Imagine a nation with surplus wealth deciding to invest that money not just for short-term gains, but to secure its financial future for generations. This vision encapsulates the purpose of Sovereign Wealth Funds (SWFs). These government-owned investment funds are a blend of strategic foresight and financial acumen, leveraging national reserves to generate wealth. In recent years, SWFs have surged to the forefront of global financial markets, managing assets that exceed trillions of dollars.

Editor’s Choice

- Norway’s GPFG is now the largest SWF in the world with about $1.86 trillion in assets as of mid-2025.

- China Investment Corporation (CIC) holds approximately $1.33 trillion in assets in 2025.

- Total global SWF assets are now about $13-14 trillion as of mid-2025, up roughly 14% year-on-year.

- The UAE’s ADIA is among the top SWFs, with assets of around $1.11 trillion in 2025.

- Qatar Investment Authority (QIA) manages about $557 billion in assets as of August 2025.

Most Valuable and Strongest Sovereign Wealth Fund Brands

- PIF is the most valuable SWF brand in 2025, worth $1.2 billion.

- NBIM (Norges Bank Investment Management) ranks second in brand value at $0.8 billion.

- China Investment Corporation holds the third spot with a brand value of $0.7 billion.

- Abu Dhabi Investment Authority (ADIA) is valued at $0.6 billion, placing it fourth in brand value.

- GIC secures fifth place with a brand value of $0.5 billion.

- Kuwait Investment Authority rounds out the top six with $0.4 billion in brand value.

- In terms of brand strength, ADIA leads with a score of 64.1, the highest among SWFs.

- PIF ranks second in strength with 62.9, showing strong global influence.

- NBIM follows closely with a brand strength score of 58.3.

- GIC achieves a score of 56.9, highlighting its resilience and reputation.

- China Investment Corporation holds a brand strength score of 54.4.

- Kuwait Investment Authority scores 53.8, ranking sixth in strength.

Nature and Purpose of Sovereign Wealth Funds

- About one-third of SWFs now serve stabilization goals, smoothing commodity revenues and budget cycles in 2025.

- About one-third act as savings or inter-generational funds, preserving wealth for future generations.

- Around 25% are strategic or development funds driving economic diversification and industrial policy domestically.

- SWFs increasingly invest in ESG, but ESG adoption fell from 79% to 69% in 2025, showing tension between green rhetoric and actual performance.

- SWFs provide liquidity buffers enabling governments to respond to unexpected fiscal shocks without raising public debt.

- Many SWFs operate under a dual or hybrid mandate combining maximum returns with strategic national interests or industrial goals.

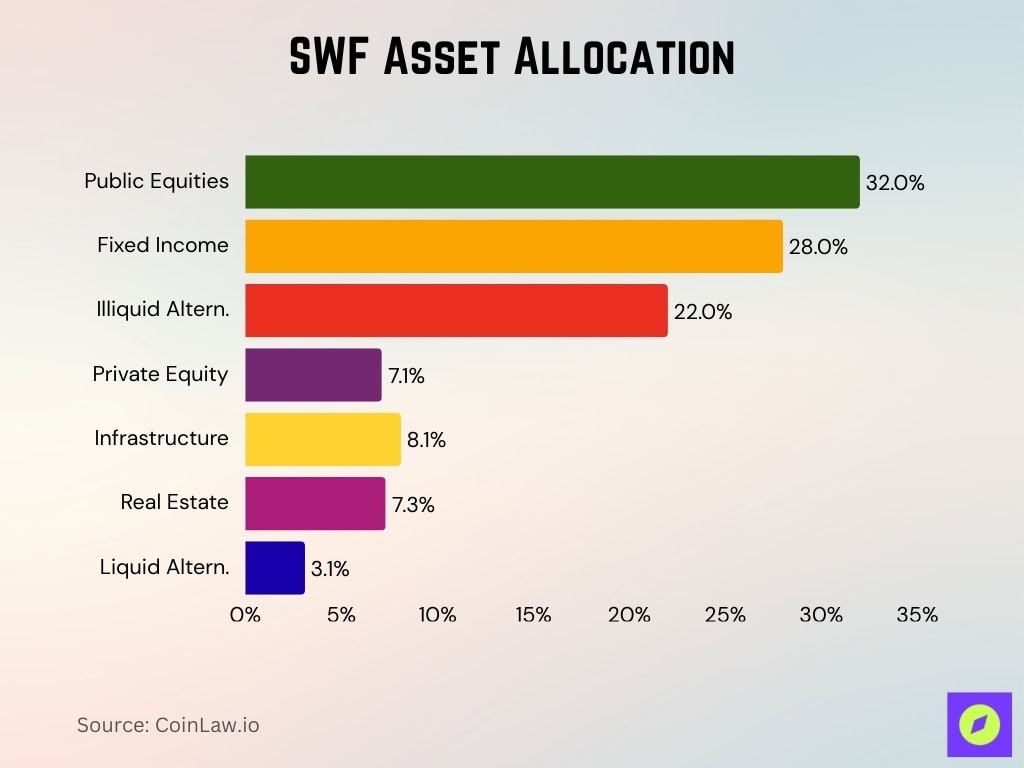

Asset Allocation and Investment Strategies

- Public equities now make up about 32% of SWF portfolios in 2025 as funds balance return potential and risk.

- Fixed income allocations stand at roughly 28% reflecting renewed interest in yield and stability.

- Illiquid alternatives (private equity, real estate, infrastructure) comprise about 22% of SWF total assets in 2025.

- Private equity investment specifically is around 7.1% of total assets, targeting high-growth sectors like biotech and clean tech.

- Infrastructure allocations increased to roughly 8.1% in 2025, with emphasis on sustainable and critical project investing.

- Real estate allocations fell slightly to about 7.3% reflecting market conditions and asset mix shifts.

- Liquid alternatives (hedge funds, absolute return funds) are near 3.1% with SWFs using them more for risk management than growth.

Global SWF Data Platform

- About 14–15 trillion in total SWF assets are now monitored in real-time through the platform in 2025.

- The top five SWFs account for nearly 40% of global assets, showing a strong concentration among those few in 2025.

- Approximately 60% of SWFs now disclose their holdings publicly, up from 35% in 2019.

- Infrastructure investments have grown by around 8.1% year-over-year, with SWFs increasingly favoring sustainable projects in 2025.

- There has been a 50% surge in data-sharing collaborations between SWFs and financial regulators to enhance compliance and risk management in 2025.

- Real estate portfolios managed by SWFs expanded by ~7.3% in 2025, with urban commercial properties leading growth.

- Enhanced data tools now offer predictive insights, allowing SWFs to adjust to market volatility more proactively in 2025.

Regional Distribution of Sovereign Wealth Funds

- Asia leads with about $5.2 trillion in SWF assets in 2025, driven by China, Singapore, and large Gulf funds.

- The Middle East now contributes roughly $4.6 trillion as major players like Saudi Arabia, the UAE, and Kuwait increase deployment.

- Europe’s sovereign wealth funds collectively manage over $2.0 trillion, with Norway’s GPFG accounting for a large share.

- North America’s sovereign wealth fund assets total around $0.5 trillion, led by key Canadian and U.S state-level funds.

- Africa’s SWFs have combined assets of approximately $160 billion, with growth accelerating in West and Sub-Saharan African nations.

- South America clocked in at roughly $30 billion in SWF assets, focusing mainly on stabilization and infrastructure investments.

- Emerging regions in Asia and Africa saw the establishment of new SWFs grow by about 20% in 2025, underscoring their rising economic influence.

Performance Metrics and Returns

- Average annual returns for SWFs globally are about 6.5% in 2025, driven by strong equity and private market investments.

- Norway’s GPFG returned ≈5.7% in the first half of 2025, outperforming many benchmark indices.

- The China Investment Corporation (CIC) achieved around 6.6% annualised return over the past 10 years.

- ESG-focused investments produced roughly 8% higher returns on average than non-ESG peers in recent years.

- Real estate portfolios grew by about 4.0% in the first half of 2025, with urban logistics hubs as key contributors.

- Over 30% of SWFs exceeded their targeted performance benchmarks in 2025, reflecting better strategic allocation.

- Private equity investments, especially in technology and healthcare, delivered around 12% returns in recent SWF-led deals.

The World’s Largest Sovereign Wealth Funds

- Norway Government Pension Fund Global is the world’s largest SWF with $1,375 billion in assets under management.

- China Investment Corporation follows closely with $1,351 billion in assets, making it the second-largest globally.

- SAFE Investment Company (China) manages about $1,034 billion, securing third place.

- Abu Dhabi Investment Authority (ADIA) holds around $993 billion in assets.

- Kuwait Investment Authority manages approximately $801 billion, ranking among the top Middle Eastern funds.

- GIC Private Limited (Singapore) oversees $769 billion in assets.

- Public Investment Fund (Saudi Arabia, PIF) has assets totaling $700 billion.

- Qatar Investment Authority rounds out the list with $450 billion in assets.

Concerns About Sovereign Wealth Funds

- Transparency issues persist, with about 31% of SWFs in 2025 not disclosing detailed holdings or strategies.

- Geopolitical tensions have prompted restrictions in sensitive sectors like technology and defense for nearly 42% of funds in 2025.

- The reliance on commodities has left many SWFs vulnerable, with oil price swings causing revenue fluctuations of up to ±20%.

- Concerns about foreign influence have grown, especially as 25% of SWFs acquire strategic assets abroad under looser oversight.

- Environmental activists criticize that only about 65% of SWFs meet basic ESG compliance standards in 2025.

- Management inefficiencies and lack of oversight have led to underperformance in smaller SWFs where returns fall short of targets by more than 2–3% annually.

- Currency fluctuations and inflation have eroded returns for SWFs heavily in fixed-income, with negative real returns in around 15% of those portfolios.

Recent Developments

- Saudi Arabia’s PIF has committed about $8.3 billion in clean energy deals in 2025 under its Vision 2030 strategy.

- Abu Dhabi Investment Authority (ADIA) invested $1.5 billion in GLP to expand its digital infrastructure and renewable energy exposure in 2025.

- Norway’s GPFG returned approximately 16.5% on financials in the first half of 2025 and posted a 6.7% return on equity investments.

- China Investment Corporation (CIC) launched a large infrastructure push in 2025 targeting emerging markets across Asia and Africa.

- Several African nations, including Ghana and Angola, have created new SWFs managing $3–5 billion collectively in 2025.

- Global SWFs reduced their exposure to US Treasury securities by roughly 10% in 2025, shifting toward gold and commodities for diversification.

- Technological advancements such as AI-driven investment models have become central strategies for SWFs in 2025 to allocate resources more efficiently and manage risk proactively.

Frequently Asked Questions (FAQs)

About $13 to $14 trillion, with the Global SWF Data Platform showing $14.17 trillion monitored in 2025.

Norway’s GPFG is at roughly $1.86 trillion in mid-2025.

Five funds exceed $1 trillion, with 23 above $100 billion and 62 above $10 billion.

About 40% of total SWF AUM, based on the 2025 rankings and aggregated totals.

5.7% with 698 billion kroner in profit.

Conclusion

Sovereign wealth funds are navigating a transformative period, balancing innovation, risk, and returns. As they continue to evolve, their influence on global markets, sustainability efforts, and economic resilience will only grow. By understanding these trends and challenges, stakeholders can better appreciate the pivotal role SWFs play in shaping the future of global finance.