SOS Limited occupies a complex niche at the intersection of commodity trading, cryptocurrency mining, and hosting services. The company’s diversified operations make it relevant for industries ranging from blockchain infrastructure to global commodity logistics, impacting not only emerging tech but also traditional trade flows. For instance, its mining operations pivot affects energy consumption in U.S. data centers, and its commodity business touches China’s supply-chain dynamics. Read on to explore the full statistical picture.

Editor’s Choice

- Year-over-year market cap change, a decline of about -20.56% for the 12-month period ending Oct 2025.

- 2024 revenue, approximately $231.42 million, up ~150% from ~$92.42 million in 2023.

- Employee count, approximately 65 employees, as reported in recent filings.

- Cash and equivalents declined by about $39.7 million compared to ~$279.2 million at the prior year’s end.

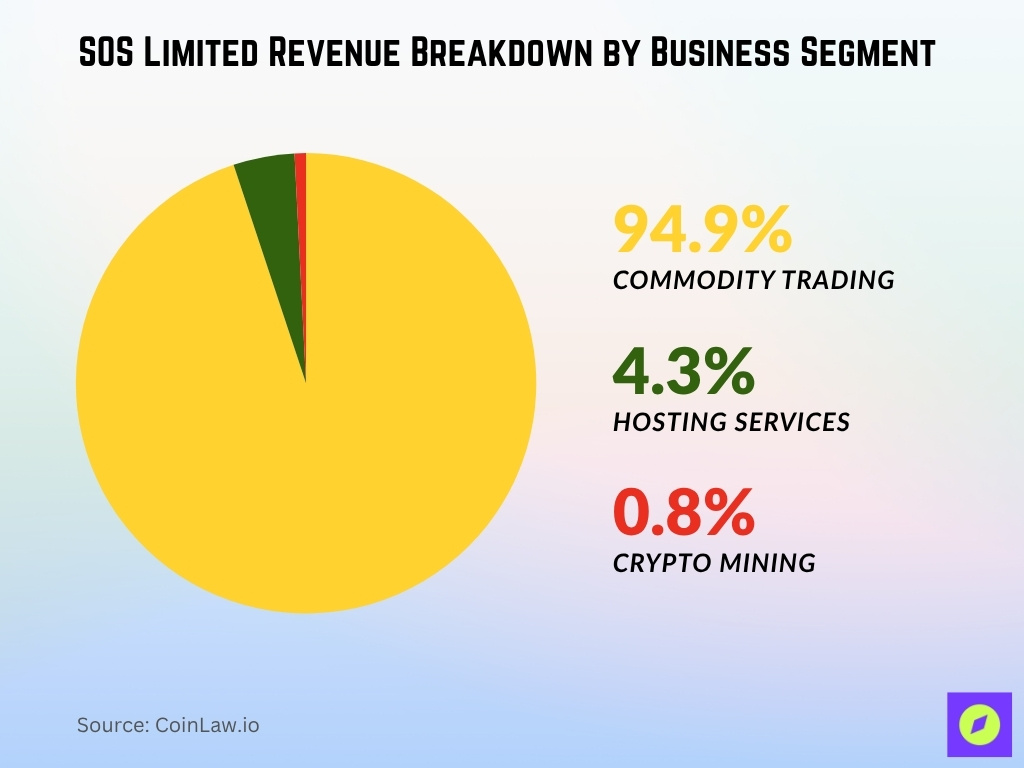

- On September 26, 2025, SOS reported its 2025 semi-annual financial results, showing its revenue breakdown for H1 2025 across commodities.

Recent Developments

- In August 2025, SOS Limited announced termination of its amended and restated deposit agreement and concurrent changes to share capital, moving toward a direct listing of ordinary shares.

- In July 2025, the company priced a $7.5 million registered direct offering to raise capital.

- The company reported its first half 2025 results, a larger loss per share compared to H1 2024 ($2.09 loss vs $4.49 loss).

- The strategic pivot toward commodity trading was emphasized in May 2024, a report noted a 92.6% surge in commodity-trading revenue while crypto-mining revenue halved.

- New framework agreement in February 2025 with a Chinese partner to optimise electricity use for mining operations.

- According to risk analysis, the company has faced regulatory and governance concerns, including a letter from the New York Stock Exchange about ADS trading price and dilution risk.

- Trading behaviour, the stock has shown very high volatility and a significant decline over recent years, underscoring elevated execution risk.

- Liquidity concerns, limited market cap, and low share-volume levels are flagged as noteworthy.

Business Segments and Operations

- Commodity trading contributed 94.9% of SOS Limited’s total revenue in the first half of 2025, marking it as the dominant segment.

- Hosting services accounted for 4.3% of total revenue in H1 2025, showing a smaller but ongoing business within the “other services” segment.

- Revenue from cryptocurrency mining has decreased significantly, contributing just 0.8% to total revenue in H1 2025.

- Revenue from commodity trading rose to $85 million in H1 2025, up from $55.5 million the previous year.

- SOS Limited’s total revenue increased by approximately 48% year-over-year to reach $89.6 million in the six months ending June 30, 2025.

- The company operates cross-border with mining and hosting infrastructure primarily in the U.S. (including Texas) and trade relationships focused on Asia.

- SOS is classified as a nano-cap stock with a market capitalization of $15 million as of late 2025.

Key Services and Offerings

- Around 65 employees support service delivery, indicating a lean workforce for multi-regional operations.

- Electricity cost optimization has been a focus to reduce mining expenses by up to 15-20% in some facilities.

- Strategic partnerships have helped expand hosting capacity by approximately 25% year-over-year in 2025.

- Service offerings predominantly target corporate clients in China’s blockchain sector, representing over 70% of the client base.

- The company’s small market cap near $15 million suggests potential challenges in scaling services rapidly.

Commodity Trading Statistics

- In 2024, SOS reported that commodity-trading revenue rose by ~92.6% year-over-year.

- For 2023, the company’s overall revenue was approximately $92.42 million, with commodity contribution not specified but showing major growth.

- Revenue for 2024, approx $231.42 million (up ~150% vs 2023).

- Market cap change, from ~$42.45 million at the end of 2023 to ~$14.36 million end-2024, showing heavy contraction.

- According to historical data, the stock’s average price for 2025 so far is ~$4.70 (though actual trading is much lower).

- The company’s commodity trading segment is cited as the primary driver of its pivot away from crypto-mining.

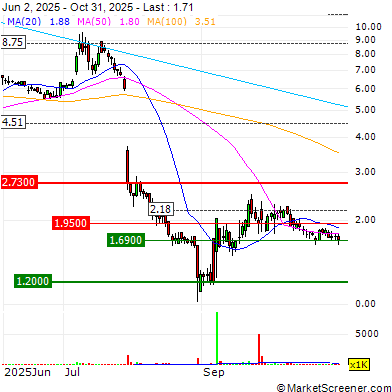

SOS Limited Stock Chart Highlights

- Last recorded price: $1.71 as of October 31, 2025, indicating a consolidation phase following previous volatility.

- Support levels: The chart identifies strong support near $1.20 and secondary support around $1.69, suggesting potential accumulation zones.

- Resistance levels: Key resistance appears at $1.95 and $2.73, marking areas where selling pressure may increase.

- Moving averages: The 20-day MA is $1.88, the 50-day MA is $1.80, and the 100-day MA is $3.51, showing a short-term convergence below the long-term trend.

- Price trend: The stock peaked at $8.75 in early June 2025 before a steep correction, with an intermediate rebound near $4.51.

- Overall outlook: The chart reflects a sideways trading pattern between $1.20–$2.73, indicating a potential breakout setup if volume increases.

Cryptocurrency Mining Statistics

- In FY 2024, SOS reported revenue of $9.26 million from cryptocurrency mining, down from $18.90 million in FY 2023, a ~51% year-on-year decline.

- The mining revenue share in 2024 was ~4.0% of total company revenue, compared to ~20.4% in 2023.

- Hosting service revenue (which supports mining infrastructure) in 2024 was $6.506 million, up from $2.365 million in 2023, representing ~2.8% of revenue in 2024.

- As of December 31, 2024, SOS held 736.75 BTC, an increase of 61.10 BTC from the previous year.

- The company also held 2,924.79 ETH as of December 31, 2024, unchanged from the prior year.

Hosting Services Statistics

- In FY 2024, SOS’s hosting services business generated $6.506 million, up from $2.365 million in FY 2023, representing ~2.8% of total revenue in 2024.

- In the first half of 2024, revenue from hosting services was $4.719 million (or ~7.8% of H1 revenue) compared to $1.225 million (~2.9%) in H1 2023.

- Despite the increase, hosting services still represent a small portion of revenue (~2-8%) relative to the dominant commodity trading segment.

- The temporary shutdown of internal mining operations appears to free some capacity for hosting others, a strategic pivot mentioned in the company’s disclosures.

- The hosting business offers a potential pathway to more stable revenue than self-mining, but currently remains nascent in scale.

Insider & Institutional Ownership

- SOS has 17 institutional owners collectively holding approximately 31,770 shares.

- Institutional ownership is estimated at ~1.92% of total shares outstanding.

- Among larger institutional investors listed are StoneX Group Inc., Citadel Advisors LLC, UBS Group AG, and Morgan Stanley.

- Insider ownership is reported by some sources at ~97.81% of float, though data coverage is inconsistent.

- Short interest in the shares is very low, about ~0.78% of shares out, ~0.86% of float, with a short ratio of 0.15 days.

- The company’s share class and ADS structure complicate ownership visibility.

- Overall institutional accumulation appears minimal, suggesting low institutional confidence or limited liquidity in the stock.

Dividend Information

- SOS Limited has paid no dividends in 2024 and 2025 to date.

- Dividend yield is reported as 0% with payout ratio marked as n/a.

- The company recorded an operating loss of $4.2 million in FY 2024.

- Retained earnings fully fund ongoing operations and infrastructure investments.

- Cash reserves decreased by 12% in 2024 due to capital expenditure needs.

- SOS’s liquidity primarily supports operational scaling, with over 60% of cash allocated for infrastructure expansion.

Balance Sheet Highlights

- As of December 31, 2024, SOS reported cash and cash equivalents of approximately $239.5 million, down from ~$279.2 million in 2023.

- Total revenue in FY 2024 was $231.4 million compared with $92.4 million in FY 2023, an increase of ~150%.

- The company reported an operating loss of approximately $21.6 million for 2024, up from $4.8 million in 2023.

- Cost of revenue jumped from ~$78.2 million in 2023 to ~$224.4 million in 2024, a rise of ~187%.

- Operating expenses increased ~50.6% year-on-year (from ~$18.99 million in 2023 to ~$28.645 million in 2024).

- The company’s debt appears negligible, giving a net cash position narrative, but cross-border asset/liability risks persist.

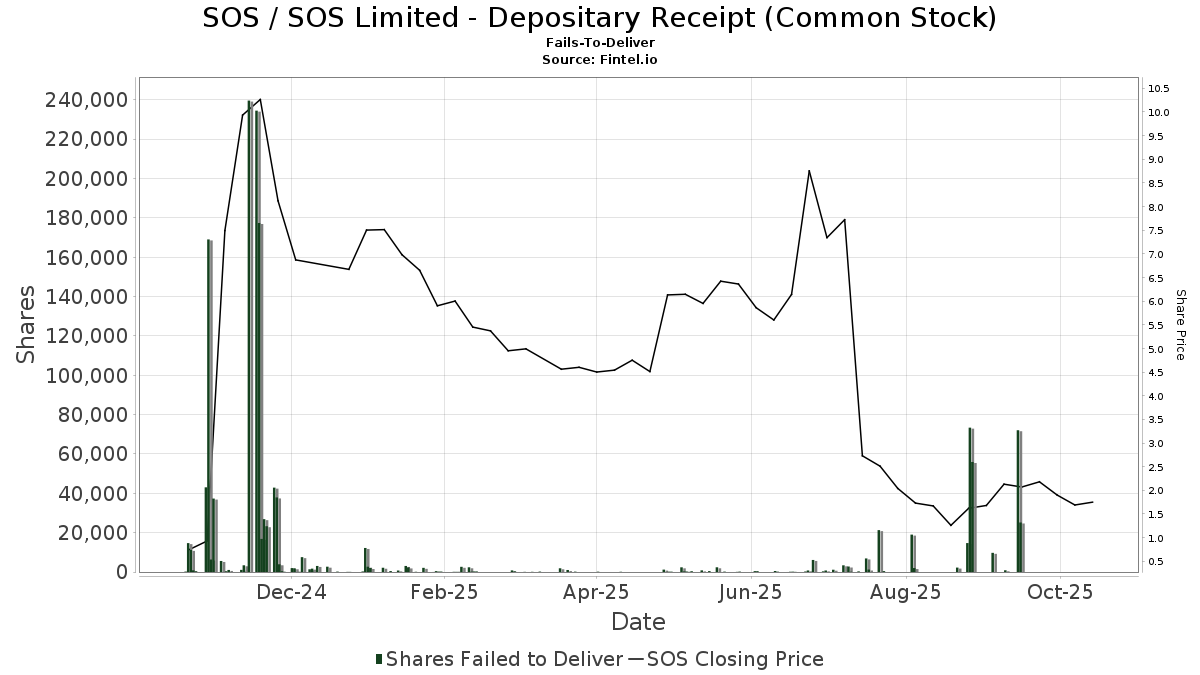

SOS Limited Fails to Deliver and Price Activity

- Fails-to-deliver volumes peaked at over 240,000 shares in late 2024, coinciding with the stock’s highest closing price near $10. This suggests temporary settlement inefficiencies during heightened trading activity.

- By January 2025, the share price eased to around $7–$8, while fails-to-deliver fell to roughly 150,000 shares, indicating partial stabilization.

- From February to May 2025, the fails-to-deliver dropped sharply below 20,000 shares, as the stock’s price trended between $4–$6 with reduced trading volume.

- A short rebound occurred in June 2025, when the price briefly climbed to $9, though delivery failures stayed minimal, reflecting improved settlement efficiency.

- In August 2025, two minor spikes appeared with fails-to-deliver around 50,000–60,000 shares, while the stock traded between $1.5–$3, signaling renewed retail activity.

- By October 2025, both the share price (around $2) and fails-to-deliver counts (<20,000 shares) had stabilized, showing a more balanced trading environment after earlier volatility.

Cash & Cash Equivalents

- $239.5 million in cash and cash equivalents as of December 31, 2024.

- The semi-annual report (H1 2024) indicates that cash outflow was impacted by the suspension of mining operations and infrastructure upgrade costs.

- Because a large portion of cash is held within Chinese entities, transfer to U.S. or foreign entities may be subject to regulatory or foreign-exchange restrictions.

- Free cash flow generation remains negative, given the operating losses and investment in infrastructure.

- The company has undertaken capital raises (e.g., a $7.5 million registered direct offering in July 2025), which may affect future cash positions.

Debt & Liabilities

- The company’s debt-to-equity ratio for the three months ended June 30, 2025, was approximately 0.13, based on long-term debt of $0.06 billion versus equity of $0.43 billion.

- Current liabilities (including payables, accrued liabilities, and lease liabilities) as of Dec 31, 2024, included $6.306 million in accrued liabilities, $24.229 million in accounts payable, and $0.377 million in lease liabilities.

- The company’s cash outflow from operating activities for FY 2024 was $63.6 million, compared to a positive $9.7 million in FY 2023.

Equity (Book Value)

- The book value (shareholders’ equity) for SOS is listed at approximately $434.07 million, with a book value per share of $63.74.

- The Price/Book (P/B) ratio stands at ~0.03, suggesting the market currently values the company at a large discount to book.

- Return on Equity (ROE) is negative, –4.09%, indicating the company is not generating profit from its equity base.

- Working capital (current assets minus current liabilities) is approximately $421.68 million.

- Tangible book value per share is $63.72, showing a limited intangible asset load.

- Shares outstanding rose by ~177.72% year-on-year to ~8.91 million shares, which dilutes equity per share value.

- Despite a large equity base, the market cap (~$15.24 million) is far below book value, suggesting either market concerns about asset realizability or governance risk.

Recent Financial Results

- For FY 2024, total revenue was $231.42 million, up from $92.42 million in 2023 (≈ +150% year-on-year).

- Commodity trading revenue in FY 2024 reached $214.34 million (≈92.6% of total), up from $68.41 million in 2023.

- Cryptocurrency mining revenue dropped to $9.26 million in 2024 (≈4% of total), compared with $18.90 million in 2023.

- Hosting services revenue increased to $6.506 million (~2.8% of total) in 2024, from $2.365 million in 2023.

- The operating loss in FY 2024 was approximately $21.6 million, compared to a loss of $4.8 million in 2023.

- Cash and cash equivalents declined to about $239.5 million at December 31, 2024, from $279.2 million a year earlier.

- The cost of revenue rose sharply in 2024 to $224.4 million (up ~187% from 2023), narrowing gross margins.

- In the six months ended June 30, 2024, net revenue was $60.5 million (up ~47.1% vs the same period prior year).

Risks and Scores

- The Altman Z-Score for SOS is 0.68, a level indicating a high risk of bankruptcy (a score under 1.8 suggests distress).

- The Piotroski F-Score is 2, which is very low (scores range 0-9, higher is better), suggesting weak financial health.

- Profit margin is negative, net margin ~ –6.49% for the trailing 12 months.

- Gross margin is only ~1.27%, meaning a very small margin cushion, even though revenue is growing.

- Liquidity ratios are strong, current ratio ~8.26 and quick ratio ~7.25, indicating short-term assets cover short-term liabilities many times over.

- Debt risk appears minimal given negligible borrowings, but the largest risk lies in operational execution, cash burn, regulatory exposure, and asset realizability.

- The company operates in volatile sectors, exposing it to commodity price swings, regulatory changes, and energy cost risk.

- Governance risk is increased by cross-border operations, share dilution, and the announced termination of its ADS programme.

Recent Corporate Events

- In July 2025, SOS priced a $7.5 million registered direct offering to raise capital.

- In August 2025, the company announced termination of its amended and restated deposit agreement and concurrent changes to share capital toward a direct listing of ordinary shares.

- The company held 736.75 BTC as of December 31, 2024 (an increase of 61.10 BTC over the prior year) and 2,924.79 ETH, unchanged.

- A strategic framework agreement was announced in February 2025 with a partner to optimise electricity use for mining operations in the U.S.

- Because of the shift in strategic focus from crypto mining to commodity trading, the company’s segment reporting changed meaningfully in 2024 and 2025.

- The share count has significantly risen (~178% Y/Y), likely due to equity issuance and dilution from capital raising events.

Frequently Asked Questions (FAQs)

Approximately $239.5 million.

Book value per share was approximately $63.74, with shareholders’ equity of ~$434.07 million.

Approximately -6.49%.

Roughly 0.78% of shares outstanding.

Conclusion

In summary, SOS Limited has made a sharp strategic pivot toward commodity trading. At the same time, profitability remains elusive; the company reported a significant operating loss and continues to burn cash. On the balance-sheet side, formal debt is minimal and equity stands high relative to market value, but large discrepancies between book value and market valuation raise questions about asset realisability and investor confidence. Risks remain elevated, from low profitability margins and execution risk to governance and regulatory exposure. That said, the company’s transition marks a bold repositioning, one that could entail upside if executed well. For investors or stakeholders, monitoring liquidity, cash flows, and margin improvement will be key.