TransUnion CIBIL statistics continue to shape how lenders and consumers understand credit health and access across markets. These data reveal trends in credit‑active populations, score distributions, and borrowing behavior in both India and the U.S., influencing decisions from mortgage underwriting to personal loan offers. Across sectors, from financial institutions to fintech platforms, businesses use these insights to refine risk models and tailor products. Explore the latest figures and trends that reveal not just numbers, but the evolving story of global credit behavior.

Editor’s Choice

- Retail credit demand moderated in India, as measured by TransUnion CIBIL’s Credit Market Indicator (CMI) in early 2025, signaling a changing consumer credit appetite.

- Growth in credit‑active consumers slowed to around 9% YoY in Q1 2025, the lowest pace since December 2021.

- 41% of new borrowers in India in early 2025 were Gen Z, showing youth participation in the credit market.

- TransUnion’s U.S. CIIR shows a rise in the super prime share of consumers to 40.9% in Q3 2025.

- U.S. credit card originations increased, with 18.5 million in Q1 2025, rebounding after declines.

- Total U.S. consumer credit balances reached $18.0 trillion in Q1 2025, a 28% nominal rise since 2020.

- Student loan delinquencies surged, with over 9 million U.S. borrowers missing a payment in 2025.

Recent Developments

- Early‑stage delinquencies in India’s micro‑loan segments are rising, prompting lenders to focus on higher-score borrowers (>750).

- TransUnion CIBIL released a December 2025 Credit Market Indicator, continuing monthly tracking of retail credit dynamics.

- Indian retail credit demand from younger consumers fell, contributing to a two‑year low in CMI.

- Credit card and home loan originations in India declined in Q4 FY25, reflecting cautious lending.

- U.S. credit card originations rebounded in early 2025, growing 4.5% YoY after previous declines.

- Consumer delinquency rates in the U.S. are moderately improving across several credit products.

- Student loan repayment reporting resumed, contributing to increased delinquency counts in U.S. credit data.

- TransUnion CIBIL hosted major credit industry events in 2025, linking stakeholders across banking and fintech.

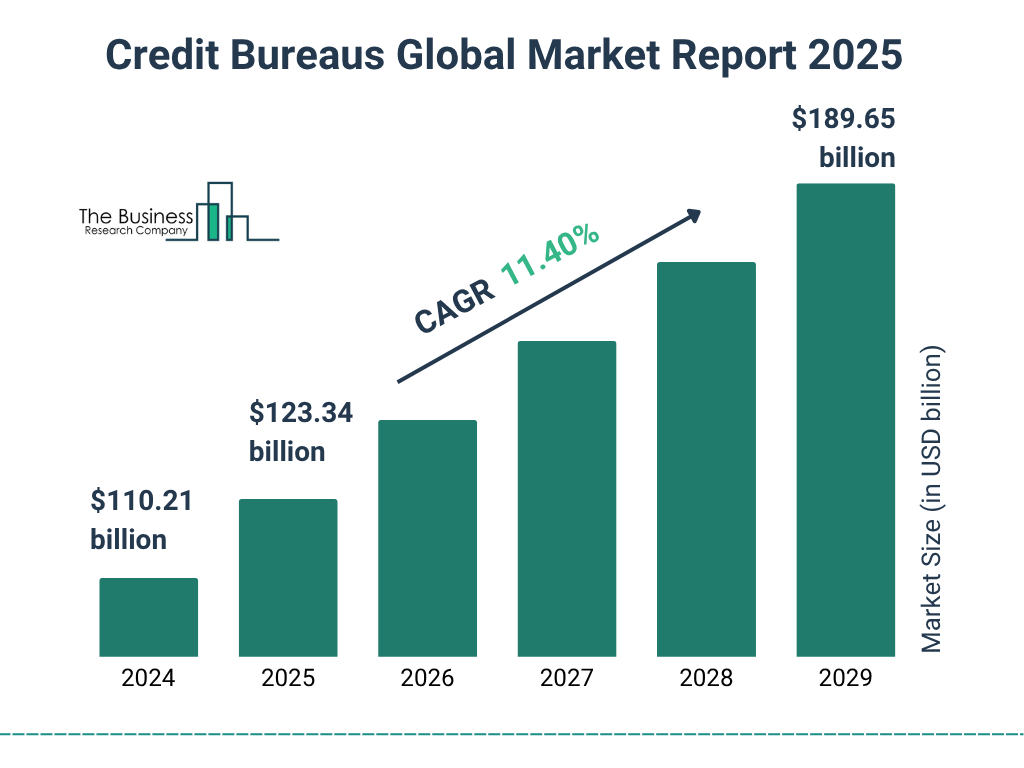

Credit Bureaus Global Market Size and Forecast

- The global credit bureau market is projected to grow to $123.34 billion in 2025, showing strong demand for data and risk analytics.

- The market is expected to reach $189.65 billion by 2029, indicating sustained expansion.

- The forecast reflects a compound annual growth rate (CAGR) of 11.40% over the 2024–2029 period.

- This growth is driven by increased credit activity, digital lending adoption, and stronger compliance requirements worldwide.

About TransUnion CIBIL

- TransUnion CIBIL is one of India’s leading credit bureaus, maintaining credit data on millions of individuals and businesses.

- It operates under RBI licensing, aggregating credit data from lenders and financial institutions countrywide.

- CIBIL generates the CIBIL Score, a three‑digit summary (300 to 900) of creditworthiness.

- A score above 750 is widely regarded as strong by lenders in India.

- Reports show credit report checks (self‑monitoring) rising sharply, indicating growing financial awareness.

- CIBIL also provides commercial credit ranks for businesses, helping evaluate commercial risk.

- CIBIL partners with 5,000+ member institutions to collect up‑to‑date credit behavior data.

- Its data helps in risk assessment, loan pricing, and portfolio management across lenders.

Consumer Credit Coverage

- India’s credit active population continued growing in 2025, but at a slower pace than in 2024.

- YoY credit‑active growth slowed to ~9% in Q1 2025, down from ~15% last year.

- 119 million Indians monitored their CIBIL score in FY24, up 51% YoY.

- In the U.S., TransUnion covers data on ~200M credit‑active consumers.

- Total U.S. consumer credit balances hit $18.0 trillion in Q1 2025, up 28% since 2020.

- U.S. credit card accounts held ~$1.09 trillion in balances in Q2 2025.

- Mortgages in the U.S. saw origination growth of around 5.1% in early 2025.

Growth in Credit‑Active Consumers Over Time

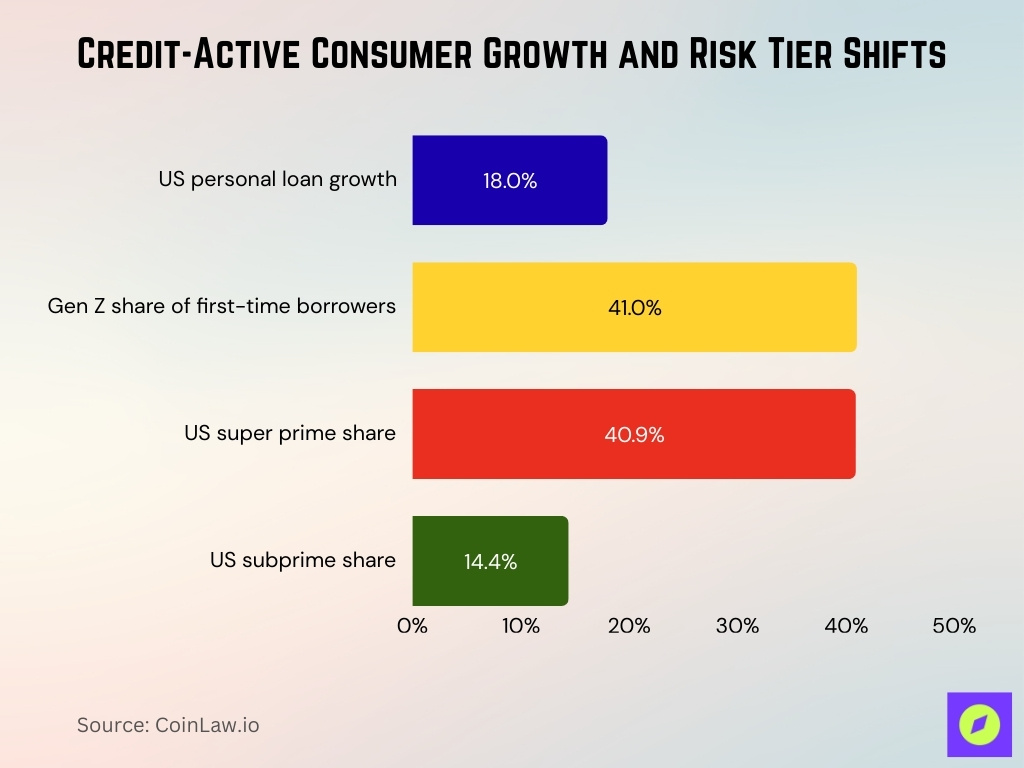

- Unsecured personal loan originations in the U.S. rose 18% in Q2 2025.

- 41% of first‑time borrowers in India were Gen Z in early 2025.

- In the U.S., super prime consumers grew to ~40.9% of the population by Q3 2025.

- Subprime share in the U.S. returned to ~14.4% of borrowers in Q3 2025.

- Originations of credit cards, auto loans, and unsecured loans helped support overall growth patterns.

- Total U.S. credit balances continue an upward trajectory across risk tiers.

CIBIL Score Distribution

- CIBIL scores range from 300 to 900; the higher the score, the better for creditworthiness.

- Scores above 750 are considered strong in India, improving loan approval chances.

- Consumers who monitor their credit tend to average scores near ~729 versus ~712 for non‑monitors.

- Score monitoring is linked with improved credit behaviour over time.

- In the U.S., the super prime segment now holds ~40.9% share of consumer profiles.

- Prime and near‑prime shares have thinned slightly.

- Subprime in the U.S. rose back to pre‑pandemic levels (~14.4%) by Q3 2025.

- Score shifts across segments influence lender risk decisions and pricing models.

Share of Consumers in Prime vs Subprime Bands

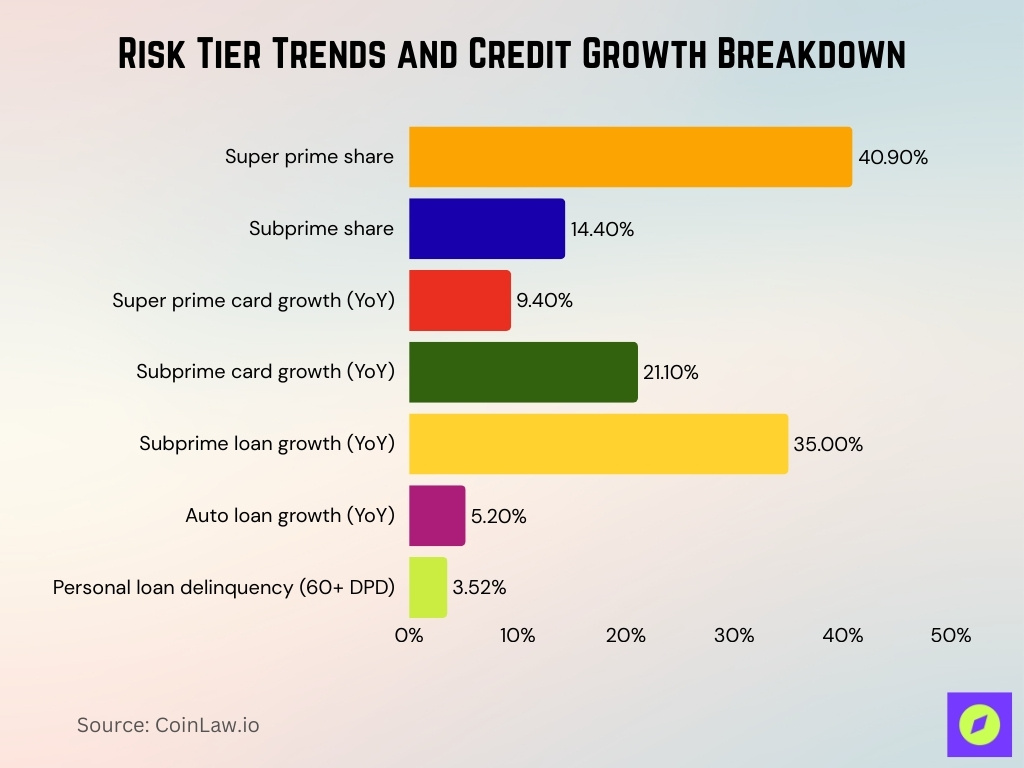

- In the U.S., the super prime share of consumers grew to ~40.9% in Q3 2025, up from 37.1% in 2019.

- The subprime share has returned to ~14.4% in Q3 2025, reversing earlier pandemic‑era declines.

- Prime plus and prime segments saw slight contractions.

- Near prime remained relatively stable at 12.2% in Q3 2025.

- Super prime growth correlated with increases in credit card and auto loan originations.

- Subprime growth was also present in originations.

- The shift in band shares underscores the importance of tailored risk strategies.

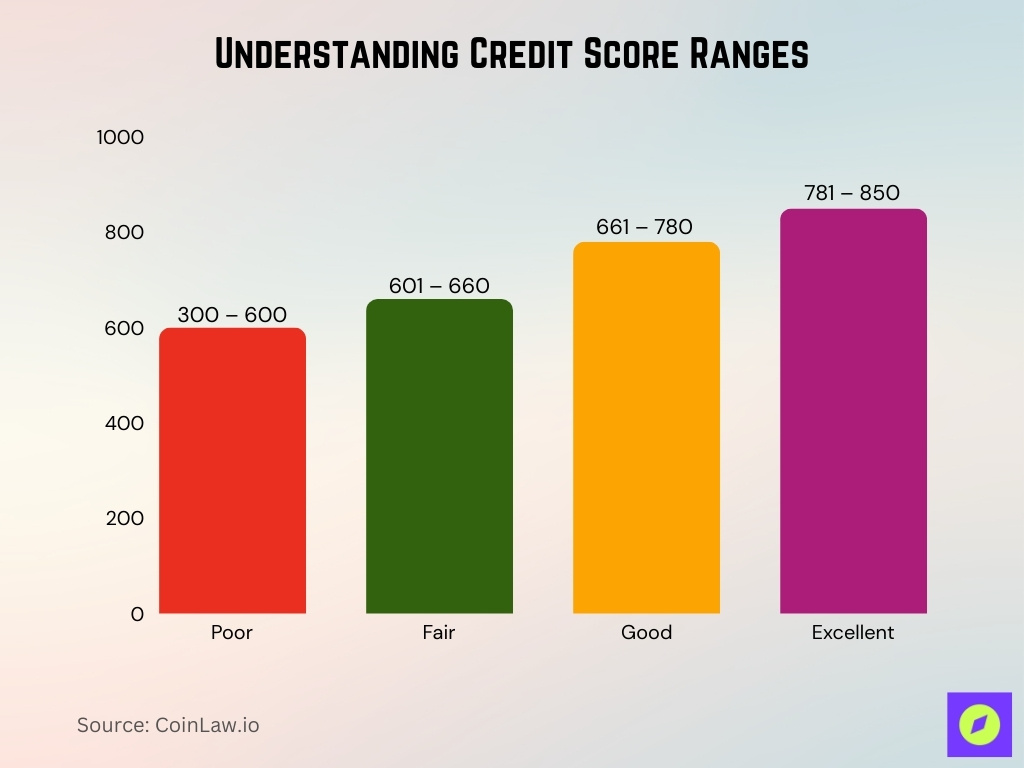

Understanding Credit Score Ranges

- Poor credit scores range from 300 to 600, often indicating high credit risk.

- Fair scores fall between 601 and 660, showing limited but improving credit history.

- Good scores range from 661 to 780, reflecting reliable credit behavior and better loan terms.

- Excellent scores span 781 to 850, offering the best access to credit and the lowest interest rates.

Credit Self‑Monitoring Trends

- In India, 27 million women borrowers monitored their credit information report as of December 2024.

- CIBIL score checks increased with overall monitoring growing 51% YoY.

- Monitorers typically maintain scores near ~729, versus ~712 for non‑monitors.

- TransUnion Philippines found that new‑to‑card consumers used credit responsibly.

- Credit awareness (CPI) remained stable at 73 out of 100 in 2025.

- Unbanked consumers’ CPI score rose to 67 in 2025.

- Self‑monitoring adoption reflects rising financial literacy and digital access.

Credit Access and Inclusion

- New‑to‑card consumers accounted for ~50% of new card originations in the Philippines in 2024.

- Among these, 57% were younger than 35.

- Women comprised 56% of these borrowers.

- CPI scores and product understanding improved in 2025.

- 9 in 10 Filipinos reported fintech usage.

- Barriers like interest rate concerns and fraud remain.

Gender and Demographic Insights

- In India, only 7% of MSME credit went to women entrepreneurs.

- 27 million women monitored credit data, indicating high engagement.

- In the Philippines, women made up 56% of new‑to‑card borrowers.

- Youth under 35 continue to dominate new credit adoption.

- Unbanked CPI scores rose, indicating inclusion.

- Digitally savvy consumers are increasing credit access.

- Inclusion trends are linked to education and self‑monitoring.

Risk Tier and Pricing Analytics

- U.S. super prime share reached 40.9% in Q3.

- Subprime borrowers returned to 14.4% of the total in Q3.

- Credit card originations grew 9.4% YoY among super prime.

- Subprime credit card originations rose 21.1% YoY.

- Subprime personal loan originations surged 35% YoY.

- Auto loan originations increased 5.2% YoY to 6.7 million in Q3.

- Personal loan delinquency rate stable at 3.52% 60+ DPD.

Product‑Wise Credit Statistics

- U.S. bankcard originations grew 4.5% YoY in early 2025.

- Outstanding credit card balances grew 4.5% YoY.

- Personal loan originations rose in mid‑2025.

- Auto and mortgage originations reflected disciplined behavior.

- New‑to‑credit consumers got lower initial limits.

- Interest grew in BNPL and microloans.

- FinTech showed broad product adoption.

- Balance growth remained controlled.

MSME and Business Credit

- MSME credit in India reached ₹35.2 lakh crore by March 2025, up ~13% YoY.

- 90+ day delinquencies fell to ~1.8%, a 5‑year low.

- New‑to‑credit MSMEs made up ~47% of new loans.

- MSMEs were a key driver of bank credit growth in FY25.

- Digital maturity exceeded 50% in some regions.

- Comprehensive borrower views reduced delinquencies.

- Loan product diversification grew regionally.

Credit Demand and Supply Trends

- Credit demand in India moderated in early 2025, per TransUnion CIBIL’s CMI.

- From Jan–March 2025, loan originations shifted to high‑ticket items.

- Lenders noted weaker demand among those aged <35.

- U.S. credit card originations rose 4.5% YoY to ~18.5 million in Q1 2025.

- U.S. credit card balances grew ~4.5% YoY.

- Unsecured loan originations increased across risk segments.

- Auto loan originations rose ~5% YoY in Q1 and Q3 2025.

- Balance growth stayed modest across products.

Portfolio Performance and Delinquencies

- Early delinquencies rose in India’s micro‑LAP and small housing loans.

- U.S. 90+ day delinquencies declined.

- U.S. unsecured loans saw stable 60+ DPD rates.

- Auto 60+ DPD rates rose slightly.

- Divergent credit performance appeared across risk tiers.

- Credit card charge‑offs stayed steady YoY.

- Risk segmentation improved portfolio outcomes.

- Lower score tiers still showed pressure vs pre‑2020 norms.

TransUnion CIBIL Regional and State‐Level Patterns

- U.S. credit card balances reached a record $269 billion in Q3.

- India’s younger consumers (18-35) saw loan originations slow to 6% YoY growth in Q2.

- Semi-urban and rural India recorded 9% credit growth while urban youth demand declined.

- U.S. average credit card debt stood at $6,523 nationwide, with state variations.

- Young borrowers’ share of total Indian credit demand fell to 56% in Q2.

- Rural/semi-urban personal loans in India grew 15% YoY, outpacing gold loans at 7%.

- U.S. auto loan 60+ days delinquency hit 1.31% in Q2, slowing from prior increases.

- India’s credit-active consumers grew 9% with stronger non-metro originations.

Digital and Fintech Lending

- FinTechs held ~50% of U.S. personal‑loan debt.

- Average loan sizes were ~$9,014.

- FinTech delinquency rose moderately.

- 8% of Indian retail borrowers used FinTechs by 2025.

- FinTechs grew their share in business lending.

- Consumer durable and SME loans expanded digitally.

- Trended data helped FinTechs manage roll risks.

- Traditional banks adopted FinTech data tools.

Frequently Asked Questions (FAQs)

41% of first‑time borrowers in India were Gen Z, per the latest TransUnion CIBIL Credit Market Indicator data.

The TransUnion CIBIL Score ranges from 300 to 900.

The “Super Prime” range is defined as 791–900 on the CreditVision score scale.

Consumption‑led loan originations for New‑to‑Credit borrowers declined by 21% YoY.

Conclusion

TransUnion CIBIL and credit industry data show a credit landscape shaped by measured growth, evolving risk, and expanded access. Super prime participation is up, subprime is stabilizing, and digital lenders are reshaping access. As credit behavior diversifies, institutions will need robust analytics, risk segmentation, and adaptive tools to navigate credit markets effectively.