SoFi Technologies has launched SoFiUSD, a fully reserved stablecoin on Ethereum, making it the first national bank to do so on a public blockchain.

Key Takeaways

- SoFiUSD is fully backed by cash reserves held at the Federal Reserve and issued by SoFi Bank, a federally regulated institution

- The stablecoin enables 24/7, low-cost settlement for card networks, banks, retailers, and crypto trading

- SoFi plans to expand SoFiUSD access to its members and other blockchains in the near future

- The move marks SoFi’s full return to crypto after relaunching trading for 30 digital assets last month

What Happened?

SoFi Technologies has launched SoFiUSD, a U.S. dollar-pegged stablecoin issued by its OCC-regulated banking arm, SoFi Bank. The token is now live on Ethereum and is designed for near-instant settlements across various financial services. This makes SoFi the first national bank to issue a stablecoin on a public blockchain, putting it at the forefront of digital asset innovation.

The launch follows SoFi’s re-entry into the crypto space last month, when it resumed spot trading for cryptocurrencies including Bitcoin and Ethereum.

The future of on-chain settlement is here. ⚡️

— SoFi (@SoFi) December 18, 2025

Today we launched SoFiUSD, a fully reserved #stablecoin issued by SoFi Bank, N.A., positioning us as a stablecoin infrastructure provider for other banks, fintechs, and enterprise platforms.

We are the first nationally chartered…

SoFiUSD Aims to Modernize Payments Infrastructure

SoFiUSD has been fully reserved on a 1:1 basis with cash held at the Federal Reserve, which eliminates credit and liquidity risk concerns that often plague other stablecoins. It is already in use for internal settlements and will soon be available to SoFi members and institutional partners.

According to SoFi, the stablecoin serves as a key infrastructure tool for:

- Card networks and retailers needing 24/7 settlement capabilities.

- Fintechs and banks seeking to issue white-label stablecoin products.

- Businesses handling cross-border payments and point-of-sale purchases.

The initial mint started at $10,000, and SoFi says it is in advanced talks with several institutions to integrate SoFiUSD into their operations. Galileo, SoFi’s payment platform partner that processes billions in transactions annually, may also adopt it.

Bank-Grade Compliance With Onchain Speed

Unlike some competitors that use permissioned or private blockchains, SoFi has launched SoFiUSD on Ethereum, one of the most popular public blockchains. The company also plans to expand the stablecoin’s reach to other chains depending on demand.

CEO Anthony Noto called blockchain a “technology super cycle” that will fundamentally reshape finance. He pointed to persistent issues in the current system like slow settlement times and fragmented service providers. SoFiUSD aims to fix those inefficiencies with regulated, nonstop, onchain infrastructure.

SoFi emphasized regulatory compliance as a core part of its strategy. SoFi Bank is supervised by the Office of the Comptroller of the Currency (OCC), and its reserves are transparently held in a Fed account. The company said it may share yield generated from those reserves with SoFiUSD holders and partners.

Strategic Timing Amid Regulatory Clarity

The launch comes as the Genius Act, signed earlier this year, provides a clearer legal framework for stablecoins. This has encouraged traditional financial firms to jump into the space. Visa recently announced it would let banks settle with Circle’s USDC in the U.S., while Fiserv introduced its own stablecoin, FIUSD.

SoFi’s crypto push also aligns with its broader product relaunch. In June, it resumed crypto trading for consumers, offering 30 cryptocurrencies via accounts directly linked to SoFi’s checking and savings platform. This followed a temporary shutdown in 2023 as a condition of securing a national bank charter.

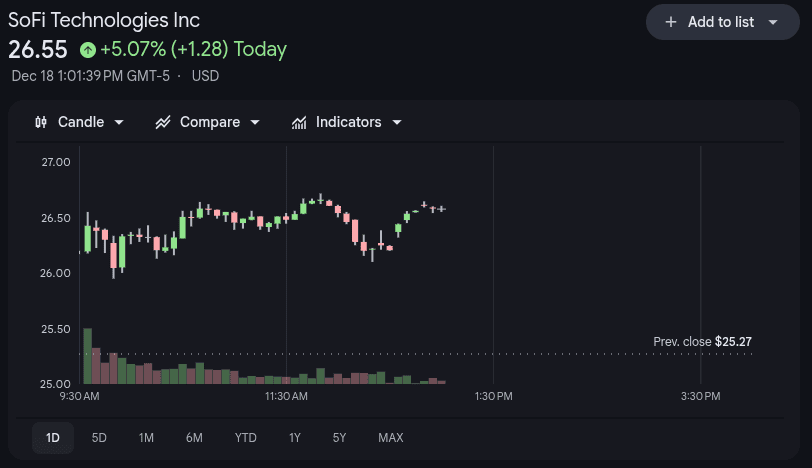

Shares of SoFi Technologies have risen 64% year-to-date, reflecting investor optimism around its digital asset strategy. Despite a brief dip this week, the stock has jumped 75% in the past six months, outperforming the Nasdaq Composite’s 18% gain during the same period.

CoinLaw’s Takeaway

In my experience watching fintechs evolve, this move by SoFi stands out. It is not just another stablecoin but it’s a bank-issued, Fed-backed financial instrument sitting on Ethereum. That’s huge. SoFi is combining regulatory credibility with real-world utility. It’s a bold, smart pivot back into crypto, especially after last year’s regulatory headwinds. I found the white-label potential for other firms particularly compelling. This isn’t a tech stunt, it’s real infrastructure. And if partners like Galileo get onboard, SoFiUSD could quickly gain mainstream traction.