In a world moving swiftly towards digital payments, HDFC PayZapp stands as one of India’s pioneering e-wallet solutions, offering a seamless bridge between traditional banking and modern mobile transactions. The app doesn’t just facilitate payments; it transforms them, providing users with an integrated experience for shopping, bill payments, and money transfers. With the digital payments industry in India expanding rapidly, PayZapp has carved a unique position, attracting millions and competing with significant players in the sector.

Editor’s Choice

- The e-wallet facility accounts for more than 20 million users. At the same time, a significant portion of these users are young adults.

- Approximately 43.3% of users utilize PayZapp for finance-related tasks.

- 75% of surveyed Indian users reported increased spending due to the adoption of the Unified Payments Interface (UPI).

- Convenience is a key factor, with 95.2% of users finding UPI payments easy to make.

- Mobile wallets are expected to account for Mobile wallets are expected to account for over 50% of global e-commerce payment methods by 2025. of global e-commerce payment methods by 2025.

- 55% of users are from urban areas, while rural user adoption has grown by 20% annually.

- On average, users conduct 10 transactions per month, primarily for bill payments, mobile recharges, and online shopping.

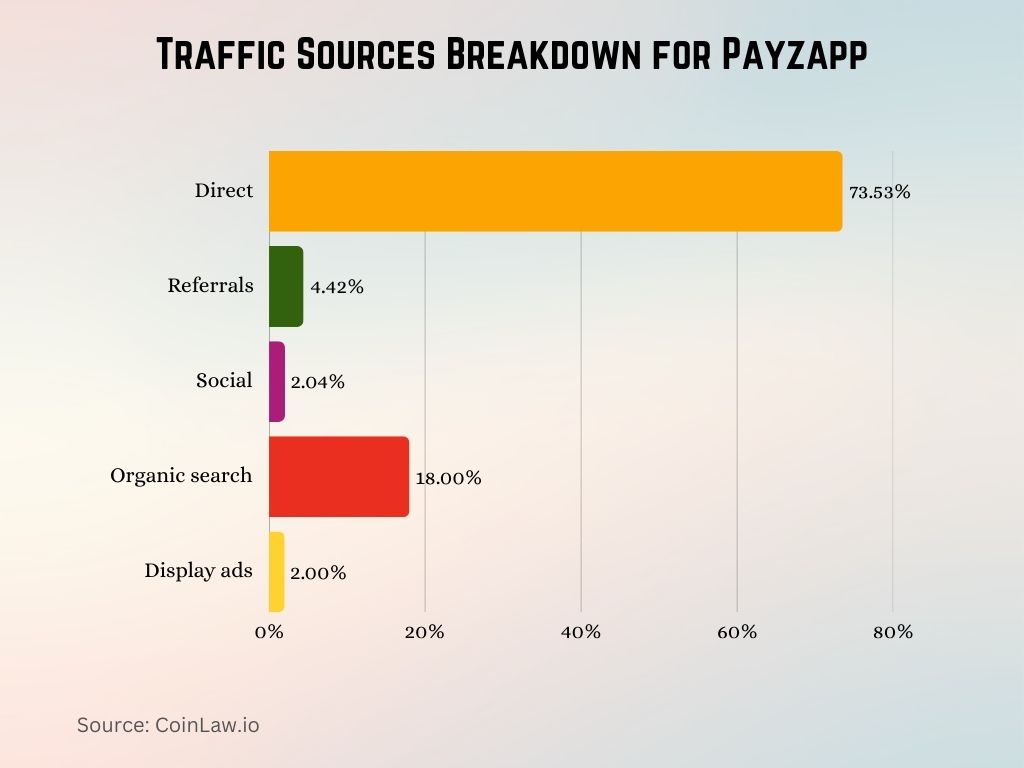

Traffic Sources Breakdown for Payzapp.com

- Direct traffic dominates with 73.53%, indicating that most users access Payzapp.com by typing the URL directly or via bookmarks.

- Organic search contributes 18.00%, showing that a significant portion of users discover the site through search engines.

- Referrals account for 4.42% of traffic, meaning external websites are sending users to Payzapp.com.

- Social platforms drive 2.04% of the traffic, reflecting a modest engagement through social media.

- Display ads contribute 2.00%, indicating some level of investment in banner advertising.

- Email traffic is 0.00%, suggesting no notable traffic from email campaigns.

- Paid search data is not available (N/A), possibly indicating no active pay-per-click campaigns or untracked data.

Market Share of India Payments Industry

- The digital payments market in India is projected to grow at a CAGR of 13.8% from 2025 to 2029, reaching $190 billion in total market size.

- PayZapp holds a 3.1% share of the Indian digital payments market in 2025, maintaining steady growth amid fierce UPI competition.

- Mobile payments account for 51% of all digital transactions in India in 2025, with PayZapp driving mobile-first adoption among urban users.

- UPI dominates with 79% of total market transactions in 2025, and PayZapp’s UPI integration boosts its market penetration.

- India’s payments sector is witnessing over 1.9 billion monthly transactions in 2025, and PayZapp handles approximately 43 million of those each month.

- QR code-based payments make up 39% of digital transactions in 2025, and PayZapp continues to scale contactless efforts in tier-2 and tier-3 cities.

- PayZapp ranks fourth among top payment players in 2025 by user satisfaction and monthly volume, confirming its solidified market position.

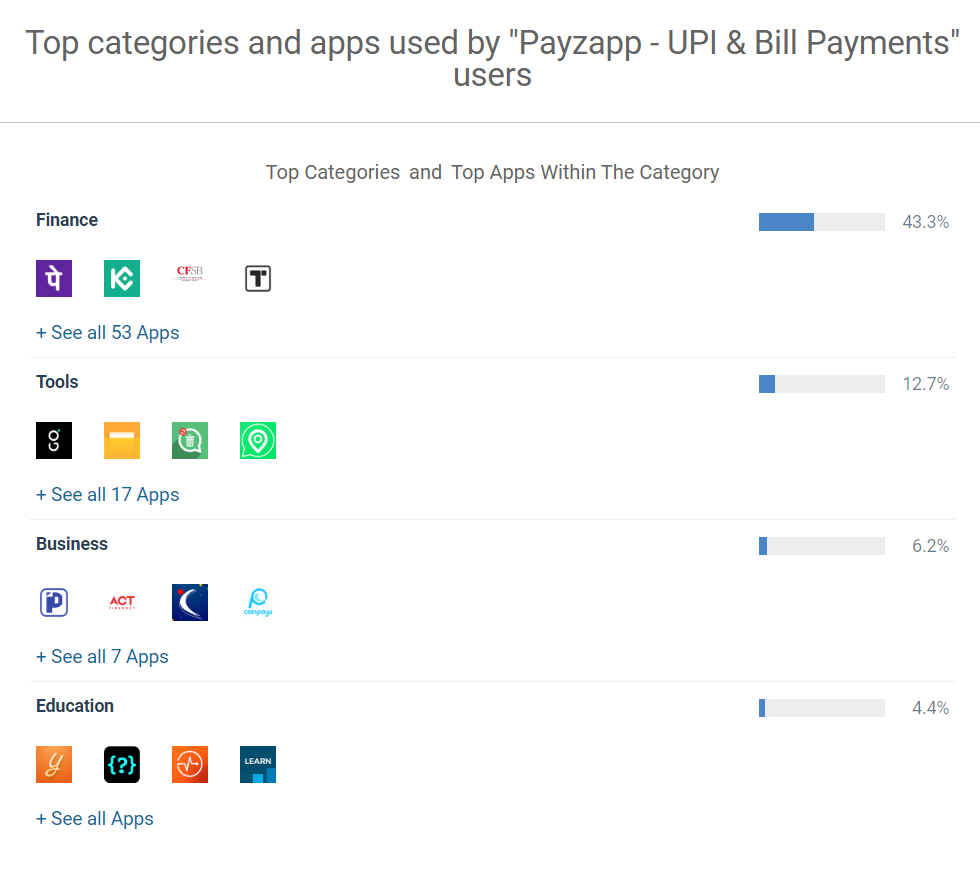

Top App Categories Used by Payzapp Users

- Finance apps lead the usage with a dominant 43.3%, indicating that Payzapp users are highly active in financial services and digital payment platforms.

- The tools category comes next with 12.7%, showing interest in utility and productivity-enhancing apps.

- Business-related apps are used by 6.2% of users, reflecting engagement with services like billers, ISPs, and professional platforms.

- Education apps capture 4.4%, suggesting a smaller but notable segment interested in learning and academic tools.

User Base and Demographics

- PayZapp has surpassed 24 million registered users in 2025, reflecting its continued expansion in India’s digital payments space.

- Monthly active users make up 41% of the user base in 2025, equating to about 9.8 million regular transactors.

- 82% of PayZapp users are under 40, with nearly 52% aged 25–34, confirming its strong appeal to digital-native millennials.

- 58% of users are from urban areas, while a 24% annual growth in the rural user base highlights PayZapp’s rural market penetration.

- 61% of users are male and 39% female in 2025, but the gender gap continues to narrow as female adoption steadily increases.

- Average transaction frequency is now 11 per user monthly, led by utility bills, mobile top-ups, and e-commerce spends.

- 72% use PayZapp for bill payments and recharges, 63% for QR-based in-store purchases, and 47% for online shopping, signaling versatile consumer behavior.

Revenue and Monetization

- PayZapp reported $48 million in annual revenue in 2025, driven by transaction fees, merchant tie-ups, and premium services.

- Merchant fees account for 33% of total revenue, earned from each PayZapp-powered customer transaction at partnered outlets.

- User service fees contribute 21% of revenue, as premium features attract high-engagement users seeking convenience and perks.

- Merchant cashback collaborations generate 24% of revenue, boosting both transaction volume and customer retention.

- Platform advertising makes up 9% of revenue, thanks to targeted placements based on user behavior and spend patterns.

- 26% of users opt for premium services, including loyalty rewards, priority support, and faster checkout features.

- Revenue is projected to grow at 19% annually, keeping PayZapp on track to exceed $57 million by year-end 2025.

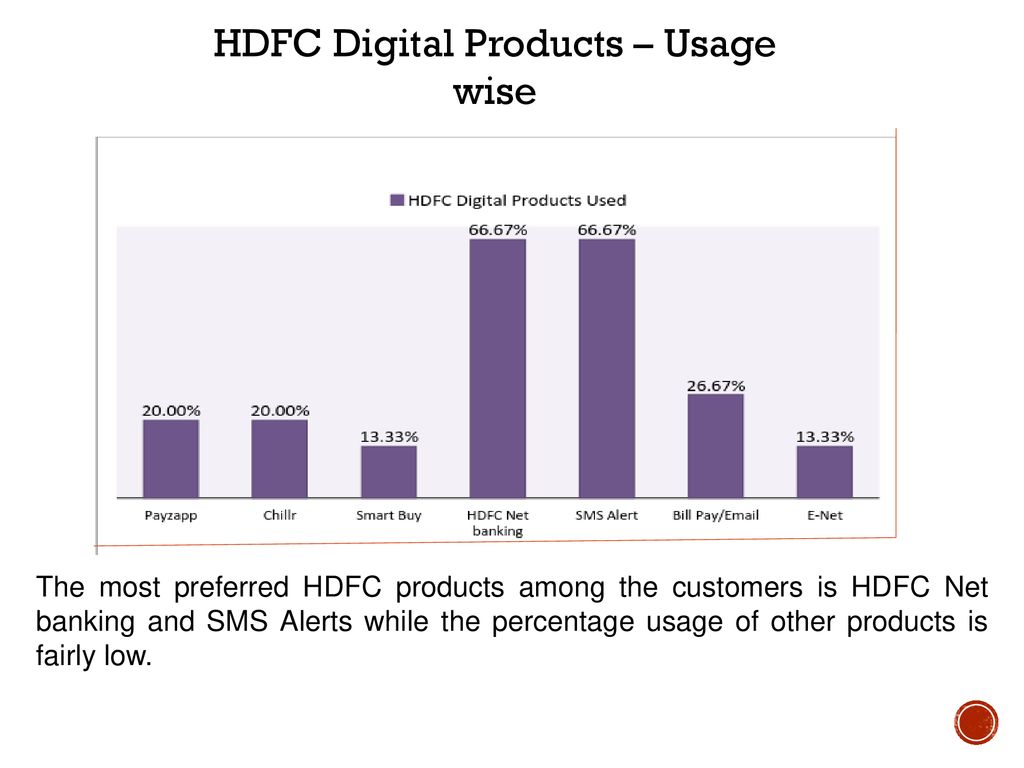

HDFC Digital Product Usage Statistics

- HDFC Net Banking and SMS Alerts are the most used services, each with 66.67% usage among customers.

- Bill Pay/Email services follow with 26.67%, showing moderate engagement.

- Payzapp and Chillr apps are equally used at 20.00%, reflecting limited mobile app adoption.

- Smart Buy and E-Net have the lowest usage at 13.33% each, indicating relatively low customer interest.

Features and Benefits of HDFC PayZapp e-wallet App

- One-click payments make PayZapp an attractive choice, allowing users to complete transactions with a single tap, a feature that simplifies bill payments, recharges, and online purchases.

- PayZapp’s integrated bill payments system covers a wide range of services, from utilities to telecom and insurance, letting users handle multiple payments within the app.

- Exclusive offers and cashback programs are available to users through partnerships with top brands across categories like travel, dining, and entertainment, enhancing user savings.

- The app provides in-app shopping across major platforms, meaning users can shop directly within PayZapp, a unique feature that consolidates the shopping experience.

- QR code functionality supports instant payments at physical stores, supporting India’s shift to cashless transactions and making it easy for users to pay on the go.

- PayZapp offers currency exchange services for international travelers, allowing them to convert currency digitally, an attractive feature for HDFC account holders who travel frequently.

- Multi-layered security ensures transactions are safe, utilizing OTP, device-binding, and biometric authentication, which has significantly reduced fraud cases.

Range of Payments

- PayZapp supports multi-utility bill payments, allowing users to pay for electricity, water, gas, and telecom services, all within one app.

- UPI integration allows users to send and receive money directly from bank accounts with ease, facilitating instant and free peer-to-peer transactions.

- The app supports international payments for users with linked HDFC bank accounts, offering flexibility for those who need to transact globally.

- In-app travel booking lets users book flights, hotels, and buses, expanding the convenience of mobile payments to travel and tourism.

- Mobile recharges and DTH payments make it easy for users to top up their telecom or TV services within seconds, with frequent cashback offers on these transactions.

- E-commerce payments are streamlined, allowing PayZapp users to shop on major online platforms with one-click pay or saved card details for faster checkout.

- Split bill options are available for group payments, making it easier to split expenses with friends or family for shared purchases or events.

Market Position and Competitors

- PayZapp remains in the top five e-wallets in India in 2025, competing with PhonePe, Google Pay, Paytm, and Amazon Pay.

- PayZapp holds a 3.1% market share in India’s digital payments industry, staying strong in a $190 billion sector.

- PhonePe and Google Pay control 76% of the UPI market in 2025, while PayZapp’s UPI push is driving renewed user growth.

- Over 1.2 million merchants accept PayZapp, enhancing customer loyalty through exclusive offers and cashback programs.

- PayZapp recorded a 17% annual growth in transaction volume in 2025, signaling its rise in the mobile-first payment ecosystem.

- HDFC Bank integration remains PayZapp’s key differentiator, ensuring a smooth banking-payment experience for millions.

- PayZapp’s all-in-one features now attract 45% of its new users, meeting the rising demand for versatile payment apps.

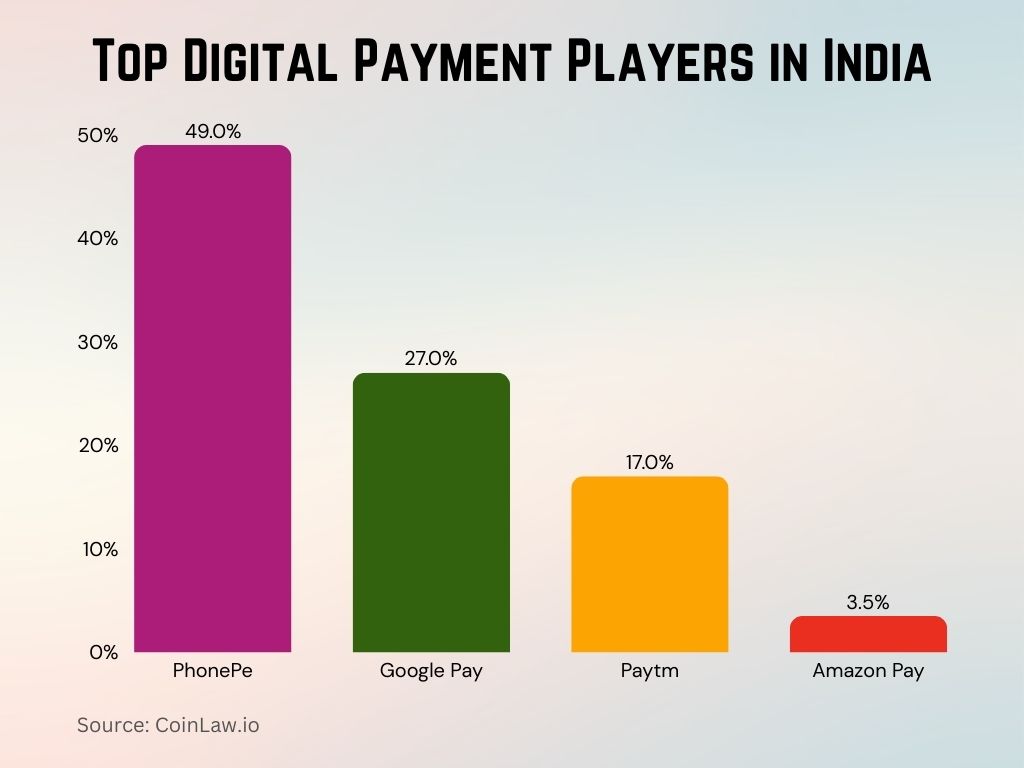

Payment in India Market Leaders

- PhonePe leads UPI payments in India with a 49% market share, maintaining dominance in the country’s digital transaction space.

- Google Pay holds 27% market share in UPI payments in 2025, continuing as a close second in user volume and transaction count.

- Paytm commands a 17% share of the market, leveraging both wallet and UPI hybrid usage to sustain its base.

- Amazon Pay holds a 3.5% market share, driven by its integrated checkout usage among Amazon India shoppers.

- PayZapp strengthens brand value through merchant alliances, despite its smaller 3.1% market share in 2025.

- PayZapp’s UPI transactions rose 29% year-over-year, underscoring growing user adoption post-integration with India’s UPI system.

- HDFC Bank’s ecosystem gives PayZapp a trust advantage, making it a preferred option for HDFC’s 80M+ retail customers.

- Retail partnerships drive 46% of PayZapp’s active usage, as users seek exclusive discounts beyond peer-to-peer transfers.

Usage Trends and Transaction Volume

- Monthly transaction volume on PayZapp surpassed 43 million in 2025, showing steady growth across daily utility and lifestyle payments.

- 83% of PayZapp transactions are for bills, recharges, and UPI, confirming its role as a multi-purpose payment platform.

- QR code payments now account for 39% of all PayZapp transactions, accelerating offline in-store adoption.

- Transaction frequency among users aged 18–35 rose 23%, showing high engagement from younger digital users.

- The average transaction value per user is $87 monthly, with spikes from travel, insurance, and big-ticket shopping.

- Holiday season usage jumps by 33%, led by e-commerce sales, flight bookings, and festive discounts.

- 2025 growth projections estimate a 22% rise in PayZapp’s transaction volume, fueled by merchant tie-ups and rising mobile adoption.

Partnerships and Integrations

- PayZapp partners with over 1.2 million merchants in India across retail, food, travel, and entertainment, offering wide-ranging payment choices.

- E-commerce collaborations power 28% of PayZapp usage, providing discounts and instant checkout on major online platforms.

- Since its 2023 UPI integration, PayZapp’s transaction volume has grown 29% year-over-year, expanding cross-platform capabilities in 2025.

- HDFC cardholders earn and redeem points seamlessly through PayZapp-linked reward programs, boosting daily transaction frequency.

- Travel bookings now account for 15% of in-app payments, thanks to exclusive deals with airlines, hotels, and rental services.

- Tie-ups with telecom brands drive 31% of recharge volume, with cashback and discounts on mobile, broadband, and DTH services.

- Joint campaigns with Zomato, Swiggy, and MakeMyTrip fuel repeat usage and engagement, offering loyalty incentives to PayZapp users.

Security and Compliance

- PayZapp complies with RBI regulations and follows strict guidelines to ensure transaction safety and data privacy for its users.

- PCI-DSS certification ensures that PayZapp meets the highest standards for secure handling of card transactions.

- The app’s biometric authentication and two-factor verification provide an additional layer of security, significantly reducing unauthorized access.

- Fraud monitoring systems run in real-time to detect and prevent suspicious activity, offering robust protection for all users.

- PayZapp has a dedicated compliance team that monitors regulatory changes and ensures the app’s practices adhere to all local and international payment standards.

- Tokenization technology masks sensitive card information, making transactions safer by minimizing exposure to card details.

- Regular data security audits ensure PayZapp’s infrastructure remains resilient against cyber threats, maintaining user trust and loyalty.

Awards and Recognitions

- PayZapp was awarded “Best Digital Wallet 2025” at the India Digital Awards, recognizing its impact on India’s growing digital economy.

- Won the 2025 “Customer Choice Award” by the Payments Council of India, affirming strong user loyalty and satisfaction.

- Named “Most Innovative Banking App” at the 2025 Fintech India Awards, thanks to its AI-driven UPI experience.

- Maintains a 4.6-star rating on Google Play with over 1.3 million positive reviews, praised for its speed and simplicity.

- Honored at the 2025 Global Fintech Awards for its role in digital financial inclusion across 75,000+ rural locations.

- Ranked among the top 3 mobile payment apps by IDC India 2025, noted for security, scalability, and smooth UX.

- Received the Excellence in Customer Support Award 2025, reflecting PayZapp’s proactive and responsive user service model.

Recent Developments

- Projected Revenue Growth: HDFC Bank anticipates PayZapp’s revenue to grow at an annual rate of 20%, aiming for $48 million in earnings by 2025 through expanded services and increased transaction volume.

- User Demographics: PayZapp’s user base in India is diverse, encompassing various age groups and income levels, reflecting its wide acceptance across the country.

- Digital Wallet Market Expansion: The global digital payments market is projected to grow by 15.71% annually from 2024 to 2029, reaching a transaction value of approximately $36.75 trillion by 2029.

- Competitive Landscape: In 2025, digital wallets have become the preferred payment method for millions worldwide, with over 5.2 billion users accounting for more than 60% of global e-commerce transactions.

- Technological Advancements: The payments industry is witnessing rapid growth, with global payments revenue projected to exceed $3 trillion by 2028.

Conclusion

HDFC PayZapp has grown to become a vital player in India’s digital payment ecosystem, empowering users with a blend of secure, convenient, and flexible payment solutions. Through strategic partnerships, innovative features, and a commitment to compliance, PayZapp continues to redefine how Indians approach digital transactions. Its integration with UPI, extensive merchant network, and focus on user experience solidify its position as a reliable choice in a crowded market. As PayZapp looks toward future advancements, it stands poised to capture a larger share of the digital payment market while continuing to innovate and respond to the needs of its diverse user base.