Mawson Infrastructure Group Inc. has emerged as a key player in digital infrastructure and Bitcoin mining. The company blends enterprise colocation services with self-mining operations and advanced computing solutions like AI/HPC, creating a diversified digital asset ecosystem. In practical terms, global cloud services providers leverage Mawson’s carbon-aware power capacity for AI data workloads, and institutional miners tap its colocation network to expand their mining fleets without owning the physical facilities.

With both traditional and crypto computing markets converging, these trends make Mawson a bellwether for how computing infrastructure evolves. Explore the deep dive ahead to see what the numbers reveal.

Editor’s Choice

- 2025 Q3 revenue of $13.2 million, up from $12.3 million in Q3 2024, a 7% annual increase.

- Gross profit nearly doubled to $8.6 million in Q3 2025 from $4.3 million a year ago.

- YTD gross profit climbed 18% year over year in 2025.

- Digital infrastructure capacity stands at 129 MW operational, with 24 MW in development.

- Energy management revenue soared 191% year over year in October 2025.

- Self-mining revenue in October 2025 dropped 55% year over year.

Recent Developments

- Mawson launched a GPU pilot program targeting decentralized AI compute networks in late 2025.

- The company extended its Bellefonte, PA, leasing for mining operations through 2030.

- Mawson’s energy management services revenue jumped 191% year over year in October 2025.

- Digital colocation revenue during October 2025 was $1.6 million, though down 59% year over year.

- Mawson reported total monthly October 2025 revenue of $3.3 million, down 30% year over year.

- Gross profit margin estimates for Q3 2025 approached 59%.

- The company maintained Nasdaq compliance via conditional listing extensions in late 2025.

- Mawson participated in industry events throughout 2025 to support its AI/HPC strategy.

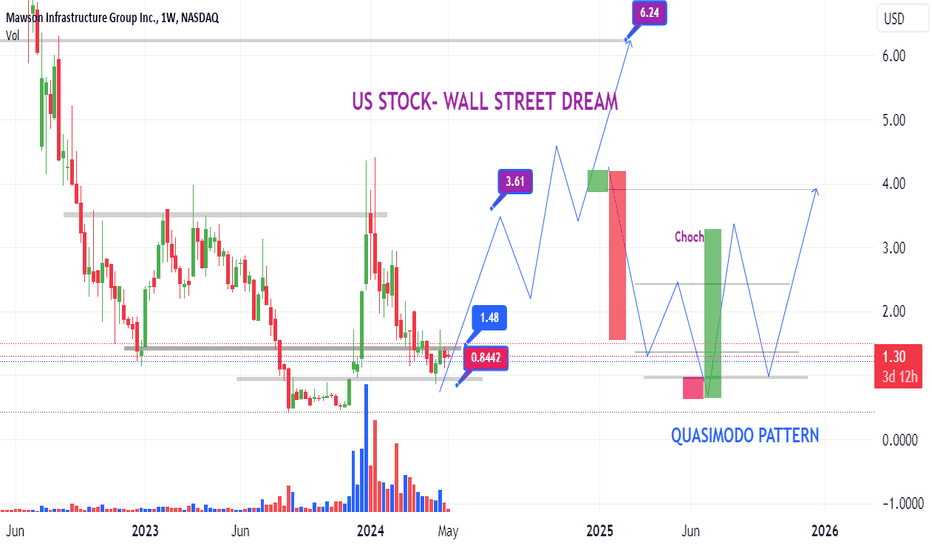

Mawson Infrastructure Stock Technical Snapshot

- The stock is currently trading at approximately $1.30 on NASDAQ.

- A key support level is identified at around $0.8442, marking a critical downside defense zone.

- A near-term resistance level is projected at $1.48, representing the first breakout hurdle.

- A stronger intermediate resistance zone is marked at $3.61, indicating potential upside momentum if surpassed.

- The major bullish price target is highlighted at approximately $6.24, suggesting a long-term upside projection.

- The chart outlines a potential Quasimodo pattern, signaling a possible structural reversal setup.

- A projected bullish path extends toward 2025–2026, indicating a multi-stage recovery scenario.

- Increased volume spikes are visible around prior breakout attempts, suggesting accumulation phases.

- Horizontal shaded zones mark historical support and resistance areas, reinforcing key technical levels.

Mawson Infrastructure Overview

- Mawson Infrastructure is headquartered in Pennsylvania, USA, and trades on NASDAQ as MIGI.

- Reported $39.8 million preliminary revenue for fiscal 2025, down 33% YoY.

- Recorded preliminary net loss of $23.8 million for fiscal 2025, improved 49% YoY.

- Q4 2025 preliminary revenue at $3.2 million, down 79% YoY with -33% gross margin.

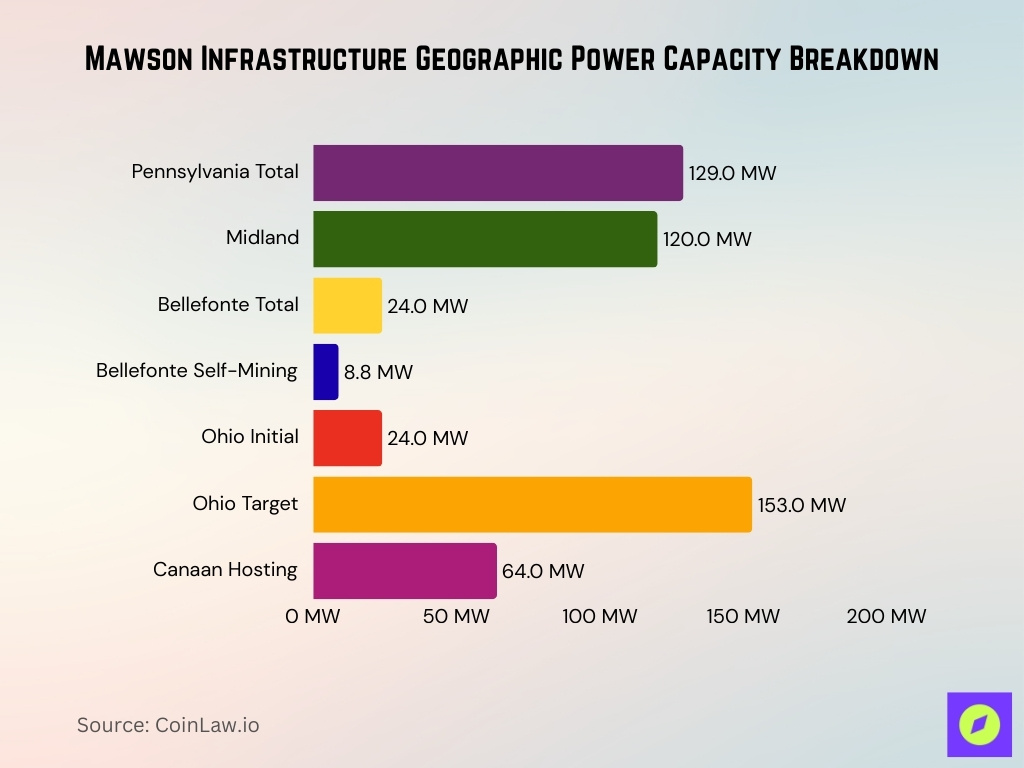

- Operates 129 MW capacity online, with 24 MW under development, targeting 153 MW total.

- Signed 64 MW digital colocation deal for 17,453 ASICs in Q1 2025.

- Q1 2025 digital colocation revenue reached $10.4 million, up 27% YoY.

- Q1 2025 energy management revenue hit $3.1 million.

Data Centers and Infrastructure Footprint

- Operates 129 MW digital infrastructure capacity across U.S. sites.

- 24 MW under development in Ohio, targeting 153 MW total.

- 64 MW Canaan colocation contract supports 17,453 ASICs.

- U.S. holds 40% of global data center capacity.

- North America AI data center demand grew by >25% YoY in 2025.

- Modular deployment scales in 5-20 MW increments.

- AI/mining racks exceed 30-40 kW, vs 5-10 kW traditional.

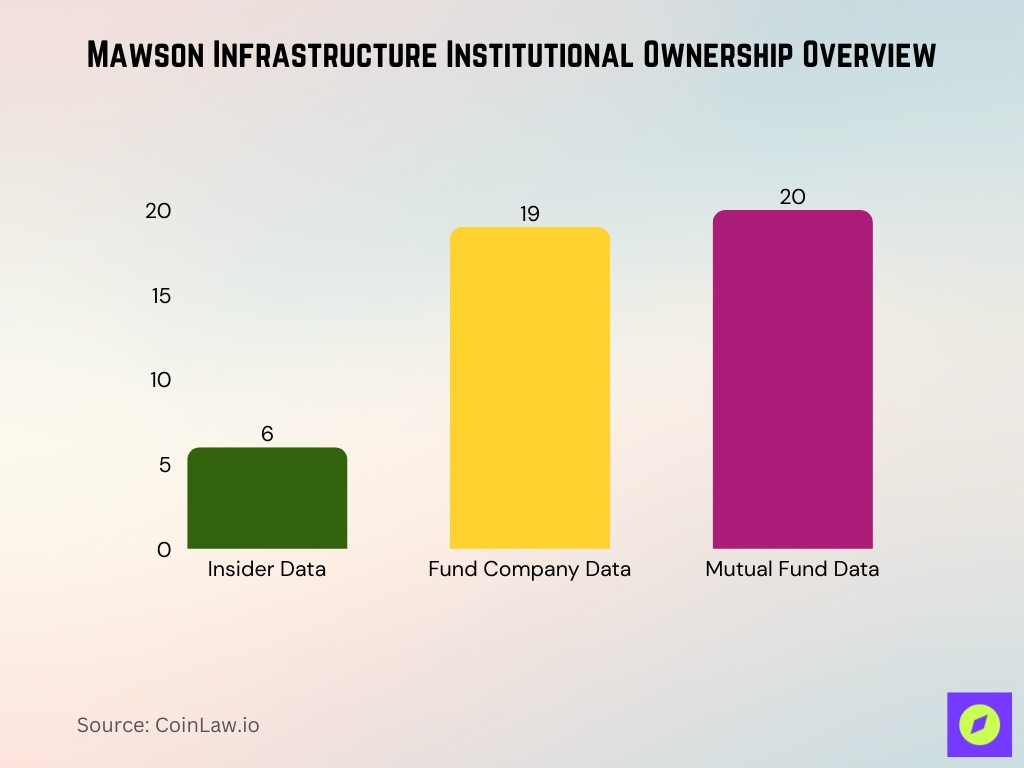

Mawson Infrastructure Institutional Ownership Overview

- A total of 20 mutual fund institutions currently hold shares, making them the largest institutional category.

- Fund companies follow closely, with 19 institutions maintaining share positions in Mawson Infrastructure.

- Insider holdings are comparatively limited, with only 6 institutions reported under insider data.

- Institutional ownership is heavily concentrated among professional investment entities, with 39 combined fund and mutual fund institutions participating.

- The significantly lower insider count of 6 suggests ownership is primarily driven by external institutional investors rather than internal stakeholders.

Mawson Infrastructure Mining Operations

- Self-mining revenue $0.1 million Oct 2025, down 55% YoY post-halving.

- Operating self-mining hash rate 4.98 EH/s, up 31% YoY.

- Global Bitcoin network hash rate >600 EH/s in 2025.

- U.S. miners control 35-38% of global Bitcoin hash rate.

- Q3 2025 self-mining revenue $6.9 million, up 41% QoQ with 246 BTC mined.

- 16,730 self-miners are hashing across Pennsylvania facilities.

Hash Rate and Computing Power Statistics

- Global Bitcoin hash rate >600 EH/s 2025, up from 350 EH/s early 2023.

- U.S. miners account for 35-38% of the global hash rate.

- Network difficulty >80 trillion all-time high in 2025.

- Mawson self-mining 4.98 EH/s, up 31% YoY.

- 144 blocks daily, ~10 min intervals.

- Hashprice below $0.07/TH/day mid-2025 lows.

- Global AI server shipments >20% YoY growth 2025.

- Hyperscalers >50% global data center capacity growth 2025.

- GPU clusters 30-40 kW/rack vs 5-10 kW legacy.

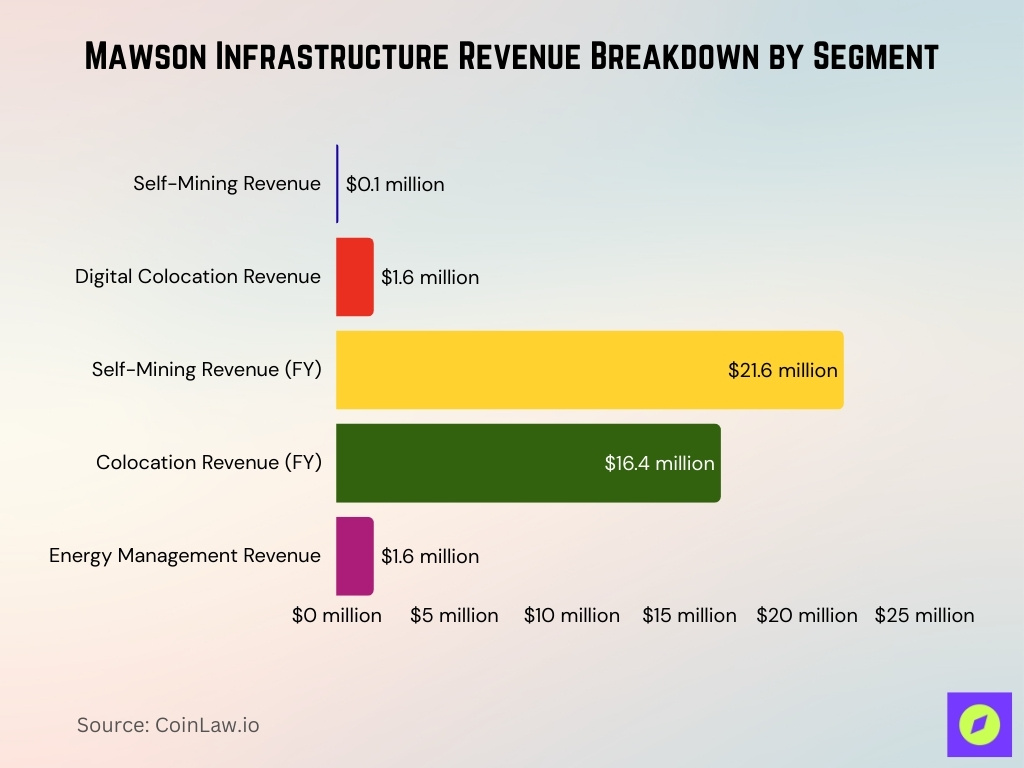

Business Model

- Integrates self-mining, generating $0.1 million in Oct 2025 (down 55% YoY) with colocation services.

- Earns digital colocation fees at $1.6 million Oct 2025 (down 59% YoY).

- Self-mining revenue tied to Bitcoin rewards, $21.59 million FY (down 49.91%).

- Colocation provides stable income, $16.36 million FY (up 22.67%).

- Energy management optimizes power, $1.6 million Oct 2025 (up 191% YoY).

- Plans expansion to 144 MW AI/HPC capacity via LOI.

- Vertical integration supports scaling with 129 MW online capacity.

Bitcoin Mining Capacity and Output

- 129 MW operational capacity supports up to ~43,000 ASICs at 3 kW each.

- Self-mining 4.98 EH/s hash rate, up 31% YoY.

- 16,730 self-miners are hashing across Pennsylvania sites.

- Q3 2025 mined 246 BTC, revenue $6.9 millio.

- Annual Bitcoin issuance 164,250 BTC post-halving.

- 144 blocks daily produce 450 BTC at 3.125 BTC/block.

- 64 MW hosting for 17,453 Canaan ASICs.

Self-Mining vs. Hosting Activities

- Self-mining revenue $0.1 million Oct 2025, down 55% YoY.

- Digital colocation $1.6 million Oct 2025, down 59% YoY.

- Energy management $1.6 million Oct 2025, up 191% YoY.

- Q1 2025 colocation revenue $10.4 million, up 27% YoY.

- Q1 2025 energy revenue $3.1 million, up 24% YoY.

- FY self-mining $21.59 million, down 49.91%; colocation $16.36 million, up 22.67%.

- 64 MW Canaan hosting contract for stable revenue.

- Public miners hosting 30-50% revenue share in 2025.

Geographic Presence and Facility Locations

- Operates 129 MW total capacity across Pennsylvania facilities in the PJM grid.

- Midland, PA facility, expanded to 120 MW, supports 38,810 miners.

- Bellefonte, PA site 24 MW total capacity, 8.8 MW self-mining operational.

- PJM market serves over 65 million people across 13 states and D.C.

- Expanded to Ohio with 24 MW initial capacity, targeting 153 MW total.

- Bellefonte lease extends through 2030, Ohio lease to 2033.

- 64 MW Canaan hosting deal at Pennsylvania sites.

Mining Hardware and Efficiency Metrics

- Antminer S19 XP 140 TH/s at 3,010 W, ~21.5 J/TH efficiency.

- 15,876 S19 XP units in Consensus colocation, 141 EH/s total.

- 2025 ASICs <20 J/TH, e.g. Antminer S21 17 J/TH.

- Whatsminer M70S+ 244 TH/s, 12.5 J/TH, 3,140 W.

- Optimized S19 Pro 155 TH/s at 25.2 J/TH with immersion.

- Older miners >35 J/TH face tight margins.

- Hardware lifespan is 3-5 years, depending on costs.

- NVIDIA H100 GPU up to 700 W per unit.

Power Capacity and Energy Usage

- Operates 129 MW active capacity, 24 MW under development.

- Global Bitcoin mining consumes 100-140 TWh of annual electricity.

- Worldwide data centers 460 TWh 2024, >620 TWh by 2026.

- PJM manages >180 GW installed capacity.

- U.S. industrial rates 8-9 cents/kWh in 2025, wholesale lower.

- Renewables 25% U.S. generation.

- Energy costs 50-70% mining OPEX.

- ERCOT is expanding wind/solar capacity.

Frequently Asked Questions (FAQs)

Trailing twelve-month revenue was $51.59 million, and net loss was −$12.53 million.

Mawson regained compliance with Nasdaq listing rules on December 22, 2025.

Total revenue in Q3 2025 was $13.2 million.

Conclusion

Mawson Infrastructure Group enters this year positioned at the intersection of Bitcoin mining, AI infrastructure, and energy optimization. While the halving reduced direct mining margins, the company’s operational footprint, diversified hosting agreements, and expanding energy management programs provide structural resilience. At the same time, global hash rate growth above 600 EH/s and surging AI data center demand underscore the competitive intensity of modern compute markets.

Looking ahead, Mawson’s ability to balance self-mining exposure with contracted hosting revenue and energy market participation will define its performance trajectory. As Bitcoin issuance tightens and AI workloads expand, infrastructure operators with scalable power access and diversified compute offerings stand to capture the next phase of digital infrastructure growth.