The allure of quick profits in the crypto world has led many to riches, and others to ruin. While blockchain was built on ideals of transparency and decentralization, scammers have used these very tools to execute some of the most brazen financial crimes in modern history. From Ponzi schemes masked as innovation to clever heists and influencer-backed frauds, the crypto space has been both a breeding ground for brilliance and betrayal.

Key Takeaways

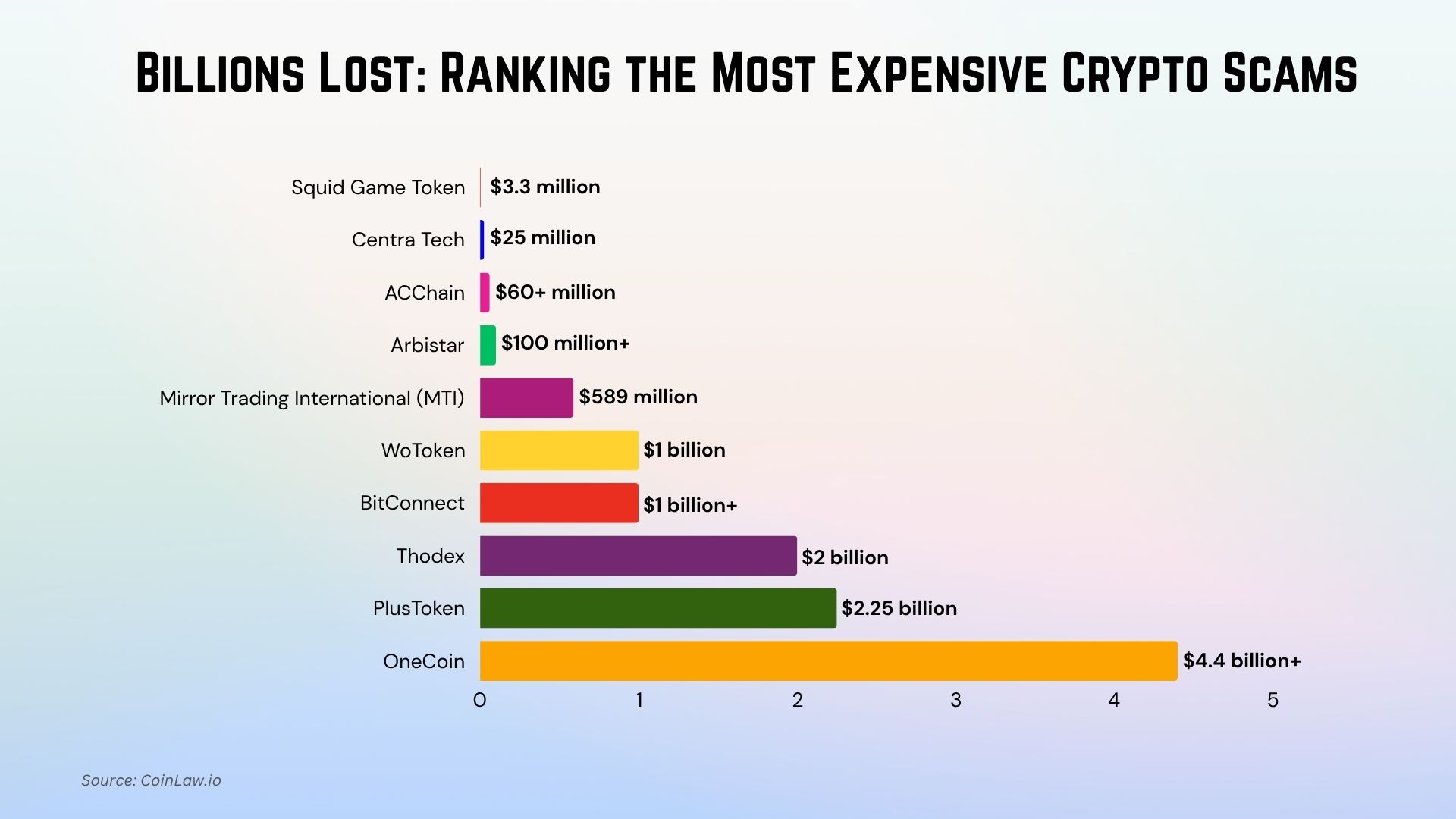

- Over $30 billion has been lost to major crypto scams and heists globally.

- PlusToken, OneCoin, and BitConnect remain the most expensive frauds to date.

- Even celebrities and global leaders have been victims or unwitting promoters.

- Investors often overlook basic red flags like anonymous teams and unrealistic returns.

- Learning to DYOR (Do Your Own Research) is more vital than ever.

Common Tactics Used to Deceive

Behind every major crypto scam is a playbook of psychological tricks and technical traps. Understanding these common tactics can help investors spot danger early and steer clear of fraudulent schemes.

- Ponzi & Pyramid Schemes: Promise high returns paid from new investors, not real profits (e.g., BitConnect, OneCoin).

- Rug Pulls: Developers pump a token’s value, then abruptly remove liquidity and disappear (e.g., Squid Game Token).

- Fake Partnerships & Whitepapers: Fraudsters invent big-name affiliations and plagiarize whitepapers to appear credible.

- Social Engineering & Phishing: Scam sites or fake wallets steal private keys via deceptive interfaces and impersonation.

- Celebrity & Authority Impersonation: Fraudsters clone real personalities to pitch fake airdrops or investment “opportunities.”

The emotional hook, greed, FOMO, or blind trust, is the real bait. Once hooked, even seasoned investors can overlook glaring red flags.

The Top 10 Most Expensive Crypto Scams

These scams weren’t just digital fraud; they were billion-dollar disasters that rocked the global crypto industry. From Ponzi schemes to rug pulls, these events serve as stark warnings of what happens when hype outpaces due diligence.

| Rank | Scam Name | Year(s) | Amount Lost | Scam Type |

| 1 | Squid Game Token | 2021 | $3.3 million | Rug Pull |

| 2 | Centra Tech | 2017–2018 | $25 million | Fake ICO & Celebrity Endorsement |

| 3 | ACChain | 2018 | $60 million+ | Fake Government Project |

| 4 | Arbistar | 2020 | $100 million+ | Fake Trading Bot |

| 5 | Mirror Trading International (MTI) | 2019–2020 | $589 million | Ponzi Scheme |

| 6 | WoToken | 2018–2020 | $1 billion | Fake Wallet & Trading App |

| 7 | BitConnect | 2016–2018 | $1 billion+ | Lending Ponzi Scheme |

| 8 | Thodex | 2021 | $2 billion (disputed) | Exchange Exit Scam |

| 9 | PlusToken | 2018–2019 | $2.25 billion | Wallet App Ponzi |

| 10 | OneCoin | 2014–2017 | $4.4 billion+ | Ponzi Scheme |

1. Squid Game Token (2021)

Riding the wave of Netflix’s global hit, this scam token had no affiliation with the show. Investors couldn’t sell before developers pulled the rug.

- Amount lost: $3.3 million

- What happened: The liquidity pool was drained. The token’s value dropped to nearly zero in minutes.

2. Centra Tech (2017–2018)

Promoted by Floyd Mayweather and DJ Khaled, Centra Tech claimed to offer a crypto debit card, but it was all smoke and mirrors. The project was later taken down by the SEC for fraud.

- Amount lost: $25 million

- What happened: The founders were arrested and charged. Celebrities paid fines for illegal promotions.

3. ACChain (2018)

ACChain was marketed as a state-backed project for global asset tokenization, but these claims were fabricated. The platform vanished after securing tens of millions.

- Amount lost: $60 million+

- What happened: No real government links or product. Investors never saw their funds again.

4. Arbistar (2020)

A Spanish investment platform offering fake trading bots and promised returns. Investigations revealed manipulated data and hidden fund movements.

- Amount lost: $100 million+

- What happened: Over 30,000 users were affected. The CEO admitted wrongdoing during court proceedings.

5. Mirror Trading International – MTI (2019–2020)

South Africa’s largest crypto scam, MTI, used AI-trading as a front to lure investors. It all unraveled after the CEO fled with users’ Bitcoin.

- Amount lost: $589 million

- What happened: No AI bot existed. The CEO was later captured in Brazil.

6. WoToken (2018–2020)

An app linked to PlusToken that defrauded hundreds of thousands using the promise of automated trading returns. It was a near-copy of its infamous predecessor.

- Amount lost: $1 billion

- What happened: Over 700,000 users were scammed. Six suspects were arrested in China.

7. BitConnect (2016–2018)

A global Ponzi scheme disguised as a lending platform, BitConnect promised impossibly high returns. It collapsed when regulators intervened, erasing billions in token value.

- Amount lost: $1 billion+

- What happened: The token lost 90% of its value. Multiple lawsuits followed.

8. Thodex (2021)

A Turkish crypto exchange that locked out hundreds of thousands of users before shutting down. The CEO fled and was later sentenced to an astonishing 11,000+ years.

- Amount lost: $2 billion (disputed)

- What happened: Exchange froze user assets and vanished. Authorities later tracked down and extradited the founder.

9. PlusToken (2018–2019)

Disguised as a high-yield wallet, PlusToken was one of the biggest scams to shake the Asian crypto market. Massive withdrawals impacted global token prices.

- Amount lost: $2.25 billion

- What happened: Over 3 million users were affected. Several ringleaders were convicted in China.

10. OneCoin (2014–2017)

The most infamous crypto Ponzi scheme to date, OneCoin, spread across 175+ countries under the leadership of the mysterious “Cryptoqueen.” It operated without a functioning blockchain.

- Amount lost: $4.4 billion+

- What happened: Investors were duped with fake tokens. Founder Ruja Ignatova is still at large.

Red Flags Investors Ignored

Every major crypto scam left behind warning signs, yet they were often overlooked in the rush for fast profits. Recognizing these red flags early can mean the difference between smart investing and devastating loss.

- Unrealistic returns: Guaranteed profits with no risk are a hallmark of Ponzi-style frauds.

- Anonymous teams: No LinkedIn profiles, no accountability.

- No real product or codebase: Many scams lacked working platforms or open-source code.

- Aggressive marketing & referral systems: If it sounds like a pyramid, it usually is.

- Celebrity promotion without substance: Endorsements were often paid and unvetted.

The problem isn’t just the scammers; it’s how easily people want to believe them.

How to Protect Yourself from Crypto Scams

In the world of crypto, security starts with skepticism. While the technology behind blockchain is built to be secure, the people exploiting it are masters of manipulation. The good news? You don’t need to be a blockchain expert to stay safe; you just need a sharp eye and a cautious mindset. These essential steps can significantly reduce your chances of becoming a victim:

- DYOR (Do Your Own Research): Before investing, thoroughly investigate the project. Look into the team’s credentials, examine the whitepaper, review the tokenomics, and explore community feedback. If details are vague or too polished, consider it a red flag.

- Use regulated platforms: Always opt for exchanges and wallets that are licensed, insured, and have a transparent operating history. These platforms typically implement stronger compliance standards, making it harder for scammers to infiltrate.

- Be skeptical of hype: If a project is trending only because of celebrity endorsements or viral social media buzz, pause. Real value isn’t built overnight, and FOMO (fear of missing out) is a tool scammers love to exploit.

- Watch for security cues: Double-check URLs, enable two-factor authentication, and avoid clicking on suspicious links, especially in emails or Telegram messages. Fake wallet apps and phishing pages are still a major threat in the crypto ecosystem.

- Start small: Even promising projects can fail or turn out to be fraudulent. Begin with small, manageable amounts you can afford to lose while you build confidence in the asset or platform.

Ultimately, the best defense isn’t technology, it’s awareness, discipline, and a healthy dose of skepticism. In crypto, your instincts are just as important as your investments.

Conclusion: Crypto Isn’t a Scam, But Scammers Love Crypto

The blockchain revolution has unlocked massive innovation, but also massive exploitation. These billion-dollar crypto scams remind us that while the tech is powerful, it’s not immune to human greed. For investors, the challenge isn’t just finding the next big thing; it’s surviving long enough to see it.