The world of non‑fungible token (NFT) royalties is evolving rapidly as creators, platforms, and collectors rethink how value is captured and distributed. From music artists earning ongoing payments to gaming studios leveraging digital assets for new revenue streams, the mechanism of royalty payments is shaping how NFTs function in practice. Two examples illustrate the impact: a musician releasing an album as NFTs with built‑in royalty streams and a gaming publisher selling in‑game items that carry a resale royalty to the studio. Explore the full article to understand the latest data and trends in NFT royalties..

Editor’s Choice

- 80%+ of NFT contracts now enforce royalties automatically in 2025.

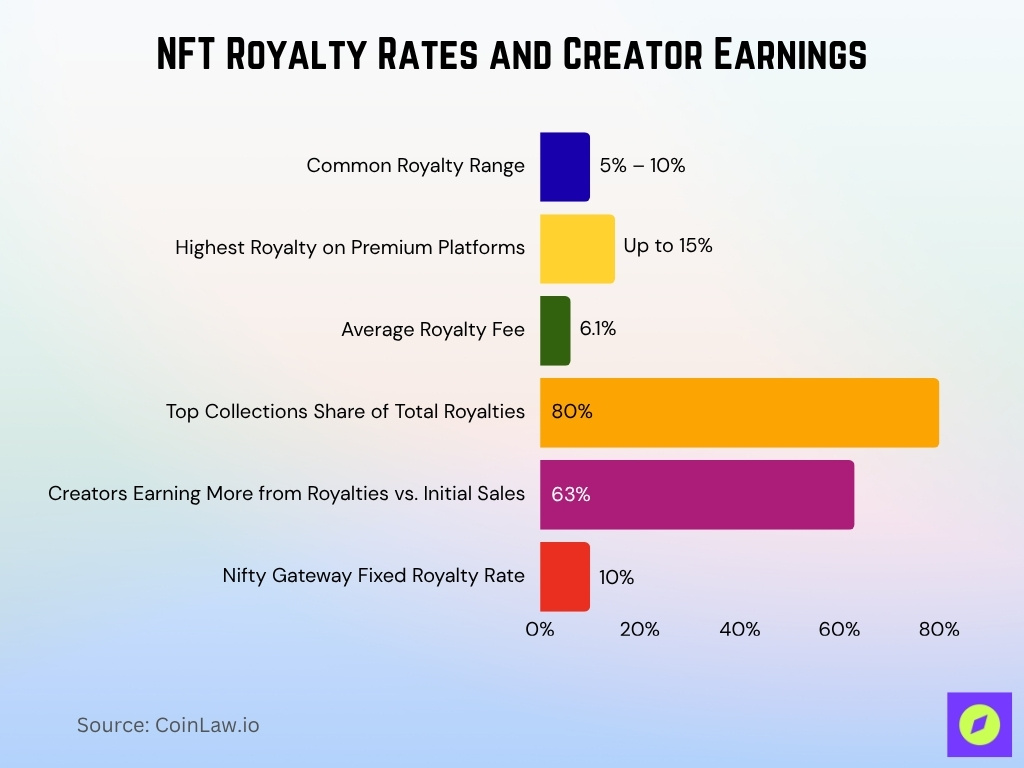

- The average royalty fee across leading NFT platforms is 6.1% in 2025, but the mean rate across collections is 7.3% with significant variance.

- On the Galaxy Digital tracker, Ethereum‑based creators have earned more than $1.8 billion in royalties to date.

- Over 63% of creators report earning more from secondary sale royalties than from initial mintings.

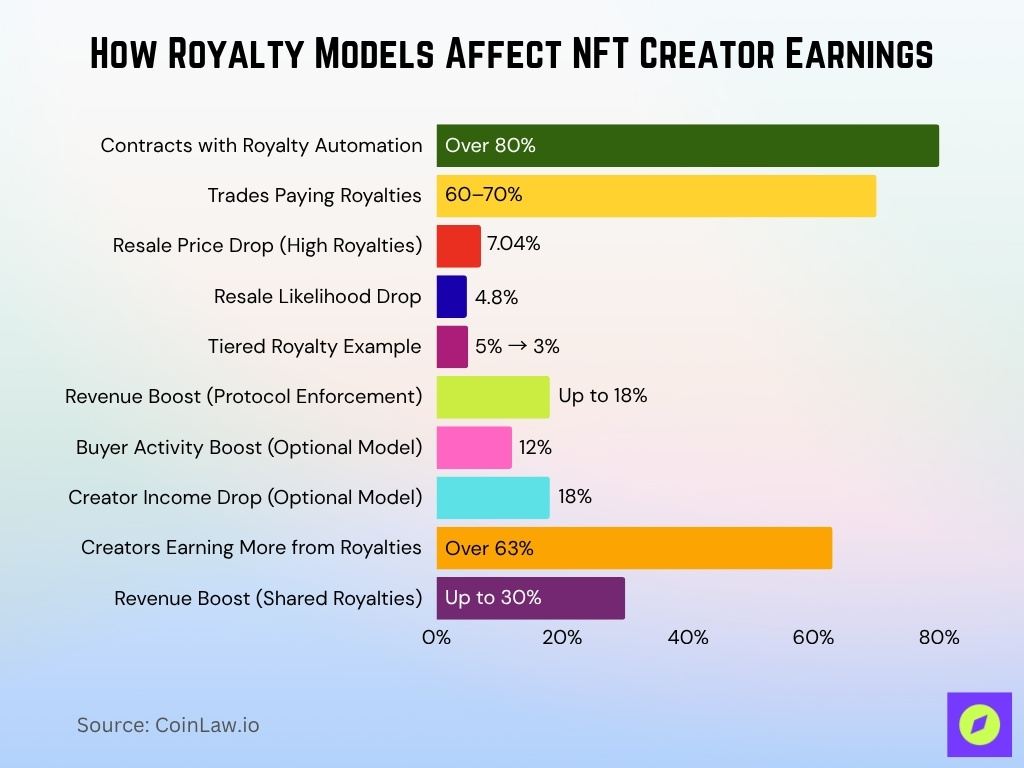

- A one‑standard‑deviation increase in royalty rate correlates with a 7.04% lower resale price for NFTs.

- In Q3 2025, the overall NFT trading volume reached $1.58 billion with 18.1 million transactions, signalling renewed activity.

- Optional royalty models (where marketplaces allow buyers to set the royalty to zero) are rising, complicating creator income forecasts.

Recent Developments

- In 2025, the global NFT market’s annualised trading volume is expected to land between $5 billion and $6.5 billion.

- Market infrastructure is shifting. Q3 saw trading activity rebound with 18.1 million sales, up from earlier periods.

- Collectibles and utility assets are overtaking pure speculative art drops in driving royalty flows.

- More marketplaces are enforcing royalties by default, rather than relying on voluntary compliance.

- Studies show that higher royalty rates can reduce liquidity, and resale probability falls by about 4.8% with higher rates.

- The number of creators who now rely on secondary sale royalties as a major revenue source has grown to over 60%.

- Some platforms are experimenting with dynamic royalty models (tiered percentages, co‑creator splits) to adapt to market behaviour.

What Are NFT Royalties?

- Most NFT projects set royalty rates between 5% and 10%, though some platforms still feature rates up to 15% for premium.

- The average NFT royalty fee across platforms is about 6.1% in 2025.

- 428 NFT collections accounted for 80% of all royalties earned by creators.

- 63% of NFT creators report earning more from secondary sales royalties than from initial sales.

- Marketplaces like Nifty Gateway enforce a fixed 10% royalty on all secondary sales.

- An NFT royalty is a percentage of the resale value of a token paid to the original creator each time it is resold.

- Ethereum-based NFT creators earned $920 million in royalties in 2025 alone, with cumulative payouts now exceeding $1.8 billion.

- Blur and OpenSea’s optional royalty structures caused a 12% increase in buyer activity but reduced creator revenue by 18%.

- Initial sales revenue goes mostly to creators, while royalties capture ongoing income from secondary market activity.

NFT Royalty Revenue by Platform

- In 2025, creators on Ethereum‑based platforms earned over $920 million in royalties, with enforcement built into more than 80% of contracts.

- The average royalty fee across platforms has stabilized at around 6.1% of the resale value.

- Platforms offering optional royalty waivers (e.g., allowing buyers to skip paying royalties) saw buyer activity increase by ~12%, but creator revenue dropped by about 18%.

- Marketplaces reported a blend of primary sales income and secondary royalty income. One survey found 63% of creators now earn more from secondary sales than from initial minting.

- A study shows that each one‑standard‐deviation increase in royalty rate correlated with a 7.04% decrease in resale price and a 4.8% drop in probability of resale.

- Some niche platforms report that royalty payouts (smart‑contract enforced) now exceed $1.8 billion in cumulative creator payments historically.

- Data suggest that between 2024 and 2025, the share of revenue coming from secondary royalties grew by an estimated 10‑15 percentage points for active creators.

- Despite large volumes, many smaller creators still report zero royalty income because their tokens never enter the resale market or are traded on royalty‑non‑enforcing platforms.

How Do NFT Royalties Work?

- A creator mints an NFT and sets a royalty percentage coded into the smart contract or metadata.

- Over 80% of NFT contracts deploy automated royalty enforcement, yet only 60–70% of secondary trades reliably pay royalties due to platform fragmentation.

- Higher royalties cause a 7.04% decrease in NFT resale prices and a 4.8% drop in resale likelihood.

- Tiered royalty models like 5% then 3% are becoming more common among NFT projects.

- Marketplaces enforcing royalties at the protocol level see up to 18% higher long-term creator revenue.

- Optional royalty marketplaces increased buyer activity by 12% but lowered creator income by 18%.

- Over 63% of NFT creators earned more from royalties on secondary sales than from initial mints.

- Some platforms split royalties among co-creators, collaborators, and influencers, increasing revenue sharing by up to 30%.

- Enforcement failure in certain marketplaces leaves creators with 0% royalty payments despite smart contract terms.

Top NFT Marketplaces by Royalty Payments

- OpenSea remains one of the largest marketplaces, spanning many blockchains, and is estimated to handle the lion’s share of royalty‑enabled secondary trades in 2025.

- Rarible continues to emphasize creator‑first policies and supports multi‑chain royalty enforcement via standardized metadata and smart contracts.

- Magic Eden handles 48% of Solana NFT trade volume in Q1 2025, with Solana collections earning $374K in weekly royalties (55% of blockchain royalty share).

- Platforms such as SuperRare and Foundation (curated/art‑focused) report royalty rates at the higher end of the spectrum (often > 7%) and longer‑tail secondary trading.

- A comparative survey found that marketplaces enforcing royalties default see secondary resale volume per token 9–12% higher than those with optional royalty mechanisms.

- Some marketplaces are now using royalty “splits” (e.g., original creator + project fund + platform) where ~5% goes to the creator, ~2.5% to the project, and ~1% to the platform.

Most Profitable NFT Projects by Royalties

- Select high‑profile collections have generated multiple millions of USD in royalty payments alone from secondary trades; for example, cumulative creator royalties from Ethereum collections exceed $1.8 billion.

- Projects that combine utility (games, memberships) with NFTs tend to yield higher royalty income because of more frequent resale activity and built‑in contract clauses.

- Some gaming‑NFT projects report that royalty income (after platform cuts) now makes up 20‑30% of overall creator income for those series.

- The “long tail” of thousands of smaller projects still sees minimal secondary royalty income; median creator royalty income remains below $1,000/year for the bottom 80% of collections.

- Collections that adopt dynamic royalty models (e.g., 5% on first resale, 3% thereafter) are seeing slightly improved long‑term revenue compared to single‑rate models.

- The concentration of royalty income is high; the top 10% of projects capture ~70% of all royalty income across marketplaces.

- Some large brand‑collaboration NFT drops (e.g., fashion, entertainment) saw royalty yields over 8%, but also had higher initial mint splits, reducing the portion attributable to secondary.

NFT Global Market Growth Highlights

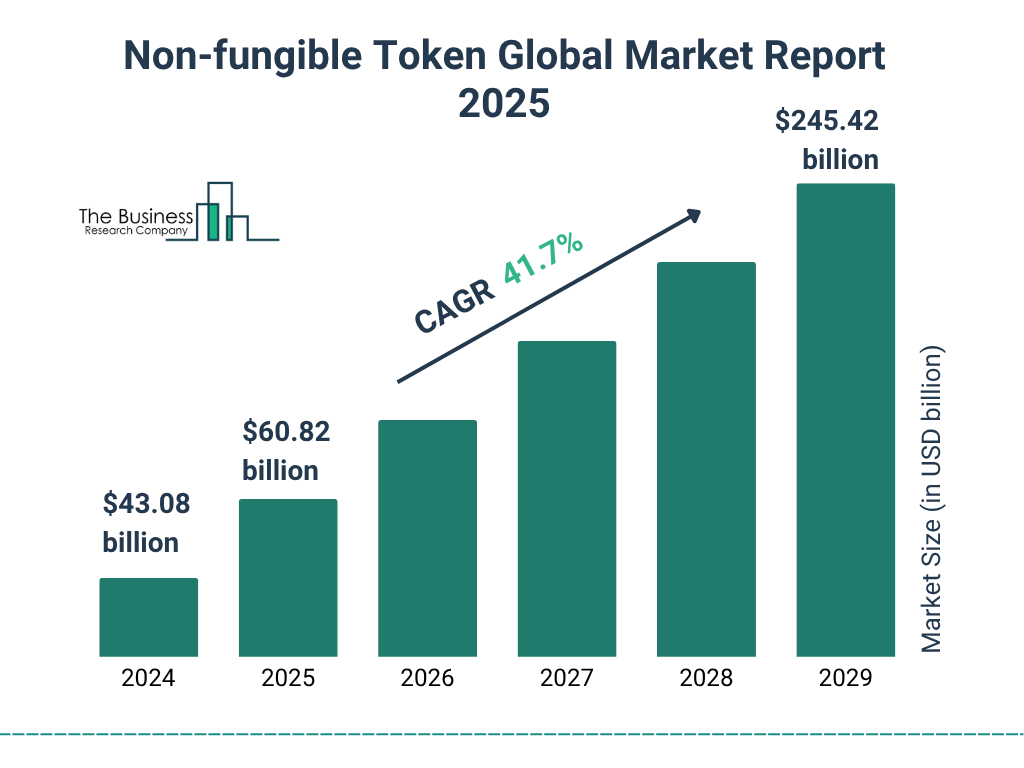

- The global NFT market is projected to grow from $43.08 billion in 2024 to $245.42 billion by 2029.

- This reflects a Compound Annual Growth Rate (CAGR) of 41.7%, indicating rapid expansion across sectors.

- In 2025, the market is expected to reach $60.82 billion, showing strong year-over-year momentum.

- By 2029, the market size is forecast to be more than 5.6 times larger than in 2024.

- This growth is driven by increased adoption in gaming, collectibles, digital art, music rights, and royalty-enforced smart contracts.

Leading NFT Collections by Royalties Earned

- The mean NFT royalty rate is approximately 7.35% with a standard deviation of 3.63%.

- Ethereum-based collections have earned over $920 million in royalties in 2025.

- About 428 NFT collections generated 80% of the total royalties in the market.

- Yuga Labs’ collections earned over $147.6 million in royalties, leading the market.

- Royalty enforcement fragmentation causes 50%-60% of potential royalties to be bypassed on non-compliant platforms.

- Solana collections earn significantly less, with weekly royalties around $374,000, capturing 55% of all blockchain royalties weekly but lagging in secondary market liquidity.

- ERC-2981 standard adoption helps automate royalties, but marketplaces are not required to enforce payouts.

- Some top collections publish dashboards showing 100%+ transparency in royalty income and trade volume.

- Collections experimenting with “no royalty” models see higher resale activity, but up to 30%-40% lower creator earnings.

Average Royalty Rates Across Blockchains and Marketplaces

- Across major platforms in 2025, the average enforced royalty rate is approximately 6.1%.

- Academic review finds average mean royalty rate ~7.35% with quartiles spanning ~5.41% (25th) to ~11.43% (75th).

- In practice, many creators set royalty rates between 5% and 10% at the minting stage.

- On chains with lower transaction cost (e.g., Solana), some marketplaces allow royalty rates as low as 2‑4% to encourage trading, though effective enforcement may vary.

- Marketplaces that allow optional royalty waivers effectively bring the average rate down for traded tokens on those platforms, even if the listed rate remains 5‑10%.

- Data shows that for each 1% increase in royalty rate above the 6% baseline, resale volume falls by roughly 0.8‑1.2%.

- Some curated platforms reward special features (e.g., “premium listing”, “artist support programme”) which may grant creators an additional 1–2% bonus royalty, effectively 6–8%.

- For smaller creators or non‑curated drops, the actual realized royalty rate (after fees, platform cuts, waived payments) can be effectively 3‑4% or less of resale value.

NFT Trading Volume Share by Category

- PFP NFTs dominate the market with a 37% share of total trading volume.

- Gaming NFTs account for 25%, showing strong engagement from interactive and play-to-earn ecosystems.

- Music/Media NFTs represent 15%, reflecting growing creator monetization in entertainment sectors.

- Other categories contribute 12%, including niche or experimental NFT formats.

- RWA (Real-World Asset) NFTs hold an 11% share, signaling early traction in tokenized tangible assets.

Impact of Optional Royalties on Revenue

- Platforms that allow creators or sellers to waive royalties (optional model) saw buyer activity increase by around +12% compared to enforced‑royalty platforms.

- That same shift toward optional royalties corresponded with a drop in creator revenue of about ‑18% on average in affected trades.

- Optional royalty models are more common on lower‑fee chains or new entrants seeking volume over creator share.

- In 2025, an estimated ~20% of secondary sales occurred in marketplaces that do not enforce royalties rigidly.

- Some creators responded by lowering their expected royalty rate or offering perks (e.g., access, utility) to offset the revenue loss tied to optional royalty environments.

Percentage of Sales with Enforced Royalties

- Over 80% of NFT smart contracts now include automated royalty enforcement logic for creators.

- More than 80% of newly minted collections (in 2025) deploy contracts with enforced royalty parameters.

- Only ~60‑70% of resale trades actually funnel the royalty payment to the creator.

- ~15‑20% of major listings bypass creator royalties in 2024‑25.

- Contracts following the ERC‑2981 standard (for royalty metadata) are increasingly adopted.

- There is no federal law guaranteeing digital resale royalty rights for NFTs in the U.S.

- Some blockchains and marketplaces publish analytics showing “royalty paid” flags with enforcement rates of 75%+ on Ethereum but lower on others.

- Higher‑value tokens see higher enforcement rates due to more scrutiny.

Royalty Distribution Among Creators

- Major creators of blue‑chip collections report that secondary sale royalties now form more than 50% of their ongoing income.

- A top‑10% of NFT creators (by volume) capture approximately 70% of all creator royalty revenue in the market.

- For smaller creators, median royalty income remains under $1,000/year.

- Royalties are increasingly being split among stakeholders.

- Blockchain divergence affects creator revenue outcomes.

- Some creators offer bonus utilities for verified royalty trades.

- In 2025, ~63% of creators earn more via secondary royalties than initial mint sales.

- Transparency is improving through marketplace dashboards.

Legal Disputes in NFT Royalties

- At least 15 legal disputes over NFT royalty circumvention were reported in the first half of 2025.

- Hermès won a lawsuit awarding $133,000 against an NFT creator for trademark and royalty violations.

- Over 80% of NFTs minted with free tools were found to be plagiarized or spam, complicating royalty enforcement.

- Many NFTs lack clear licensing for statutory royalties, leading to frequent legal challenges.

- Cross-border NFT trades cause jurisdictional conflicts affecting royalty enforcement in multiple countries.

- Wrapping tokens to dodge royalty logic has become a common tactic in over 20% of disputed cases.

- Emerging NFT insurance covers royalty breach risks, with market growth around 15% annually.

- Legal cases related to NFT royalties increased by approximately 25% year-over-year in 2025.

- Enforcement largely depends on contractual terms and platform compliance, with enforcement failures reported in up to 60% of cases.

Trends in NFT Royalty Models (Dynamic, Fixed, Percentage)

- Over 80% of NFT contracts use fixed-percentage royalties enforced automatically in 2025.

- Dynamic royalty models can increase creator revenue by up to 40% through real-time adjustments.

- Co-creator royalty splits commonly range from 2.5% to 10% per secondary sale.

- About 22% of DAOs with NFTs hold votes to adjust royalty settings.

- Zero-royalty NFT drops have grown, representing roughly 15% of total new releases in 2025.

- Higher royalty rates cause an average 7.04% drop in resale prices across NFT markets.

- Some collections link utility perks with royalty logic to boost royalty compliance by 12%.

- Marketplaces incentivize royalty enforcement with token rewards and fee discounts, increasing trade volume by over 10%.

- Fixed royalty rates remain the norm, but 30% of new projects explore tiered or dynamic approaches.

- Multi-party drops with royalty splitting increase collaborative creator earnings by up to 30%.

Frequently Asked Questions (FAQs)

63% of creators report earning more from secondary‑sale royalties than initial mint income.

The average royalty rate is about 6.1% of the resale value.

Over $1.8 billion in royalties have been paid to Ethereum‑based NFT creators.

More than 80% of NFT contracts enforce royalties automatically.

Conclusion

The evolving landscape of NFT royalties today reveals a clear shift from simply setting a percentage to devising complex models, ensuring enforcement, and balancing creator and marketplace incentives. While enforced royalties and fixed percentage models remain widespread, optional models and dynamic splits are gaining ground, bringing both opportunities and risks. Creators must now navigate volume vs. enforcement trade‑offs, explore utility‑linked revenue beyond resale, and stay aware of legal frameworks as they develop. For any project or marketplace, understanding the data, the enforcement realities, and emerging models is critical to building sustainable creator income.