The world of retail investing has undergone a dramatic transformation over the last few years. From technological advancements to demographic shifts, retail investors now have more tools and opportunities than ever to participate in the financial markets. Whether it’s the rise of commission-free trading or the increasing influence of younger, tech-savvy investors, the data behind these trends paints a compelling picture of how everyday investors are reshaping global markets.

Editor’s Choice

- Retail investors now account for about 20–25% of daily U.S. equity trading volume on average in 2025, up from roughly 10–15% a decade ago, with peaks near 35% in periods of high volatility.

- Since early January, retail investors have bought around $10.1 billion of U.S. equities, well above the recent weekly average.

- Retail investors now represent an estimated 20–35% of daily trading volume across major markets like the U.S., U.K., and South Korea.

- In India and China, individual investors account for roughly 40–50% of stock market trading volume.

- Citadel Securities estimates that individuals drive about 60% of customer transactions at the Options Clearing Corporation.

- The average age of a new retail investor is now around 30–35 years, underscoring a strongly youth‑driven market.

- Around 60–70% of Millennials consider ESG factors when investing, versus roughly 25–30% of Baby Boomers, highlighting a pronounced generational tilt toward sustainable investing.

Recent Developments

- AI trading now underpins roughly 70% of global trading volume, with the AI trading market projected to reach about $35 billion by 2030.

- Around 67% of Gen Z crypto traders have activated at least one AI‑powered trading bot, accounting for 60% of all AI bot activations on one major platform.

- AI crypto trading bots are projected to grow from about $40.8 billion in 2024 to roughly $985.2 billion by 2034, a 37.2% CAGR.

- Retail investors contributed approximately $302 billion of inflows into U.S. stocks in 2025, up 53% from $197 billion in 2024.

- Retail trading accounted for roughly 20–35% of daily activity across the U.S., U.K., and South Korea, reaching a record near 35% in April 2025.

- Meme‑stock episodes in 2025 saw retail traders responsible for about 16% of single‑stock trading volume during peak frenzies.

- Crypto‑investment product capitalization climbed to about $235 billion by July 2025, up from $130 billion at the end of 2024.

- Stablecoins still represent only about 0.2% of global e‑commerce transaction value, despite growing institutional interest and payments pilots.

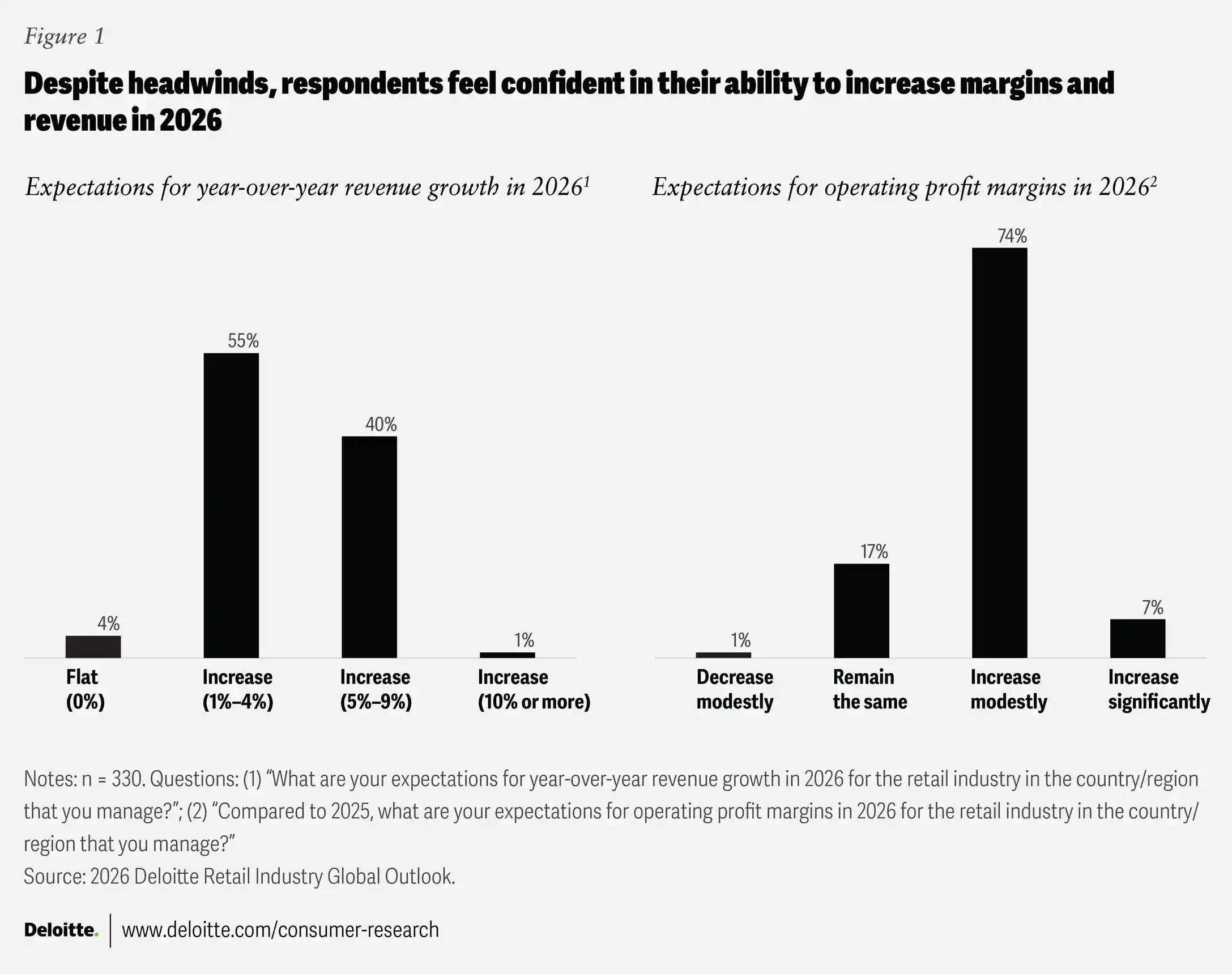

Retail Leaders Expect Revenue and Margin Growth

- Revenue growth optimism is strong, with 96% of respondents expecting higher revenues in 2026 compared to the prior year.

- A majority of retail leaders anticipate moderate revenue gains, as 55% forecast 1–4% growth, reflecting cautious but positive expansion.

- Stronger top-line momentum is also evident, with 40% expecting 5–9% revenue growth, signaling confidence in consumer demand and pricing strategies.

- Only 1% of respondents project double-digit revenue growth (10% or more), highlighting continued macroeconomic headwinds.

- Flat revenue expectations are minimal, with just 4% anticipating no growth, suggesting widespread confidence across the sector.

- Profit margin expectations are even more bullish, as 81% of respondents expect operating margins to increase in 2026.

- Most retailers foresee incremental margin improvement, with 74% expecting margins to increase modestly, driven by cost controls and operational efficiencies.

- A smaller but notable 7% anticipate margins to increase significantly, pointing to successful pricing, automation, and supply chain optimization efforts.

- Margin pressure concerns remain limited, as only 1% expect margins to decline, while 17% believe margins will remain unchanged.

Demographic Trends Among Retail Investors

- 77% of Gen Z investors began investing before age 25, underscoring a strong youth-led shift into markets.

- The average income of new retail investors is $54,000, signaling broad participation from middle‑income earners.

- 48% of new brokerage accounts are opened by investors from diverse ethnic backgrounds, up from earlier years.

- Women aged 18–35 increased their market activity by 26% compared to the prior year, narrowing historic gender gaps.

- 71% of retail investors have at least a bachelor’s degree, highlighting the role of higher education in market participation.

- About 77% of Gen Z women and 74% of millennial women invest in the stock market, outpacing older cohorts.

- Overall, 71% of women now own stock market investments, an 18% increase versus the previous year.

Impact of Technology on Retail Investing

- About 60% of retail investors now use mobile trading apps as their primary platform for managing investments.

- Roughly 33% of retail investors report using robo-advisors, up from the mid‑20% range a few years ago.

- The stock trading and investing applications market is valued at about $63.6 billion in 2025 and is expected to nearly double by 2029.

- The stock trading app market is forecast to grow from $13.6 billion in 2024 to around $39.2 billion by 2034, an 11.2% CAGR.

- Globally, online trading platforms generated about $10.15 billion in revenue in 2024, with projected growth to $16.71 billion by 2032.

- Nearly 50% of retail investors say they use social media as an input to investment decisions, alongside traditional research tools

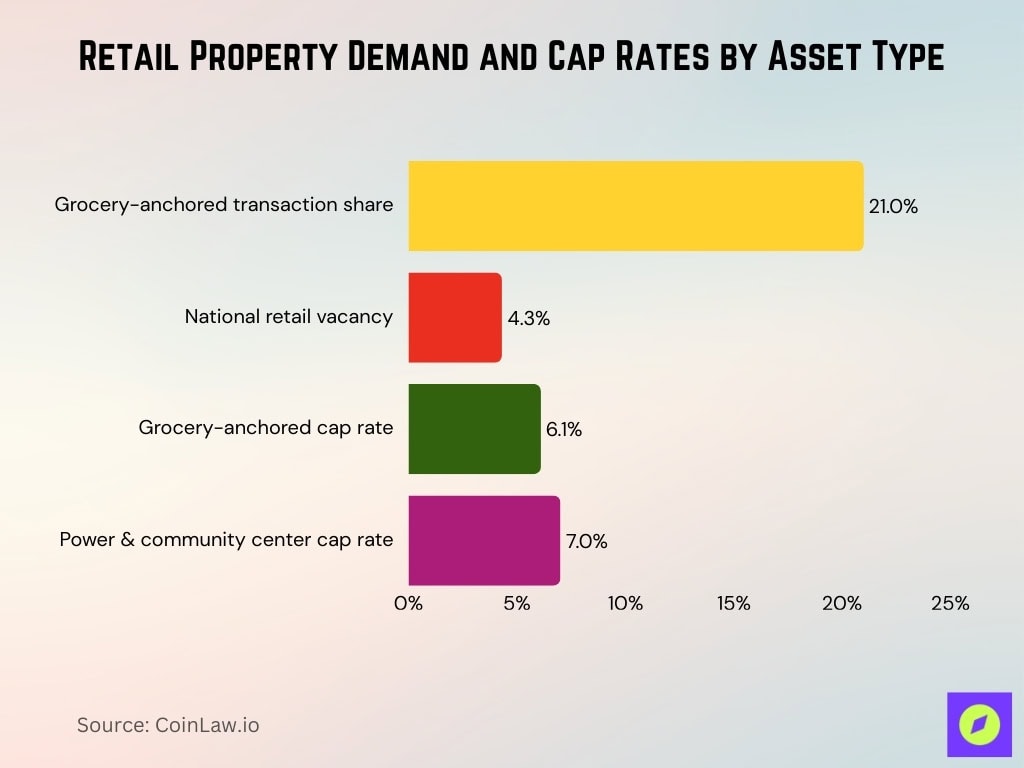

Retail Acquisition Volume by Product Type

- Grocery-anchored centers account for about 21% of recent U.S. retail transaction volume, remaining the single largest retail subtype for investors.

- National retail vacancy hovers near 4.3%, with grocery-anchored neighborhood centers described as stabilized and in strong demand.

- A Kroger-anchored grocery center traded at a 6.1% cap rate in early 2025, while large power and community centers traded closer to 7%.

The Rise of Retail Investors

- Retail investors now account for about 21–25% of U.S. equity trading volume, roughly double their share a decade ago.

- Retail traders added approximately $302 billion to U.S. stocks in 2025, up 53% from about $197 billion in 2024.

- Individual investors globally represent around 52% of equity trading volume in markets like India, with similar participation rising across Asia and Europe.

- Retail investors drove a 2,589% surge in weekly trading volume for meme stocks like Kohl’s during renewed 2025 meme‑stock activity.

- Meme names such as Kohl’s saw single‑day price jumps of roughly 37%, with monthly gains exceeding 50% in some cases.

- Online communities like WallStreetBets remain highly active, with Reddit stock discussions reaching over 112,000 mentions for equities in 2024 alone.

- Social media use for investment ideas among 18–34‑year‑old investors rose from about 17% to 26% for Reddit in three years.

- Future IPOs are expected to routinely allocate 10–30% of shares to the public as retail access programs expand.

Retail Investors Can Have a Big Impact on Public Companies

- As of mid-2025, Tesla’s general public (largely retail) holds about 36.3% of TSLA shares, compared with institutional ownership of 48.1% and insider stakes of 15.4%.

- Retail shareholders on average own about 26% of shares across U.S. firms, with ownership ranging from 38% in smaller firms to 16% in the largest.

- Historically, only about 12% of retail accounts vote their proxies, casting roughly 32% of their shares, though turnout has been rising with digital platforms.

- ESG-related news increases retail trading volumes by about 5.7% on average, and up to 8.1% in the post-2020 period.

- Research shows retail investors collectively own a “significant portion” of public company shares, with their trades around ESG news predicting future abnormal returns.

- Elon Musk individually owns roughly 12.8–13% of Tesla, equating to about 410 million shares and helping align management incentives with retail shareholders.

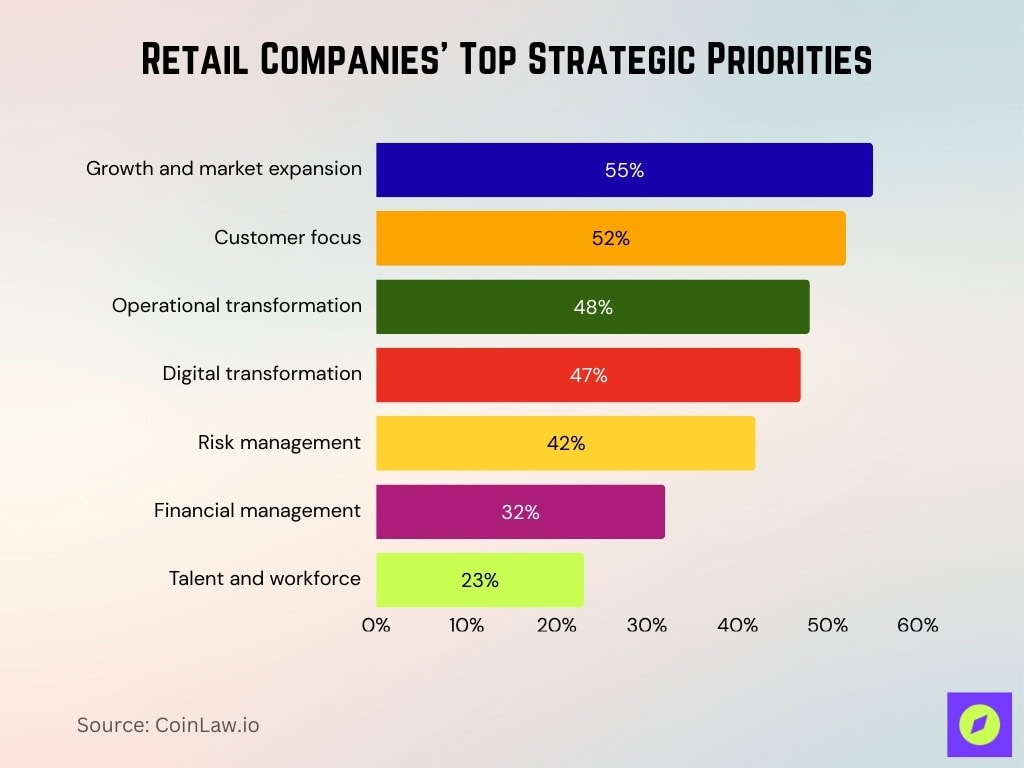

Retail Companies’ Top Strategic Priorities

- Growth and market expansion rank as the top priority, cited by 55% of companies, signaling a strong push to scale operations and enter new markets.

- Customer focus remains central, with 52% of respondents prioritizing customer experience, loyalty, and personalization alongside growth initiatives.

- Operational transformation is a key area of investment, as 48% of companies aim to streamline processes, reduce costs, and improve efficiency.

- Digital transformation continues to accelerate, with 47% prioritizing technology adoption, automation, and data-driven decision-making.

- Risk management stays firmly on the agenda, with 42% of respondents focused on navigating economic uncertainty, supply chain risks, and regulatory pressures.

- Financial management is less dominant but still relevant, as 32% emphasize capital discipline, cash flow management, and profitability control.

- Talent and workforce initiatives trail other priorities, with only 23% ranking workforce strategy as a top concern, highlighting a greater emphasis on growth and transformation over hiring expansion.

Private Companies Are Less Influenced by Retail Investors but Not Immune

- Retail investors’ holdings of private capital are projected to grow from about 0.2% of fund assets in 2024 to 5% by 2030 in the U.S., and from 11.3% to 30% in the EU.

- As of January 2025, Kickstarter alone has seen over 651,000 projects launched and more than $8.53 billion pledged globally.

- Reward‑based crowdfunding is estimated to hit around $1.22 billion in 2025, growing about 1.84% year over year.

- Individual investors drove about 28% of private equity trades in secondary markets, significantly shaping price discovery for private assets.

- Platforms like EquityZen and Forge Global recorded a 33% increase in retail participation, broadening access to pre‑IPO equity deals.

- EquityZen’s marketplace has enabled over 44,000 private investments in more than 450 late‑stage companies, serving about 710,000+ largely individual clients.

- Global retail investors’ private capital holdings are projected to rise from roughly $80 billion to $2.4 trillion in the U.S. by 2030, with EU exposure more than tripling.

Behavioral Patterns and Market Influence

- 51% of retail investors are influenced by social media‑driven FOMO when placing trades, especially during hype cycles.

- Panic selling during 2025 volatility led 30% of retail investors to exit positions during major market drawdowns.

- About 67% of investors use dollar‑cost averaging strategies to manage risk and smooth market fluctuations.

- Roughly 78% of retail investors adjust portfolios in response to breaking news and headlines, underscoring high reactivity.

- Herd behavior remains strong, with about 40% of investors following popular trades rather than conducting independent analysis.

- Day trading activity rose roughly 25% year over year, supported by easier app access and heightened market volatility.

- Around 35% of retail investors actively trade around earnings season based primarily on analyst forecasts instead of reported results.

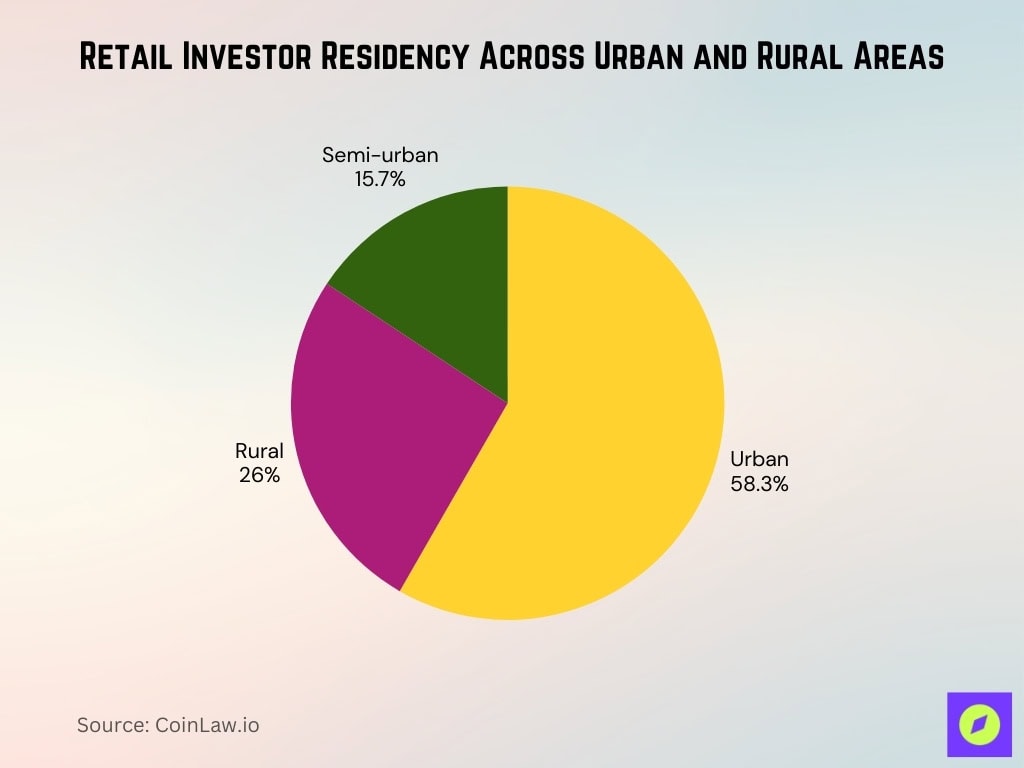

Where Retail Investors Reside: Major Financial Centers vs. Others

- Urban investors account for about 58.3% of digital trading platform users, with rural at 26% and semi-urban at 15.7%.

- The latest global outlook finds retail investors spread across 13 major markets, with roughly 4,259 surveyed in Australia and 3,401 in the UAE alone.

- Around 50% of retail investors globally participate in capital markets via countries like Brazil, India, China, and South Africa, underscoring broad geographic dispersion.

- In China, individuals account for roughly 60–90% of daily trading volumes, showing heavy retail participation outside traditional Western financial hubs.

- The UAE is seeing rapid retail investor growth, with domestic policies promoting long-term investment, and 219 million adults participating in capital markets worldwide.

Regulatory Changes Affecting Retail Investors

- Reg BI remains a core focus of SEC and FINRA exams, with virtually all broker-dealers serving retail clients now subject to enhanced best-interest and disclosure reviews.

- Leverage-constraint policies reduce speculative retail trading volume by about 23% and cut high-leverage traders’ monthly losses by roughly 40%.

- Retail investors’ trading volume in domestic equities climbed from about 10% in 2010 to roughly 23% in 2021 under evolving regulatory and market structures.

- Fractional share initiatives in Asia followed a drop in retail participation from 34.6% to 25.7% of trading, aiming to rebuild inclusion.

- Global crowdfunding volumes are projected to reach around $5.53 billion by 2030, growing at a 17.6% CAGR as regulated online capital-raising expands.

Frequently Asked Questions (FAQs)

Retail investors are estimated to account for 30%–37% of daily trading volume, varying by market conditions.

Around 50% of retail investors globally participate in capital markets via self‑managed trading accounts.

Approximately 30 million new retail investors opened brokerage accounts in the U.S. within the last two years.

Individual investors accounted on average for 20%–25% of total U.S. equity trading volume, spiking to 35% in high‑volatility periods.

Conclusion

Retail investors are no longer mere spectators in the financial markets. Their influence spans public and private companies, regulatory landscapes, and investment trends, with technology empowering everyday investors and demographic shifts reshaping preferences. This year promises to be another pivotal year for the retail investing landscape. Whether through ESG-focused investments, crypto assets, or traditional equities, retail investors are now a driving force that global markets cannot ignore. The data not only underscores their growing impact but also highlights the dynamic nature of investing today.