Michael Saylor’s Bitcoin-focused firm Strategy has resumed its weekly crypto buying streak, acquiring 1,229 BTC for approximately $108.8 million despite Bitcoin and its own stock trending toward year-end losses.

Key Takeaways

- Strategy purchased 1,229 BTC for $108.8 million, paying about $88,568 per coin.

- The purchase was funded through the sale of 663,450 MSTR shares during the same period.

- Strategy now holds 672,497 BTC, acquired at a total cost of $50.44 billion.

- Despite the latest buy, Bitcoin and MSTR stock are both heading toward 2025 year-end losses.

What Happened?

From December 22 to December 28, Strategy bought 1,229 Bitcoin at an average price of $88,568 per coin. The company funded this move by selling $108.8 million worth of its Class A common stock under its at-the-market equity program. This transaction brings its total holdings to 672,497 BTC, valued at around $58.7 billion at current prices.

Strategy has acquired 1,229 BTC for ~$108.8 million at ~$88,568 per bitcoin and has achieved BTC Yield of 23.2% YTD 2025. As of 12/28/2025, we hodl 672,497 $BTC acquired for ~$50.44 billion at ~$74,997 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/5VvOgBYwhk

— Michael Saylor (@saylor) December 29, 2025

Strategy Resumes Bitcoin Buying After Brief Pause

After pausing its buying activity the previous week, Strategy has once again entered the market with a sizable Bitcoin acquisition. The break in purchases, which ended on December 21, marked a rare moment of stillness for a company known for its consistent weekly buys. During the pause, Strategy added to its USD reserves, which now total $2.19 billion. These reserves are designed to support dividend payments and cover debt interest.

The latest purchase, disclosed in a Monday SEC filing, was preceded by Michael Saylor’s typical Sunday signal on X (formerly Twitter), where he posted “Back to Orange” along with a visual graph of the company’s Bitcoin holdings. In Strategy’s community, these orange dots are recognized as an informal announcement of a fresh acquisition.

This is Strategy’s third major BTC purchase in December alone:

- Dec. 7: 10,624 BTC for $962.7 million.

- Dec. 14: $980 million worth of BTC.

- Dec. 28: 1,229 BTC for $108.8 million.

Together, these December buys highlight an aggressive strategy even amid a cooling crypto market.

Bitcoin and MSTR Struggle to End the Year in the Green

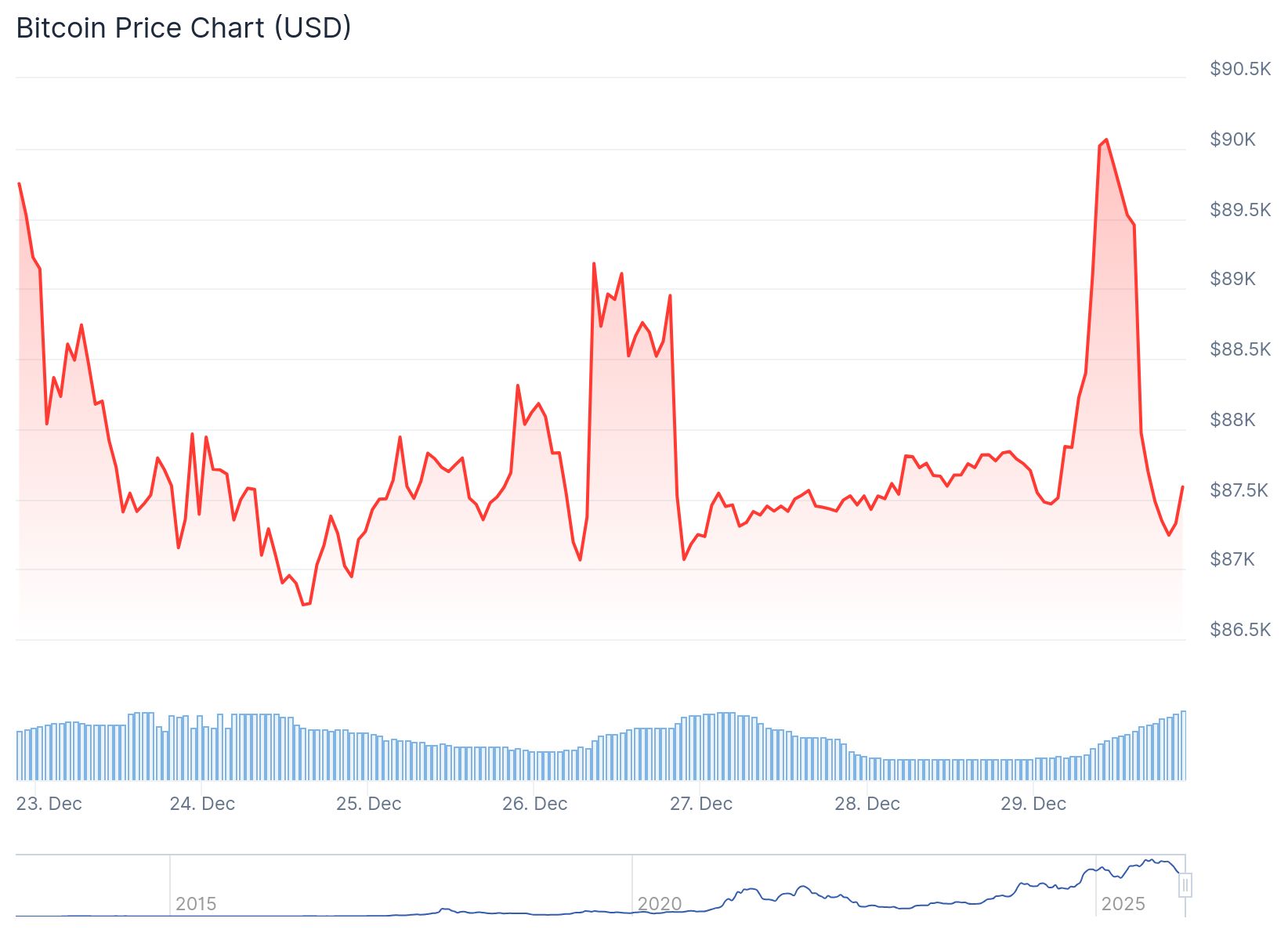

Despite Strategy’s bullish buying spree, the crypto market is showing signs of fatigue. Bitcoin has dropped nearly 7% year-to-date and is now hovering around $87,000. It briefly pushed above $90,000 earlier in the week but has since fallen back, leaving the flagship cryptocurrency on track to close the year in the red.

The MSTR stock is also not faring well. After reaching a yearly high of about $455, it has tumbled to around $156, reflecting a 47% decline for the year. Even after the announcement of the latest Bitcoin purchase, the stock traded flat with no significant bounce.

Interestingly, Strategy’s routine of disclosing purchases every week has made pauses even more noticeable. Just like the break at the end of November, the December 15-21 gap in buying was closely watched by analysts and investors.

CoinLaw’s Takeaway

Honestly, Strategy’s commitment to stacking Bitcoin week after week, no matter what the market looks like, is nothing short of bold. I’ve followed Michael Saylor’s strategy for years, and this relentless accumulation stands out, especially during periods of market uncertainty. In my experience, moves like this reflect long-term conviction rather than short-term hype. The “Back to Orange” post might look cryptic to outsiders, but it has become a reliable signal of action for those tracking Strategy’s Bitcoin playbook. With BTC and MSTR both down, it’s gutsy. But if Bitcoin rebounds in 2026 as history suggests, Strategy could be well-positioned once again.