Pakistan has partnered with a firm linked to Donald Trump-backed World Liberty Financial to explore the use of the USD1 stablecoin in regulated cross-border payments.

Key Takeaways

- Pakistan signed a memorandum of understanding with SC Financial Technologies, a company affiliated with World Liberty Financial (WLFI), to explore integrating the USD1 stablecoin into its digital payment system.

- The collaboration focuses on regulated cross-border payments, especially remittances, with hopes of reducing costs and improving efficiency.

- This marks one of WLFI’s first partnerships with a sovereign state, coinciding with Pakistan’s rapid shift in cryptocurrency policy.

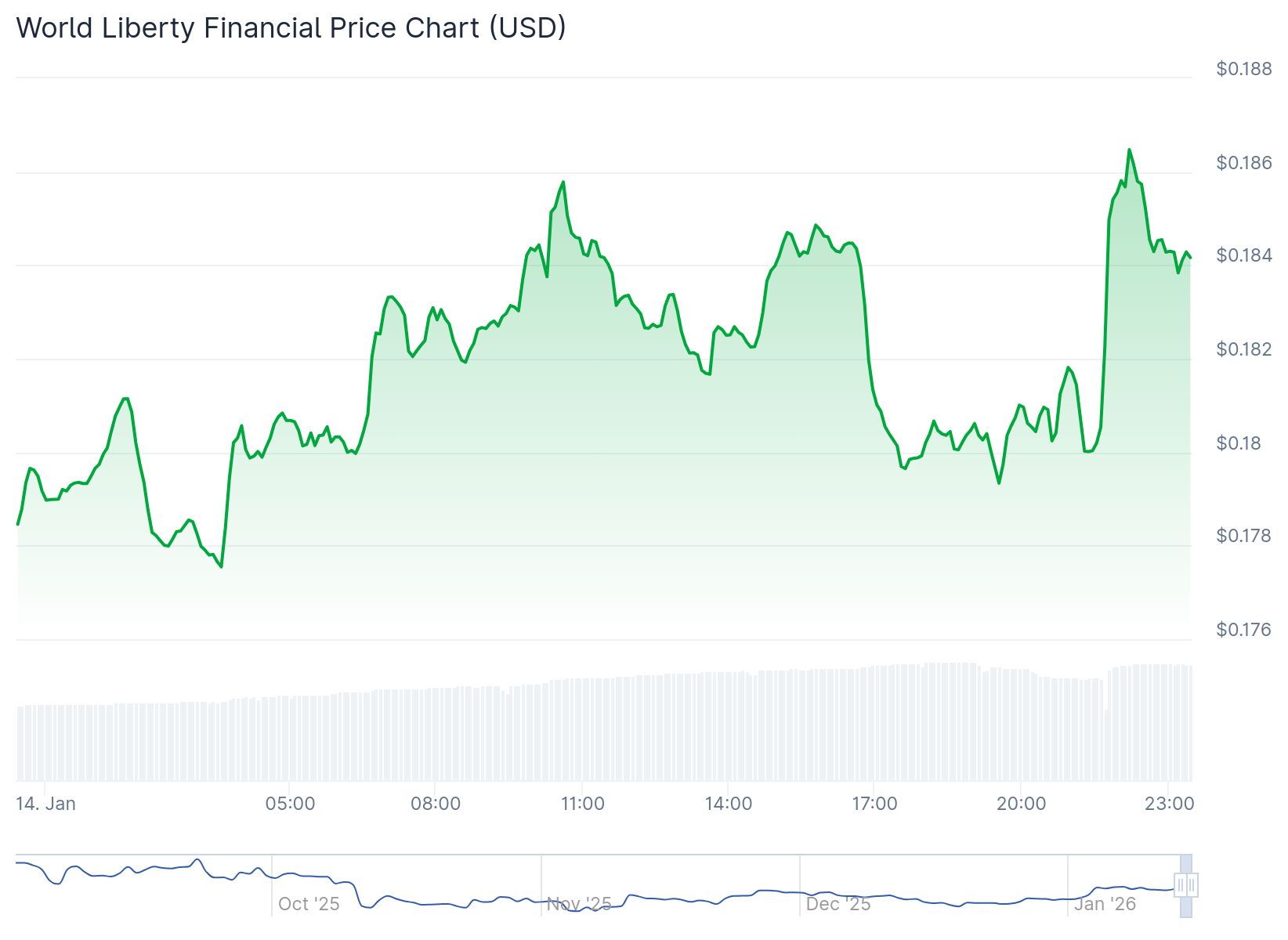

- The move sparked renewed interest in WLFI’s native token, which surged over 6 percent alongside a 65 percent spike in trading volume.

What Happened?

On January 9, Pakistan’s Virtual Asset Regulatory Authority (PVARA) signed a formal agreement with SC Financial Technologies to examine the use of WLFI’s USD1 stablecoin for international payments. This marks a significant step in Pakistan’s transformation from a crypto-skeptic nation to one actively exploring blockchain-based financial infrastructure.

LATEST: $WLFI | 🇵🇰 The Pakistan government (@PakistanVARA) has inked a cross-border stablecoin payment agreement with a $WLFI-asssociated company, SC Financial Technologies. pic.twitter.com/Qe48ugaPKT

— crypto.news (@cryptodotnews) January 14, 2026

Stablecoin Deal Signals Policy Pivot

Pakistan’s new partnership with SC Financial Technologies, an affiliate of World Liberty Financial, underlines a strategic pivot toward embracing digital finance. The USD1 stablecoin, backed by the U.S. dollar, is expected to operate within Pakistan’s regulated payment ecosystem, supporting compliant and transparent cross-border transactions.

Finance Minister Muhammad Aurangzeb emphasized Pakistan’s commitment to innovation within a stable regulatory environment. He said during the announcement:

WLFI CEO Zach Witkoff visited Islamabad to meet with top officials, including Prime Minister Shehbaz Sharif and the State Bank Governor. This high-level engagement reflects the importance of the partnership, which is being positioned as both technologically progressive and geopolitically significant.

Remittances Are the Primary Target

At the heart of this agreement is Pakistan’s drive to modernize how it handles remittances. Overseas Pakistanis send home more than 30 billion dollars annually, mostly through traditional banking systems that are slow and expensive. By integrating the USD1 stablecoin, officials aim to:

- Cut transaction fees

- Accelerate settlement times

- Enhance transparency and traceability

This could bring substantial benefits to millions of families who depend on remittance flows and also bolster the country’s foreign exchange reserves.

WLFI Sees Market Boost After Announcement

News of the Pakistan deal sent WLFI’s native token climbing. It rose over 6 percent to 0.1799 dollars, while trading volume jumped 65 percent to 270.12 million dollars. Over the past month, WLFI has gained nearly 30 percent, placing it among the more active mid-cap crypto assets.

This surge reflects growing investor confidence in WLFI’s global ambitions and its pivot toward real-world financial use cases.

Broader Crypto Reforms in Motion

Pakistan’s stance on digital assets has evolved quickly. Once wary of Bitcoin and cryptocurrencies, the government now actively discusses regulated mining, a national Bitcoin reserve, and central bank digital currency (CBDC) pilots.

The stablecoin initiative is part of a broader effort to draft comprehensive virtual asset regulations and integrate blockchain solutions into mainstream finance.

CoinLaw’s Takeaway

In my experience, few countries have flipped their crypto stance as swiftly and strategically as Pakistan. Just a couple of years ago, any crypto-related deal with the government would have seemed impossible. Now, they’re onboarding a U.S.-linked stablecoin for remittances. That’s not just innovation, it’s a financial leap.

I found it particularly interesting that the deal ties back to WLFI, a project with political ties in the U.S., indicating how crypto is becoming deeply embedded in global diplomacy and policy. If Pakistan can pull off stablecoin remittances at scale under a compliant framework, it may set a precedent for other developing nations looking to modernize without risking financial instability.