Sphere 3D Corp is a small-cap Bitcoin mining company focused on digital asset infrastructure and hosted mining operations in the United States. As Bitcoin economics tightened, the company shifted its focus toward cost discipline, fleet efficiency, and liquidity preservation. Investors track Sphere 3D closely because its financial performance reflects broader trends in crypto mining, including hash rate growth, energy pricing, and Bitcoin price volatility. Below is a comprehensive look at Sphere 3D’s financial and operational statistics.

Editor’s Choice

- Net profit margin remains near –167%, reflecting sustained operating losses.

- Total debt is effectively $0, leaving the company minimally leveraged.

- Current ratio stands near 4.6, signaling strong short-term liquidity.

- Q3 2025 revenue reached $2.62 million, up slightly from $2.36 million year over year.

- Shares trade near $1.70 in early 2026, reflecting continued market pressure.

Recent Developments

- Q3 2025 revenue totaled $2.62 million, with continued net losses.

- The 2024 Bitcoin halving reduced block rewards by 50%.

- Operational restructuring reduced overhead expenses in 2024 and 2025.

- Reverse stock splits maintained Nasdaq compliance.

- Strategic reviews evaluated cost optimization initiatives.

- Bitcoin price recovery in late 2025 improved revenue potential.

- Equity financing supported working capital needs.

- Fleet modernization efforts remain under evaluation.

- Competitive pressure from larger miners persists.

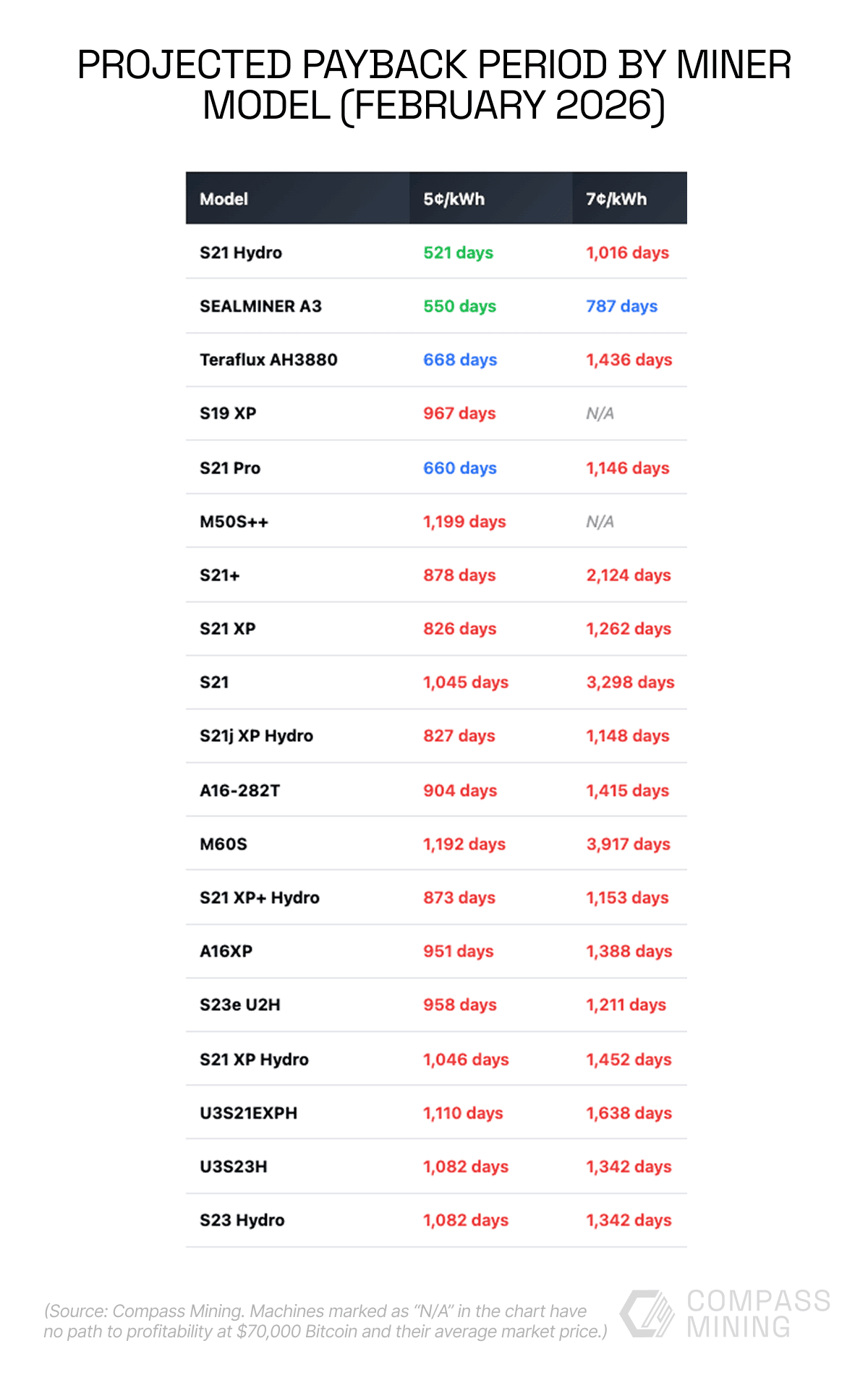

Projected Payback Period by Bitcoin Miner Model

- The S21 Hydro shows the fastest ROI, with payback in 521 days at 5¢/kWh, rising to 1,016 days at 7¢/kWh.

- SEALMINER A3 ranks among the most efficient, requiring 550 days at 5¢/kWh and 787 days at 7¢/kWh.

- Teraflux AH3880 needs 668 days at low power costs but jumps sharply to 1,436 days at higher electricity rates.

- Older hardware like the S19 XP requires 967 days at 5¢/kWh and becomes unprofitable (N/A) at 7¢/kWh.

- The S21 Pro maintains competitive efficiency with 660 days at 5¢/kWh and 1,146 days at 7¢/kWh.

- The M50S++ shows weak economics, taking 1,199 days at 5¢/kWh and having no profitability path at higher power costs.

- The S21+ requires 878 days at 5¢/kWh, ballooning to 2,124 days at 7¢/kWh, highlighting sensitivity to energy prices.

- Standard S21 XP units need 826 days at low electricity costs and 1,262 days at higher rates.

- The base S21 model stretches to 1,045 days at 5¢/kWh and an extreme 3,298 days at 7¢/kWh.

- Hydro-cooled models like S21j XP Hydro improve efficiency, achieving 827 days at 5¢/kWh and 1,148 days at 7¢/kWh.

- The A16-282T requires 904 days at low power prices and 1,415 days at higher electricity costs.

- The M60S becomes highly unattractive economically, with 1,192 days at 5¢/kWh and 3,917 days at 7¢/kWh.

- The S21 XP+ Hydro performs better than many air-cooled peers at 873 days and 1,153 days, respectively.

- A16XP miners need roughly 951 days at low power costs and 1,388 days at higher rates.

- The S23e U2H requires about 958 days at 5¢/kWh and 1,211 days at 7¢/kWh.

- The S21 XP Hydro extends to 1,046 days at low electricity prices and 1,452 days at higher costs.

- The U3S21EXPH model needs 1,110 days at 5¢/kWh and 1,638 days at 7¢/kWh.

- Both U3S23H and S23 Hydro show identical estimates of 1,082 days at 5¢/kWh and 1,342 days at 7¢/kWh.

- Overall, many miners exceed 3–10 years payback at 7¢/kWh, underscoring how electricity costs determine mining profitability.

Sphere 3D Earnings and Profitability Statistics

- Full-year 2024 revenue was approximately $16.61 million, down about 24% year over year.

- Q1 2025 revenue totaled $2.8 million, below prior-year levels despite modest sequential stabilization.

- Q3 2025 revenue came in at $2.62 million, compared to $2.36 million in Q3 2024.

- Q1 2025 net loss reached approximately $8.8 million, reflecting ongoing cost pressures.

- Q1 2025 earnings per share were –$0.32, missing analyst expectations.

- Q3 2025 operating loss narrowed to approximately $4.04 million, compared to a larger loss in the prior year.

- Bitcoin mined in Q3 2025 totaled 23 BTC, down from 38.7 BTC the year before.

- Revenue volatility closely tracks Bitcoin price movements and network difficulty.

- Gross profit remains inconsistent due to fluctuating energy costs and hash rate efficiency.

- Cumulative losses have reduced retained earnings over multiple fiscal years.

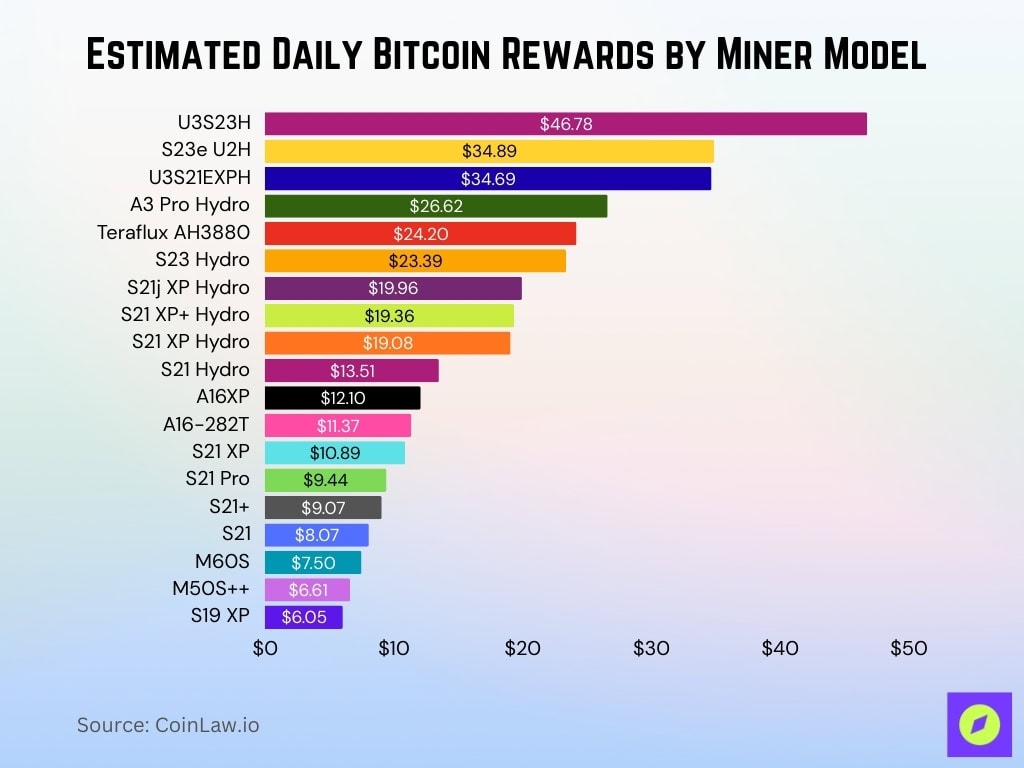

Estimated Daily Bitcoin Rewards by Miner Model

- The U3S23H leads all models, generating about $46.78 per day, nearly double that of most competing miners.

- High-performance units S23e U2H and U3S21EXPH follow closely with $34.89 and $34.69 daily, respectively.

- The A3 Pro Hydro delivers strong output at $26.62 per day, outperforming many mainstream rigs.

- Teraflux AH3880 produces roughly $24.20 daily, placing it among the top non-hydro performers.

- The S23 Hydro yields about $23.39 per day, highlighting the efficiency of next-generation hydro-cooled systems.

- Mid-tier hydro models such as S21j XP Hydro, S21 XP+ Hydro, and S21 XP Hydro cluster around $19–$20 daily.

- The standard S21 Hydro drops to $13.51 per day, showing a notable gap versus newer flagship hardware.

- Air-cooled models like A16XP and A16-282T earn approximately $12.10 and $11.37 daily.

- Popular mainstream units, including S21 XP, S21 Pro, and S21+, generate roughly $9–$11 per day.

- The base S21 model earns about $8.07 daily, reflecting declining profitability for older equipment.

- Legacy and less efficient rigs such as M60S, M50S++, and S19 XP produce only $6–$7.50 per day.

- Overall, top-tier miners can generate over 7× more daily revenue than older models, emphasizing rapid hardware obsolescence in Bitcoin mining.

Balance Sheet and Debt Statistics

- Sphere 3D carries no meaningful long-term debt, strengthening balance sheet flexibility.

- Debt-to-equity ratio remains near 0%, limiting financial risk.

- Total assets are approximately $31 million, compared to liabilities of roughly $1.6 million.

- Shareholder equity stands at $29.5 million, despite cumulative losses.

- Cash reserves totaled approximately $5.4 million at year-end 2024.

- The company relies primarily on equity financing rather than borrowing.

- Equity levels declined over recent years due to sustained net losses.

- Short-term liabilities remain manageable relative to current assets.

- Capital structure remains straightforward, with no complex debt instruments.

Cash Flow and Liquidity Ratios

- Operating cash flow for 2024 was approximately –$4.6 million, reflecting operational burn.

- Free cash flow in 2024 totaled roughly –$13.5 million, driven by capital expenditures.

- The current ratio of approximately 4.57 indicates strong short-term coverage.

- Cash runway, at current burn rates, provides roughly one year of operational coverage.

- Capital expenditures focus primarily on ASIC mining hardware.

- Liquidity remains a relative strength compared to other small-cap miners.

- The company maintains limited dependence on external debt markets.

- Cash flow volatility mirrors fluctuations in Bitcoin price and mining output.

- Cost-control initiatives in 2025 helped moderate cash outflows.

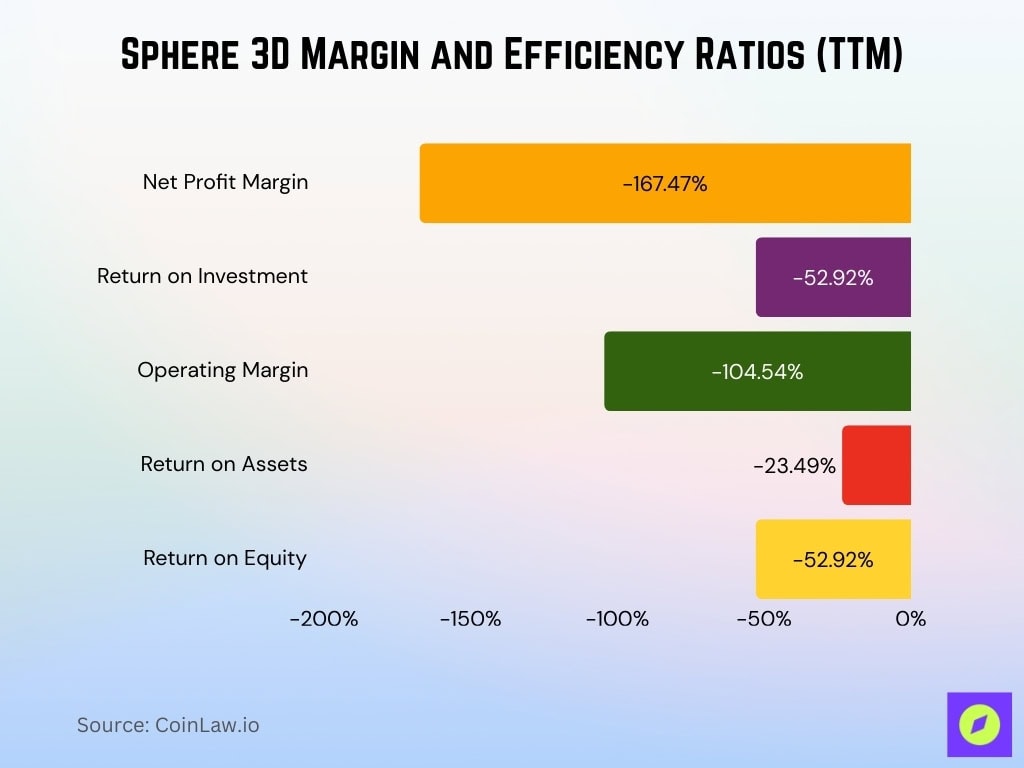

Margin and Efficiency Ratios

- Trailing net profit margin is –167.47%.

- Return on investment over TTM is –52.92%.

- Operating margin remains –104.54%.

- Return on assets is –23.49%.

- Return on equity remains –52.92%.

- Average fleet efficiency improved to under 19.0 J/TH.

- Depreciation and amortization averaged $1.7 million per recent quarter.

- Cost of revenue is $8.83 million TTM relative to $11.10 million revenue.

Per-Share Value Metrics

- Trailing twelve-month earnings per share are approximately –$0.85, reflecting continued losses.

- Q1 2025 earnings per share were –$0.32.

- Book value per share stands near $1.30 to $1.40, based on total equity and share count.

- Revenue per share for 2024 was approximately $0.70 to $0.75.

- Cash per share equals roughly $0.20 to $0.25, based on $5.4 million in cash.

- Shares outstanding exceed 22 million shares as of early 2026.

- Equity issuances contributed to shareholder dilution in recent years.

- Retained earnings remain negative, limiting intrinsic value growth.

- Tangible book value closely matches reported book value.

Market Capitalization and Valuation Metrics

- Sphere 3D’s market capitalization ranged between $35 million and $40 million in early 2026.

- Price-to-book ratio sits around 1.2 times book value.

- Enterprise value remains close to market capitalization due to minimal debt.

- EV-to-revenue ratio is approximately 2 times revenue.

- The price-to-earnings ratio is not meaningful due to negative earnings.

- Valuation remains highly sensitive to Bitcoin price trends.

- Institutional ownership remains relatively low compared to larger miners.

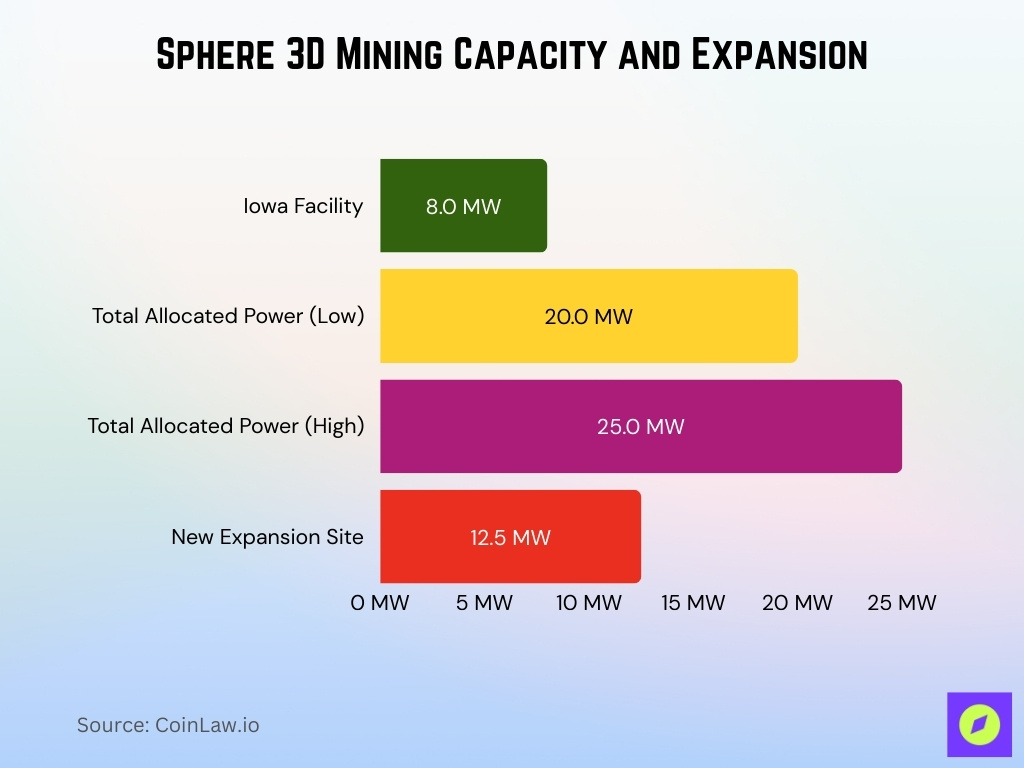

Sphere 3D Mining Facilities Capacity and Expansion

- Operations are hosted in an 8 MW Iowa facility and Texas-based sites.

- Power allocation totals approximately 20-25 MW.

- Expansion aligns with the Bitcoin market, adding a 12.5 MW site.

- Hosting capacity supports up to 1.3 EH/s.

- Texas facilities benefit from competitive electricity pricing below $0.04/kWh.

- Grid curtailment events in Texas reduce uptime to 99%.

- Infrastructure expansion is limited by capital, targeting 1.5 EH/s.

- No ownership of large-scale proprietary data centers.

- Hosting agreements with partners like Simple Mining provide flexibility.

Sphere 3D Stock Price Performance Statistics

- Shares trade between $1.60 and $1.80 in early 2026.

- The 52-week trading range spans approximately $1.25 to $4.50.

- Shares declined more than 40% year over year entering 2026.

- Three-year performance remains sharply negative following 2021 crypto highs.

- Reverse stock splits were implemented to maintain Nasdaq listing compliance.

- Average daily trading volume ranges from 300,000 to 600,000 shares.

- Share price volatility increases around quarterly earnings releases.

- Performance strongly correlates with Bitcoin price cycles.

- Relative strength versus the Nasdaq Composite remains weak.

Volatility, Beta, and Risk Metrics

- Beta measures between 2.5 and 3.0, indicating high market sensitivity.

- Annualized volatility exceeds 80%.

- The stock frequently experiences double-digit percentage swings.

- Correlation with Bitcoin price remains elevated.

- Short interest represents roughly 5% to 8% of float.

- Small market capitalization increases liquidity risk.

- Earnings misses historically trigger outsized price reactions.

- Regulatory and energy pricing risks affect mining profitability.

- Nasdaq compliance requirements remain an ongoing structural risk.

Share Structure and Ownership Statistics

- Total shares outstanding exceed 22 million shares.

- Insider ownership remains below 10%.

- Institutional ownership ranges between 15% and 20%.

- Public float accounts for most shares outstanding.

- Recent equity offerings contributed to dilution.

- No dual-class share structure exists.

- Reverse splits significantly reduced historical share counts.

- Retail investors comprise a large portion of shareholders.

- Analyst coverage remains limited compared to larger competitors.

Mining Fleet Size and Efficiency Metrics

- Sphere 3D operates approximately 6,500 to 7,000 ASIC miners.

- Total hash rate capacity stands near 0.73 exahashes per second.

- Q3 2025 Bitcoin production totaled 23 BTC.

- Average monthly production in 2025 ranged from 7 to 9 BTC.

- Fleet efficiency averages 30 to 35 joules per terahash.

- Hardware primarily consists of Bitmain Antminer S19 series units.

- 2024 halving reduced block rewards from 6.25 BTC to 3.125 BTC.

- Increased network difficulty lowered output per machine.

- Hash rate optimization improved utilization in late 2025.

Dividend and Yield Statistics

- Sphere 3D does not pay a dividend.

- Dividend yield remains 0%.

- No historical dividend payments issued.

- Capital allocation prioritizes $25 million in equipment investments.

- Negative retained earnings at –$125 million prevent distributions.

- Free cash flow deficit of –$15.2 million TTM limits feasibility.

- Management reinvests 95% of cash into mining expansion.

Frequently Asked Questions (FAQs)

Sphere 3D’s net income swung from a $1.67 million gain to a $4.25 million loss in the latest reported quarter.

Analysts set a price target of approximately $3.00 for Sphere 3D’s stock in early 2026.

The company’s price-to-sales ratio stood at roughly 0.52–0.6 times, below industry averages.

Conclusion

Sphere 3D enters today as a small-cap Bitcoin mining company facing structural profitability challenges but maintaining balance sheet flexibility with minimal debt. While liquidity remains solid, persistent net losses and reduced block rewards continue to pressure margins.

Valuation metrics show the stock trading near book value, with limited analyst coverage and high volatility. Ultimately, Sphere 3D’s financial trajectory depends heavily on Bitcoin price recovery, operational efficiency gains, and disciplined capital management. For investors, the company represents a high-risk, high-volatility exposure to Bitcoin mining economics in the evolving digital asset landscape.