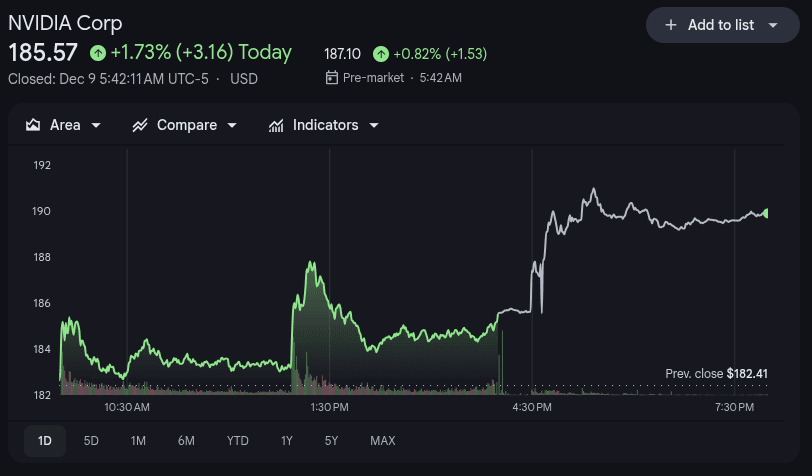

NVIDIA’s stock saw a lift after US President Donald Trump approved the sale of its H200 AI chips to select customers in China, under strict national security conditions and a unique 25% revenue-sharing rule. At the time of writing this article, NVIDIA shares are trading at 185.57 USD, up by 3.16 points or 1.73%.

Key Takeaways

- Trump has authorized NVIDIA to sell H200 AI chips to approved Chinese customers, reversing prior restrictions.

- Sales are subject to a 25% tariff, benefiting the US government directly from each transaction.

- The Department of Commerce will vet all buyers, ensuring national security remains a top priority.

- NVIDIA stock climbed 1.73% following the announcement, reflecting cautious investor optimism.

What Happened?

The Biden administration had previously barred sales of high-performance chips to China over fears of military misuse. On Monday, President Trump reversed that position, confirming that NVIDIA can export H200 AI chips to China and other jurisdictions under a new agreement with Chinese President Xi Jinping.

The deal includes a condition that 25% of revenue from these chip sales will go to the United States, creating a revenue stream for American taxpayers. Sales will be allowed only to vetted customers, with oversight from the US Department of Commerce.

The US has reportedly decided to approve exports of NVIDIA’s H200 chip to China.

— Tim Fist (@fiiiiiist) December 8, 2025

This gives Chinese AI labs chips that outperform anything China can make until ~2028.

How big a deal this is depends on how many we export.

Thread with key charts from our new report… pic.twitter.com/bc2poxLmxx

Trump’s Policy and Export Conditions

President Trump announced the new arrangement via Truth Social, stating, “President Xi responded positively! 25% will be paid to the United States of America.” He emphasized the goals of protecting national security, boosting US manufacturing, and supporting American jobs.

The chips will be shipped from manufacturing sites in Taiwan to the US for inspection before being delivered to approved customers in China. Trump confirmed that the same approach would apply to AMD, Intel, and other major US chipmakers.

The current 25% requirement is an increase from the 15% revenue share NVIDIA and AMD agreed to earlier this year. Trump also blamed the previous administration for pushing US companies to make “degraded” chips for the Chinese market, which he argued slowed innovation and hurt American workers.

What Chips Are Included?

This policy applies only to NVIDIA’s H200 chips, not the company’s most advanced Blackwell or upcoming Rubin processors. Those next-generation GPUs, which are critical for training high-end generative AI models, remain exclusive to US clients.

The H200 is a generation more powerful than NVIDIA’s earlier H20 model but still lags behind the most advanced systems. Analysts believe this positions the deal as a strategic middle ground, allowing US firms access to China’s AI market while avoiding the transfer of top-tier capabilities.

Industry Response and Market Reaction

NVIDIA has praised the move, saying, “Offering H200 to approved commercial customers, vetted by the Department of Commerce, strikes a thoughtful balance that is great for America.”

The company’s shares saw a modest bump of 1.73%, reflecting investor confidence in the potential revenue from renewed access to the Chinese market. CEO Jensen Huang has been actively lobbying for such a deal and warned earlier that overregulation would only accelerate China’s domestic chip development, benefiting rivals like Huawei.

However, not all reactions have been positive. Critics such as Senator Elizabeth Warren called the move a backroom deal that could indirectly aid China’s military advancement. Cole McFaul, a senior research analyst at Georgetown’s CSET, warned that access to H200 chips could “enable China to more easily use and deploy AI systems for military applications.”

Geopolitical and Economic Impact

The announcement comes amid an ongoing strategic rivalry between the US and China over semiconductor dominance. Trump and Xi met in South Korea earlier this year, where China agreed to pause retaliatory actions against US chip firms, paving the way for this export deal.

China still holds a near-monopoly on rare earth mineral processing, which is critical to global electronics manufacturing. Some analysts believe this chip sale arrangement buys time for the US to negotiate broader supply chain agreements and reduces the risk of sudden disruptions.

While Chinese firms may benefit from access to the H200, experts expect Beijing will continue efforts to reduce reliance on US technology, pushing for locally produced alternatives.

CoinLaw’s Takeaway

In my experience, this deal is one of the more creative workarounds we’ve seen in the tech cold war between the US and China. On the surface, it looks like a loosening of restrictions, but make no mistake, the US government just inserted itself into chip commerce with a 25% cut. That’s a power move.

I found it particularly smart that the arrangement keeps America’s most advanced AI chips locked down while still giving companies like NVIDIA a way to earn from the world’s second-largest AI market. At the same time, we can’t ignore the national security concerns. Striking this balance is risky, but given how far China has come with firms like Huawei and DeepSeek, the US needs leverage and this might just be it.