The syndicated loan market, with its intricate web of investors, borrowers, and financial institutions, represents a crucial sector in global finance. These loans, which bring together a group of lenders to fund a single borrower, are often used by large corporations, governments, and institutions seeking capital for expansive projects or acquisitions. In recent years, this market has experienced significant fluctuations. Economic shifts, regulatory changes, and digital innovations have shaped a dynamic landscape, and stakeholders are keen to understand where the market is heading in 2025. In this article, we delve into the most current syndicated loan statistics and trends, offering a comprehensive view of a market primed for growth and transformation.

Key Takeaways

- 1U.S. institutional loan issuance reached $362 billion across 308 deals in Q1 2025.

- 2The global syndicated loan market is projected to hit $782.79 billion in 2025, with U.S. leveraged loans contributing between $590 billion and $620 billion in volume.

- 3The global syndicated loans market is expected to grow to $1,342.3 billion by 2029, maintaining a 14.4% CAGR.

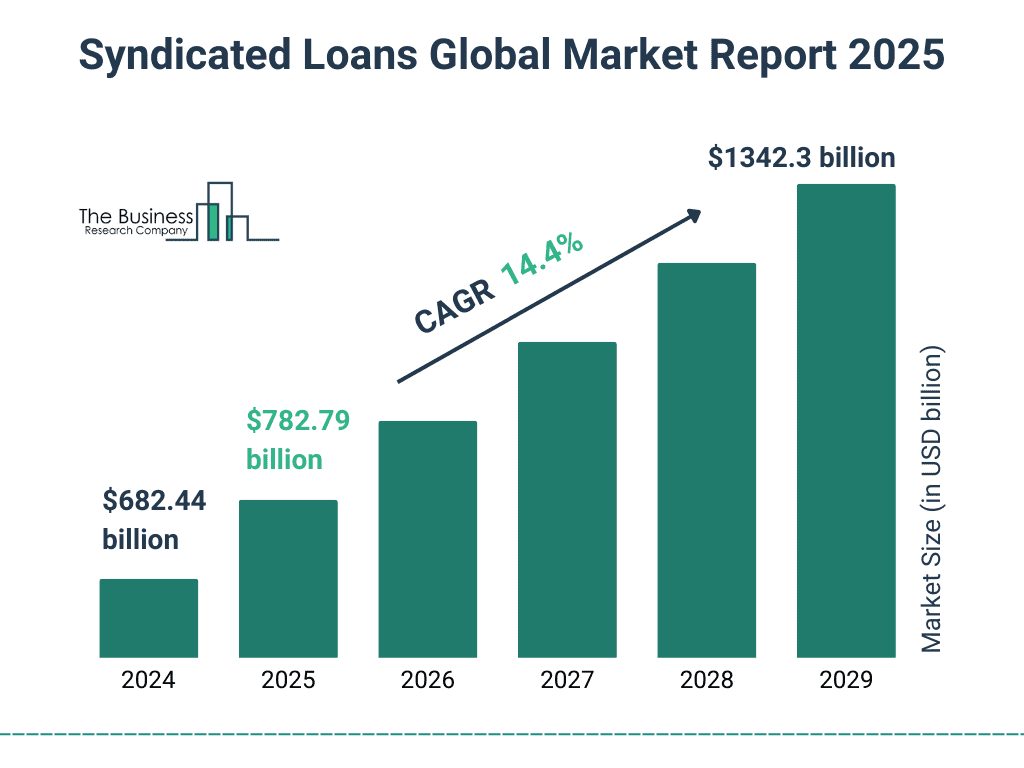

Syndicated Loans Global Market Forecast

- The syndicated loans market is projected to grow steadily over the next five years.

- It is expected to rise to $782.79 billion in 2025.

- The market is forecasted to reach $1,342.3 billion by 2029.

- This reflects a compound annual growth rate (CAGR) of 14.4% from 2024 to 2029.

- The trend indicates strong demand and increased participation in syndicated lending globally.

Key Players and Market Share

- JPMorgan Chase, Bank of America, and Citi now manage over 28% of the global syndicated loan market share in 2025.

- Deutsche Bank and HSBC hold around 17% of Europe’s syndicated loan volume, reinforcing their regional dominance.

- Goldman Sachs increased its syndicated loan activity by 15% in 2025, with a continued focus on tech and healthcare sectors.

- In Asia-Pacific, MUFG accounts for 7.2% and SMBC closely follows, strengthening their leadership in regional syndications.

- China Construction Bank led China’s market again in 2025, arranging syndicated loans worth over $226 billion.

- Digital-first lenders now facilitate 13% of all syndicated loans, signaling rising fintech disruption in 2025.

- Banco Santander maintains its lead in Latin America, driving syndicated loan growth in the infrastructure and energy sectors.

- HSBC boosted its Middle East market share by 5.3% in 2025, driven by demand in renewables and green projects.

- Credit Suisse continues as a force in European leveraged loans, handling 9.1% of total syndicated volumes.

- UBS and Barclays each hold a 5.6% share of the investment-grade syndicated loan market as of 2025.

Syndicated Loans Market Segment Insights

- The investment-grade loan segment holds 58% of market volume in 2025, favored by institutional investors for its stability and low risk.

- Leveraged loans expanded by 11% in 2025, fueled by demand in technology, energy, and real estate.

- Green and sustainability-linked loans hit $246 billion in 2025, reflecting growing corporate alignment with ESG priorities.

- Direct lending now comprises 14% of the syndicated loan market, offering flexibility to SMEs and non-traditional borrowers.

- The subordinated debt market rose to $58 billion globally, driven by sectors seeking long-term, high-risk capital.

- High-yield syndicated loans in the U.S. increased by 7.8%, led by tech and energy companies pursuing aggressive growth.

- The consumer goods sector represents 9.2% of syndicated loans, reflecting rising activity amid supply chain modernization.

- Cross-border syndicated financing totaled $652 billion, with strong momentum in U.S.-Asia and intra-Asia loan structures.

- The financial services sector remains dominant with 32% of global syndicated loans, underpinned by M&A and capital restructuring.

- Middle-market firms accessed 17% of syndicated loan funding, bolstered by interest from private equity and growth capital investors.

Loan Types and Regional Breakdown

- Revolving credit facilities now make up 42% of syndicated loan structures in 2025, remaining the top choice for corporate flexibility.

- Term loans account for 33% of total syndicated lending, backing long-term investments in infrastructure and acquisitions.

- Bridge loan demand grew by 18% in North America, driven by short-term funding gaps in mergers and real estate.

- In Asia-Pacific, revolving credit facilities rose to 52%, underlining the region’s preference for adaptive financing.

- Green syndicated loans reached 14% of total volume in Latin America, led by surging renewable energy and ESG financing.

- Asset-based loans now represent 22% of European syndications, supporting manufacturing growth and infrastructure modernization.

- The Middle East still sees 38% of syndicated loans tied to oil and gas, though green energy demand is steadily rising.

- U.S. real estate syndications totaled $486 billion in 2025, fueled by urban revitalization and multifamily housing demand.

- Cross-border syndicated loans in Asia increased by 10.5%, as firms seek capital for regional and global expansion.

- The healthcare sector captured 17% of syndicated loans in North America, reflecting strong capital demand and innovation growth.

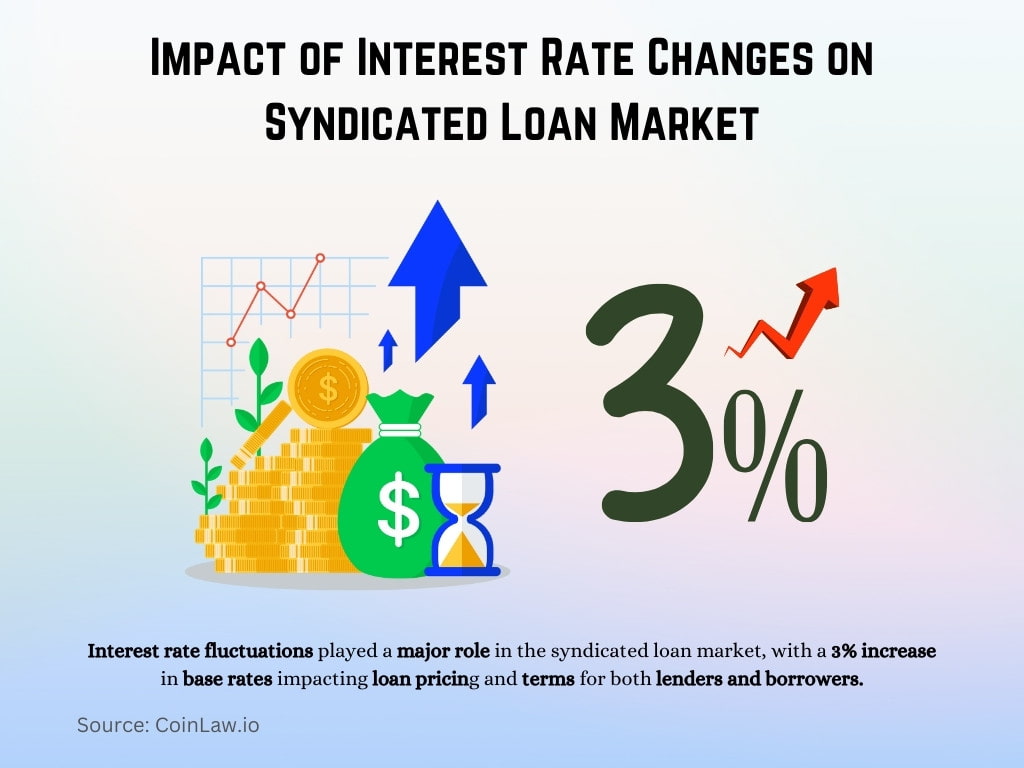

Top Impacting Factors

- Interest rate fluctuations played a major role in the syndicated loan market, with a 3% increase in base rates impacting loan pricing and terms for both lenders and borrowers.

- The growing importance of ESG compliance has influenced syndication terms, as borrowers now face increased scrutiny regarding their environmental impact and governance practices.

- Technological advancements in loan syndication platforms have streamlined processes, reducing transaction times by 25% and making it easier for investors to access syndicated deals.

- Economic recovery efforts post-pandemic led to increased borrowing as companies expanded operations and sought new capital for growth.

- Geopolitical tensions, especially in Europe and Asia-Pacific, created market volatility, which influenced the pricing and availability of cross-border syndicated loans.

- Corporate restructuring following significant M&A activity in industries like healthcare and technology has driven up the demand for customized loan structures to meet specific corporate needs.

Key Benefits for Stakeholders

- Borrowers benefit from syndicated loans by accessing larger sums of capital, often at more favorable terms than individual loans, as multiple lenders share the risk.

- Lenders can diversify their portfolios, spreading risk across multiple high-value loans while reducing exposure to any single borrower.

- Syndicated loans enable corporations to maintain liquidity while pursuing expansion projects, allowing them to capitalize on opportunities without disrupting cash flow.

- Institutional investors are attracted to syndicated loans due to their potentially higher returns compared to other debt instruments, especially in segments like leveraged loans.

- For lead banks, arranging syndicated loans strengthens client relationships and enhances their reputation in the financial services market.

- Private equity firms leverage syndicated loans to fund buyouts and acquisitions, providing flexible financing options with structured repayment terms.

- Debt investors find syndicated loans appealing as they offer floating interest rates, which can protect returns in a rising interest rate environment.

- Cross-border syndicated loans provide multinational corporations with the ability to raise capital in multiple regions, supporting global expansion efforts.

- Green and sustainable loans within syndications offer environmental and social impact benefits, aligning with corporate and stakeholder values.

- Middle-market firms gain access to larger-scale funding sources typically unavailable in traditional lending, which is instrumental for growth in competitive industries.

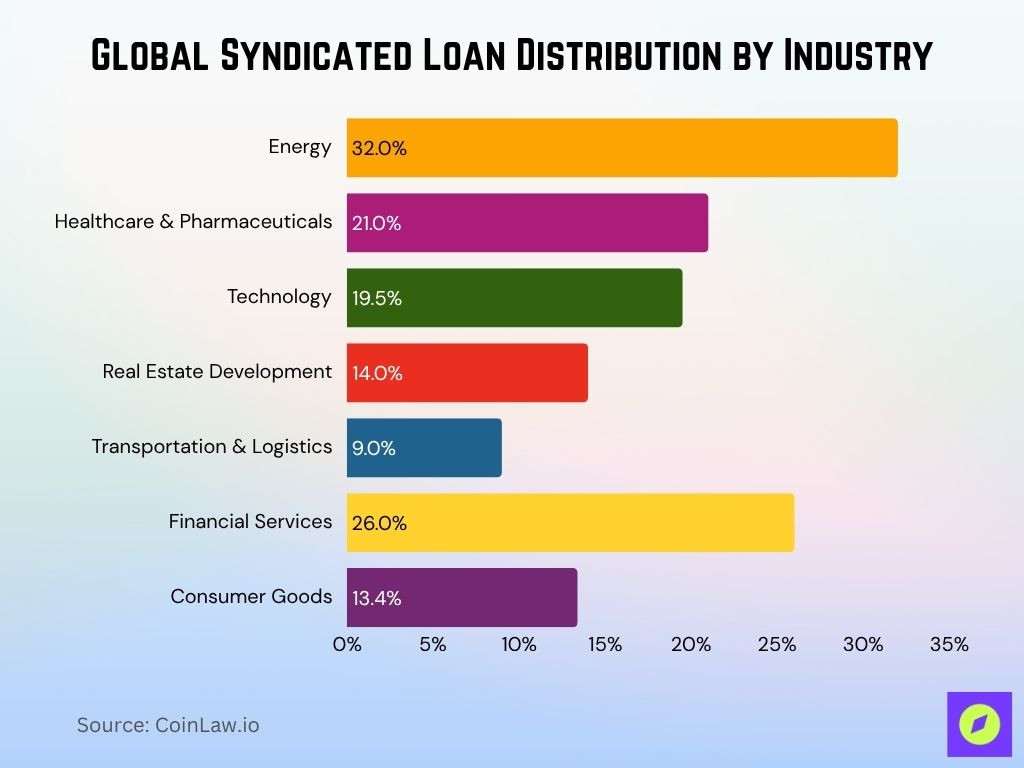

Industry Adoption Across Sectors

- The energy sector leads with 32% of syndicated loans in 2025, supporting renewables, modernization, and energy transition projects.

- Healthcare and pharmaceuticals account for 21% of syndicated loans, driven by M&A and advanced R&D funding.

- Technology firms represent 19.5% of global syndicated loans, fueled by AI, cloud, and infrastructure investment.

- Real estate development absorbs 14% of syndicated financing, with a continued focus on urban and commercial property projects.

- The manufacturing sector saw a 12% rise in syndicated loans, led by production scale-ups in Asia and Latin America.

- Transportation and logistics hold 9% of the loan market share, backing ports, rail, and supply chain upgrades.

- Financial services maintain a stronghold with 26% of syndicated loan volume, supporting capital markets and restructuring.

- Media and telecom loans grew by 7.2%, as firms accelerate streaming, 5G, and digital platform rollouts.

- Consumer goods companies account for 13.4% of syndicated loans, managing inventory, supply chain, and expansion efforts.

- Automotive sector loans rose by 5.6%, driven by investment in EV manufacturing and resilient global sourcing.

Risk of Bad Debts

- Syndicated loan default rates held steady at 2.1% in 2025, reflecting strong underwriting and risk controls.

- Leveraged loans showed a default rate of 3.8%, attributed to cash flow reliance and market sensitivity.

- Currency-related defaults made up 4.6% of cross-border syndicated loans, due to exchange rate volatility and policy shifts.

- Sector-specific risk rose in real estate and hospitality, where defaults increased to 3.2% amid slower recovery timelines.

- The technology sector reported 3% of syndicated loans at risk, linked to capital-intensive models and market disruption.

- Emerging market loans showed a 5.5% high-risk classification, driven by macroeconomic instability and political unrest.

- High-yield syndicated loans carried a 4.8% default risk, reflecting elevated exposure in leveraged growth sectors.

- The healthcare sector remains stable with just 1.4% at risk, backed by consistent demand and strong fundamentals.

- Private equity-backed loans saw a 4.2% risk of default, tied to debt-heavy acquisitions and margin pressure.

- Corporate restructurings and M&A continue to heighten default risk, particularly in deals with integration and cash flow misalignment.

Technological Innovations and Digital Platforms

- Blockchain technology is being tested in loan syndication, promising greater transparency and a reduction in transaction times by up to 30%.

- Artificial intelligence (AI) is increasingly used to assess borrower risk, enhancing underwriting efficiency and reducing time spent on manual due diligence.

- Smart contracts on blockchain networks could automate syndicated loan terms, potentially reducing administrative costs by 20%.

- Machine learning algorithms help investors monitor syndicated loan portfolios, predicting potential defaults and risk patterns in real time.

- The rise of fintech partnerships has improved the distribution of syndicated loans, allowing smaller investors to participate in deals traditionally reserved for large institutions.

- Robotic process automation (RPA) in loan administration has reduced processing times by 25%, expediting loan setup and compliance checks.

- Cloud-based loan management systems are now standard, enabling secure, on-demand access to loan portfolios and real-time data updates.

- Investor dashboards provide a user-friendly interface for tracking syndicated loan performance, allowing stakeholders to make data-driven decisions.

Syndicated Loans Jobs in the USA

- 100% of syndicated loans job openings in the U.S. are full-time positions.

- 65% of roles are in-person, while 35% follow a hybrid work setup.

- The average annual salary for syndicated loans jobs is $79,364, which equals about $38.20 per hour.

- Salary ranges from $50.5k on the lower end to as much as $138k at the top.

Regulatory and Compliance Landscape

- The Dodd-Frank Act mandates stricter reporting and transparency standards for U.S.-based syndicated loans, affecting the compliance processes for lenders.

- In Europe, the Market Abuse Regulation (MAR) enforces disclosures on syndicated loans, ensuring that public loan arrangements meet stringent transparency guidelines.

- Anti-money laundering (AML) requirements have intensified globally, adding layers of verification for syndicated loan participants.

- Cross-border loans face regulatory hurdles, with jurisdiction-specific compliance standards affecting transaction times.

- Loan syndication disclosures are mandatory under SEC regulations in the U.S., impacting financial reporting for publicly traded companies.

- Data privacy regulations such as GDPR affect syndicated loans in Europe, with companies needing secure, compliant loan management systems.

- Credit rating agencies play a critical role, as their assessments determine loan terms and pricing based on compliance with market regulations.

- The rise in green loans has led to new standards for environmental impact assessments, with syndicated loans in the energy sector requiring extensive environmental compliance documentation.

Recent Developments

- The syndicated loans market is projected to grow from $782.79 billion in 2025 to $912.6 billion in 2026, reflecting a CAGR of 14.6%.

- The BSL market regained momentum in 2025, recapturing share from private debt as lower pricing lures sponsor-backed borrowers.

- Top 10 U.S. banks now hold over $768 billion in private credit exposure, raising flags around systemic risk and regulatory gaps.

- S&P Global Ratings projects CLO issuance to hit new highs in 2025, boosted by improving speculative-grade outlooks and fewer CCC-rated tranches.

- Ares Management raised a record $37.2 billion for its latest direct lending fund, signaling strong demand from mid-market U.S. firms seeking non-bank capital.

Conclusion

As the syndicated loan industry continues to evolve, the trends in technological innovation, sustainability, and regional growth are shaping a dynamic market poised for further expansion. Lenders and borrowers alike are adapting to new regulatory landscapes, embracing digital platforms, and meeting investor demands for transparency and compliance. With global economic uncertainties and shifting investor preferences, the syndicated loan market remains an essential tool for large-scale financing. Looking ahead, the industry is expected to balance growth and resilience, as it accommodates the needs of various sectors while adapting to emerging financial innovations and ESG standards.

Hover or focus to see the definition of the term.