Nvidia stock received a major boost as Piper Sandler raised its price target to $225, citing strong AI chip demand and expanding revenue from China.

Key Takeaways

- 1Piper Sandler upgraded Nvidia’s price target to $225, citing solid demand from both U.S. and Chinese markets.

- 2China AI chip sales could generate $6 billion in October quarter revenue, with room for sustained 12-15% growth.

- 3Nvidia is expected to beat earnings again, fueled by hyperscaler capex and easing supply constraints.

- 4The stock has rebounded 93% in 2025 and now holds a $4.4 trillion market cap, the highest in the world.

What Happened?

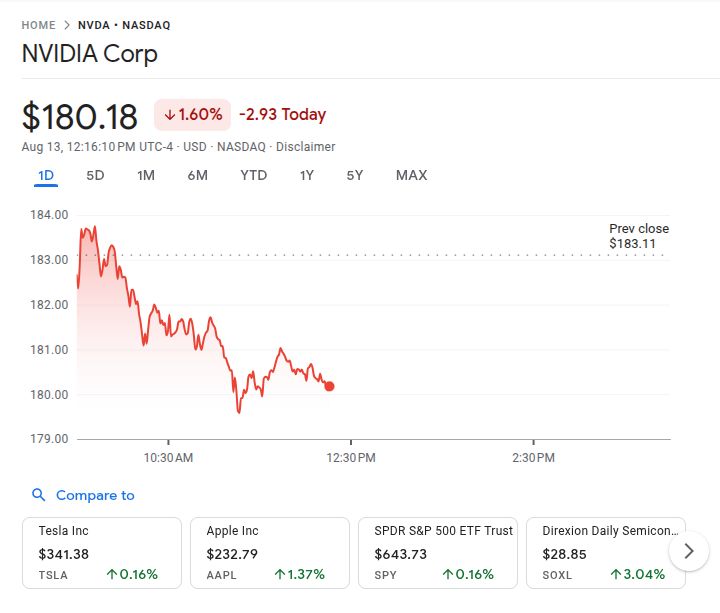

Nvidia stock got a bullish lift ahead of its upcoming earnings report after Piper Sandler raised its price target from $180 to $225. The firm cited robust demand for AI chips across both the U.S. and China, predicting upside in the July and October quarters.

Piper analysts pointed to growing investment from cloud providers and the reopening of Chinese revenue channels as major catalysts for Nvidia’s future performance.

Strong China Revenue Outlook

Piper Sandler projects that Nvidia could generate between $5.5 billion to $6.5 billion in revenue from China in the October quarter alone. Analysts noted that Chinese demand for AI chips is rebounding quickly, with expectations it could ramp to $10 billion by January 2026 and potentially reach $50 billion annually by fiscal 2027.

- This comes after Nvidia struck a deal with the U.S. government to resume shipping H20 chips to China, agreeing to pay 15% of related revenue to U.S. authorities.

- Though the agreement could trim Chinese gross margins by around 15%, Piper noted the H20 chip still carries competitive profitability at roughly 60% margin levels.

- Analysts expect this deal to unlock strong demand, as Chinese buyers race to secure supply amid ongoing geopolitical uncertainties.

U.S. Hyperscaler Capex Drives AI Infrastructure Boom

Nvidia continues to benefit from “elevated and resilient” capital spending by major U.S. cloud companies. Amazon Web Services, Google Cloud, Microsoft Azure, and Meta have all increased their AI infrastructure investments.

- Oracle, CoreWeave, and newer cloud platforms like Nebius Group are also adding to the demand for Nvidia GPUs.

- Piper estimates revenue for the July quarter will hit $45.1 billion, just shy of Wall Street’s $45.7 billion consensus, but noted Nvidia often posts modest upside beats.

Market Momentum and Valuation Support

Nvidia stock has surged 93% year-to-date following a steep decline early in 2025 due to tariff pressures and China market fears. The company now boasts a $4.4 trillion market cap, making it the world’s most valuable publicly traded company.

- Nvidia’s forward price-to-earnings (P/E) ratio continues to act as a technical support level, with the 24-30 range repeatedly marking stock rebound zones.

- Piper’s new $225 price target implies a 37x multiple, compared to Nvidia’s current 29.8x fiscal 2027 non-GAAP EPS estimate.

Blackwell Chips Fuel Future Growth

Nvidia’s latest Blackwell GPU architecture is already attracting strong enterprise interest. The RTX PRO 6000 Blackwell Server Edition will soon be integrated into standard servers from Cisco and Dell.

- Goldman Sachs maintained its Buy rating with a $200 target, citing the Blackwell rollout as a key growth driver.

- Nvidia’s earnings results are expected on August 27, with Wall Street anticipating another strong quarter.

CoinLaw’s Takeaway

This is one of those moments where I just have to say, Nvidia is absolutely crushing it. With China back in the picture and U.S. cloud giants still pouring money into AI, the runway for growth looks massive. I’m especially bullish on how they handled the export restrictions by quickly negotiating a path forward. That 15% revenue share deal could have been a roadblock, but instead, it’s opening billions in upside. If Nvidia nails their earnings again later this month, I wouldn’t be surprised to see more analysts raising their targets beyond $225.