MetaMask has become one of the most visible names in Web3 wallets. Since its launch, the wallet has grown beyond simple storage: users now rely on it to interact with dApps, swap tokens, bridge across chains, and much more. In industries from decentralized finance (DeFi) to NFTs, MetaMask’s reach shapes how billions of dollars move. In payments, its integrations affect fiat-onramps and accessibility, in security, its design choices influence trust and incidents. Below are current statistics that show where MetaMask stands, and where it’s headed.

Editor’s Choice

- As of mid-2025, MetaMask reportedly has around 30 million monthly active users, based on industry estimates and third-party tracking platforms.

- MetaMask now supports 11 blockchains, including the recent integration of the Sei network.

- Via its Social Login feature, MetaMask reduced onboarding friction by 30 %.

- The cumulative market size for crypto wallets is projected to reach $15.5 billion in 2025.

- Swap revenue for MetaMask is about $325 million (cumulative) from its internal swap feature.

- At least 12.7 % of all MetaMask users are from Nigeria, per recent data.

Recent Developments

- MetaMask added support for the Sei network, bringing in ~4.2 million daily transactions and $600 million+ in total value locked (TVL) on Sei.

- The wallet now supports 11 blockchains, increasing its cross-chain interoperability.

- MetaMask introduced Social Login (via Google/Apple) to replace or augment the 12-word secret recovery phrase, improving onboarding.

- That Social Login feature reduced onboarding friction by 30 %, increasing retention.

- MetaMask’s growing feature set includes enhanced swap tools, bridging, and network integrations.

- Bug issue: Its browser extension for Chrome/Edge/Opera is consuming much more SSD storage than intended, writing hundreds of gigabytes per day for some users.

- MetaMask Card (physical debit card) is part of past expansions (mentioned in 2024) to enable spending crypto more directly via traditional merchant networks.

- Security upgrades: biometric auth, phishing protections, local key management improvements.

Most Popular Hot Wallets for Crypto Self-Custody

- MetaMask dominates the market with 22.66 million users, making it the most widely used hot wallet for self-custody.

- Coinbase Wallet follows with 11.00 million users, showing its strong position among U.S. and global crypto holders.

- Trust Wallet ranks third, serving 10.40 million users, boosted by its Binance ecosystem integration.

- Blockchain.com Wallet attracts 10.00 million users, one of the longest-standing players in the crypto wallet space.

- Phantom stands out in the Solana ecosystem with 2.54 million users, reflecting its rapid rise in DeFi and NFT markets.

- Smaller but notable players include Bitget Wallet (1.10 million), Crypto.com Wallet (1.07 million), Exodus (1.07 million), SafePal (1.06 million), and TokenPocket (1.02 million).

MetaMask Wallet Overview

- MetaMask is a self-custodial software wallet developed by Consensys. Users retain their private keys or recovery phrases.

- Available as a browser extension (Chrome, Firefox, Brave, Edge) and mobile app (iOS/Android).

- Supports Ethereum and EVM-compatible networks (e.g., BNB Chain, Polygon, Avalanche). More recently added non-EVM chains via features like Snaps.

- Offers built-in Swaps (aggregates across DEXs) to find the best token exchange rates.

- Has features for bridging, portfolio display, token management, and RENEWED onboarding methods (Social Login).

- Emphasis on security: local key storage, biometric login, and optional hardware wallet support.

- Has also expanded usability enhancements (e.g., portfolio tracking, better gas controls, network UI) to reduce friction.

User Growth and Adoption

- MetaMask had ~143 million users globally in 2025.

- Monthly Active Users (MAUs) are about 30 million.

- Onboarding improvements (Social Login) reduce friction, likely contributing to growth in emerging markets and among less tech-savvy users.

- Nigeria alone accounts for around 12.7 % of all MetaMask users.

- Adoption is no longer limited to traditional crypto-friendly countries; cross-chain integrations (e.g., Sei) are helping to pull users from newer ecosystems.

- Compared to last year, the number of supported blockchains has increased (adding new ones), expanding the potential user base.

- MetaMask Swaps revenue (cumulative) is substantial (~$325 million), suggesting active usage rather than just passive holding.

- The wallet market itself is projected to grow strongly, with MetaMask well-positioned due to its large base and ongoing feature improvements.

Global Crypto Wallet Market Growth

- By 2025, the market is projected to rise to $18.96 billion, reflecting accelerating adoption.

- The industry is forecast to expand at a CAGR of 30.4% between 2024 and 2029.

- By the end of 2029, the market size is expected to reach $54.79 billion, nearly 4x growth in just five years.

- This surge highlights the increasing role of self-custody, DeFi, and NFT adoption in driving wallet demand.

Monthly Active Users

- ~30 million MAUs in 2025.

- Earlier benchmarks: by 2021, MetaMask had over 10 million MAUs. This indicates roughly 3× growth over ~4 years.

- The addition of new blockchains (e.g., Sei) and features helps MAU growth.

- MAU growth correlates with feature roll-outs like Social Login and improved onboarding.

- The platform’s extension + mobile app combo drives engagement; mobile tends to attract more frequent usage.

- Retention improves when friction drops: Social Login is reported to have caused ~30 % better retention in early metrics.

- MAUs are also influenced by blockchain performance (gas fees, speed), as high fees tend to reduce regular usage. MetaMask’s support for EVM chains with better fee structures helps.

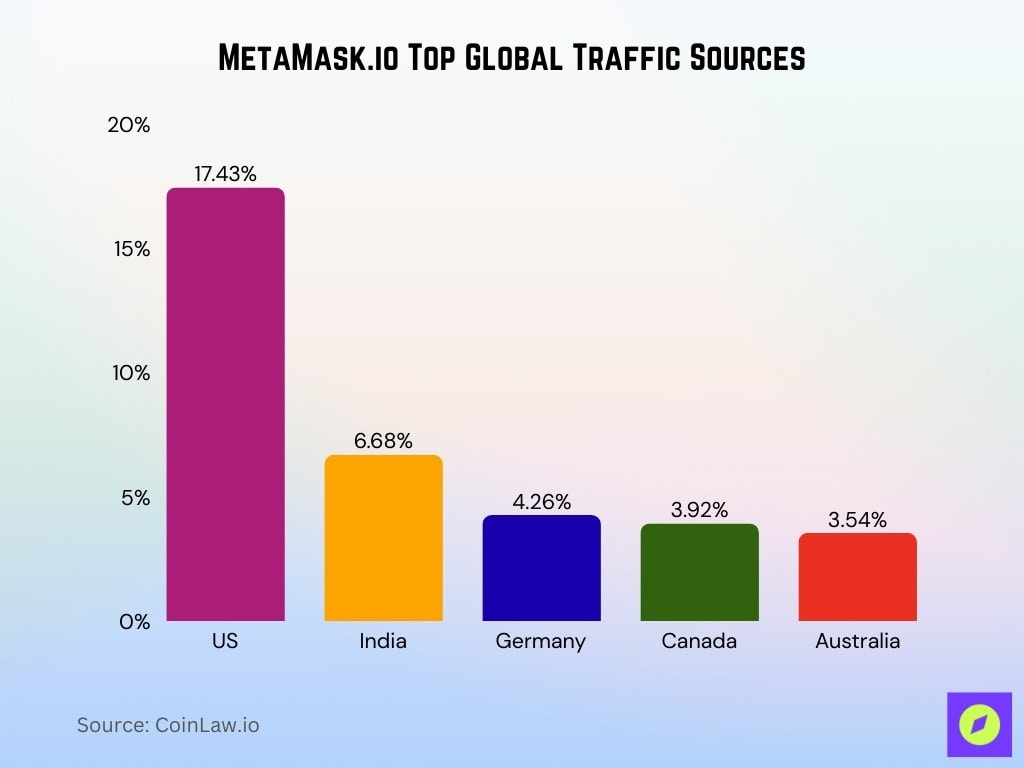

Download Statistics by Country

- MetaMask’s Google Play listing shows 10 million+ downloads globally.

- In August 2025, metamask.io (its website) received 5.64 million visits, with 17.43% of those visits from the United States (~983,000 visits).

- India accounted for about 6.68% of metamask.io’s web traffic in August 2025 (~376,750 visits).

- Germany contributed 4.26% of metamask.io traffic in that same period.

- Canada made up 3.92%, and Australia ~3.54% of metamask.io web traffic in August 2025.

- There is a significant concentration of web interest (downloads + site traffic) in North America, with the U.S. being the largest single-country source.

User Demographics

- The global crypto-user demographic skews younger: 25–34 year-olds make up ~31% of crypto users worldwide in 2025.

- Those aged 18–24 represent about 20% of global crypto users.

- In the U.S., the median crypto user is about 37 years old, while in Southeast Asia, it’s closer to 29 years.

- Gender breakdown globally: 61% male, 39% female among crypto users in 2025.

- Education level: 52% of crypto wallet users globally have at least a bachelor’s degree.

- Income distribution: Users earning over $100,000 annually make up ~22-34% of crypto wallet holders, depending on region; those in the $50,000–$99,999 range around 29–42%.

- Emerging markets show high growth among younger, mobile-first users, often with lower income but high engagement.

Usage by Region

- Nigeria holds 12.7% of the MetaMask user share among all countries.

- In India, MetaMask dominates with 63% of users and 79% of funds among wallets in that market.

- Indonesia: MetaMask leads with 59% of users and 57% of balance share.

- In the United States, ~60% of non-custodial wallet users are on MetaMask (vs other wallets).

- Germany and France show high MetaMask user percentages (70-76%), though capital/funds distribution varies among wallets.

- Latin America: In countries like Brazil, MetaMask holds ~71% of users, but Trust Wallet often holds a higher share of balances.

- Developed markets contribute a larger share of wallet capital/balances compared to emerging markets, even when user counts are high in emerging economies.

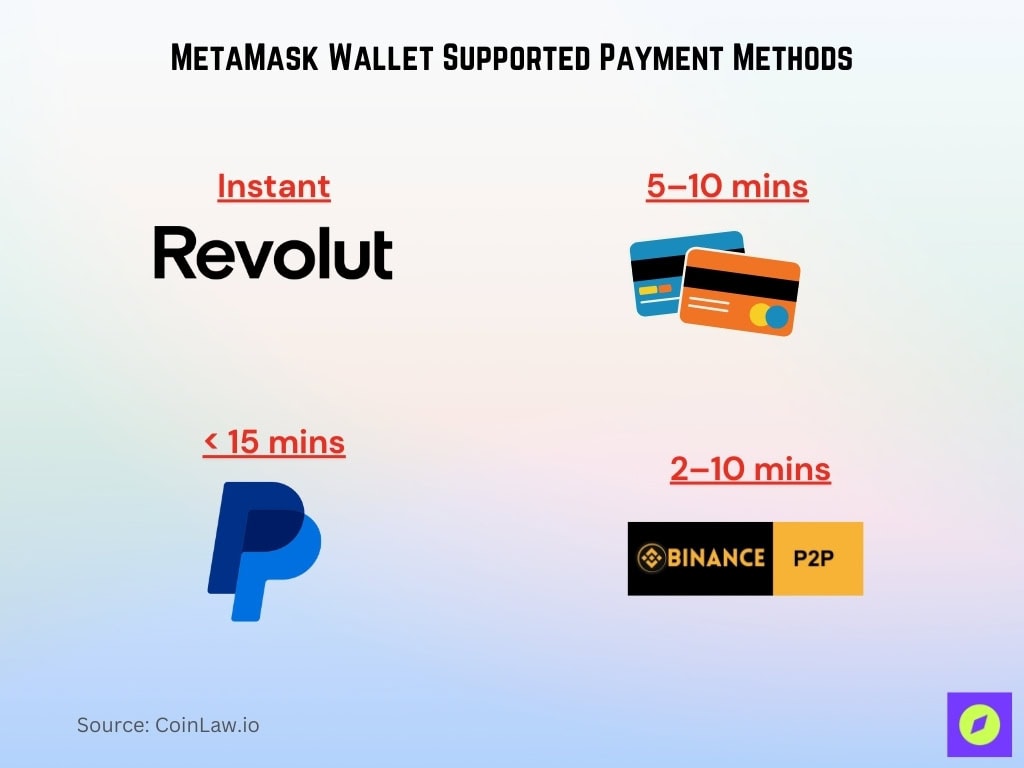

MetaMask Wallet Supported Payment Methods

- Revolut Pay offers instant processing, making it one of the fastest options for funding a MetaMask wallet.

- Debit or Credit Cards take about 5–10 minutes to process, providing a widely accessible but slightly slower method.

- PayPal transactions are completed in less than 15 minutes, combining speed with global availability.

- Binance P2P payments typically clear within 2–10 minutes, giving users a quick peer-to-peer option.

Supported Blockchains and Networks

- MetaMask supports many EVM-compatible networks such as Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Base, etc., plus integrations via plugins/snaps.

- Newer integrations: non-EVM or hybrid networks are increasingly added (e.g., Layer-2 networks) to reduce gas fees and improve transaction speed.

- Support for mobile, browser extension, and plugin-based networks (“snaps”) allows users to connect to less common chains.

- Supported tokens include major coins (ETH, stablecoins, wrapped tokens) plus thousands of tokens across chains.

- MetaMask’s network support now also includes at least 11 blockchains, following recent expansions.

Wallet Features

- Social Login / Web3Auth integration: MetaMask acquired Web3Auth and began offering login/recovery methods beyond seed phrase to reduce user friction.

- Onboarding enhancements: less technical users can now use device-based recovery / social methods.

- Built-in swaps: MetaMask aggregates DEX liquidity so users can swap inside the wallet app.

- Portfolio tracking and token management: users can view holdings, see price data, and manage multiple tokens across chains.

- Security enhancements: local key storage, hardware wallet integration, phishing detection, and improved audits.

- Cross-chain bridging and support for Layer-2 scaling solutions to reduce gas fees and improve speed.

- Better UX on mobile: improved mobile app stability, smoother interaction with dApps via in-app browser, push notifications, etc.

Swaps and Usage Statistics

- MetaMask Swaps’ cumulative revenue was reported at ~$325 million.

- Swap volumes and usage continue to rise, especially once embedded swaps (via wallets) become more common in 2025.

- A recent Dune / Addressable report noted 33 million embedded swaps in a single month (wallet-based) and more than $9 billion in volume via those swaps. MetaMask is a major participant in that trend.

- The State of Wallets 2025 report shows that in many markets, user counts are high, but balance distribution is skewed: large value is held in fewer wallets.

- Usage frequencies: users in emerging markets tend to engage in swaps and chain interactions more frequently (smaller value, higher frequency), whereas in developed markets, usage includes larger transfers.

- Wallets with swap + dApp support see higher retention vs wallets that are purely for holding. MetaMask, with its integrated swap and dApp connectivity, benefits.

Fee Structure

- MetaMask Swaps charges a flat 0.875% fee on top of network (gas/liquidity provider) costs.

- For fiat-on-ramp services, MetaMask integrated Transak to allow users in the USA and EU to buy stablecoins (mUSD, USDC, USDT) in-app at prices very close to 1:1, reducing spreads and hidden fees.

- With the newly launched Gas Station feature, MetaMask now includes network fees in swap quotes, so users know the total cost upfront.

- Roadmap plans include gradually reducing visible gas fees: MetaMask aims to eventually allow users to pay gas using any token they hold, and lessen how obviously gas fees are shown.

- While MetaMask itself does not charge for downloading or basic usage, users still incur gas fees (on Ethereum Mainnet or equivalent networks), which vary depending on congestion and base fee. Average gas fees on Ethereum in 2025 are about $3.78 per transaction, down from ~$5.90 in early 2024.

- There are liquidity provider fees and protocol fees baked into swaps, on top of MetaMask’s swap commission.

- On fiat purchases (through third-party on-ramps), some users report combined fees (card + service + spread + network) of over 5% in certain jurisdictions.

Security Statistics

- In MetaMask’s June 2025 Security Report, they estimated that 35% of users do not adequately back up their secret recovery phrase, putting them at increased risk of loss.

- MetaMask has over 30 million active users and boasts an ~eight-year track record, which helps maintain trust.

- The monthly security reports detail frequent scams: fake browser extensions, phishing domains, and malicious dApps are among the top threats.

- MetaMask’s bug bounty and community reporting processes are active, especially as they expand into new networks like Solana, to preempt vulnerabilities.

- As MetaMask adds more integrations, the attack surface increases. The extension ecosystem (Firefox, Chrome) remains a vector for fake add-ons or compromised versions.

- Security features include local key encryption, phishing detection tools, hardware wallet integration, and efforts to tighten developer security practices.

Wallet Hacks and Incidents

- In 2025, services in the crypto space have lost over $2.17 billion to thefts, hacks, and exploits; MetaMask-related user attacks are among them.

- MetaMask attacks are reported to affect ≈ 500 users per day, on average, via phishing, fake extensions, etc.

- The “LastPass/GitHub/Toptal” incident in June 2025 affected both Picasso and Xene packages, which in turn impacted MetaMask users via compromised packages. The exposure lasted several hours.

- As part of the security developments, MetaMask is monitoring and flagging malicious domains and sites more aggressively.

- There have been no large-scale thefts from MetaMask itself (i.e., from the core wallet infrastructure), but user mistakes (losing recovery phrase, falling for phishing) account for many losses.

- Some jurisdictions report elevated risk when using browser extensions vs mobile apps owing to fake versions or browser-based malware.

Frequently Asked Questions (FAQs)

Over 30 million monthly active users.

It received about 5.64 million visits, with 17.43% of that traffic from the United States.

MetaMask charges a fee of 0.875% on swaps done within its wallet.

As of 2025, estimates suggest there are between 700–820 million active crypto wallets globally, with Asia-Pacific leading adoption at around 43%.

Conclusion

MetaMask remains a central player in the crypto wallet space today, balancing scale, improved UX, and stronger security. Its fee model is becoming more transparent thanks to new features like Gas Station and fiat-in-wallet options, while security remains a major focus. That said, user risk (via phishing, recovery phrase mismanagement) still poses challenges. As competition heats up, MetaMask’s roadmap, particularly cross-chain expansion, seamless fiat integration, and fee simplification, will be critical to its continued relevance.

For users, the takeaway is to use the newest security tools available, compare fees (especially for swaps or fiat on-ramps), and watch for platform updates. For developers and stakeholders, MetaMask’s evolution offers signals about broader trends in Web3 usability, trust, and regulation.