Imagine walking into a store and making a payment without ever sharing your actual credit card number. That’s the promise of payment tokenization, a method that’s reshaping how we think about digital security. With fraud on the rise and industries moving toward seamless, secure payment methods, tokenization has become the cornerstone of modern commerce. In this article, we’ll explore the statistics and trends shaping payment tokenization, offering a window into its transformative potential.

Editor’s Choice

- 60% of merchants use tokenization in 2025 to secure customer payment data.

- The global payment tokenization market size is projected at $3.95 billion in 2025 with a CAGR of 18.3%.

- Over 70% of financial institutions continue to report reductions in payment fraud after implementing tokenization technology.

- Apple Pay and Google Pay now account for 60% of all mobile tokenized payments.

- In 2025, 35% of all transactions are estimated to be tokenized, with Visa reporting 50% of its e-commerce volume using network tokens.

- Tokenization now secures 89% of NFC-based payments globally to enhance contactless security.

- EMV tokenization standards are adopted by 90% of global card issuers.

Tokenization Global Market Report

- In 2025, the market is projected to $4.1 billion, reflecting steady expansion as enterprises and SMEs adopt tokenization to reduce fraud risk. This year signals tokenization becoming mainstream in payment systems.

- By 2026, the market is estimated to exceed $5.2 billion, fueled by regulatory support and growing use in cloud-native platforms. This growth shows tokenization shifting from niche to essential infrastructure.

- The 2027 market projection is around $6.6 billion, highlighting acceleration driven by BNPL platforms, e-commerce, and cross-border payments. Adoption at this stage is propelled by scalable, API-driven solutions.

- In 2028, the market is expected to reach nearly $8.3 billion, underpinned by demand from banking, fintech, and real-time payments ecosystems. The technology’s role in securing transactions at scale becomes indispensable.

- By 2029, the tokenization market is forecasted to hit $10.46 billion, more than tripling its 2024 value. This reflects a strong 26.4% CAGR, showing tokenization’s sustained momentum as a global security standard.

Tokenization Market Analysis

- The global tokenization market is valued at $4.13 billion in 2025, with forecasts pointing toward $12.8 billion by 2032.

- The BFSI sector accounts for 29.6 % of tokenization revenue in 2025, making it the largest vertical.

- SMEs are seeing rapid growth with a ~18 % increase in tokenization adoption in 2025.

- Tokenization‑as‑a‑Service (TaaS) models grew by 25 % in 2025 as businesses sought scalable solutions.

- The mobile payments industry, valued at $3.5 trillion, now relies heavily on tokenization for secure transactions.

- Tokenization for IoT payments is projected to grow at a 16 % CAGR from 2025 onward.

- 80 % of enterprises are now expected to use tokenization for payment data security in 2025.

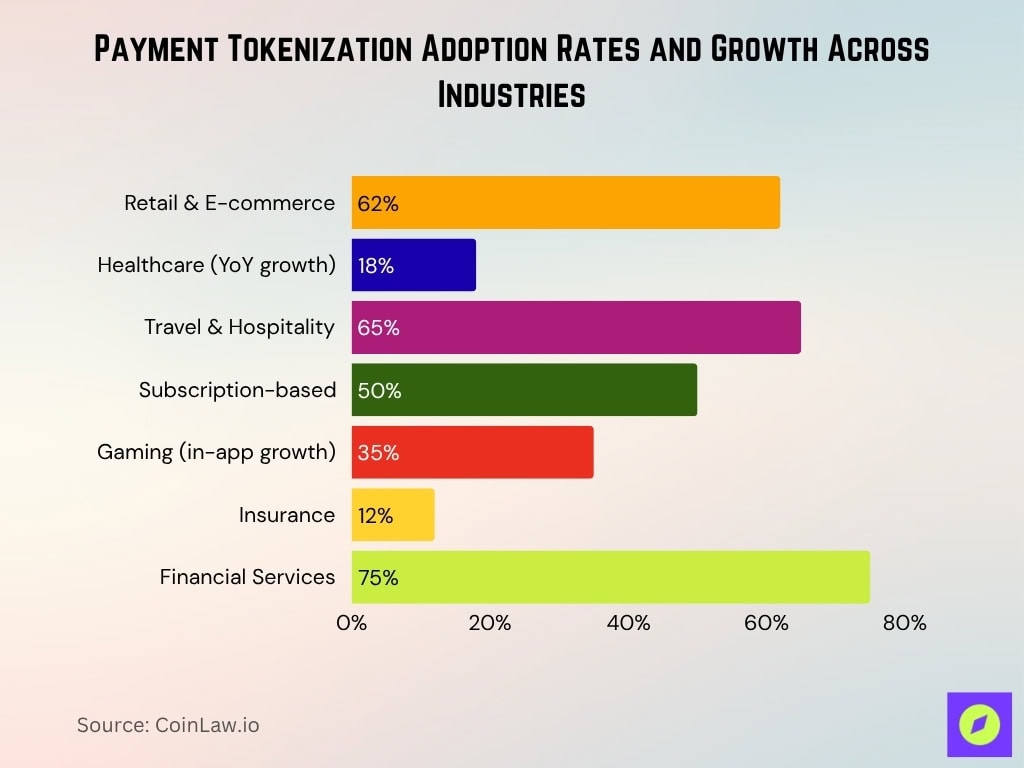

Adoption Rates Across Industries

- Retail and e‑commerce lead with ~62% of merchants using tokenization in 2025 to secure customer data.

- The healthcare sector saw a year‑on‑year adoption growth of ~18% in 2025, protecting patient payment data.

- 65% of travel and hospitality businesses use tokenization in 2025 to secure online bookings and payments.

- Tokenization is now integral to 50% of subscription‑based businesses in 2025, reducing churn from failed payments.

- In gaming, tokenized in‑app purchases grew by 35% in 2025, driven by microtransactions.

- The insurance sector experienced a 12% rise in tokenized payments in 2025, streamlining premium collections.

- 75% of financial services providers use tokenization in 2025 to protect online and in‑branch transactions.

Tokenization vs Encryption

- Tokens replace sensitive data with non‑sensitive values in 2025, while encryption transforms data into unreadable ciphertext.

- Unlike encryption, which can be reversed with a key, tokens hold no intrinsic value, making them useless if stolen.

- 50% of businesses prefer tokenization in 2025 for payments due to its cost‑effective compliance with PCI DSS.

- Encryption may leave residual risk if keys are compromised, whereas tokenization ensures data is fully removed from exposed systems.

- Tokenization now reduces the scope of data breaches by 65% offering a safer alternative for sensitive payment information.

- Dynamic tokenization, where tokens change after each use, offers 25% higher security in mobile payments compared to static encryption.

- In healthcare, 60% of hospitals now use tokenization over encryption to secure patient payment data in 2025.

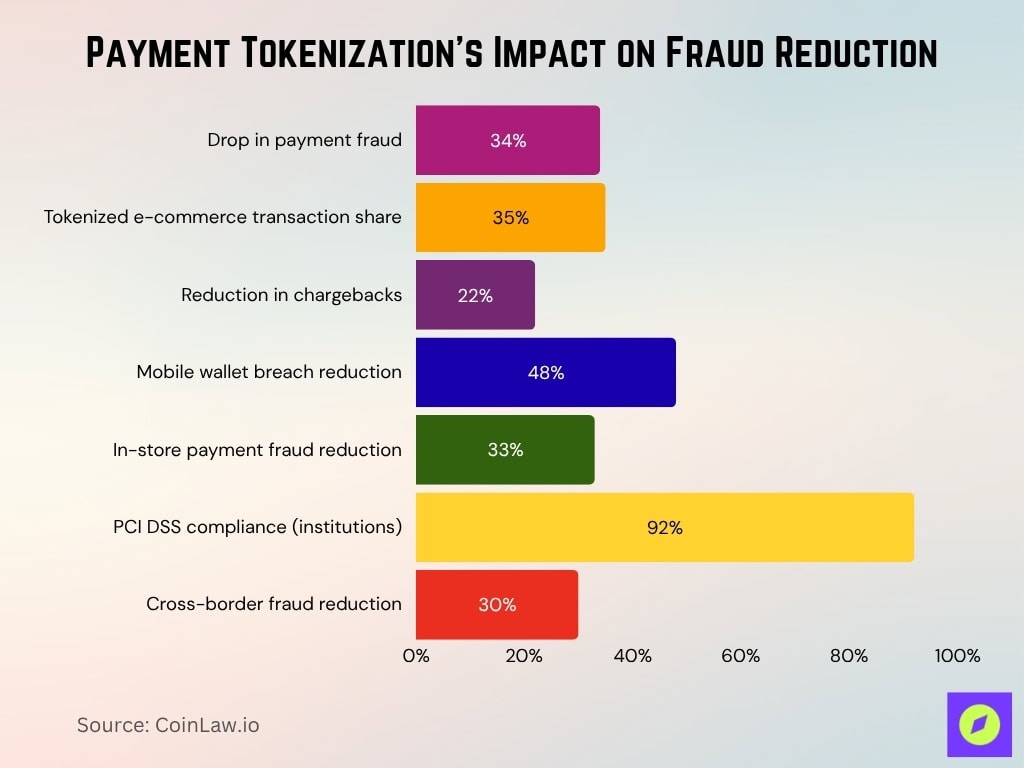

Impact on Fraud Reduction

- Businesses using tokenization now report a 34% drop in payment fraud compared to traditional security measures.

- In 2025, tokenized transactions account for 35% of all e‑commerce payments, reducing fraud‑related chargebacks by 22%.

- Global credit card fraud losses fell to $18 billion in 2025, thanks to tokenization and EMV chip adoption.

- Mobile wallet providers leveraging tokenization have reduced data breaches by 48% over the past two years.

- Tokenization in point‑of‑sale systems has cut in‑store payment fraud by 33% in 2025.

- 92% of financial institutions consider tokenization a core strategy for compliance with PCI DSS standards.

- Cross‑border tokenized transactions are now 30% less likely to incur fraud, making international payments safer.

Technological Innovations in Tokenization

- AI‑driven tokenization algorithms can now identify and tokenize sensitive data automatically, reducing human error by ~40% in 2025.

- Blockchain‑based tokenization is gaining traction for decentralized security in cross‑border payments and digital assets.

- Dynamic QR codes using tokenized payment data have improved transaction security by ~28% in 2025 in retail settings.

- Integration with biometric authentication systems has increased tokenized payment adoption by ~18% in 2025.

- Real‑time tokenization platforms now enable instant security even for very high‑volume e‑commerce transactions.

- Tokenization in wearables such as smartwatches saw a ~35% adoption surge in 2025, particularly in fitness and health tech.

- Innovations in contactless payments have accelerated tokenization in ~55% of transit systems worldwide by 2025.

Investments in Tokenized Real Estate

- In 2024, institutional investors plan to allocate 1.6% of their real estate portfolios to tokenized assets, while HNWIs allocate 5.6%. This shows that wealthy individuals are adopting tokenized real estate faster than large institutions at the early stage.

- By 2025, institutional allocations rise to 3.3% and HNWIs to 7.2%, signaling growing trust in blockchain-backed property assets. Adoption momentum suggests tokenization is moving from experimental to mainstream portfolio strategy.

- In 2026, institutional investors increase allocations to 4% while HNWIs reach 8.7%. This nearly doubles early adoption rates, highlighting rising demand for liquidity and fractional ownership in real estate.

- From 2027 and beyond, institutions are projected to commit 6% and HNWIs 10.2% of their portfolios to tokenized assets. This represents a 2–4x increase compared to 2024, underscoring tokenization’s role in transforming real estate investing.

Recent Developments

- In 2025, Visa launched an updated tokenization API for SMEs to simplify payment security for smaller businesses.

- In 2025, Mastercard expanded tokenized payment partnerships with fintechs to enter more emerging markets.

- Tokenization is now integral to ~50% of BNPL users globally in 2025, enhancing security.

- In 2025, the U.S. Federal Reserve issued updated guidelines endorsing tokenized systems for real‑time payments.

- Adoption of cloud‑native tokenization platforms grew ~30% in 2025, reflecting a shift toward flexible security.

- Tokenization enabled zero‑trust architectures now in use by ~65% of large enterprises in 2025.

- The travel and hospitality sector now integrates tokenization into ~80% of booking platforms in 2025, reducing reservation fraud.

Frequently Asked Questions (FAQs)

Approximately 18.3%

Up to 60% reduction in fraud.

Around 36.45%.

About 47% less likely.

Conclusion

The evolution of payment tokenization reflects the growing need for robust, scalable, and compliant payment security solutions in an increasingly digital world. With global adoption on the rise, tokenization is not just a technical safeguard but a strategic enabler for businesses to gain consumer trust and meet regulatory demands. The market is poised to double in size, fueled by technological innovations, increased awareness, and the need for frictionless transactions. Tokenization stands as a beacon of security in a landscape fraught with data vulnerabilities, ensuring safer digital interactions for years to come.