In the bustling landscape of digital payments, Paytm has emerged as a trailblazer, transforming the way people transact in India. From its humble beginnings as a mobile recharge platform to becoming a multi-billion-dollar fintech giant, Paytm’s journey exemplifies innovation and adaptability. Today, Paytm will continue to shape the digital economy with record-breaking statistics and trends. Let’s dive into the numbers and milestones that define Paytm’s story this year.

Editor’s Choice

- Paytm’s revenue hit ₹26,800 crore in 2025, reflecting a 16% YoY growth driven by its expanding financial and lending services.

- 270 million monthly active users (MAU) in early 2025, further strengthening its hold on India’s digital payments landscape.

- ₹9.3 trillion in transaction value processed in Q1 2025, marking a 19% increase from Q1 2024.

- Loan disbursals surged past ₹15,500 crore in 2025, up by 29% compared to the previous year.

- Paytm Payments Bank reached 52 million subscribers, keeping its position as one of the fastest-growing digital banks globally.

- Partnered with 28 million merchants across urban, semi-urban, and rural India to deepen financial inclusion.

- Paytm Wallet processed ₹4.2 trillion in 2025, maintaining a 28% share of the mobile wallet market.

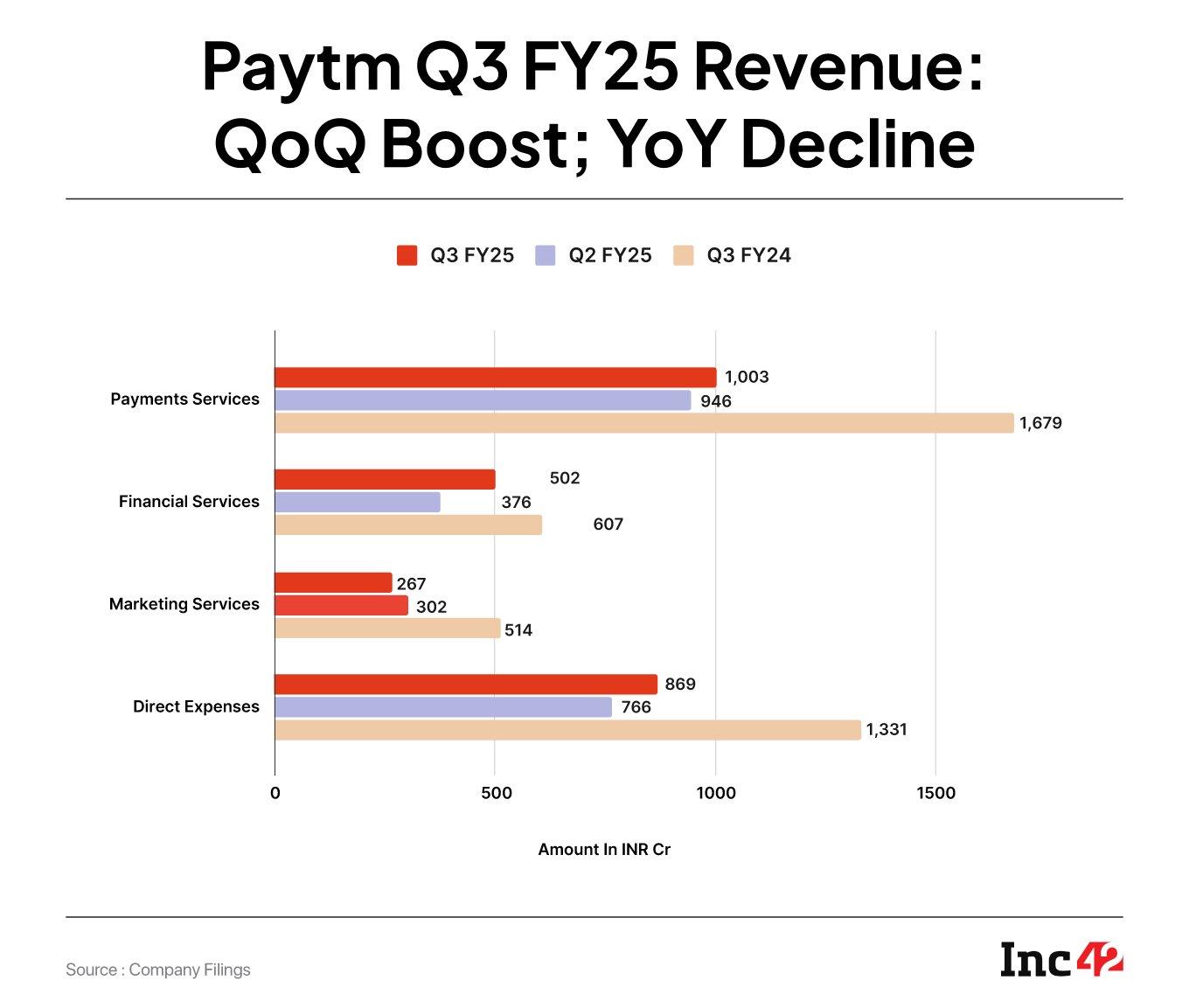

Paytm Q3 FY25 Revenue: QoQ Growth, But YoY Decline

- Payment Services revenue rose to INR 1,003 Cr in Q3 FY25, up from INR 946 Cr in Q2 FY25, but significantly down from INR 1,679 Cr in Q3 FY24.

- Financial Services revenue climbed to INR 502 Cr in Q3 FY25, a quarter-over-quarter boost from INR 376 Cr, though lower than INR 607 Cr a year ago.

- Marketing Services revenue dropped to INR 267 Cr in Q3 FY25, compared to INR 302 Cr in Q2 FY25 and INR 514 Cr in Q3 FY24, marking a double decline.

- Direct Expenses increased to INR 869 Cr in Q3 FY25, rising from INR 766 Cr in Q2 FY25, but still below the INR 1,331 Cr spent in Q3 FY24.

Financial Performance

- Paytm recorded a net profit of ₹152 crore in Q1 2025, continuing its positive streak after achieving profitability.

- Operating revenue for FY 2025 surpassed ₹28,100 crore, fueled by robust growth in lending, insurance, and wealth management services.

- Contribution margin rose to 57%, reflecting strong gains in operational efficiency.

- Advertising revenue jumped 48% to ₹3,260 crore, driven by increased brand partnerships and in-app promotional campaigns.

- Gross merchandise value (GMV) climbed to ₹19.4 trillion in FY 2025, showing a 21.3% year-over-year increase.

- Cloud services revenue grew by 42%, as the division gained traction with enterprise fintech and retail clients.

- R&D spending crossed ₹640 crore, with a continued push toward AI-based financial innovations and fraud prevention tools.

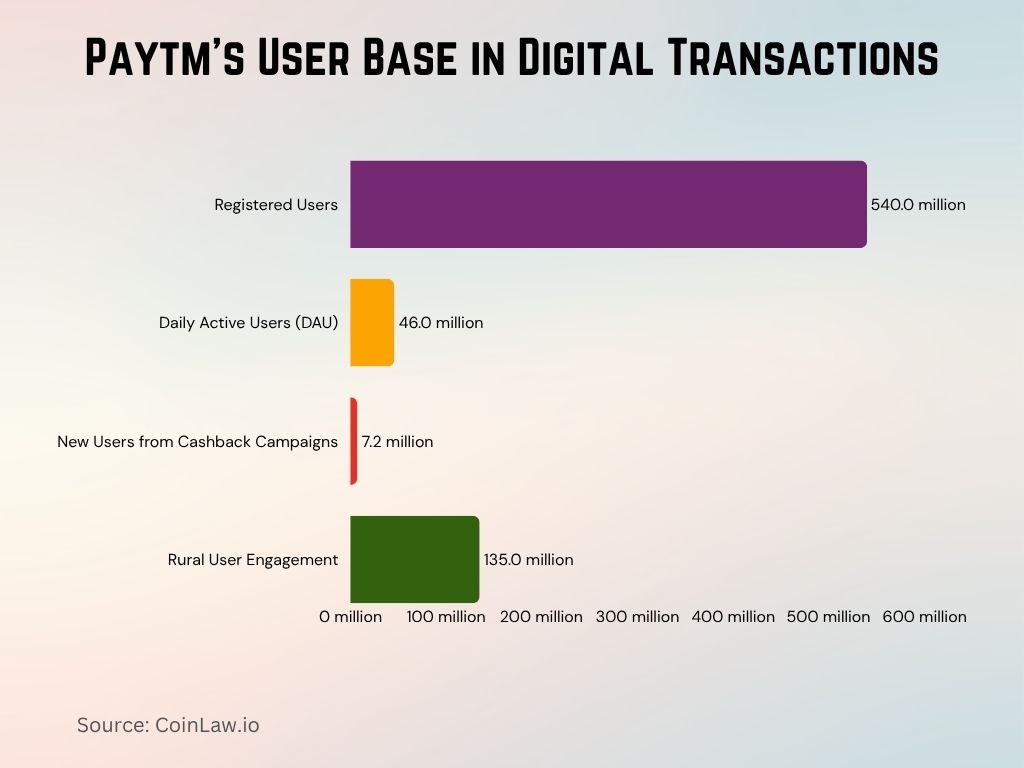

User Base and Engagement

- Paytm crossed 540 million registered users in 2025, solidifying its position as one of the largest global digital payment platforms.

- Daily active users (DAU) rose to 46 million, reflecting a 15% year-over-year growth from 2024.

- Average session time reached 24 minutes per user, showing deeper in-app engagement.

- User retention hit 93% among transacting users over the past six months, reinforcing Paytm’s strong loyalty metrics.

- 7.2 million new users joined via cashback campaigns in Q1 2025, boosting acquisition through rewards-based strategies.

- UPI transaction volume exceeded 9.5 billion in Q1 2025, highlighting Paytm’s leading role in real-time payments.

- Rural user base climbed to 135 million, with a 28% increase in rural engagement, driven by offline merchant integration.

Common Metrics

- Paytm Payments Bank deposits reached ₹1.85 trillion in Q2 2025, reflecting a 23% year-over-year growth.

- Customer satisfaction index climbed to 90%, signaling continued improvements in service quality and user trust.

- QR code payments made up 68% of all merchant transactions, with rising usage in tier 2 and rural markets.

- Average ticket size increased by 17% to ₹492 per transaction, driven by higher consumer spending and utility usage.

- Annual bill payments processed exceeded 2.5 billion, growing at a 21% YoY rate across telecom, utilities, and broadband.

- Recharge transactions hit 340 million in Q1 2025, remaining a key contributor to Paytm’s revenue diversification.

- Marketplace shoppers reached 39 million monthly, with a 42% product conversion rate, strengthening its commerce ecosystem.

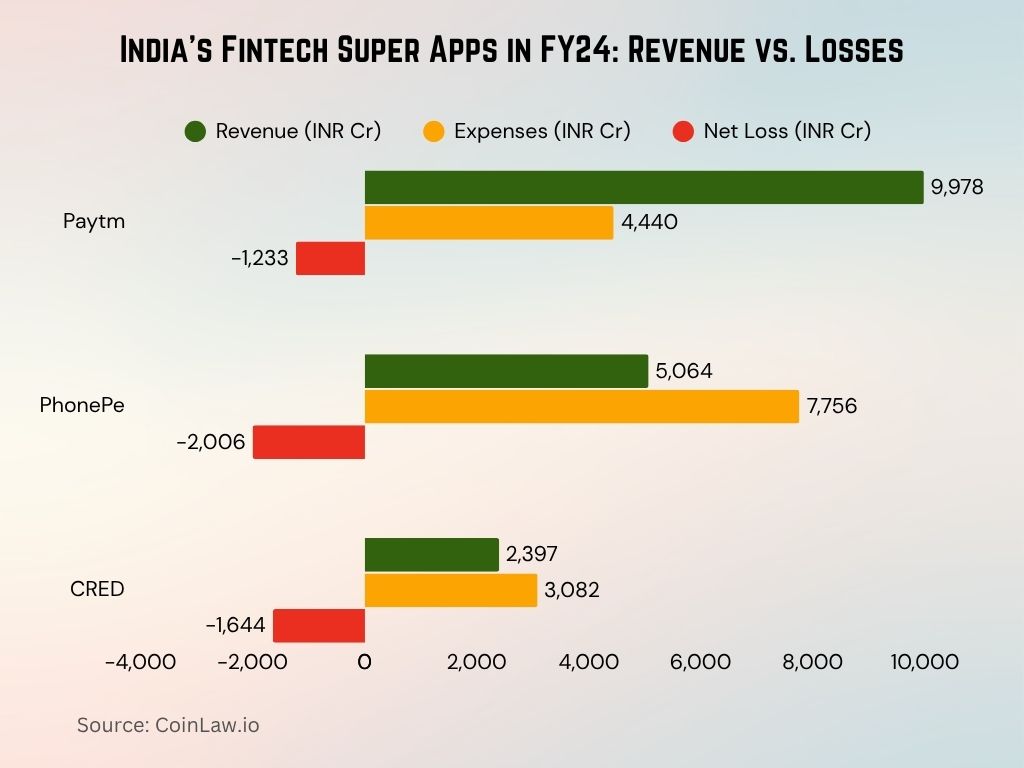

India’s Fintech Super Apps in FY24: Revenue vs. Losses

- Paytm reported a revenue of INR 9,978 Cr, with expenses at INR 4,440 Cr, leading to a net loss of INR 1,233 Cr in FY24.

- PhonePe generated INR 5,064 Cr in revenue, but its expenses soared to INR 7,756 Cr, resulting in a net loss of INR 2,006 Cr.

- CRED posted revenue of INR 2,397 Cr, while its expenses totaled INR 3,082 Cr, causing a net loss of INR 1,644 Cr.

Payment Services Overview

- Paytm UPI processed over 12.4 billion transactions in H1 2025, marking a 24% YoY growth from 2024.

- QR-based payments expanded to 23 million merchants, with stronger reach in tier-2, tier-3, and rural regions.

- Paytm Wallet held a 28% market share, processing ₹4.4 trillion in transactions during Q2 2025.

- Credit card issuance grew 55%, reaching 5.4 million active users and expanding financial product adoption.

- More than 56% of offline stores in India now accept Paytm, reinforcing its retail dominance.

- Bus ticketing revenue rose by 31%, driven by increased travel demand and cashback-based loyalty campaigns.

- International remittance volume grew 37%, with usage rising among NRIs and global freelancers.

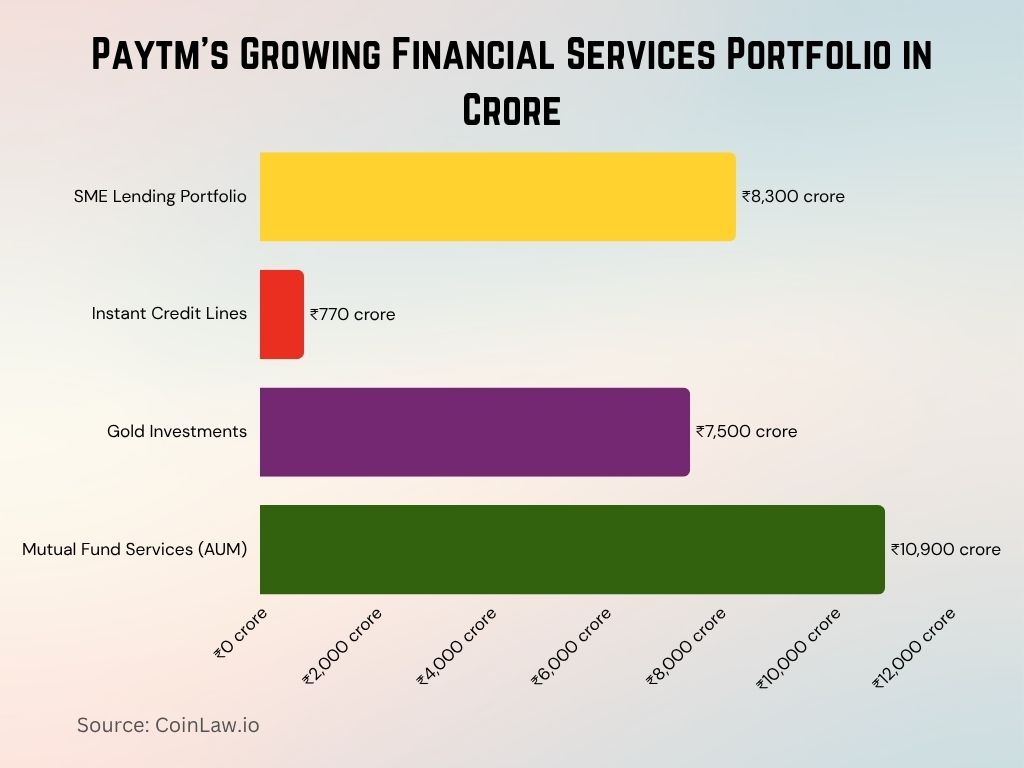

Loan Distribution and Financial Services

- Paytm disbursed ₹22,700 crore in loans in 2025, showing a 26% growth over the previous year.

- Personal loan disbursements rose 48%, serving 1.7 million active borrowers across urban and semi-urban regions.

- SME lending portfolio expanded to ₹8,300 crore, empowering over 260,000 small businesses with working capital access.

- Instant credit lines crossed ₹770 crore in Q1 2025, reflecting increased demand for real-time micro-credit.

- Gold investment users reached 6.4 million, with assets under management totaling ₹7,500 crore on the platform.

- Paytm Insurance covered 13.2 million policyholders, contributing ₹1,950 crore in premium collections for health, life, and auto segments.

- Mutual fund services grew 36%, crossing ₹10,900 crore in assets under management (AUM) by mid-2025.

Cyber-Safety

- Paytm’s fraud detection system blocked ₹3,500 crore worth of suspicious transactions.

- Biometric authentication adoption surged, with over 25 million users activating fingerprint login for added security.

- AI-powered algorithms reduced transaction failures to less than 1%, ensuring seamless service.

- Paytm’s “Safe Payments Week” initiative reached 10 million users, educating them on secure online practices.

- Regular penetration testing ensures 99.99% uptime, reinforcing the platform’s reliability.

- The platform launched a fraud helpline, resolving over 90% of reported cases within 24 hours.

- Over 5,000 new cyber safety specialists were hired to enhance security operations.

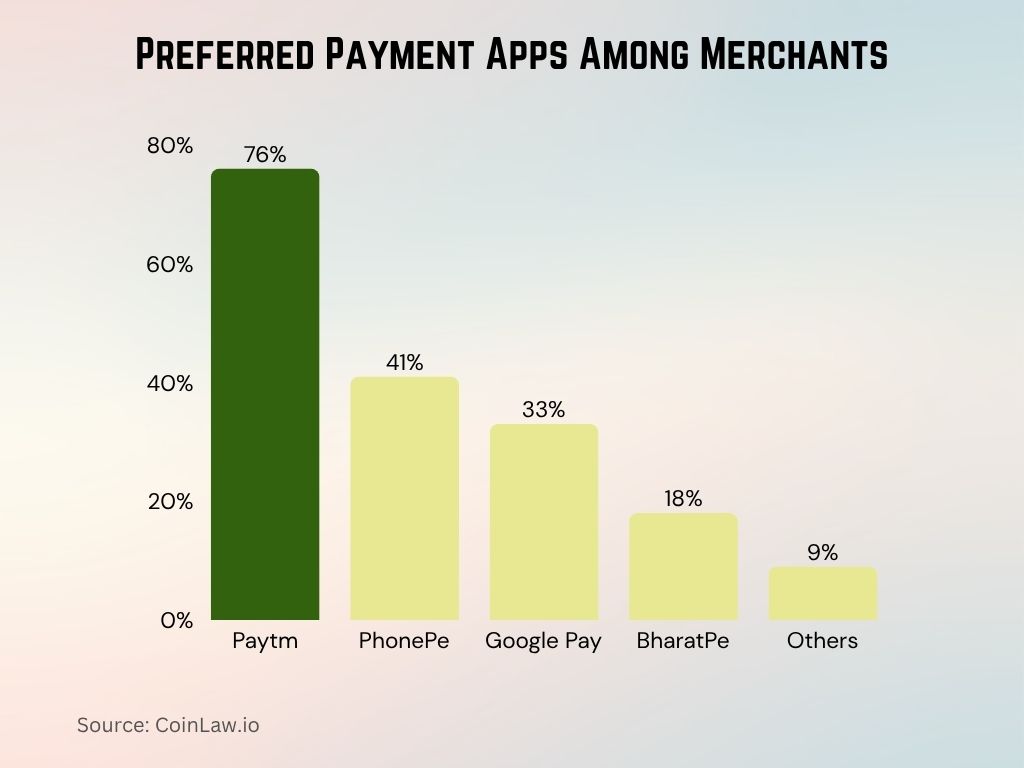

Preferred Payment Apps Among Merchants

- 76% of merchants surveyed are using Paytm to accept payments from customers ,the most used app in the study.

- PhonePe is used by 41% of merchants, making it the second most popular choice.

- Google Pay is used by 33%, reflecting a solid presence among merchant payment solutions.

- 18% of merchants rely on BharatPe, indicating a smaller market share compared to top players.

- 9% of merchants use other apps, showing limited adoption beyond the major players.

Conclusion

As Paytm continues its leadership in the fintech space, its advancements in payments, lending, and cyber-safety set a high benchmark for the industry. With record-breaking user engagement, impressive financial performance, and a commitment to innovation, Paytm is not only reshaping the digital payments landscape but also empowering millions across India and beyond. By leveraging technology and maintaining its customer-first approach, Paytm remains a driving force in India’s digital economy. The future looks bright as the platform expands its footprint and strengthens its impact on users and businesses alike.