A small online retailer in California made headlines by announcing it would accept Monero (XMR) for payments. While some celebrated it as a step forward for consumer privacy, others worried about potential scrutiny from regulators. The clash between privacy coins and regulatory compliance isn’t just a debate; it’s reshaping how we think about financial privacy in the digital world.

Privacy coins promise untraceable and anonymous transactions, appealing to those seeking more control over their data. However, governments and regulatory bodies are increasingly concerned about their use in illicit activities. In this data-driven deep dive, we explore the evolving dynamics between privacy coins and regulation. Whether you’re an investor, regulator, or crypto enthusiast, the numbers tell a compelling story.

Editor’s Choice

- In 2025, global transactions involving privacy coins surpassed $250 billion.

- Monero (XMR) remains the most popular privacy coin, holding 58% of the total privacy coin market capitalization.

- Over 61% of privacy coin users cite financial privacy as their primary reason for using them, while 27% point to investment potential.

- 74% of surveyed blockchain companies consider compliance with the FATF Travel Rule a major challenge when working with privacy coins.

- Zcash (ZEC) saw an 8% decline in active addresses year-over-year as stricter Know Your Customer (KYC) measures dampened user activity.

- Privacy coin sector expanded 335% year-to-date, with total market capitalization exceeding $34 billion in November.

- As of Q1 2025, privacy coins are used in 11.4% of all cryptocurrency transactions globally.

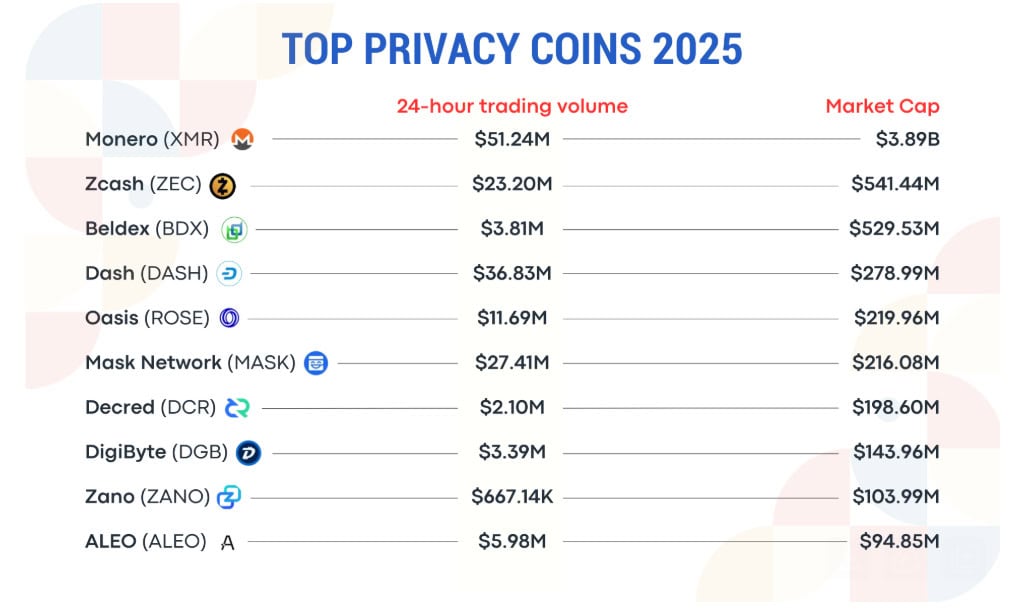

Top Privacy Coins (Trading Volume and Market Cap Highlights)

- Monero (XMR) dominates the market with a $51.24 million 24-hour trading volume and a $3.89 billion market cap.

- Zcash (ZEC) holds strong with $23.20 million in daily volume and a $541.44 million valuation.

- Beldex (BDX) shows consistent demand, reporting $3.81 million in 24-hour volume and a $529.53 million market cap.

- Dash (DASH) ranks high in liquidity with $36.83 million in trading volume and a $278.99 million market cap.

- Oasis Network (ROSE) secures $11.69 million in daily trades and a $219.96 million valuation.

- Mask Network (MASK) posts $27.41 million in 24-hour volume, backed by a $216.08 million market cap.

- Decred (DCR) records a lower $2.10 million trading volume but maintains a $198.60 million market cap.

- DigiByte (DGB) shows $3.39 million in daily trades and a $143.96 million valuation.

- Zano (ZANO) trails in activity with just $667.14K in 24-hour volume, yet reaches a $103.99 million market cap.

- ALEO (ALEO) emerges with $5.98 million in trading volume and a $94.85 million valuation.

Global Adoption Rates of Privacy Coins

- As of Q1 2025, privacy coins are used in 11.4% of all cryptocurrency transactions globally, up from 9.7% in 2024.

- In North America, 18% of crypto users report holding at least one privacy-focused asset, up from 14% in 2023.

- In Europe, privacy coins account for 22% of decentralized finance (DeFi) protocols offering privacy features.

- Asia-Pacific leads in adoption rates, with 29% of crypto traders reporting regular use of privacy coins.

- South Korea reports a 41% increase in Monero-based transactions following new privacy regulations allowing limited private transactions for retail payments.

- In Africa, privacy coin usage has grown by 37% year-over-year, driven by demand for anonymous remittances and low-fee cross-border transfers.

- Latin America shows a 26% adoption rate among small businesses, particularly in Argentina and Venezuela, where economic instability has increased reliance on private transactions.

- A survey conducted in January 2025 found that 55% of privacy coin users prioritize Monero, followed by Zcash (ZEC) at 28% and Dash (DASH) at 12%.

- Privacy coin trading volume reached $8.7 billion in February, a 15% rise from the previous year.

Regulatory Frameworks Impacting Privacy Coins

- As of March 2025, 97 countries have introduced or updated regulations concerning privacy coins, up from 79 in 2023.

- The Financial Action Task Force (FATF) extended its Travel Rule to explicitly include privacy coins, impacting 57% of global transactions.

- The European Union’s Markets in Crypto Assets (MiCA) framework mandates enhanced disclosure requirements for privacy coins, resulting in a 22% reduction in European exchanges offering them.

- The United States FinCEN proposed a rule in January 2025 requiring comprehensive record-keeping of all private coin transactions exceeding $500.

- Japan and South Korea have implemented bans on privacy coins for institutional trading desks, leading to an 11% drop in liquidity on Asian exchanges.

- Australia’s regulatory body, ASIC, launched Project ClearSight, a pilot initiative integrating blockchain analytics tools to monitor privacy coin flows across 10 major exchanges.

- 73 crypto exchanges delisted privacy coins globally in 2025, up from 51 two years prior.

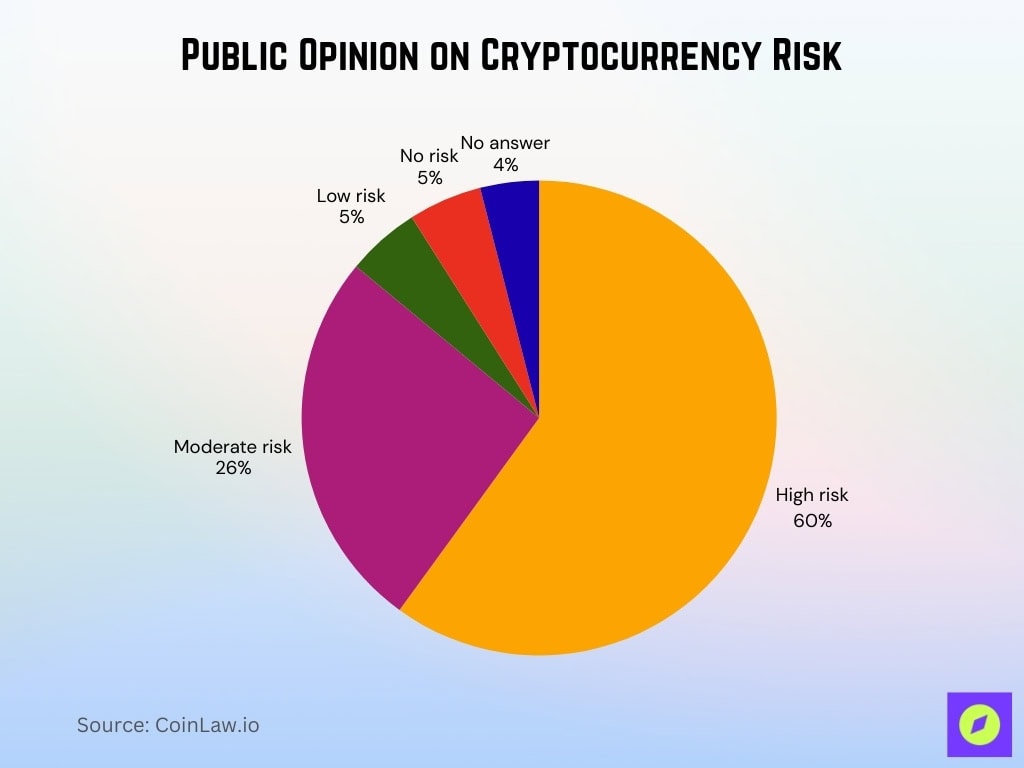

Public Opinion on Cryptocurrency Risk

- 60% of respondents believe investing in cryptocurrency carries high risk, reflecting major concerns about volatility and security.

- 26% consider it a moderate risk, suggesting some trust in crypto but with cautious outlooks.

- Just 5% rate it as low risk, showing minimal confidence in crypto’s safety.

- Another 5% say there is no risk at all, signaling a strong belief in crypto stability.

- 4% of participants gave no answer, possibly due to a lack of knowledge or hesitation to comment.

Privacy Coin Delistings from Exchanges

- In 2025, a total of 73 exchanges worldwide have delisted privacy coins, a 43% increase from 51 in 2023.

- Binance, the world’s largest crypto exchange, announced in February 2025 the delisting of XMR, ZEC, and DASH across its European and US platforms, impacting an estimated $600 million in trading volume.

- Kraken delisted privacy coins from its Canadian platform in March 2025, citing non-compliance with updated FINTRAC regulations.

- In Japan, all registered crypto exchanges have ceased support for privacy coins, following guidance from the Japan Financial Services Agency (JFSA).

- South Korea’s top five exchanges, including Upbit and Bithumb, have removed privacy coins from their listings as of Q1 2025.

- Australia’s Independent Digital Assets Exchange (IDAX) reported that 78% of its institutional clients supported the removal of privacy coins to meet AML/CTF obligations.

- Poloniex delisted Monero (XMR) globally in April 2025 after concerns were raised by the US Treasury Department.

- Despite global delistings, Switzerland and Liechtenstein exchanges still offer limited privacy coin services under strict KYC/AML frameworks.

- Peer-to-peer (P2P) markets, such as LocalMonero, have seen a 19% uptick in activity following delistings on centralized exchanges.

Law Enforcement Actions and Seizure Statistics Involving Privacy Coins

- South Korea’s Cybercrime Investigation Unit dismantled a Monero laundering network, freezing $17 million worth of assets in January 2025.

- Australia’s Federal Police reported seizures of $9 million in privacy coins connected to ransomware operations in 2024.

- Japan’s National Police Agency confiscated $6 million in privacy coins as part of anti-money laundering efforts, including assets linked to crypto-jacking cases.

- Interpol partnered with Chainalysis in 2025 to develop advanced tracking solutions for privacy coins, though early reports cite limited effectiveness.

- Despite increased seizures, law enforcement agencies state that privacy coins represent only 3% of total crypto assets confiscated globally.

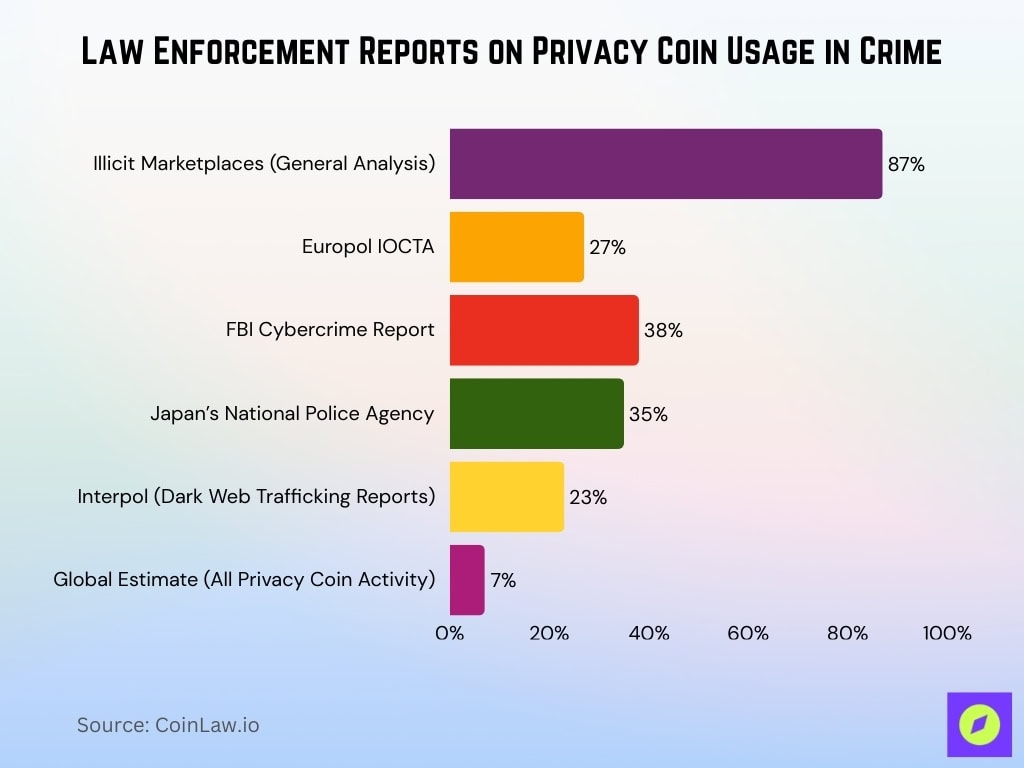

Privacy Coin Usage in Illicit Activities: Data and Trends

- Monero (XMR) remains the currency of choice for illicit marketplaces, involved in 87% of all privacy coin transactions linked to illegal activity.

- Europol’s 2025 Internet Organized Crime Threat Assessment (IOCTA) reports a 27% increase in ransomware payments made using privacy coins, particularly Monero and Zcash.

- The FBI’s 2025 Cybercrime Report links privacy coin transactions to 38% of data extortion cases where victims were required to pay in Monero (XMR).

- Japan’s National Police Agency reported a 35% rise in crypto-jacking cases using privacy coin mining malware, specifically targeting XMR.

- Interpol noted that 23% of human trafficking-related transactions on the dark web involved privacy coins.

- Despite these trends, only 7% of global privacy coin transactions are suspected of illicit intent, underscoring a wide gap between perception and reality.

Future Outlook for Privacy Coins Under Evolving Compliance Standards

- By 2027, analysts expect privacy coin adoption to grow by 24%, driven by institutional use in privacy-preserving corporate treasury payments.

- Gartner forecasts that by 2026, 50% of blockchain-based transactions will include built-in privacy features via privacy coins or hybrid models.

- Switzerland’s FINMA is developing a Privacy Coin Regulatory Sandbox expected to launch in 2025 to support compliant privacy-focused crypto services.

- The EU’s MiCA framework will require mandatory transaction disclosures for privacy coin users by Q4 2025, intensifying regulatory scrutiny.

- The U.S. Treasury is expected to finalize privacy coin transaction thresholds in late 2025, with penalties for unreported transfers above $1,000.

- China is researching centralized privacy solutions for its Digital Yuan using zero-knowledge proofs, despite its broader crypto ban.

- Industry experts anticipate wider adoption of opt-in transparency, with Zcash already enabling selective disclosure keys for institutional partners.

- Regulated DeFi platforms are exploring privacy-preserving transactions, including compliance evaluations of Monero’s Kovri project.

- By mid-2025, five major privacy coin DAOs had adopted voluntary self-regulation and compliance codes.

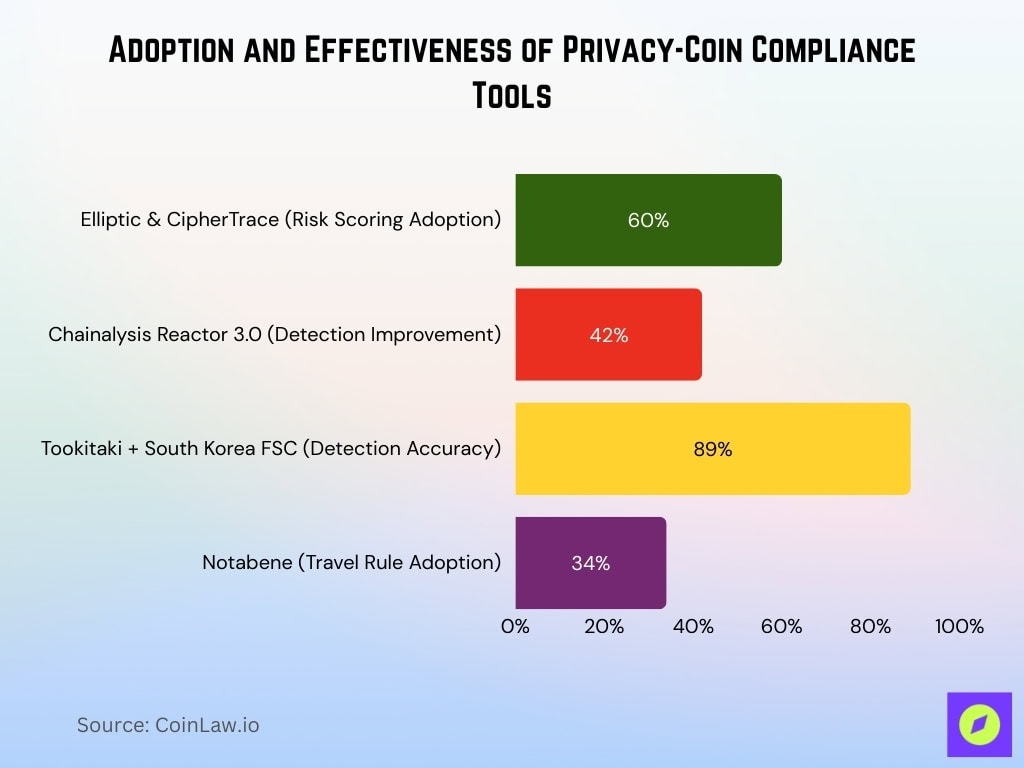

Regulatory Technology (RegTech) Innovations Addressing Privacy Coin Compliance

- Elliptic and CipherTrace have deployed enhanced privacy-coin risk-scoring systems now used by 60% of regulated exchanges.

- Chainalysis Reactor 3.0, launched in January 2025, improved detection of suspicious privacy-coin flows by 42% versus prior versions.

- Tookitaki’s partnership with South Korea’s FSC achieved 89% accuracy in identifying high-risk privacy-coin transactions using PCRA analytics.

- Notabene’s Travel Rule tools for privacy coins are now adopted by 34% of cross-border payment platforms.

- The crypto RegTech market is projected to reach $5.4 billion, with 18% focused specifically on privacy coin compliance solutions.

- Elliptic Discovery tracks 147 exchanges globally with privacy-coin exposure risk ratings for compliance benchmarking.

- Veriscope launched its Privacy Coin Reporting Suite in Q1 2025, enabling automated compliance for Zcash and Dash.

- Uppsala Security’s Private Chain Trace technology is currently used by five national regulators for behavioral analytics on privacy coins.

- Despite progress, 42% of compliance officers still view privacy coins as a high compliance burden due to tracing limitations.

Recent Developments

- Monero (XMR) implemented its Jamtis Wallet Protocol in February 2025, offering enhanced privacy features and multi-sig support.

- Zcash (ZEC) upgraded its Halo 2 proving system, eliminating trusted setups and improving scalability for shielded transactions.

- Dash launched Dash Platform 1.0, introducing decentralized API services and expanding merchant integrations in Latin America.

- Beam completed a hard fork in April 2025, integrating Confidential Assets to support privacy-preserving tokenization.

- Grin developers released Slatepack 2.0, simplifying private transaction workflows and boosting mobile wallet adoption by 12%.

- Firo (FIRO) began testing Lelantus Spark, a next-gen privacy protocol aiming to reduce transaction sizes by 40%.

Frequently Asked Questions (FAQs)

As of early 2025, privacy coins are used in 11.4% of all cryptocurrency transactions globally.

Around 74% of privacy coin projects and blockchain companies identify complying with the FATF Travel Rule as their biggest regulatory hurdle.

MEXC Research reports that 81% of global privacy coin trading volume now originates from MENA, CIS, and Southeast Asia.

Conclusion

The clash between privacy and regulation continues to shape the future of cryptocurrencies. Privacy coins offer empowered financial sovereignty, yet they face escalating scrutiny in an era focused on transparency and compliance.

Privacy coins remain a dynamic and controversial sector of the crypto market. While regulators tighten controls, technological innovation is pushing privacy coins toward new models that balance anonymity with compliance. For investors, users, and policymakers, the road ahead requires vigilance, adaptability, and ongoing dialogue.