Nvidia just became the first company in history to hit a $4.5 trillion market cap, following a massive surge in its stock price driven by booming AI infrastructure deals.

Key Takeaways

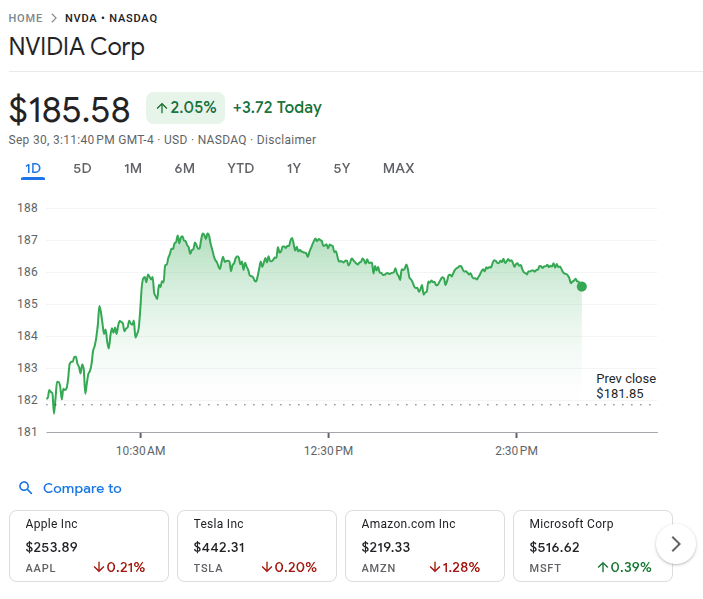

- Nvidia’s market cap soared past $4.5 trillion as its stock hit an all-time high of $187.35.

- The company announced a $100 billion equity stake in OpenAI, part of a broader $500 billion “Stargate” data center project.

- CoreWeave, partly owned by Nvidia, secured a $14.2 billion AI services deal with Meta.

- Analysts are bullish, with Citi raising Nvidia’s price target to $210 due to increased AI spending.

What Happened?

Nvidia’s shares surged nearly 3 percent, pushing its stock to a record high and lifting its market valuation above $4.5 trillion. This milestone cements Nvidia’s position as a dominant force in the artificial intelligence race, backed by massive new infrastructure deals with industry giants like OpenAI and Meta.

Nvidia $NVDA just became the first company ever to become worth more than $4.5 Trillion pic.twitter.com/SOmGjAsCDR

— Evan (@StockMKTNewz) September 30, 2025

AI-Powered Momentum Driving Nvidia’s Rally

Nvidia’s rise is powered by aggressive investments in artificial intelligence. OpenAI recently announced Nvidia would take an equity stake in the company worth up to $100 billion, while also committing to build hundreds of billions of dollars in AI data centers packed with Nvidia’s high-performance chips.

These new data centers are part of the “Stargate” project, a $500 billion initiative that includes five large facilities being developed in partnership with Oracle. Each facility is expected to deploy hundreds of thousands of Nvidia GPUs, underscoring Nvidia’s central role in the global AI infrastructure buildout.

According to Nvidia CEO Jensen Huang, 70 percent of the cost of building a new AI data center is tied directly to Nvidia’s technology, reflecting the company’s unmatched position in the market.

More Big Deals and Analyst Optimism

Nvidia’s momentum does not stop with OpenAI. CoreWeave, a cloud infrastructure firm in which Nvidia holds a stake, just inked a $14.2 billion deal with Meta to provide AI computing services. This adds another layer of strategic importance to Nvidia’s role in the future of AI.

In response to these developments, Citigroup raised its price target on Nvidia’s stock from $200 to $210, citing growing AI infrastructure demand. The investment bank noted that Nvidia’s product strength and the increasing compute load per user make it a top choice for companies ramping up AI capabilities.

Citi analyst Atif Malik wrote:

Analysts Are All In on Nvidia

The market is clearly bullish on Nvidia. Among 38 Wall Street analysts, the stock has a consensus rating of “Strong Buy”, with 35 issuing Buy recommendations. The average price target sits at $212.78, suggesting nearly 20 percent upside from current levels.

Nvidia’s stock has climbed nearly 39 percent year-to-date, outperforming all other megacap tech companies except Broadcom, which has also been buoyed by AI growth.

CoinLaw’s Takeaway

In my experience watching tech giants rise, Nvidia’s current run is absolutely historic. The numbers are staggering. A $4.5 trillion valuation, a $100 billion OpenAI deal, and even $14.2 billion in Meta contracts all signal that Nvidia is not just riding the AI wave, it is shaping it. What stands out most to me is the way Nvidia has managed to position itself as the indispensable engine behind AI’s future, from data centers to deep learning tools. If this pace keeps up, we may be witnessing the birth of the most important hardware company of the decade.