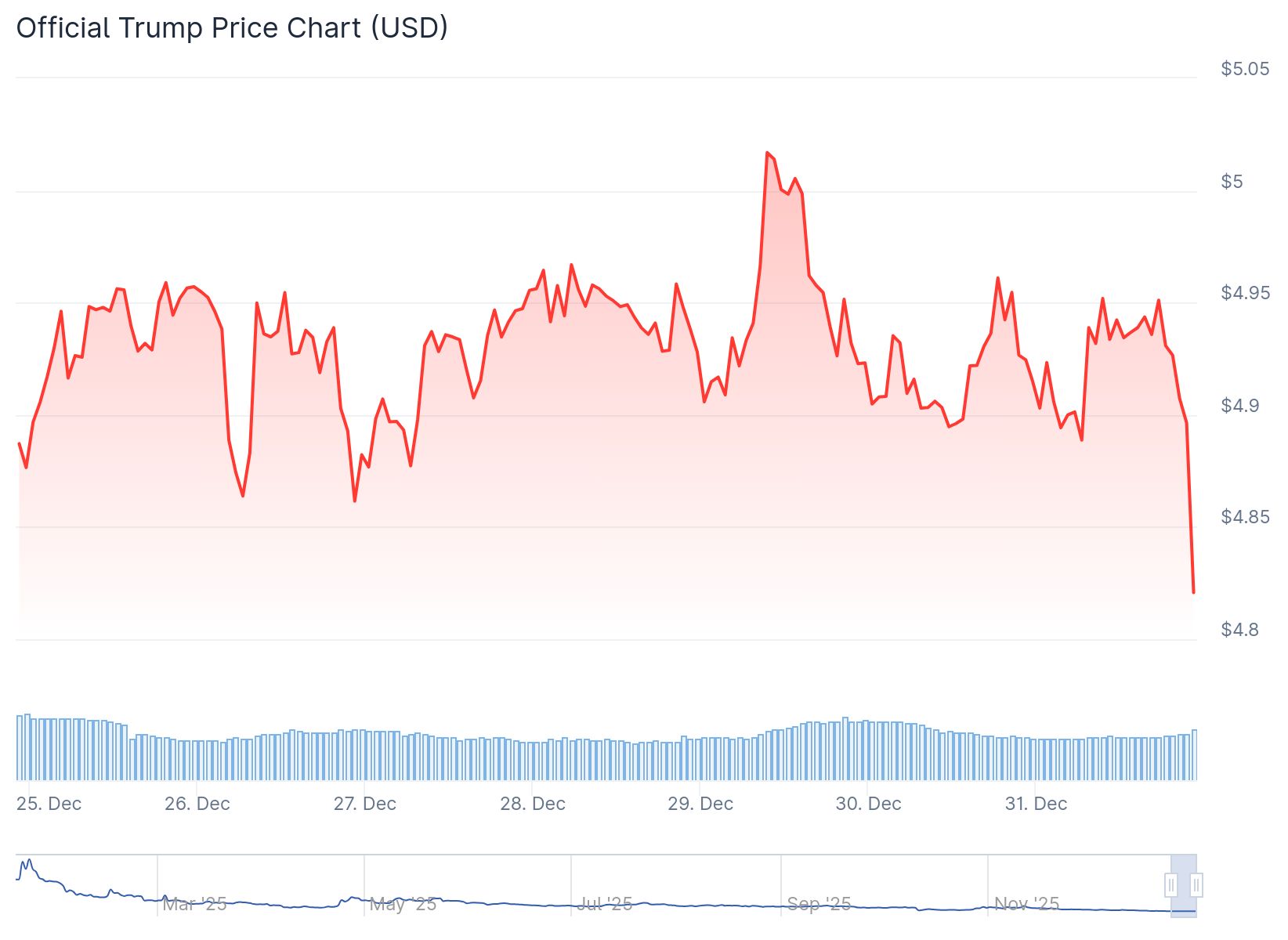

TRUMP launched on January 18, 2025, shortly before the U.S. presidential inauguration. It quickly surged to an all-time high of $75.35 the next day, but the hype proved short-lived. By year-end, the token was trading below $5, representing a drop of over 90 percent.

While the broader memecoin market also suffered steep losses in 2025, the decline in TRUMP was especially sharp given its strong political branding and initial investor excitement. Trading activity has since thinned, leaving many late entrants in the red.

Despite the drop, insiders reportedly earned more than $320 million in fees from trading structures, liquidity programs, and token mechanics. Critics argue that these profits were made at the expense of retail investors who were left holding depreciated tokens.

Regulatory and Political Pressure Mounts

The TRUMP memecoin’s association with Donald Trump through branding and licensing deals has added to the political stakes. Earlier this year, Democratic lawmakers formally requested the U.S. Treasury Department to investigate Trump’s crypto holdings and financial dealings connected to MAGA-themed tokens.

Although Arkham’s wallet labels do not confirm direct ownership, the consistency of large liquidity withdrawals by the same addresses has heightened public and legal interest.

- The funds may have been moved for treasury management, tax planning, or off-chain obligations

- However, the scale and frequency of stablecoin exits make it harder to dismiss concerns about insider operations

No official statement has been made by the TRUMP team addressing the transfers, adding to the uncertainty surrounding the project’s internal decision-making.

Memecoins in Decline Across the Board

TRUMP’s downturn is not an isolated case. The memecoin sector saw a widespread correction in 2025:

- Dogecoin, Shiba Inu, and Pepe retained strong market caps but traded well below their yearly highs.

- Solana and Ethereum-based personality-driven tokens experienced 80 to 90 percent drops.

- Many of these saw early hype cycles followed by collapsing liquidity and fading retail interest.

As TRUMP’s liquidity winds down and large exits continue, traders and watchdogs alike are paying closer attention to whether the project remains sustainable.

CoinLaw’s Takeaway

In my experience, when a project funnels nearly $100 million in stablecoins to a major exchange while its token price crashes 90 percent, it’s a red flag. The scale of these movements and the repeated use of custody layers like Fireblocks hint at more than just routine treasury work. I found the lack of communication from the TRUMP team especially telling. When investors lose millions and insiders walk away with hundreds of millions in fees, there’s a trust gap that only transparency can fix. This is a textbook case of how politically branded crypto can become a minefield when liquidity and ownership are kept behind the curtain.