The Russell 2000 Index remains one of the core benchmarks for U.S. small‑cap equities. As small businesses play an outsized role in employment and innovation, tracking this index offers key insights into economic trends and investor sentiment. The index is widely used by portfolio managers and passive funds to gauge performance and build diversified strategies. Analysts and traders follow its movements to understand broader market dynamics and to benchmark small‑cap performance against large‑cap peers like the S&P 500 and Russell 1000. Explore this article for a detailed, data‑driven look at Russell Statistics.

Editor’s Choice

- The Russell 2000 Index tracks approximately 2,000 small‑cap U.S. stocks, representing the bottom segment of the Russell 3000.

- As of late 2025, the index hovered near 2,500 points, with notable YTD gains.

- The index’s median constituent market cap was about $0.99 billion as of end‑2024.

- Index reconstitution occurs annually, influencing flows into small‑cap ETFs.

- Preliminary inclusions for the December 2025 Russell list include fresh entrants like USA Rare Earth.

- Russell series indexes collectively benchmark ~$10.6 trillion in assets.

- Small‑cap stocks have shown greater volatility and cyclical swings relative to large‑caps.

Recent Developments

- Russell 2000 achieved a ~13.5% YTD price return as of December 26, 2025, closely in line with press reports citing a roughly 13.9% gain for the year.

- Small-cap stocks in the Russell 2000 rallied over 13% year-to-date.

- 40% of Russell 2000 companies reported negative earnings in Q3.

- Record $102.455 billion notional value traded during 2025 reconstitution Closing Cross.

- Palantir’s surge caused over 11.1% decline in Russell mid-cap growth tech weighting.

- Approximately $10.6 trillion indexed to Russell US indexes, driving reconstitution trades.

- Russell 2000 preliminary adds included 242 new constituents from outside the universe.

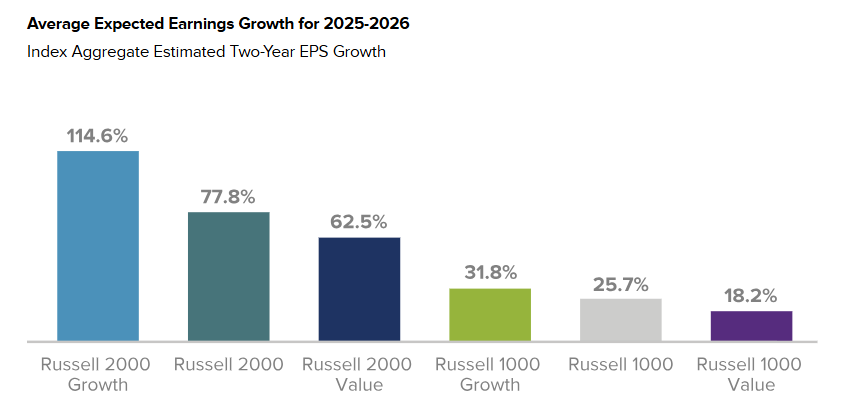

Average Expected Earnings Growth

- Russell 2000 Growth leads all segments with an estimated 114.6% two-year EPS growth, highlighting aggressive small-cap growth expectations.

- The broader Russell 2000 is projected to deliver 77.8% earnings growth, significantly outperforming large-cap benchmarks.

- Russell 2000 Value shows strong momentum with expected EPS growth of 62.5%, reflecting recovery potential among undervalued small caps.

- Russell 1000 Growth is forecast to achieve 31.8% earnings growth, less than half the pace of small-cap growth stocks.

- The overall Russell 1000 index posts a more modest 25.7% two-year EPS increase.

- Russell 1000 Value trails all segments with expected earnings growth of 18.2%, underscoring the growth gap between small and large caps.

Russell Index Family Explained

- The Russell US Equity Indexes encompass a set of rules‑based benchmarks covering the U.S. market.

- Russell 3000 represents the broader U.S. equity market by total market capitalization.

- From the Russell 3000, the Russell 1000 tracks the largest 1,000 companies.

- The Russell 2000 captures the smallest 2,000 U.S. companies by market cap.

- Other Russell benchmarks include small‑cap growth and value subsets.

- Over time, the Russell family has become central to benchmarking and passive investment products.

- Together, these indexes cover more than 98% of the U.S. investable equity market.

- The modular design allows customized exposure to segments like growth vs. value.

What Is the Russell 2000 Index

- The Russell 2000 is a stock market index of U.S. small‑cap companies maintained by FTSE Russell.

- It represents approximately the bottom two‑thirds of the Russell 3000 by market capitalization.

- Constituent weights are based on free‑float market cap, emphasizing larger small‑caps within the group.

- As of December 31, 2024, the constituent count was around 1,966.

- Its performance is widely used as a benchmark for small‑cap mutual funds and ETFs.

- The index was launched in 1984 and has evolved with annual reconstitutions.

- Small‑cap benchmarks like the Russell 2000 often show higher return variability than large‑cap peers.

- The index is considered a barometer of the U.S. economic cycle due to the domestic focus of its companies.

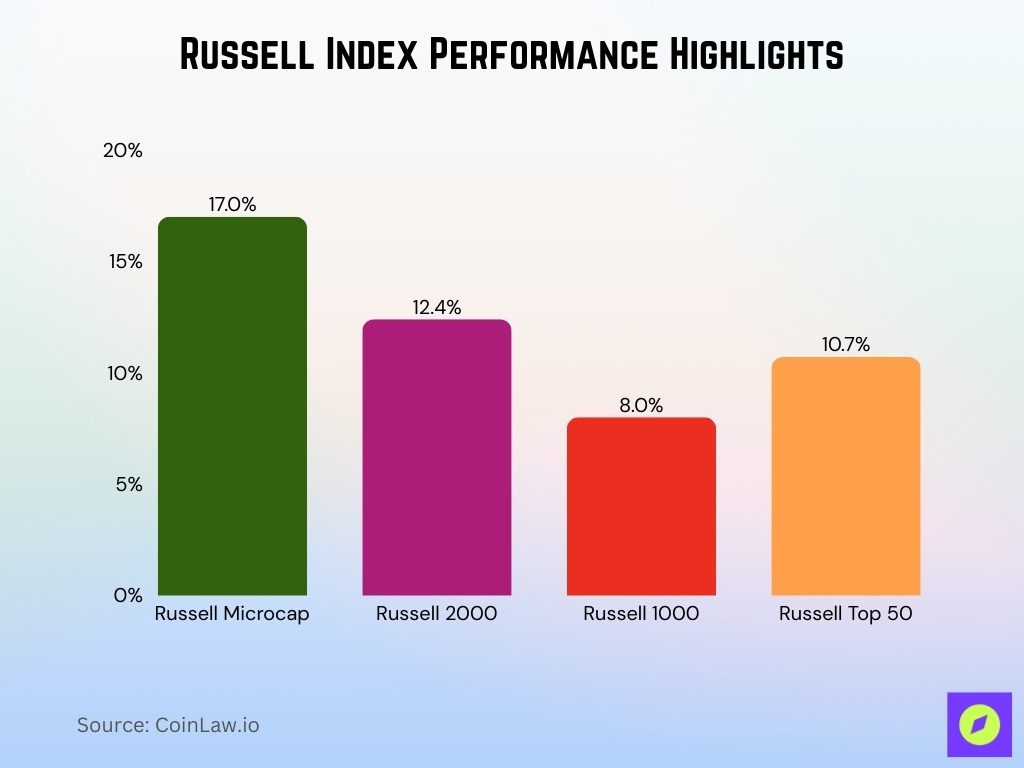

Russell Index Performance Highlights

- Russell Microcap delivered the strongest quarterly performance with a 17.0% gain, leading all major Russell segments.

- The Russell 2000 posted a solid 12.4% return in 3Q25, reinforcing small-cap outperformance versus large caps.

- Russell Top 50 advanced by 10.7%, benefiting from strength in the largest U.S. companies.

- The Russell 1000 recorded a more moderate 8.0% return, lagging behind smaller-cap indexes during the quarter.

- Overall results highlight a clear small-cap and microcap leadership trend in U.S. equities during 3Q25.

Russell 2000 Key Facts and Figures

- All‑time highs for the Russell 2000 occurred in October 2025, above 2,520 points.

- For the year ending 2024, the index returned about 10.02% (price) and 11.54% (total).

- Longer history shows mixed annual performance, with major swings through market cycles.

- The median market cap among constituents was roughly $0.99 billion as of late 2024.

- The largest company’s cap within the index was about $14.72 billion as of 2024.

- Approximately 7% of the Russell 3000’s total market cap is tied to the Russell 2000 segment.

- Monthly data shows ~59% of months since 2005 were positive for the index.

- Members tend to exhibit higher sensitivity to U.S. economic conditions compared to global‑oriented large caps.

Index Methodology and Construction

- Minimum market cap eligibility stands at $30 million on the rank day.

- Global median ADDTV requirement reached $140,000 at the 2025 reconstitution rank date.

- Free float threshold requires an absolute 5% of shares available for eligibility.

- $10.6 trillion in assets benchmarked to Russell US indexes as of mid-year.

- Annual reconstitution rank day held on April 25, with an effective date of June 27.

- Quarterly IPO additions are processed for over 100 new eligible securities annually.

- Float adjustment, pioneered by Russell in 1984, remains the industry standard.

- Russell 3000 covers the top 3,000 US stocks by float-adjusted market cap.

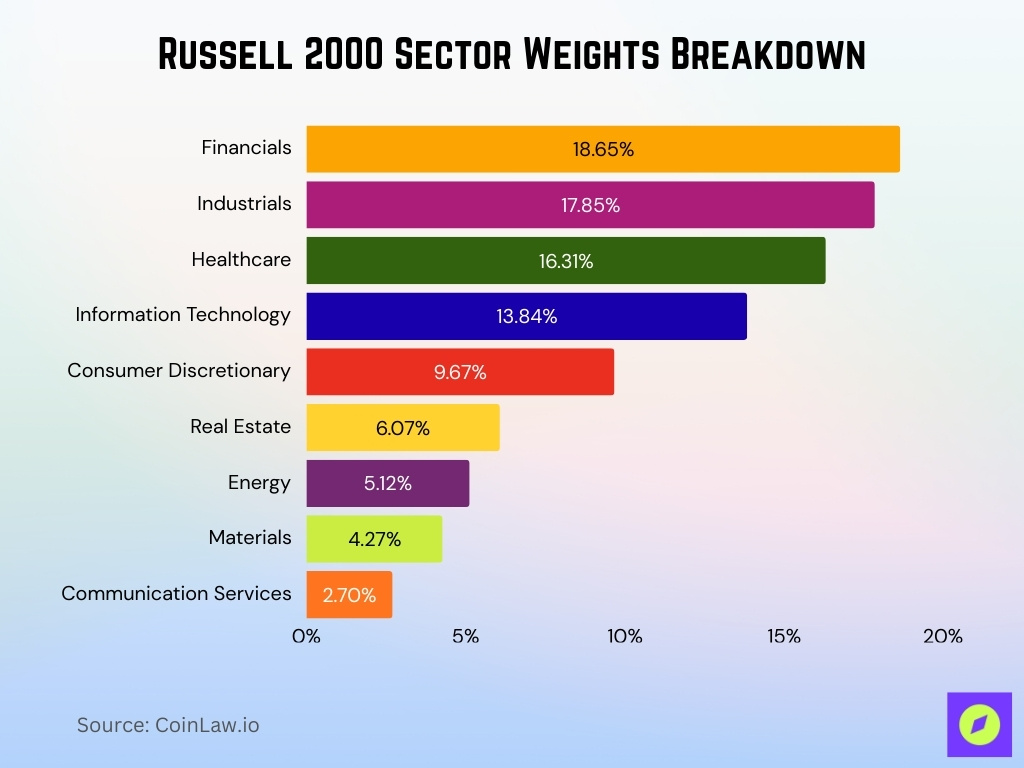

Sector Composition and Weights

- Financial sector weight reached 18.65% as of December 31.

- Industrials comprised 17.85% of the Russell 2000 total weight.

- Healthcare allocation stood at 16.31% in the index.

- Information Technology exposure measured 13.84%.

- Consumer Discretionary held 9.67% sector weighting.

- Real Estate contributed 6.07% to the overall composition.

- Energy sector weight was 5.12%.

- Materials represented 4.27% of the index.

- Communications sector at 2.70%.

Eligibility Criteria and Inclusion Rules

- To be eligible for the Russell 2000, a company’s shares must be listed and actively traded on rank day (end of April).

- Eligibility requires several nationality tests: incorporation, headquarters, and listing must align to qualify as U.S. for index membership.

- Stocks must exceed the $1 minimum closing price threshold on their primary exchange on the rank day.

- Companies must have their corporate documentation available to FTSE Russell by rank day, including share counts and corporate descriptions.

- IPOs that price and trade by rank day are included in the reconstitution eligibility pool for that year.

- At the annual reconstitution in 2025, the Russell 2000 saw 211 additions and 155 deletions, including changes from migrations between the Russell 1000 and 2000.

- Around 44 stocks migrated across the Russell 1000 and 2000 boundaries in 2025, demonstrating dynamic eligibility shifts.

- Eligibility is reassessed each April, with updated style classifications determining Russell Growth and Value memberships.

Russell 2000 vs Other Major Indexes

- The Russell 2000 covers approximately. 2,000 U.S. small‑cap stocks, representing roughly 8% of the total U.S. equity market by capitalization.

- Relative to the Russell 1000, which tracks the largest 1,000 U.S. companies, the 2000s constituents have smaller average market caps and higher volatility.

- Compared with the CRSP Small/Micro Index, Russell’s small‑cap segment generally has a lower median market cap, reflecting deeper small‑cap exposure.

- The S&P 500 Index focuses on large caps; by contrast, the Russell 2000 historically has a higher sensitivity to domestic economic conditions.

- Growth and value subsets within each index diverge; Russell 2000 Growth outpaced Russell 2000 Value in several recent quarters.

- Smaller indexes such as the Russell Microcap Index cover even smaller firms, often below the 2000s lower market cap threshold.

- Comparisons highlight that small-cap risk and returns differ markedly from large and broad benchmarks like the Russell 3000 or S&P 500.

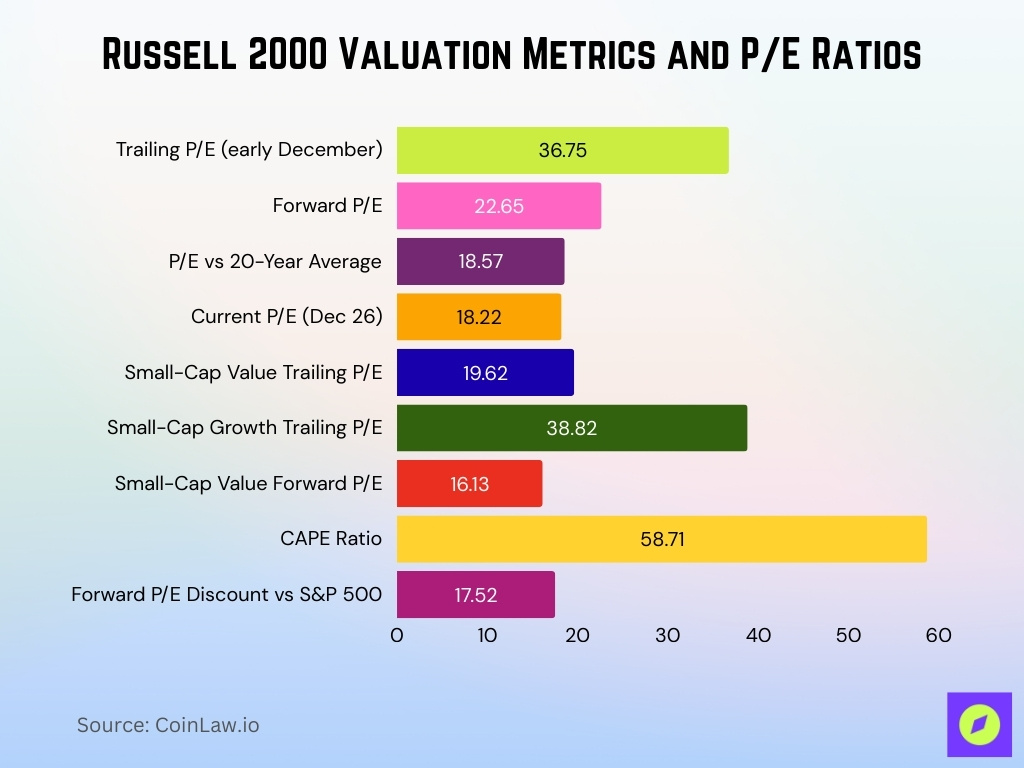

Valuation Metrics and Ratios

- Trailing P/E ratio measured 36.75 as of early December.

- Forward P/E ratio stood at 22.65 compared to the S&P 500’s 22.54.

- P/E ratio reached 18.57, exceeding the 20-year average of 16.16.

- The current P/E calculated at 18.22 on December 26 is considered overvalued.

- Small-cap value trailing P/E was 19.62 versus growth at 38.82.

- Small-cap value forward P/E measured 16.13 as of year-end.

- CAPE ratio hit 58.71, including negative earnings companies.

- Forward P/E discount of 17.52 versus the S&P 500’s 22.1.

Drawdowns and Volatility Metrics

- The Russell 2000 shows higher volatility levels compared to large‑cap benchmarks, reflective of smaller company risk profiles.

- The CBOE Russell 2000 Volatility Index was near 18.42 in December 2025, indicating elevated short‑term market uncertainty.

- Historical data reveal the index’s largest daily losses include up to −6.59% in 2025 and much larger swings in prior crisis periods.

- Monthly data since 2005 show the Russell 2000 ended positively in ~59% of months, indicating frequent short‑term swings.

- Bear market territory occurred in early 2025 when the index fell more than −20% from peak levels.

- Value and growth styles within the index experienced different volatility patterns, with growth often exhibiting larger swings.

- While larger indexes sometimes cushion downturns, small caps typically exhibit deeper troughs and sharper rebounds in the same cycle.

- Implied volatility from options markets confirms risk perceptions remain elevated relative to historical averages.

Risk, Beta, and Sharpe Ratio Statistics

- Russell 2000 1-year Sharpe ratio measured 0.06 as of November.

- Russell 2000 3-year Sharpe ratio stood at 0.40 through November.

- Russell 2000 annualized standard deviation reached 19.18% over 20 years.

- Russell 2000 beta relative to the market averaged 1.23 in recent quarters.

- The maximum drawdown for the Russell 2000 hit 41.75% over the past decade.

- Russell 2000 5% monthly VaR calculated at -9.26% versus S&P 500‘s -6.63%.

- iShares Russell 2000 ETF’s 3-year standard deviation was 18.9%.

- Russell 2000 showed a 20.36% standard deviation with a Sharpe ratio of 0.38.

- 62% of April trading days saw Russell 2000 moves exceeding 1%.

Top Constituents and Index Concentration

- The Russell 2000 Index comprises roughly 1,900+ companies as of late 2025, reflecting slight turnover after annual reconstitution.

- While the index has 2,000 spots, actual component counts often shift modestly based on eligibility and exchange listings.

- Performance data reveals some small‑cap stocks achieving extraordinary short‑term returns, with Mercurity Fintech up +538.4% over three months and Better Home & Finance up +353%, among others.

- YTD leaders include Oncology Institute at +1,029%, Thredup at +579%, and Better Home & Finance at +529%.

- Despite these standouts, the index’s top holdings by weight still feature diversified names without extreme concentration akin to mega‑cap benchmarks.

- The dispersion among return leaders highlights distributional breadth in small caps, where winners can far outpace the average.

- Concentration measures indicate that even though top performers can dominate short episodic returns, long‑term weighting remains relatively balanced across sectors.

- Constituents span sectors including industrials, financials, health care, and technology, underpinning overall diversity.

Dividend Yield and Income Characteristics

- The Russell 2000’s dividend yield was about 1.44%, modestly higher than its large‑cap counterpart, the Russell 1000.

- Income indices tied to the Russell 2000 track annual dividend accumulation, resetting each year per index ground rules.

- Small‑cap dividend yields generally lag broader income benchmarks like the S&P 500 due to sector mix and reinvestment focus.

- Some value‑oriented small‑cap funds, such as certain Vanguard Russell 2000 Value ETFs, show yields approaching ~1.8%–1.9%, highlighting yield differences within segments.

- Dividend income representation in the Russell 2000 can be uneven, with some sectors (financials, utilities) contributing more yield relative to cyclical sectors.

- Higher‑yielding small caps often come from established industrial or resource names, balancing the growth tilt in many constituents.

- Annual dividend data often reflects small increases in payout totals as company earnings grow, but with variability across years.

- Income investors may layer quality dividend strategies on top of the Russell 2000 base to enhance yield exposure.

ETF Assets and Index Fund Flows

- The iShares Russell 2000 ETF (IWM) remains the dominant small‑cap ETF, with assets over $70 billion under management.

- Vanguard’s Russell 2000 ETF (VTWO) holds around $13.6 billion, notable for its low 0.07% expense ratio.

- Vanguard Russell 2000 Growth and Value ETFs hold $1.3 billion and $877.9 million, respectively, underscoring investor interest in style tilts.

- IWM’s dividend yield near 1% provides modest income while tracking broad index performance.

- VTWO’s holdings span approximately 2,000 stocks, mirroring the Russell 2000’s comprehensive small‑cap exposure.

- ETF flows into small‑cap funds often spike around annual reconstitution dates as benchmarks drive portfolio adjustments.

- Annual ETF flow patterns reflect broad sentiment shifts, with inflows when small‑cap outlooks improve and outflows when risk aversion rises.

- Small‑cap ETF assets under management together represent a significant slice of total small‑cap benchmarked funds, highlighting investor reliance on passive exposure.

Reconstitution and Rebalancing Impact Statistics

- Record $102.455 billion notional value traded in Nasdaq Closing Cross.

- 242 stocks added to Russell 2000 from outside universe.

- 174 stocks were deleted from the Russell 2000 index.

- $8.5 trillion in Russell-indexed assets shifted during rebalance.

- Russell 2000 futures volume surged 50% year-over-year on reconstitution day.

- 2.5 billion shares executed in 0.871 seconds during Closing Cross.

- Small caps experienced over 20% decline in daily volumes.

- 84 graduations from Microcap to Russell 2000.

Frequently Asked Questions (FAQs)

It tracks approximately 2,000 small‑cap U.S. companies as the smallest segment of the Russell 3000.

The Russell 2000 comprises about 7% of the total U.S. equity market capitalization.

The index reached a record closing high of 2,520.44 points in October 2025.

Through part of 2025, the Russell 2000 posted an average 1.92% return YTD.

Conclusion

The Russell 2000 Index offers a vivid lens into the performance, structure, and evolving dynamics of U.S. small‑cap equities. With valuation metrics indicating elevated yet compelling pricing, and ETFs such as IWM and VTWO managing significant assets, the index remains central to both passive and strategic investment approaches. Dividend yields trail large‑cap benchmarks, but style and value nuances can boost income for targeted investors. Reconstitution events continue to shape flows and participation, underscoring the importance of systematic index methodology. As market cycles shift, the Russell 2000’s breadth and volatility will persist as key factors for portfolio construction and market insight.