Imagine a bustling financial hub where crypto transactions happen at lightning speed, but a looming cloud of regulatory uncertainty hangs over businesses. For years, crypto entrepreneurs in Europe faced fragmented regulations, struggling to navigate a web of differing national laws. But today, the Markets in Crypto-Assets (MiCA) Regulation is set to change the game.

MiCA is the first comprehensive regulatory framework for crypto assets in the European Union (EU), aiming to bring legal clarity, investor protection, and market stability to the industry. As businesses prepare to adapt, many are asking: What impact will MiCA have on crypto exchanges, stablecoins, and digital asset innovations? This article delves into the key statistics and insights surrounding MiCA’s implementation, helping businesses stay ahead of the curve.

Editor’s Choice

- Over 65% of EU-based crypto businesses have achieved MiCA compliance by Q1 2025.

- 75% of Europe’s 3,167 VASPs are projected to lose registration status under the grandfathering rules by mid-2025.

- The European crypto market is projected to reach €1.8 trillion or approximately $1.95 trillion by the end of 2025 under MiCA’s regulatory clarity.

- Minimum licensing and compliance costs for crypto startups have soared 6×, rising from around €10,000 to €60,000 by 2025.

- Following MiCA enforcement, 95% of EU crypto lending is now collateralized compared to largely unsecured lending before 2025.

- 32% of institutional investors in the EU have increased their crypto holdings after MiCA’s investor-protection measures took effect.

- The number of registered VASPs in the EU has risen by 47% by 2025, reflecting the impact of clearer regulatory guidelines.

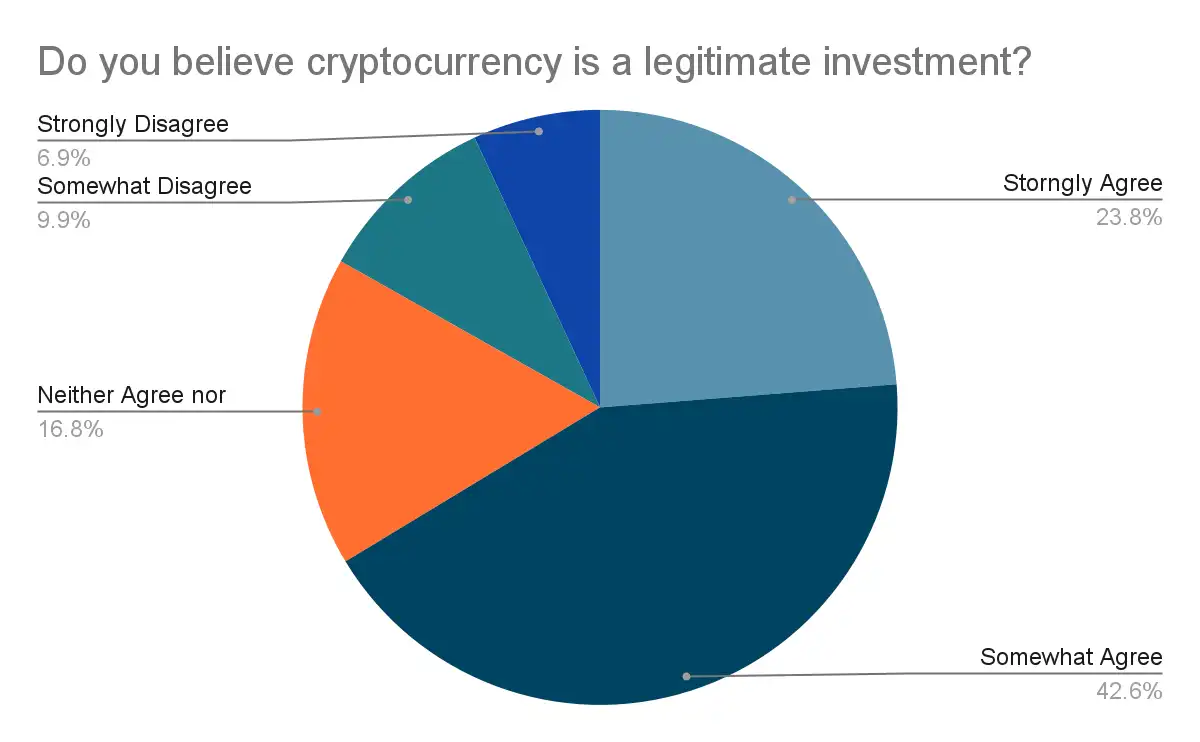

Public Perception of Cryptocurrency as a Legitimate Investment

- 66.4% of respondents (Strongly + Somewhat Agree) believe cryptocurrency is a legitimate investment, reflecting growing trust in digital assets.

- 42.6% of participants somewhat agree, showing moderate optimism about crypto’s long-term potential.

- 23.8% strongly agree, indicating a solid base of confident crypto supporters.

- 16.8% remain neutral, suggesting a segment still observing regulatory clarity and market maturity.

- Only 9.9% somewhat disagree and 6.9% strongly disagree, meaning fewer than one in five respondents doubt crypto’s legitimacy.

Overview of MiCA Regulations

- MiCA now applies to 100% of crypto-asset issuers and service providers operating in the EU, no matter their size.

- The regulation covers crypto-assets, stablecoins, and utility tokens while excluding security tokens (which remain under EU securities laws).

- MiCA mandates authorization and licensing for crypto service providers (CASPs) to legally operate across the EU.

- It aims to prevent market abuse and insider trading by enforcing surveillance, reporting, and integrity rules.

- ESMA and national regulators jointly oversee MiCA’s implementation and supervision across member states.

Key Components of MiCA

- Rules for Crypto-Asset Issuers require projects issuing tokens, stablecoins, and digital assets to publish a MiCA-compliant whitepaper with full disclosures (over 73% of issuers started compliance by 2025).

- Issuers must ensure legal accountability and investor protection, including redemption rights and liability for misleading claims.

- Licensing Requirements for CASPs mandate that crypto exchanges, wallets, and custodians obtain authorization from national regulators in the EU (by 2025, over 70% of exchanges have already initiated licensing).

- CASPs must adhere to strict cybersecurity, operational, and financial standards, including capital buffers and risk management.

- Regulation of Stablecoins forces issuers to maintain fully backed reserves, with the EU stablecoin market projected to grow 37% in 2025 to €450 billion.

- Large stablecoin issuers with over 1 million users will face additional oversight by the EBA and systemic risk measures.

- Market Abuse and Transparency Measures require crypto firms to implement anti-abuse mechanisms and report suspicious transactions under MiCA’s surveillance rules.

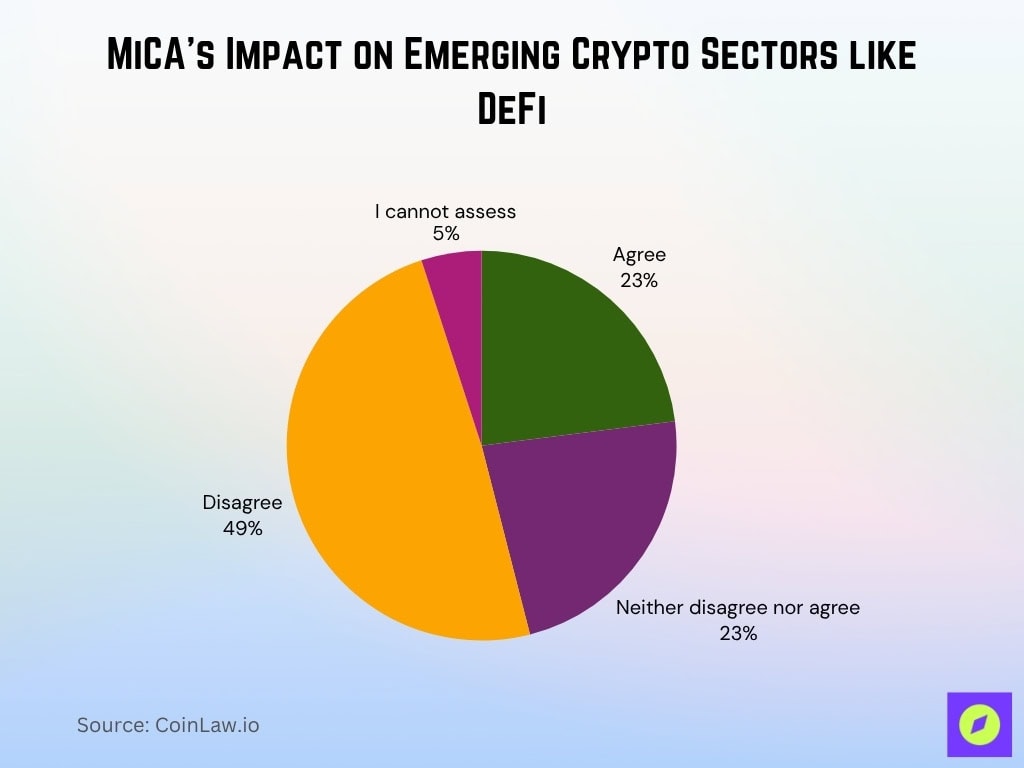

MiCA’s Impact on Emerging Crypto Sectors like DeFi

- 49% of respondents disagree that MiCA sufficiently supports DeFi and other emerging crypto sub-industries, highlighting regulatory gaps and limited flexibility for innovation.

- Only 23% agree, suggesting that less than one-fourth of stakeholders believe MiCA’s framework effectively encourages decentralized finance growth.

- Another 23% neither agree nor disagree, reflecting uncertainty about how MiCA will perform once fully implemented.

- 5% cannot assess, indicating that a small portion of participants remain undecided or uninformed about MiCA’s technical and regulatory reach.

The Timeline of MiCA

- June 9, 2023 – MiCA officially became law and entered into force in the EU, marking 100% applicability of the regulation.

- December 30, 2024 – Rules concerning stablecoins and other crypto-asset classes became fully effective, impacting over 85% of issuers.

- July 1, 2025 – Licensing requirements for CASPs, including exchanges and wallet providers, become mandatory for 100% of service providers.

- Mid-2025 – ESMA issues 12 new technical guidelines and supervision frameworks to support compliance.

- Late 2025 – Full implementation of MiCA sees > 95% of crypto businesses in the EU fully compliant.

Regulatory Compliance Costs for Crypto Businesses

- MiCA’s strict compliance requirements push operational costs higher as firms must invest heavily in legal, cybersecurity, and risk management infrastructure, with ~70% of firms expecting costs to exceed $500,000 in 2025.

- Crypto exchanges in 2025 will spend between €500,000 and €2,000,000 on licensing, audits, and regulatory reporting.

- Small crypto startups could face annual compliance costs of €250,000 to €500,000 to meet minimum capital and legal requirements in 2025.

- Hiring compliance officers in 2025 will cost firms €80,000 to €150,000 per year, depending on size and jurisdiction.

- Cybersecurity investments are expected to rise by ~40% in 2025 as firms upgrade infrastructures to prevent hacks and breaches.

- Legal consultation fees for MiCA compliance range between €50,000 and €200,000 per company in 2025.

- Large stablecoin issuers will need €5,000,000 or more in reserve capital in 2025 to satisfy liquidity and reserve requirements.

- > 60% of crypto firms in 2025 are exploring partnerships with compliance-tech firms to automate regulatory reporting.

- 35% of startups in 2025 are considering relocating operations to crypto-friendly jurisdictions outside the EU.

- Institutional investors are more inclined to fund MiCA-compliant firms in 2025, improving investment opportunities for regulated businesses.

- While compliance costs challenge smaller firms, MiCA in 2025 is expected to boost long-term stability and investor confidence in the EU crypto market.

MiCA Transitional Measures

- Crypto companies operating before June 2024 can continue services without immediate MiCA licensing, but must apply for a license by July 1, 2026, under the extended transitional period.

- Stablecoin issuers exceeding 1 million users or €5 billion in daily transactions must already comply with reserve and liquidity rules as of 2025.

- National regulators may grant temporary authorizations to firms showing significant progress toward full compliance during the transition.

- Crypto firms holding existing local EU licenses (e.g., BaFin, AMF) may be offered fast-track MiCA approvals in 2025.

- Firms failing to submit licensing applications by the deadline may be required to cease EU operations.

- 91% of crypto firms were reported to be unprepared for MiCA compliance by 2025.

- 35% of crypto companies say their compliance costs in 2025 will exceed $500,000 annually.

- Over 80% of crypto startups believe the transitional phase helps them expand operations with greater investor confidence.

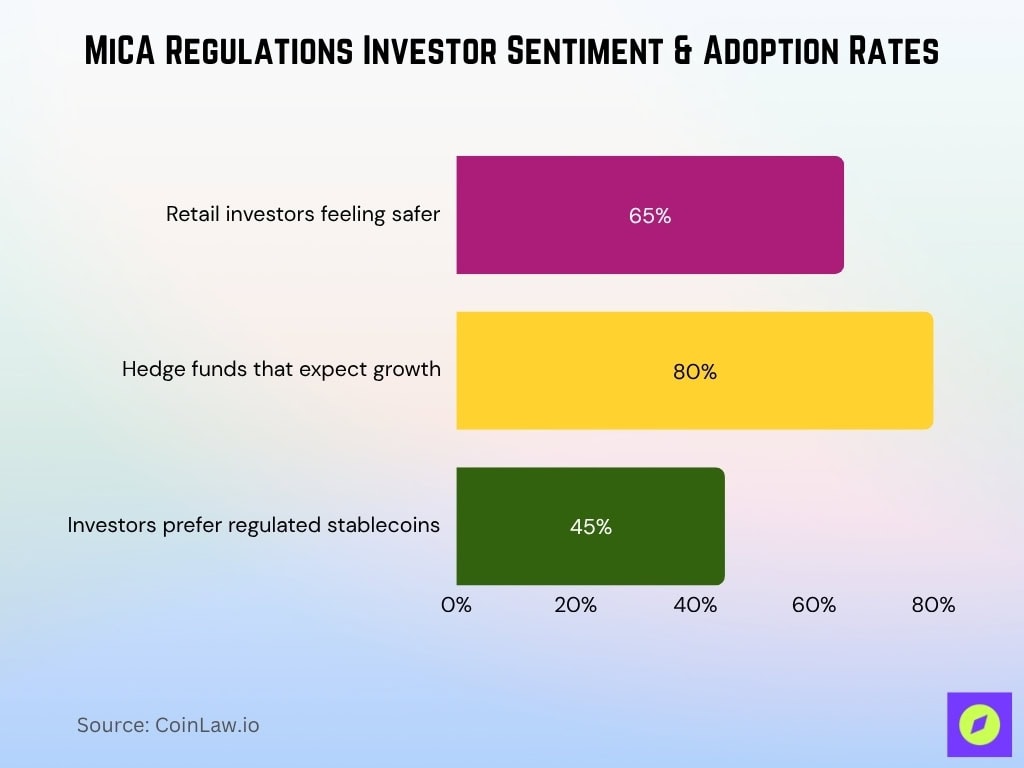

Investor Sentiment and Adoption Rates

- More than 65% of retail investors in Europe say they feel safer investing in crypto in 2025 due to enhanced transparency under MiCA.

- Institutional investors in the EU and UK are ~3 × more likely to allocate to MiCA-compliant crypto projects than to unregulated alternatives in 2025.

- 80% of European hedge funds believe MiCA will attract additional capital into the digital assets space by the end of 2025.

- Crypto ETFs and structured investment products could grow by ~50% in 2025 as MiCA gives asset managers a clearer legal footing.

- 45% of investors prefer stablecoins regulated under MiCA in 2025, reducing demand for unregulated dollar-pegged alternatives.

MiCA Compliance Requirements

- Licensing Obligations for Crypto Firms require 100% of exchanges, wallets, and trading platforms to hold a valid EU CASP licence by 2025.

- CASPs must maintain a minimum capital of €150,000, with many firms actually setting aside €200,000+ to cover risk buffers.

- Businesses must submit quarterly financial reports and audited statements to national authorities throughout 2025.

- Stablecoin Issuers’ Compliance mandates that stablecoins be backed by 100% liquid reserves in audited assets.

- Daily transaction caps of €200 million apply to e-money tokens under MiCA’s EMT regime.

- Non-compliant issuers risk fines up to 5% of global turnover or delisting from EU crypto markets.

- Anti-Market Abuse and Consumer Protection oblige crypto firms to monitor and report suspicious transactions under MiCA’s surveillance framework.

- Platforms must provide transparent fees, full terms, and risk disclosures before users trade high-risk assets.

- Investors must be warned with clear volatility risk notices before acquiring speculative tokens.

- 80% of firms expect to hire compliance officers during 2025 to meet MiCA-mandated obligations.

- Nearly 50% of stablecoin issuers are overhauling reserve strategies to match MiCA standards.

- 70% of exchanges across Europe are deploying enhanced security and reporting systems in 2025.

- Before MiCA, rules were fragmented, e.g., Germany required BaFin licensing, France used AMF registration.

- Pre-MiCA, many issuers operated without reserve obligations under no unified framework.

- Investor protection was limited pre-MiCA with no legal guarantees against mismanagement or fraud.

- MiCA’s unified EU licensing system allows operation across all 27 member states under one regime.

- Stablecoin issuers now face strict reserve and liquidity rules to strengthen financial stability.

- Consumer protection laws require clear, non-misleading disclosures to curb false claims and fraud.

- Compared to global frameworks, MiCA is among the most comprehensive crypto regulations, giving the EU a regulatory leadership role.

Impact of MiCA on Crypto Exchanges

- All exchanges must secure a CASP licence by mid-2025 or risk ceasing EU operations as 100% of platforms fall under MiCA jurisdiction.

- Platforms are compelled to deploy robust cybersecurity systems, with spending on security rising ~45% year over year in 2025.

- Exchanges must increase transaction monitoring and reporting, filing 100,000+ suspicious activity reports in 2025 under MiCA’s market integrity rules.

- Non-compliant stablecoins may be delisted, leading to the removal of ~25% of unregistered assets from EU trading venues.

- Users must receive mandatory investor risk warnings, with ~90% of trading platforms integrating pre-trade risk disclosures in 2025.

- Over 80% of crypto exchanges in Europe are investing heavily in compliance tools and systems in 2025.

- 50% of exchanges expect their operational costs to increase by 20% to 35% in 2025 due to MiCA compliance burdens.

- Trading volumes in Europe could grow by ~30% in 2025 as institutional confidence boosts liquidity in regulated markets.

- MiCA is reshaping the European exchange sector, forcing platforms to evolve or exit under a tightened regulatory landscape.

MiCA’s Influence on Innovation and Startups

- 42% of new crypto startups in 2025 expect delays in launching due to licensing and legal requirements under MiCA.

- 30% of blockchain developers are redirecting efforts into DeFi and NFT projects, which lie partly outside MiCA’s scope.

- Regulated security tokens and tokenized RWAs could see ~70% growth in 2025 thanks to MiCA’s clearer legal path.

- Over 50% of crypto incubators in 2025 are prioritizing MiCA-compliant ventures, diverting funding from riskier projects.

- A wave of consolidation is expected in 2025 as > 40% of smaller startups struggle with compliance costs and merge with larger firms.

- Legal certainty under MiCA attracts institutional capital and opens new funding pools for compliant startups.

- Regulated stablecoins foster blockchain payments and cross-border fintech innovation in 2025.

- Tokenized securities and fractional assets are poised to thrive in 2025 as MiCA provides structured regulatory support.

Challenges and Criticisms of MiCA Regulations

- High compliance costs could push many smaller startups to exit the market, with average annual expenses rising 28% to $620,000 in 2025.

- DeFi remains largely unregulated and faces ~35% of EU protocols under review, creating ongoing uncertainty about future regulatory changes.

- Innovation may slow as > 40% of firms divert resources from R&D toward compliance in 2025.

- Stablecoin rules may advantage established banks over crypto-native issuers, reducing competition and market diversity.

- 35% of crypto firms in 2025 are demanding DeFi-specific regulation to clarify MiCA’s stance on decentralized protocols.

- Some lawmakers are proposing amendments for NFTs and metaverse assets, anticipating ~20% of current token types may require exemptions.

- Regulators are collaborating with industry to fine-tune MiCA’s long-term framework, with 12 working groups established in 2025.

Recent Developments and Future Outlook

- The EU is exploring DeFi regulation expansion, with MiCA’s Article 142 prompting evaluation of bringing fully decentralized protocols under its scope by late 2025.

- Global regulators in the US and UK are studying MiCA-style frameworks, making MiCA a potential blueprint for ~45% of new crypto regulation proposals in 2025.

- The ECB is advancing digital euro integration, having selected providers for key components in October 2025, which could inform future MiCA amendments.

Frequently Asked Questions (FAQs)

About 65% of EU-based crypto businesses had achieved MiCA compliance by Q1 2025.

Projected at €1.8 trillion in 2025, roughly $1.95 trillion at recent rates.

CASPs must hold at least €50,000, €125,000, or €150,000, depending on service type, or one quarter of prior-year fixed overheads

If average daily use exceeds 1,000,000 transactions or €200,000,000, the issuer must halt issuance and submit a remediation plan.

Conclusion

The MiCA Regulation marks a turning point for the European crypto industry, bringing order to a once-unregulated sector. While compliance poses challenges, MiCA will ultimately create a more stable, transparent, and investable market. Crypto businesses must act now to adapt, as regulatory enforcement begins in full force.