Traditional banks continue to serve as the backbone of global finance, yet neobanks, digital-only banking solutions, are rapidly reshaping customer expectations and financial habits. As people pivot toward streamlined and cost-effective services, both sectors now influence how money moves. This article unpacks the latest data to help you compare and understand these evolving models.

Editor’s Choice

- U.S. digital banking users are expected to hit 216.8 million in 2025.

- The global neobanking market is projected to $230.55 billion in 2025.

- North America neobanking revenue forecast: from $5.93B in 2021 to $30.12B in 2025.

- Neobank users in the U.S. are expected to rise from 29.8M (2021) to 53.7M (2025).

- 68% of digital banking users report that neobank apps offer superior budgeting and financial management tools compared to traditional banks.

- Nearly 80% of neobank customers use their accounts for daily activities such as paying bills, shopping, and transferring funds.

- Revolut reached 60 million users globally in 2025.

Recent Developments

- The global neobanking market is estimated at $230.55 billion in 2025, with potential to grow beyond $4 trillion by 2034.

- North America’s share of neobanking revenue is forecast to grow fivefold from $5.93B (2021) to $30.12B (2025).

- The U.S. expects 53.7 million neobank account holders by 2025, up from 29.8 million in 2021.

- Revolut expanded to 60 million global users in 2025, reinforcing its role as a leading digital provider.

- Digital banking adoption surged in the U.S., and mobile banking adoption climbed to 48% in 2023, more than triple a decade earlier.

- Rural neobank adoption in the U.S. saw a 27% year-over-year increase in 2023, driven by improved digital access and mobile coverage

- 68% of users now prefer neobanks’ budgeting tools over those of traditional banks.

The Neobanking Market Statistics

- $3,406.47 billion projected global neobanking market size by 2032.

- 38% European market share for neobanks.

- 43% of Brazilian people have neobank accounts.

- 100 million global neobank users for Nubank.

Overview of Traditional Banks and Neobanks

- Traditional banks offer full-service branches, ATM networks, and extensive product portfolios, often with higher overhead and fees.

- Neobanks operate exclusively via mobile or web, without physical branches, and usually partner with licensed banks rather than holding one themselves.

- In the U.S., around 27% of customers use direct (online-only) banks, distinct from neobanks that often lack their own banking charters.

- Neobanks benefit from lower operational costs, reduced fees, and often offer competitive interest rates on savings and balances.

- Traditional banks still dominate with consumer trust, regulatory clarity, and financial stability.

- Neobanks, in contrast, lean on digital agility, UX design, and niche product agility to attract younger users.

Customer Demographics by Bank Type

- Younger demographics, especially Gen Z and millennials, are gravitating toward mobile banking; 60% of millennials and 57% of Gen Z primarily use mobile apps.

- Rural U.S. adoption of neobanks jumped 27% in 2023, thanks to better smartphone access and financial literacy.

- College-educated and higher-income users show 54% and 56% mobile adoption, respectively.

- Affluent users contribute approximately 25% of neobank transaction volume, averaging around $2,500 per month in activity.

- Among Gen Z, transaction value per user grew 15% year-over-year to $950 per month.

Adoption Rates and Growth Trends

- U.S. digital banking users are expected to reach 216.8 million by 2025, up from 196.8 million in 2021.

- Mobile banking use in the U.S. was 48% in 2023, triple from ten years earlier.

- Digital banking is now preferred by 77% of consumers, with mobile usage 2.5× more popular than desktop.

- 41% prefer mobile banking, compared to 33.5% via web browser.

- 73% of U.S. adults actively use online banking services in 2025.

- Neobank engagement is high; 80% of users use the accounts for daily transactions.

- The average monthly transaction value per neobank user increased from $950 in 2022 to $1,200 in 2023, reflecting growing reliance on digital-first banking.

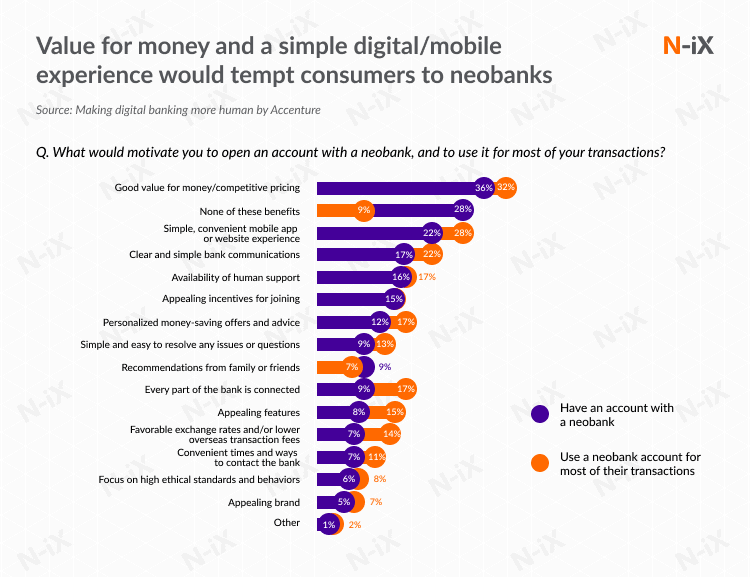

Motivations for Opening and Using Neobank Accounts

- 36% of people open a neobank account for good value for money/competitive pricing, with 32% using it for most transactions.

- 9% cite none of these benefits, but still 28% use neobanks for most transactions.

- 22% choose neobanks for a simple, convenient mobile app or website experience, with 28% using them primarily.

- 17% value clear and simple bank communications, with 22% frequent usage.

- 16% appreciate the availability of human support, with 17% regular usage.

- 15% are drawn by appealing incentives for joining.

- 12% like personalized money-saving offers and advice, with 17% frequent usage.

- 9% find ease in resolving issues or questions important, with 13% regular usage.

- 7% are influenced by recommendations from family or friends, with 9% using neobanks often.

- 9% value when every part of the bank is connected, with 17% regular use.

- 8% like appealing features.

- 7% choose them for favorable exchange rates/lower overseas transaction fees, with 14% usage.

- 7% value convenient times and ways to contact the bank, with 11% usage.

- 6% focus on high ethical standards and behaviors, with 8% usage.

- 5% are attracted to an appealing brand, with 7% usage.

- 1% cite other reasons, with 2% usage.

Financial Performance Comparison

- Neobanks benefit from lower cost structures, often a fraction of what traditional banks incur, due to minimal physical infrastructure and automation-heavy back ends.

- Many neobanks pass savings along, offering lower fees and higher rates, thanks to reduced overhead.

- Chime’s revenue grew 31% in 2024 to $1.7 billion, though it remains unprofitable with narrowed losses.

- Monzo expects to reach profitability soon, while Starling Bank already reports consistent profits.

- Traditional banks continue to have higher margins due to diversified revenue but face rising pressure from leaner digital rivals.

- Neobank profit models often rely on lending, premium services, and interchange fees, but reaching scale remains a challenge.

- Traditional banks’ diversified income streams, e.g., mortgages, wealth management, support profitability even amid digital disruption.

Fee Structures and Interest Rates

- Neobanks generally offer lower or no fees on checking, overdraft, and minimum balances, leveraging lower operating costs.

- They often provide higher interest rates, especially in high-yield savings accounts, compared to traditional bank offerings.

- Varo Bank, for example, has provided checking and savings with up to 5.00% APY, alongside zero-fee policies.

- Current offers a 4% APY savings product, no-fee overdrafts, early pay, and points rewards, all cost-saving features.

- Traditional banks are responding, waiving certain fees and boosting savings rates to remain competitive.

- Transparent pricing is more common among neobanks, with fewer hidden fees compared to many traditional banks.

- Some neobank features, like budgeting tools or early pay, can reduce incidental fees often charged by traditional banks.

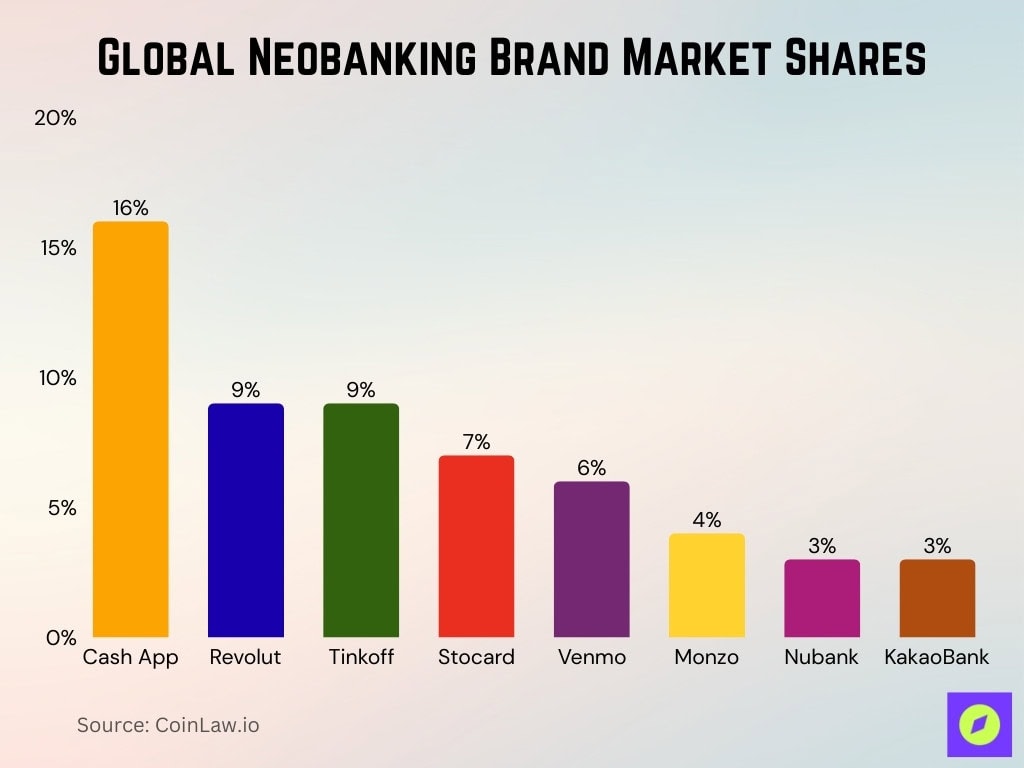

Global Neobanking Brand Market Shares

- Cash App leads with a 16% worldwide share.

- Revolut and Tinkoff each hold 9% of the global neobanking market.

- Stocard captures 7% of the market.

- Venmo accounts for 6% of the global share.

- Monzo holds 4% market share.

- Nubank and KakaoBank each represent 3% of the global market.

Product and Service Offerings

- Neobanks typically offer digital essentials, checking/savings accounts, debit cards, transfers, loans, and P2P payments.

- Advanced features include real-time notifications, budgeting tools, and personalized insights, especially appealing to younger users.

- API-based Banking-as-a-Service (BaaS) underpins 64% of new fintech apps launched in 2023, powered by neobank systems.

- Varo offers free tax filing, P2P transfers (“Varo to Anyone”), and cash advance features.

- Current provides tools like crypto trading, earned wage access, and cashback reward systems.

- Traditional banks still lead in full-spectrum services, in-person consultations, cash deposits, wealth management, and insurance.

- Neobanks often augment these with modern fintech services, yet still typically partner with chartered banks for actual banking functions.

Digital Experience and Technology Usage

- Neobanks excel at sleek app design, automation, and digital security, operating with lean IT and faster processes.

- Users rate neobanks’ Net Promoter Score (NPS) at 72, compared to 55 for traditional banks’ digital services and 41 overall.

- Digital banking platforms can automate tasks to boost productivity by up to 50%, improving service speed and accuracy.

- Neobank infrastructure, like BaaS, enables the rapid rollout of third-party services and features.

- Traditional banks struggle with legacy systems that slow innovation and hamper digital experience upgrades.

- Many neobanks feature real-time alerts, biometric login, and fraud monitoring by design, core to their service model.

- Neobanks consistently attract tech-first consumers who value digital fluency and seamless UX over branch access.

Customer Service and Support Statistics

- In the U.S., 63% of digital bank customers report ‘very satisfied’, compared to 55% for traditional banks.

- Digital bank satisfaction outpaces traditional banks in the U.K. (59% vs. 51%) and Latin America, even more pronounced in Mexico and Brazil.

- Yet, direct bank satisfaction scores declined in early 2024, checking accounts averaged 688, down 27 points, and savings averaged 710, down 8 points.

- Neobanks lead on NPS (72 vs. 55), especially among users under 40.

- Customer retention remains a challenge for neobanks; 40% of users consider switching, compared to 83–85% retention in traditional banks.

- High satisfaction and UX don’t fully offset trust and retention gaps; support remains a differentiator for traditional banks.

- In the U.K., digital-only Monzo and Starling lead in customer recommendations, outperforming big high-street banks.

Trust and Security Perceptions

- Trust remains a strong advantage for traditional banks; average trust score (oCX) is 87 vs. 74 for neobanks.

- 79% of consumers trust traditional banks more with sensitive financial data.

- Neobanks outperform on digital experience and innovation, but still lag on long-term security perceptions.

- FDIC insurance concerns persist, fintech apps like Venmo lack it, while neobanks rely on partner banks for insurance.

- Some high-profile fintech disruptions (e.g., Synapse collapse) intensified worries around digital bank reliability.

- Traditional banks’ long track record and regulatory oversight continue to reassure many customers.

- To close the trust gap, neobanks must bolster customer support, transparency, and robust security measures.

Regulatory Compliance and Financial Stability

- Regulatory oversight remains a key advantage for traditional banks, grounded in frameworks like Basel III, which sets global standards for capital, liquidity, and leverage to prevent systemic failures.

- Neobanks face growing scrutiny and have recently incurred penalties for compliance failures, such as a high-profile fine levied against a digital bank for anti-money laundering lapses.

- Financial regulators, particularly in the U.S. and Europe, are increasing scrutiny of non-bank financial institutions and neobank models to ensure financial resilience and safeguard customer funds.

- The Federal Reserve’s 2025 exploratory analysis highlights risks from nonbank financial institutions, noting that large banks’ exposures to such entities reached trillions, underscoring the need for system-wide vigilance.

- As compliance costs rise, many neobanks and fintechs are adopting RegTech solutions, leveraging AI and automation, to strengthen oversight, reduce risk, and demonstrate governance readiness.

- Some fintechs are pursuing traditional or trust bank charters (e.g., national trust charters) to gain access to more robust regulatory backing and improve financial stability.

- Traditional banks, with their deep liquidity access and established capital buffers, continue to offer superior stability, especially during economic stress, while neobanks are still building their regulatory pedigree.

Consumer Preferences: Key Factors Influencing Choice

- 72% of customers say personalization influences their choice of bank, but only 3% actually use available personalization tools.

- Main decision factors include ease of use, security, cost-effectiveness, customer service, and innovative features.

- 77% of consumers prefer managing accounts via a mobile app or computer.

- Millennials show the highest digital preference at 80%, followed by Gen Z at 72%.

- 73% of consumers would use a digital bank if it means faster, easier transactions.

- Nearly 42% of U.S. consumers now use fintech providers like Chime or SoFi, beyond traditional banks.

- 17% of consumers are likely to switch financial institutions in 2025, and this doubles to 37% if another institution better meets their needs.

- Barriers to switching include account setup hassle (41%), uncertainty about benefits (27%), and concerns over fees (24%).

Geographic Distribution and Penetration

- In 2022, global neobank penetration was 2.5% (≈188 million users), projected to reach 4.7% (≈377 million) by 2027.

- In the U.S., the rate was significantly higher, 12.4% (≈41 million users) in 2022, expected to climb to 22.8% (≈78 million) by 2027.

- Europe led in user volume, with 80 million neobank users, representing 40% of the global share.

- Europe accounted for a 37.75% share of the global neobanking market in 2024.

- The estimated neobanking market in 2024 was $143.29 billion, projected to reach $210.16 billion in 2025, and then surge to $3.41 trillion by 2032, CAGR 48.9%.

- In Europe, neobank user penetration was 7.3% in 2022 and is expected to hit 13.3% by 2027.

- Certain markets like Australia saw neobank initiatives largely decline or consolidate, with customer-owned banks gaining favor due to transparency and local trust.

Impact of Gen Z and Millennials

- Millennials lead digital banking adoption at 80%, with Gen Z close behind at 72%.

- Gen Z relies on social media more than bank reps for financial advice.

- Among U.S. adults, 34% didn’t write a single check in the past year, and the share climbs to 46% for Gen Z.

- Younger users are more likely to switch; over half of Millennials (58%) and Gen Z (57%) would switch banks if another bank meets their banking priorities better.

- Younger segments are stronger recommenders of neobanks and believe in their long-term potential, even if opinions vary significantly by age.

Willingness to Switch: Consumer Migratory Trends

- About 17% of consumers are likely to switch banks in 2025, and that percentage jumps to 37% if another bank better matches their needs.

- 66% say they are unlikely to switch, with main barriers being satisfaction with current products (75%), switching hassle (41%), cost concerns (24%), and lack of information (16%).

- Younger consumers remain more willing to move, driven by expectations of better digital experiences, personalization, and lower fees.

Hybrid Banking Models: Collaborations and Mergers

- Traditional banks are responding by improving online access, reducing fees, and offering more personalized services to compete.

- Fintechs like Revolut and Monzo are targeting the U.S., exploring partnerships, crypto trading, and reward-rich offerings to break into this large, complex market.

Sustainable Finance and International Transfers

- Neobanks such as Revolut and Wise have championed low-cost international transfers, attracting users who frequently transact across borders.

- Growing consumer demand centers on eco-conscious banking, though specific stats for the U.S. in 2025 remain sparse.

Conclusion

The rise of neobanks is no longer speculative; they now hold a substantial and swiftly growing slice of the global financial pie. From enhanced user-friendly digital experiences, lower fees, and innovative tools, new banking platforms have captured the mindset of younger generations, especially Millennials and Gen Z. Yet traditional banks maintain ground through entrenched trust, regulatory strength, and diverse offerings. As lines blur, through hybrid models, strategic partnerships, and expanding services, the competition propels both sectors to innovate. The question is not “who wins,” but how each adapts in a shared digital future that rewards both agility and stability.