Imagine a world where contracts execute themselves, no middlemen, no delays, no disputes. Today, that’s not a fantasy; it’s becoming standard practice. Smart contracts are changing the legal landscape, offering streamlined processes that can enforce agreements automatically. But with opportunity comes complexity. Legal compliance remains a critical hurdle, as regulators, industries, and global economies race to adapt.

In this article, we’ll explore the latest statistics on smart contracts and their legal compliance, providing a clear picture of where we stand today and where we’re headed.

Editor’s Choice

- 68% of legal firms in the US have integrated smart contracts into their operations by Q1 2025.

- 47% of smart contract disputes in 2024 were due to compliance gaps with existing legal frameworks.

- The global smart contracts market is projected to reach $3.69 billion in 2025, growing at a CAGR of 82.21% through 2034.

- 41% of cross-border smart contract transactions fail to meet GDPR compliance standards.

- 60% of US-based companies using smart contracts report challenges with jurisdictional enforcement.

- While the smart contracts market is valued at $3.69 billion in 2025, cross-border transaction adoption continues to grow with increasing settlement volumes across blockchain platforms.

- The banking sector leads smart contract adoption with ~48% of use cases.

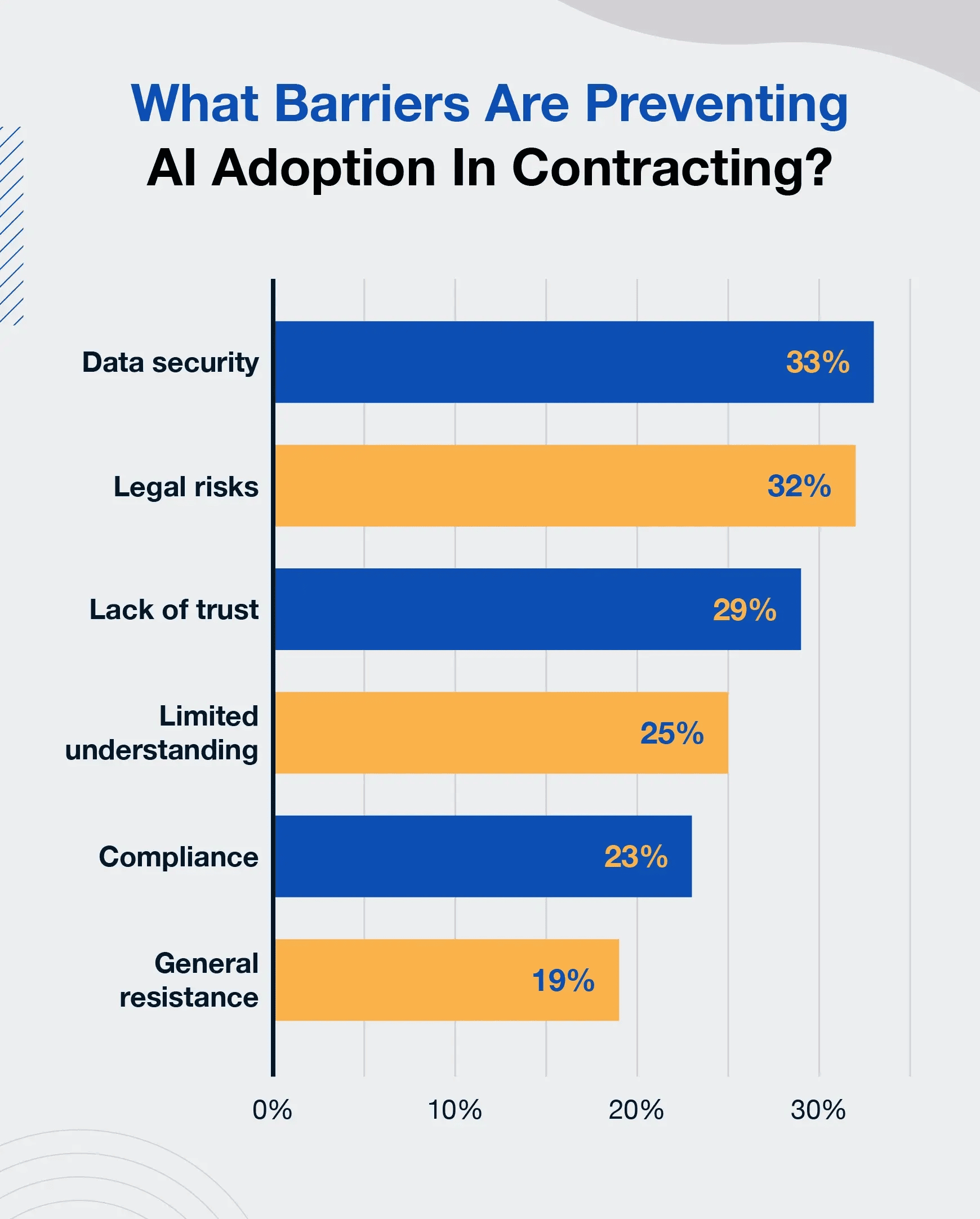

Barriers to AI Adoption in Contracting

- 33% cite data security concerns as the top barrier to AI adoption in contracting.

- 32% are concerned about legal risks associated with AI in contract management.

- 29% report a lack of trust in AI systems as a significant hurdle.

- 25% attribute slow adoption to limited understanding of how AI works in legal contexts.

- 23% highlight compliance challenges as a key barrier to implementation.

- 19% face general resistance to change within their organizations.

Global Adoption Rates of Smart Contracts in Legal Sectors

- 62% of law firms in North America employ smart contract technologies in legal processes.

- 48% of legal organizations in Europe reported pilot programs for blockchain-based contracts by late 2024.

- 45% of corporate legal teams in Asia-Pacific markets integrate smart contracts into compliance workflows.

- 29% adoption rate of smart contracts in the legal sectors for the Middle East and Africa region.

- Over 80% of multinational corporations in 2025 plan to expand their blockchain and smart contract use, with the US leading adoption at 45% globally, followed by Europe at 30%.

- 37% of smart contract usage within legal frameworks globally is accounted for by fintech companies.

- 56% of legal tech startups offer smart contract platforms as a core service.

- 44% of government procurement contracts in Estonia and Singapore are executed via smart contracts.

- 40% of smart contract deployments in the legal field focused on automated compliance and audit trails.

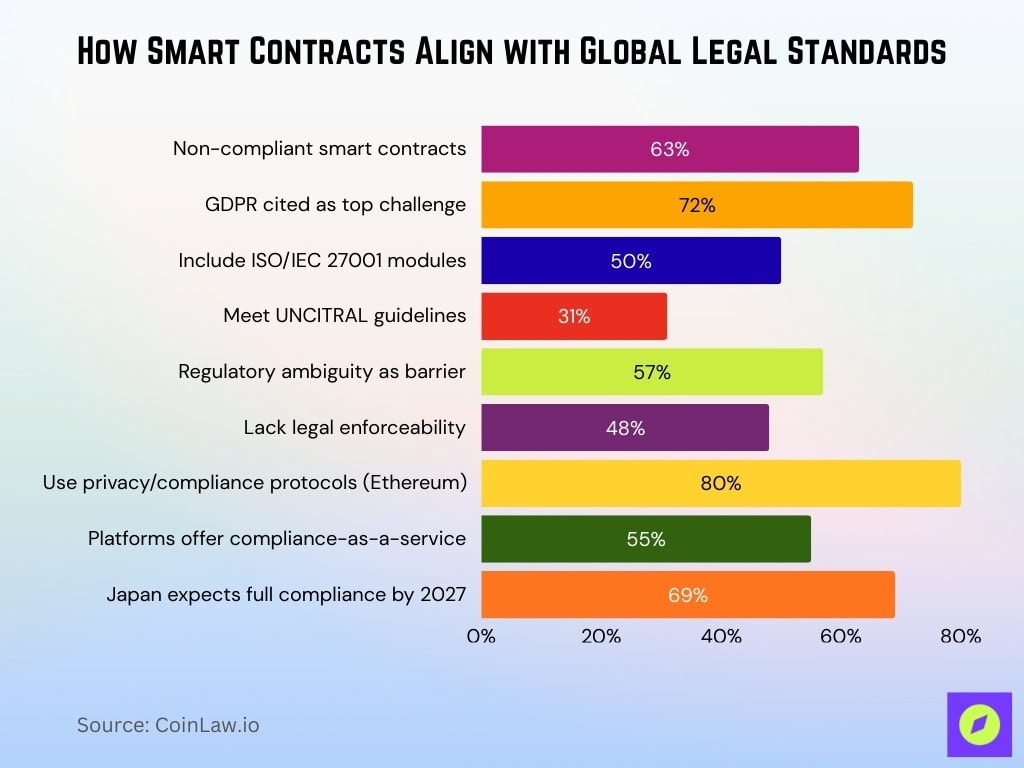

Smart Contracts Compliance with International Legal Frameworks

- 63% of smart contracts deployed globally fail to meet one or more international compliance standards.

- 72% of organizations using smart contracts cite GDPR as the most challenging regulation to comply with.

- 50% of smart contracts used in cross-border transactions include compliance modules with ISO/IEC 27001 standards.

- Only 31% of smart legal contracts meet the United Nations Commission on International Trade Law (UNCITRAL) guidelines for digital agreements.

- 57% of compliance officers report regulatory ambiguity as a barrier to smart contract deployment across multiple jurisdictions.

- 48% of international arbitrators believe smart contracts lack sufficient legal enforceability under current laws.

- 80% of legal contracts on Ethereum-based blockchains implement data privacy and compliance verification protocols.

- 55% of blockchain platforms providing smart contract services now offer compliance-as-a-service features.

- 69% of legal professionals in Japan predict smart contracts will become fully compliant with national regulations by 2027.

Legal Disputes Involving Smart Contracts

- The average settlement amount in smart contract dispute cases reached $1.2 million, up 15% from 2023.

- 60% of disputes over smart contracts are resolved through private arbitration rather than public court systems.

- 28% of cross-border smart contract disputes involve conflicting data privacy laws, particularly GDPR and CCPA compliance.

- Only 12% of smart contract disputes are resolved in favor of the plaintiff, indicating a high burden of proof for aggrieved parties.

- 44% of smart contract-related lawsuits in Europe involve decentralized finance (DeFi) applications.

Smart Contracts and Data Privacy Compliance Statistics

- 40% of US-based smart contract platforms have achieved full CCPA compliance by early 2025.

- 33% of legal teams are adopting zero-knowledge proof protocols to enhance privacy compliance within smart contracts.

- 64% of smart contract developers in Europe cite data localization requirements as their biggest compliance hurdle.

- 49% of smart contracts on public blockchains expose sensitive metadata, increasing privacy risks.

- 78% of privacy-focused blockchain projects integrate self-sovereign identity solutions to comply with global privacy standards.

- 87% of legal professionals believe that privacy-preserving computation will be essential for future smart contracts.

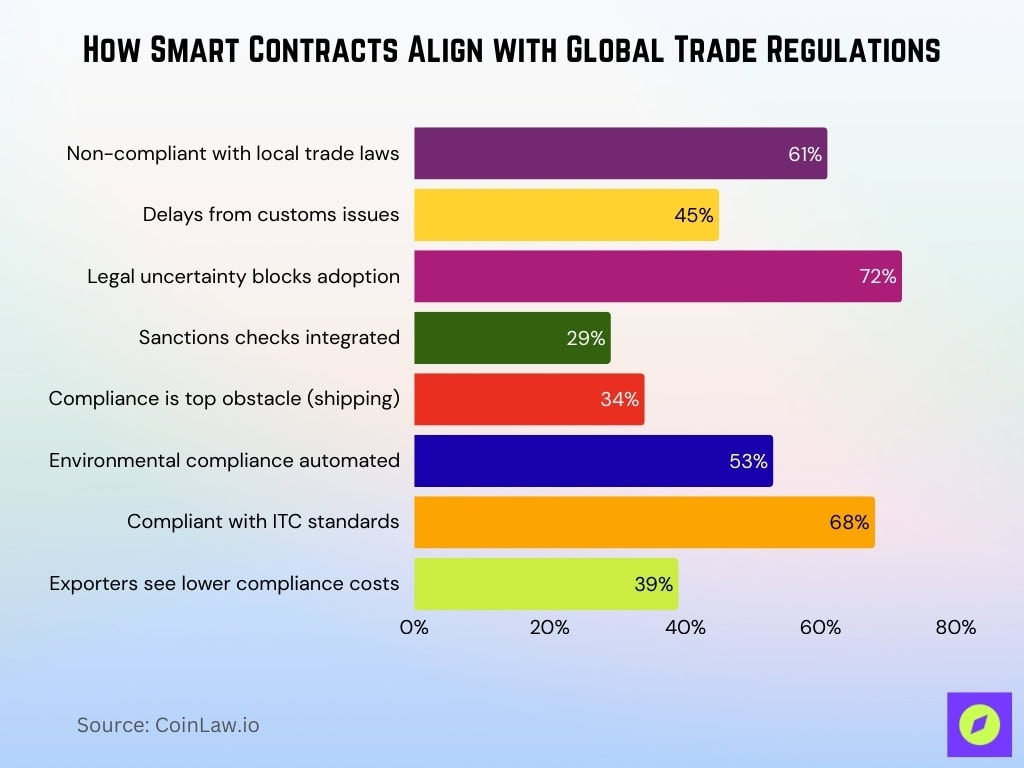

The Regulatory Compliance Challenge in Global Trade

- 61% of smart contracts used in global trade fail to comply with at least one local import/export regulation.

- 45% of cross-border transactions using smart contracts are delayed due to incomplete customs declarations.

- 72% of companies in international supply chains believe that legal uncertainty hinders smart contract adoption.

- 29% of smart contracts in trade finance integrate automated compliance checks against sanctions lists.

- 34% of global shipping firms report regulatory compliance as the biggest obstacle to implementing blockchain smart contracts.

- 53% of logistics providers use blockchain-based smart contracts to automate compliance with environmental regulations.

- 68% of cross-border smart contracts are compliant with international trade compliance (ITC) standards.

- 39% of exporters using smart contracts in Asia-Pacific report reduced compliance costs by an average of 18%.

How Blockchain-Based Smart Contracts Improve Compliance

- 77% of organizations using blockchain smart contracts report enhanced compliance transparency.

- 65% of financial institutions rely on smart contracts to automate KYC/AML compliance processes.

- 47% of insurance companies use smart contracts to enforce regulatory compliance in claims processing, reducing fraud.

- 73% of legal departments utilizing blockchain smart contracts report time savings in compliance reporting workflows.

- 50% of regulatory bodies in Europe recognize blockchain-based smart contracts as legally enforceable when tied to regulated identities.

- 62% of organizations in the real estate sector use blockchain smart contracts to automate compliance with anti-money laundering (AML) regulations.

- 88% of legal experts believe that blockchain smart contracts will reduce regulatory compliance costs by 30% or more by 2027.

Smart Contracts (Codes) and Smart Legal Contracts

- 59% of legal professionals differentiate smart legal contracts from traditional coded smart contracts.

- 70% of smart legal contracts explicitly reference existing legal statutes within the contract code.

- 42% of legal agreements executed via smart legal contracts contain provisions for human-readable interpretation alongside machine execution.

- 33% of smart contract developers now collaborate with legal experts during the coding process.

- 78% of smart legal contracts include on-chain dispute resolution clauses, addressing enforceability concerns.

- 57% of law firms offer customizable smart legal contract templates that comply with jurisdiction-specific laws.

- 82% of smart legal contracts deployed are coded in Ethereum’s Solidity language, with compliance logic built into the contract.

- 38% of blockchain platforms have added hybrid contracts that blend automated execution with manual legal review mechanisms.

- 49% of smart legal contracts include built-in compliance checks for intellectual property protection.

- 66% of enterprises using smart legal contracts link them to digital identity frameworks for enhanced authentication and legal compliance.

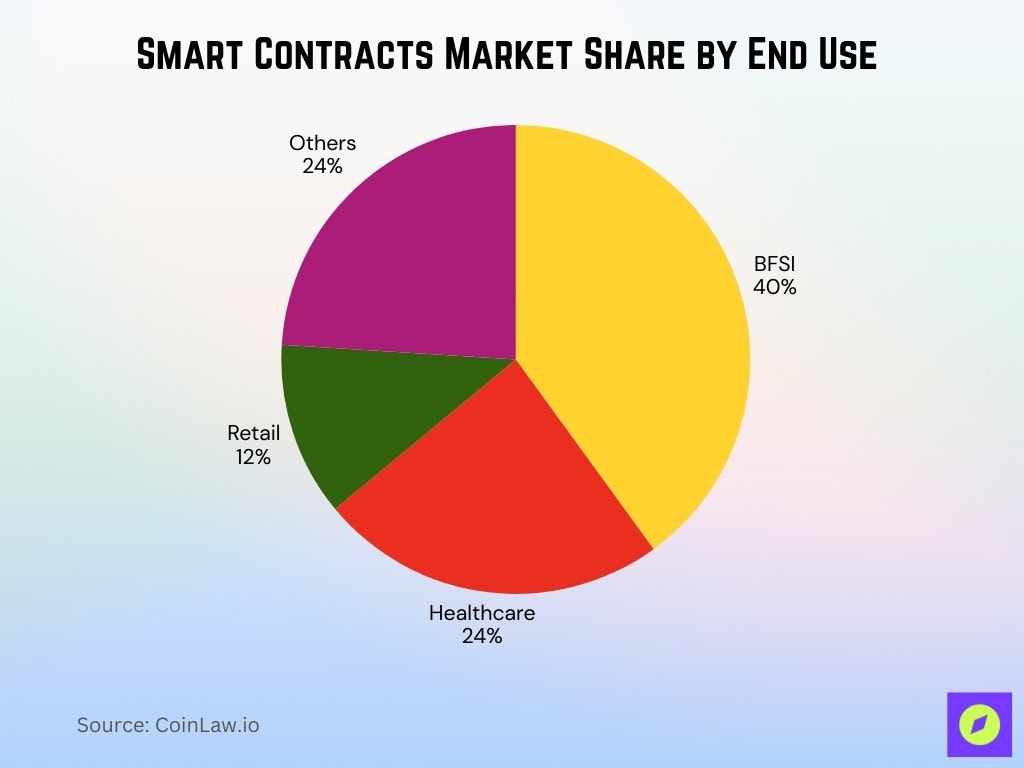

Smart Contracts Market Share by End Use

- 40% of smart contract applications are concentrated in the BFSI (Banking, Financial Services, and Insurance) sector, making it the dominant industry.

- 24% of the market is taken by the healthcare industry, driven by digital records, claims automation, and compliance needs.

- 12% of smart contract adoption is seen in the retail sector, where it’s used for payments, supply chain, and loyalty programs.

- 24% is categorized under others, including sectors like education, energy, and entertainment that show growing but fragmented adoption.

The Life Cycle of Smart Legal Contracts

- 72% of enterprises using smart legal contracts follow a five-phase life cycle, including design, coding, validation, deployment, and enforcement.

- 65% of smart legal contracts undergo third-party audits during the validation phase to ensure compliance.

- 59% of legal departments report that the negotiation phase of smart legal contracts takes 40% less time due to automated processes.

- 48% of deployed smart legal contracts have auto-renewal mechanisms, eliminating the need for manual contract extensions.

- 88% of legal professionals believe the design phase is the most critical for ensuring regulatory compliance in smart legal contracts.

- 46% of contracts in healthcare and finance sectors now include compliance logs that record every life cycle event for legal review.

Survey Data on Legal Professionals’ Perspectives on Smart Contract Compliance

- 72% of legal professionals believe that smart contracts will outpace traditional contracts in adoption by 2030.

- 66% of legal professionals predict that governments will implement centralized registries for smart legal contracts within five years.

- 59% of lawyers rank compliance monitoring as the top challenge for smart contract deployment.

- 78% of legal experts foresee mandatory certification for smart contract developers to ensure legal compliance.

- 54% of surveyed legal professionals say that client demand for smart legal contract services has doubled since 2023.

- 47% of respondents believe that cross-border enforcement will remain difficult without global regulatory frameworks.

- 69% of legal professionals recommend integrating legal fallback clauses into smart contracts to handle dispute resolution.

Recent Developments

- 75% of Canadian legal firms report improved smart contract adoption following the Digital Charter Implementation Act.

- 68% of EU smart legal contracts now comply with the Artificial Intelligence Act provisions.

- 42 US states support Smart Contracts Clarity Act provisions for federal recognition.

- Japan’s national smart contract standardization reduced compliance inconsistencies by 35%.

- Singapore’s Smart Contract Regulatory Sandbox 2.0 tested 127 cross-border compliance solutions.

- UK oracle ruling resolved 64% of smart contract disputes involving external data feeds.

- Brazil’s Blockchain Governance Framework achieved 92% compliance in public procurement smart contracts.

- India’s mandatory code audits improved smart contract security compliance by 47% in regulated industries.

- South Korea’s FSC guidelines increased compliant digital asset smart contracts by 56%.

Frequently Asked Questions (FAQs)

53% of legal departments globally are actively using smart contracts in 2025.

41% of cross-border smart contract transactions fail to meet GDPR compliance standards.

58% of smart contracts fail to meet data minimization principles under major privacy laws like GDPR.

Conclusion

Smart contracts are reshaping the legal and compliance landscape. From global adoption and cross-border challenges to security concerns and enforcement hurdles, the data paints a complex but promising picture. As legal frameworks evolve and technology matures, smart contracts are poised to become integral to regulatory compliance and legal processes worldwide.

The challenge ahead lies in balancing automation with legal safeguards, ensuring that smart contracts deliver their promise of efficiency, transparency, and trust without compromising compliance and enforceability.