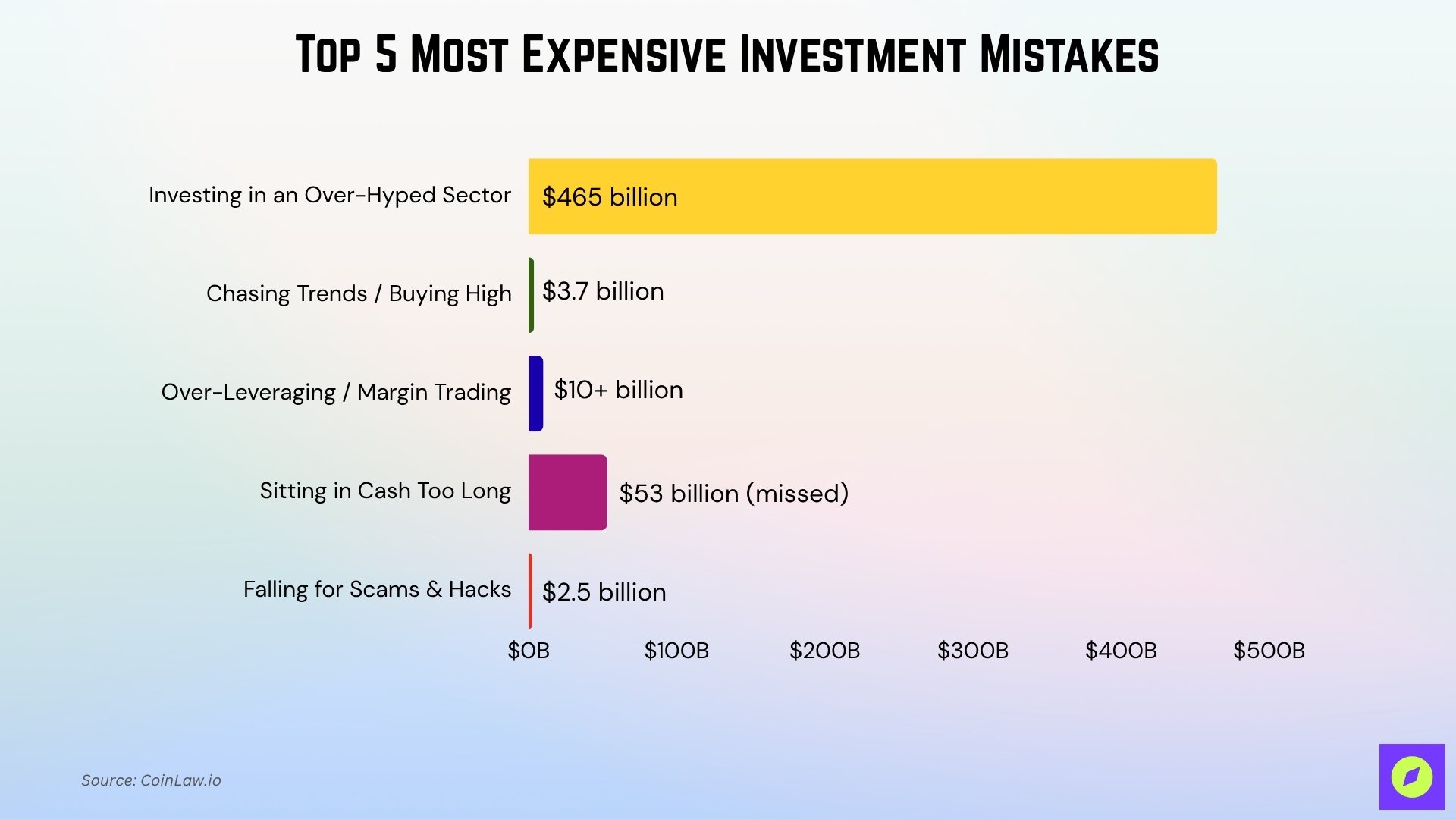

$534.2+ billion in investment value was destroyed by five avoidable missteps, from over-hyped bubbles to crypto scams. These aren’t abstract risks; they’ve wiped out portfolios, shaken global markets, and humbled even billionaire investors. This article breaks down the five most expensive investment mistakes, showing exactly how much they cost and what you can do to avoid falling into the same traps.

Key Takeaways

- Nvidia’s market capitalization declined by approximately $465 billion during the early 2025 correction in AI-related equities, reflecting the risks of speculative overvaluation.

- Retail investors may have lost up to $3.7 billion in July 2025 when a group of thinly traded Chinese penny stocks, driven by social media hype, experienced sharp declines.

- The Archegos Capital collapse triggered $10+ billion in losses due to over-leverage.

- Warren Buffett’s decision to hold large cash reserves in 2024–2025 resulted in an estimated $53 billion in missed gains, as major tech stocks surged.

- In the first half of 2025, investors lost an estimated $2.5 billion due to crypto-related scams and security breaches.

Why Investment Mistakes Are More Costly Than You Think

Small errors may seem harmless in the moment, but they can compound into devastating losses over time. The hidden cost isn’t just lost money; it’s lost momentum, opportunity, and confidence.

- Mistakes compound just like returns: A 10% loss requires more than an 11% gain to recover, which means setbacks are steeper than they appear on the surface.

- Opportunity cost is invisible but devastating: Holding cash or sitting out market rebounds can cost more than a bad investment, especially during high-growth periods.

- Emotional decisions lead to real financial losses: Panic-selling during downturns locks in losses, while FOMO buying during rallies sets investors up for overvaluation risk.

- Rebuilding trust takes longer than rebuilding money: Investors who lose big often delay re-entering the market, missing future gains due to fear.

- Mistakes create long-term drag on performance: Even a single misstep, like over-leveraging or chasing hype, can set a portfolio back by years.

Top 5 Most Expensive Investment Mistakes

Avoiding costly errors can make all the difference in growing your wealth. Here are the top five most expensive investment mistakes that even smart investors sometimes make, and how you can steer clear of them.

| Mistake | Estimated Loss | Example | How to Avoid It |

| 1. Investing in an Over-Hyped Sector | $465 billion | NVIDIA’s stock collapsed during the 2025 AI bubble | Avoid speculative mania; check valuations and earnings. |

| 2. Chasing Trends / Buying High | $3.7 billion | Collapse of 7 Chinese penny stocks in July 2025 | Ignore hype; invest based on fundamentals, not FOMO. |

| 3. Over-Leveraging / Margin Trading | $10+ billion | Archegos Capital blow-up due to leveraged positions | Use minimal leverage; apply strict risk controls. |

| 4. Sitting in Cash Too Long | $53 billion (missed) | Berkshire Hathaway’s uninvested gains in 2025 | Invest cash strategically; follow an asset plan. |

| 5. Falling for Scams & Hacks | $2.5 billion | Crypto phishing attacks and rug-pulls in early 2025 | Use cold wallets; verify sources; avoid “too good” deals. |

1. Investing in an Over-Hyped Sector or Bubble

Speculative bubbles attract enormous capital inflows at unsustainable valuations. When sentiment shifts or earnings fail to justify the hype, prices collapse, leaving investors exposed.

- Estimated Loss Amount: $465 billion (Nvidia market value wiped out in Jan 2025)

- Example: Nvidia’s stock plunge during the 2025 AI correction.

- Why it’s expensive: Investors often buy at peak valuations, and even quality companies can suffer massive short-term drawdowns in bubble bursts.

- How to avoid it: Focus on valuation metrics, long-term fundamentals, and avoid investing based on momentum or narrative alone.

2. Chasing Trends or Buying High

FOMO-driven investing often leads to entering late, when assets are overpriced and overbought. Once hype fades, prices collapse, leaving trend-chasers holding the bag.

- Estimated Loss Amount: $3.7 billion (losses from seven Chinese penny stocks in July 2025)

- Example: July 2025 collapse of social media-hyped Chinese penny stocks.

- Why it’s expensive: Investors overpay during peak mania and face heavy losses when speculative bubbles deflate.

- How to avoid it: Ignore social media hype, avoid price chasing, and base decisions on research and intrinsic value.

3. Over-Leveraging or Trading on Margin

Leverage can amplify gains, but it also turns small market corrections into devastating losses. Without safeguards, borrowed capital can wipe out entire portfolios.

- Estimated Loss Amount: $10+ billion (Archegos Capital collapse)

- Example: Archegos Capital’s margin-fueled losses in derivatives positions.

- Why it’s expensive: Margin calls force liquidation at market bottoms, turning temporary drawdowns into permanent losses.

- How to avoid it: Limit or avoid leverage, use strict risk controls, and understand the downside before amplifying exposure.

4. Sitting in Cash Too Long Instead of Investing

Holding too much idle cash during bull markets results in missed growth and lost compounding. Over-cautious investors often lose more to inaction than bad investments.

- Estimated Loss Amount: $53 billion (Berkshire Hathaway’s missed opportunity)

- Example: Berkshire Hathaway’s uninvested capital during the 2024–2025 market surge.

- Why it’s expensive: Cash erodes in value over time and can’t capture upside in recovering or expanding markets.

- How to avoid it: Deploy excess cash strategically, follow a set investment plan, and maintain diversified exposure across asset classes.

5. Falling Victim to Scams, Hacks, or Fraudulent Schemes

Bad actors exploit investor trust through phishing, rug-pulls, fake platforms, and social engineering. These losses are usually irreversible and widespread in high-risk markets like crypto.

- Estimated Loss Amount: $2.5 billion (crypto scams and hacks in H1 2025)

- Example: 2025 crypto wallet hacks, scam tokens, and phishing site exploits.

- Why it’s expensive: Funds are lost permanently, with little to no recovery, often impacting thousands of retail investors.

- How to avoid it: Use hardware wallets, stick to reputable platforms, verify transactions, and never trust unsolicited investment offers.

Common Warning Signs You’re About to Make an Expensive Mistake

Most costly investment errors are preceded by clear warning signs if you know what to look for. Recognizing these red flags early can save you from preventable loss.

- You feel pressure to act fast or “miss out”: Urgency is a classic sign of hype-driven environments, and a cue to slow down and do your research.

- You don’t fully understand the investment.

If you can’t explain how it works, what it earns, or what could go wrong, you’re operating on blind risk. - The investment promises guaranteed returns: Every investment carries risk; if someone claims otherwise, it’s likely a scam or Ponzi scheme.

- You’re risking more than you can afford to lose: Putting rent money, emergency funds, or borrowed capital into volatile assets is a recipe for disaster.

- You’re relying on anonymous tips, influencers, or viral content: Decisions based on unverified sources or trends often lead straight to overhyped, underperforming traps.

- You’re ignoring your original plan or asset allocation: Deviating from your long-term strategy in pursuit of short-term excitement typically ends in regret.

How to Build a Low‑Cost, Mistake‑Resistant Investment Process

A disciplined investment process doesn’t just protect your capital; it shields you from emotional decisions, high fees, and costly blunders. By focusing on simplicity, structure, and consistency, investors can minimize risk while maximizing long-term results.

- Start with Clear Investment Goals: Define your time horizon, risk tolerance, and end objectives before selecting any asset. This acts as your personal compass, helping you stay on course during volatile markets.

- Automate Your Contributions: Use automatic monthly deposits into your investment accounts to build wealth steadily. This removes emotion from the process and ensures consistency even when markets fluctuate.

- Keep Costs Low with Index Funds or ETFs: Avoid high-fee mutual funds or complex products that erode your returns over time. Low-cost ETFs give you instant diversification and better compounding potential.

- Limit Speculation and Stay Diversified: Allocate no more than a small portion of your portfolio to high-risk bets. Spread the rest across asset classes, sectors, and geographies to reduce the impact of any single loss.

- Avoid Market Timing and Stick to the Plan: Instead of trying to predict short-term market moves, rely on a rules-based strategy and long-term asset allocation. Staying invested through cycles typically outperforms reactionary trading.

- Rebalance Periodically: Review your portfolio every 6–12 months and adjust allocations if they drift from your target. Rebalancing helps lock in gains and reduces unintended risk exposure.

- Prioritize Security and Fraud Protection: Use two-factor authentication, reputable custodians, and offline storage where appropriate. A secure foundation ensures that your process isn’t undone by preventable fraud or theft.

Frequently Asked Questions (FAQs)

U.S. equities experienced an estimated decline in market capitalization of $6.1 trillion.

Annualised return fell from ~8.45% to ~2.07%.

Approximately 78% of the best days occurred during bear markets or the first two months of a bull market.

Estimated drop: $2.3 trillion in value.

Conclusion

The most expensive investment mistakes aren’t just financial, they’re psychological, structural, and entirely avoidable. Whether it’s chasing hype, overusing leverage, sitting on too much cash, or falling for scams, these errors can wipe out years of progress in moments. But with the right mindset, a low-cost strategy, and a disciplined process, you can sidestep the pitfalls that have cost others billions. Learn from real losses, stay grounded in fundamentals, and remember: in investing, protecting your downside is often more powerful than chasing the upside.