Layer 2 networks are no longer niche tools; they’re fundamental infrastructure in blockchain ecosystems. Enterprises are integrating these scaling solutions to reduce transaction costs, and DeFi platforms are pushing user numbers into the hundreds of thousands. In one real‑world application, payment startups are routing millions of micropayments across Layer 2 rails to serve emerging markets. In another, gaming platforms are using Layer 2 to onboard players without the friction of high gas fees and slow confirmation times. Read on to explore the full article and see how Layer 2 adoption is unfolding in depth.

Editor’s Choice

- Cumulative Layer 2 TVL reached $39.39 billion for the 12 months up to November 2025 (all L2s combined).

- 4.63%, year‑on‑year growth in TVS for Layer 2 networks during that same period.

- >1.9 million, estimated daily transactions handled by Layer 2 networks in 2025.

- 51%, estimated market share of Arbitrum One in the Layer 2 TVL segment in early 2025.

- Arbitrum boasted 1.37 million daily active wallets in early November 2025, per Arbitrum’s updated metrics.

Recent Developments

- Stablecoin transactions on Layer 2 increased by 54% year-over-year, led by Optimism and Base.

- Over 70% of Layer 2 payments in 2025 were made with stablecoins instead of ETH.

- Enterprise clients adopted Arbitrum’s private Layer 2 networks with a Total Value Locked (TVL) growth of 150%+ in L2 ecosystems.

- Bridging solutions now enable asset transfers between Layer 1 and Layer 2 in under 3 minutes on average during peak times.

- Regulatory focus increased on Layer 2 data availability and bridging risks with 50+ new guidelines proposed globally in 2025.

- Sequencer centralization concerns emerged, with 30% of Layer 2 projects actively working on decentralization protocols.

- Interoperability initiatives reduced Layer 2 ecosystem fragmentation by 25% through cross-rollup communication protocols.

- Polygon’s AggLayer enabled 2.3-second average block times, facilitating enterprise-scale Layer 2 applications.

Key Layer 2 Scaling Solutions

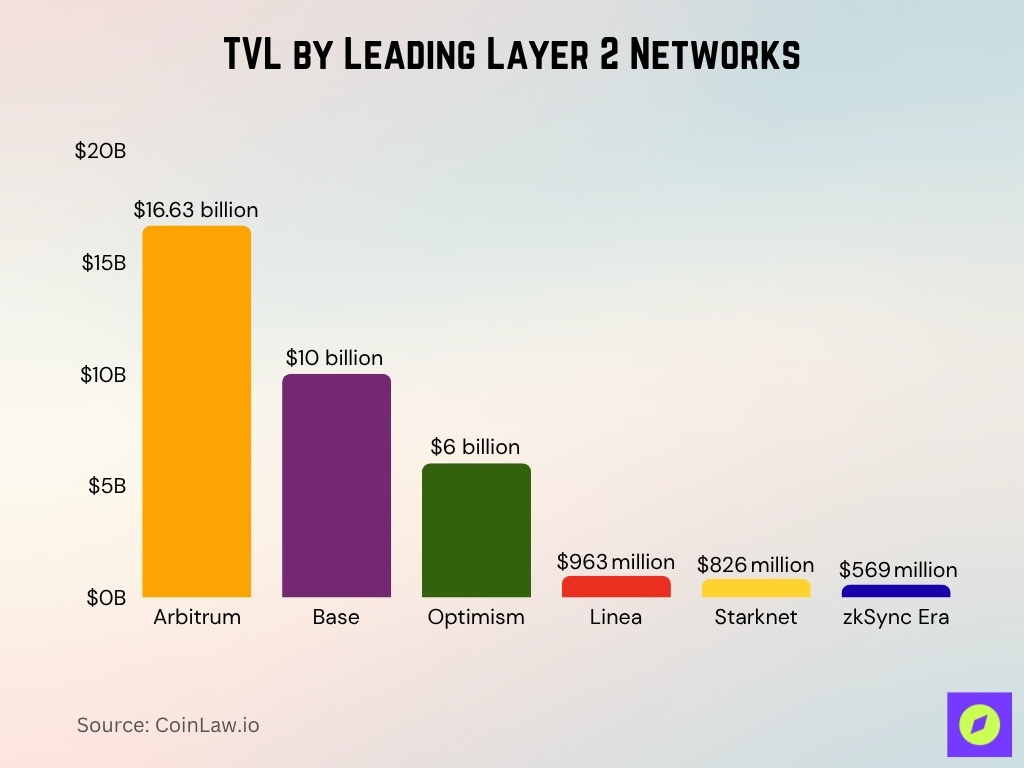

- Arbitrum now leads Layer 2 networks with $16.63 billion TVL as of November 2025.

- Base holds $10 billion TVL in November 2025.

- Optimism has secured $6 billion TVL by November 2025, based on the latest network metrics.

- Linea, a newer zk‑rollup reaching ~$963 million TVS with 11.6% 1‑year growth.

- Starknet, ~$826 million TVS, and ~21.2% one‑year growth.

- zkSync Era, ~$569 million, ~22% one‑year growth, early mover in zk‑rollup adoption.

Total Value Locked (TVL) on Layer 2 Networks

- TVL grew by 4.63% year-on-year across Layer 2 networks.

- Some Layer 2 networks saw a combined TVL decline of 10.9% in early 2025.

- DeFi TVL is increasingly focused on Class I rollups, capturing growing market share.

- Stablecoins, real-world assets, and bridged tokens make up over 45% of Layer 2 TVL.

- TVL reporting varies, with only 46.5% of protocols aligning claims with on-chain data.

- TVL diversification indicates reduced reliance on ETH alone for value locked.

- Smaller Layer 2 rollups captured 12% incremental TVL share in 2025.

Layer 2 Transaction Volume Growth

- Layer 2 networks processed over 1.9 million daily transactions in 2025.

- Stablecoins constitute over 70% of all Layer 2 transaction volumes in 2025.

- Gaming and micropayments contributed to a 50% increase in Layer 2 transaction volume year-over-year.

- DeFi activity on Layer 2 grew transaction counts by 38% despite modest TVL growth.

- Some Layer 2 networks recorded six-figure daily active addresses, supporting high transaction throughput.

- Cross-chain Layer 2 bridge improvements boosted volume growth projections by 45%.

- Layer 2 TVL grew by a moderate 12%, decoupled from transaction volume trends.

- Layer 2 volume composition shifted with stablecoins leading payment and transfer transactions.

- A growing share of Layer 2 volume now comes from cross-network transactions, not single-chain activity.

User Adoption and Active Addresses

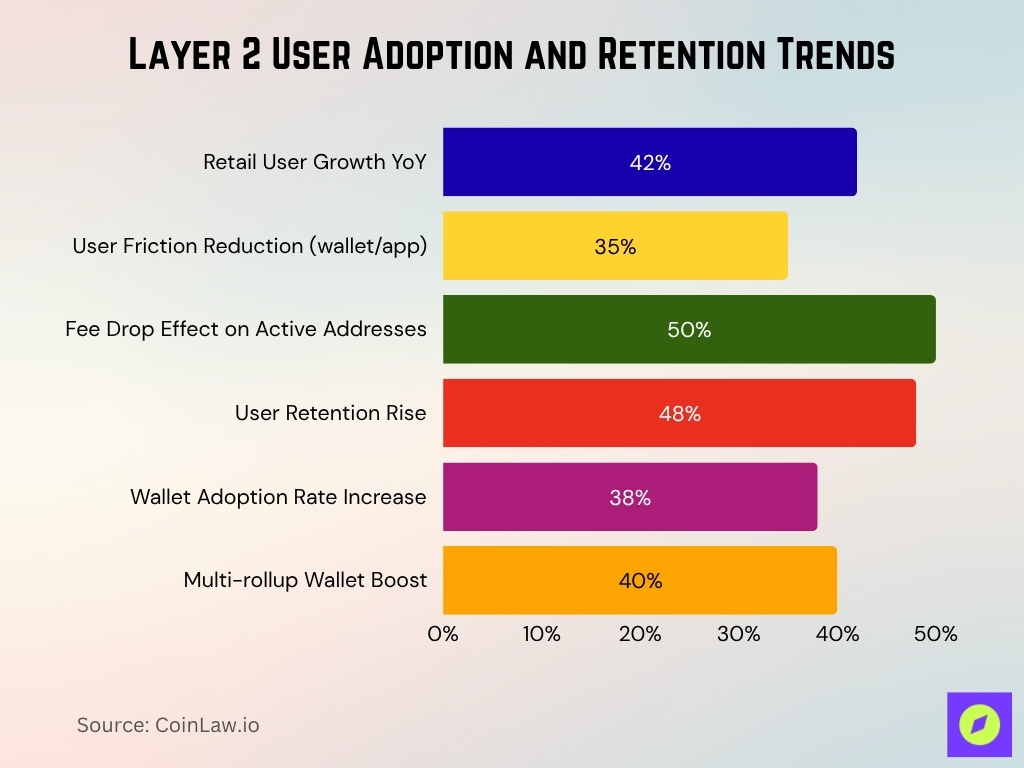

- Retail Layer 2 users grew by 42% year-over-year, outpacing institutional adoption.

- Improved wallet and app onboarding reduced user friction by 35% on Layer 2 in 2025.

- Transaction fee drops on Layer 2 increased active addresses by 50% versus Layer 1.

- Layer 2 dApp ecosystem growth contributed to a 48% rise in user retention in 2025.

- Layer 2 wallet integrations grew adoption rates by 38% among mainstream users.

- Wallets supporting multi-rollup connections boosted mobility and usage by 40% in 2025.

- Arbitrum daily active addresses reached approximately 1.37 million in Q2 2025.

- Layer 2 networks ranked among the top 10 fastest-growing blockchains by active users in 2025.

- Smaller Layer 2 chains experienced user growth rates over 4,000% year-on-year by late 2024.

- The projected Layer 2 user base is expected to exceed 6 million active addresses by 2026.

Geographic Distribution of Layer 2 Adoption

- In 2025, the Chainalysis Global Crypto Adoption Index shows the United States and India leading in grassroots crypto usage, indicating strong potential for a Layer 2 uptick in these markets.

- The U.S. alone accounts for approximately 41% of global NFT transaction volume in 2025, suggesting high Layer 2 engagement through NFT and gaming channels.

- The Asia‑Pacific region grew institutional crypto adoption from 27% to 69% year‑over‑year in 2025, highlighting rising enterprise interest across APAC, which may include Layer 2 infrastructure.

- Latin America’s institutional growth rose from 53% to 63% in 2025, suggesting emerging markets may drive Layer 2 usage via payments and remittance scenarios.

- Although regional data specific to Layer 2 is still sparse, the above indicators point toward North America and Asia being key hubs of L2 adoption in 2025.

Layer 2 Adoption in DeFi Applications

- In 2025, the total value locked (TVL) across all DeFi protocols reached $123.6 billion, up 41% year over year.

- Layer 2 adoption in DeFi drove Arbitrum’s TVL to $16.63 billion in November 2025 across DeFi protocols and bridges.

- Developer data shows that over 65% of new smart contracts in 2025 were deployed directly on Layer 2 rather than on Layer 1.

- In a peer‑reviewed study, Layer 2 rollups secured over $40 billion and accounted for nearly half of Ethereum’s DEX volume in Q1 2025.

- Layer 2 DeFi usage is expanding to include real‑world asset tokenization, with tokenized bonds and other assets becoming accessible via L2.

- While DeFi adoption among retail segments is strong on Layer 2, institutional uptake remains comparatively modest because L2 institutional infrastructure is still building.

- L2 DeFi environments are benefiting from lower fees and higher throughput, enabling yield‑farming, lending, and liquidity‑pool strategies to migrate off L1.

- As protocols enhance UX and inter‑rollup composability, the share of DeFi activity on Layer 2 is expected to continue growing through 2025 and beyond.

Ethereum Layer-1 vs Layer-2: Key Performance Differences

- Ethereum Layer-1 handles ~15–30 TPS, while Layer-2 solutions can process up to 10,000+ TPS for significantly faster throughput.

- Gas fees on Layer-1 often range from $5 to $50+, compared to under $0.01 on Layer-2—a major cost advantage.

- Layer-1 scalability is limited, whereas Layer-2 networks are highly scalable, supporting mass adoption.

- Security on Layer-1 is native to the Ethereum mainnet, while Layer-2 inherits security from Layer-1 but improves performance.

- Use cases for Layer-1 include being the base layer for dApps, DeFi, and NFTs.

- Layer-2 is optimized for high-volume apps, microtransactions, and DeFi scaling, making it ideal for real-time, low-cost operations.

- Examples of Layer-2 solutions include Arbitrum, Optimism, Polygon, and zkSync, all built to enhance Ethereum’s performance.

Enterprise and Institutional Layer 2 Adoption

- In 2025, 86% of global institutional investors hold or plan to invest in digital assets.

- 60% of institutional crypto investors prefer regulated vehicles like ETFs over direct token holdings.

- Enterprise adoption barriers are shifting from protocol maturity to concerns over regulatory clarity.

- Institutions report 30-40% lower operational costs when using Layer 2 infrastructures.

- Tokenized real-world assets on Layer 2 reached $25 billion market size in 2025, growing 260% year-to-date.

- Bridge and compliance tools improvements have increased Layer 2 enterprise deployments by 45% in 2025.

- Institutional Layer 2 adoption lags retail due to security and decentralization concerns in 52% of firms.

- Wait-and-see institutional attitudes prevail with 70% of firms delaying large-scale Layer 2 integration pending standardization.

- Forecasts predict total value locked by enterprises on Layer 2 networks to surpass $50 billion by 2026.

Layer 2 Adoption in Payments and Micropayments

- Lightning Network micropayments averaged 44.7k satoshis (~$11.84) with a 99.7% success rate.

- Stablecoins account for over 70% of Layer 2 payment flows in 2025.

- Base network processes over 30% of U.S. stablecoin transactions, led by strong USDC volumes.

- Over 1.9 million daily transactions were processed on Layer 2 networks in 2025.

- Emerging markets like India and Nigeria drive high-volume, low-value transfers on Layer 2.

- Media platforms integrating Layer 2 micropayment systems increased by 42% in 2025.

- Layer 2 wallets with enhanced UX boosted real-time transaction usage by 48% year-over-year.

- New payment models on Layer 2, such as streaming content payments, grew by 27% in adoption.

- The average Lightning Network fee reduction reached 50% due to enterprise adoption in 2025.

Layer 2 Networks: TPS and EVM Compatibility Snapshot

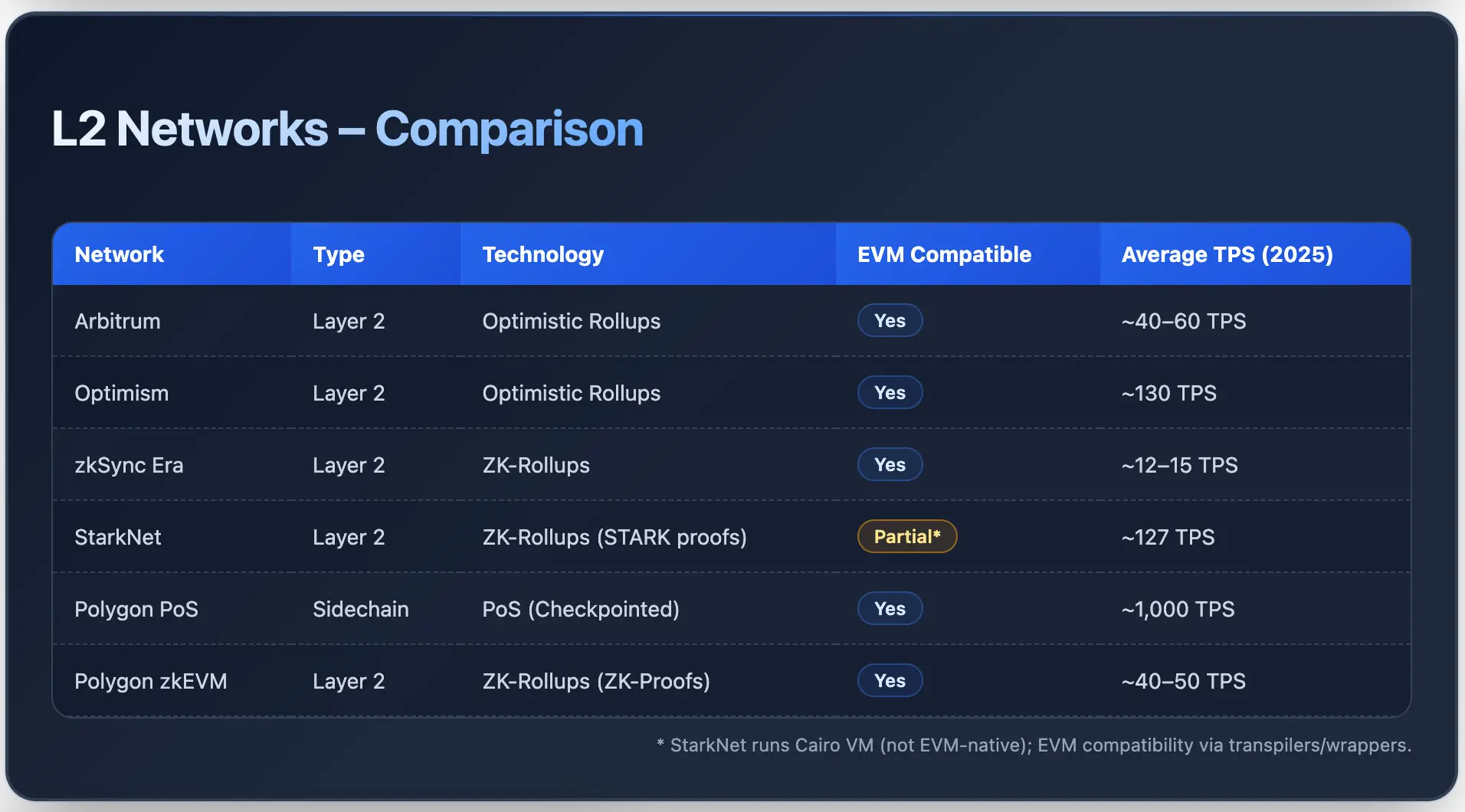

- Arbitrum uses Optimistic Rollups and delivers ~40–60 TPS with full EVM compatibility.

- Optimism also runs on Optimistic Rollups, offering a higher throughput of ~130 TPS, fully EVM compatible.

- zkSync Era leverages ZK-Rollups and achieves ~12–15 TPS, with EVM compatibility supported.

- StarkNet utilizes ZK-Rollups with STARK proofs, delivering ~127 TPS, but is only partially EVM compatible via transpilers/wrappers.

- Polygon PoS, a sidechain with PoS (Checkpointed) technology, leads in speed with ~1,000 TPS and full EVM compatibility.

- Polygon zkEVM employs ZK-Rollups (ZK-Proofs), offering ~40–50 TPS, fully EVM compatible.

Gaming and NFT Adoption on Layer 2

- The U.S. accounted for 41% of global NFT transaction volume in 2025.

- Over 65% of new smart contracts in 2025 were deployed on Layer 2 networks.

- Some Layer 2 networks reported six-figure daily active addresses, driven by gaming NFT activity.

- Gaming NFTs contributed to 38% of total NFT transaction volume in 2025.

- Layer 2 reduced gas fees by 74% for gaming transactions compared to Layer 1 fees.

- Monthly blockchain-based in-game transactions exceeded $620 million in 2025.

- Cross-chain interoperability covered 24% of blockchain gaming transactions in 2025.

- Over 80% of NFT creators used royalty-enforcing smart contracts in 2025.

- Layer 2 platforms like Immutable X offer gas-free NFT minting specifically targeting gaming.

- Enhanced wallets and interoperability frameworks boosted Layer 2 gaming adoption by 48% year-over-year.

Advantages of Layer 2 Networks for Users

- Layer 2 networks reduce user fees by 90-99% compared to Layer 1.

- Over 85% of Layer 2 transactions settle within seconds or less.

- User satisfaction with dApp responsiveness improved by 37% due to lower congestion on Layer 2.

- Layer 2 inherits security from Layer 1, securing over 98% of transactional proofs.

- Gaming, NFT, and DeFi transactions on Layer 2 increased by 42% due to improved performance.

- Non-technical users adopting Layer 2 wallets rose by 50% year-over-year in 2025.

- Layer 2 networks enabled an average 3x faster transaction speed versus Layer 1.

- The percentage of Layer 2 users reporting excellent experience increased by 28% in 2025.

- Combined improvements in cost, speed, and UX doubled active Web3 Layer 2 users to over 5 million in 2025.

Cost Savings and Fee Reductions

- Average Layer 1 gas fees were approximately $3.78 in 2025, illustrating the cost challenges of operating directly on Layer 1.

- A real‑world system integration using L2 rollups reduced transaction fees by ~75% and increased throughput by ~60%.

- Batched transactions reduce gas use on Layer 1, significantly lowering per‑transaction cost.

- Developers and businesses benefit from more predictable and lower operating expenses.

- Lower fees also reduce user abandonment, since cost barriers become minimal.

- Overall, L2 networks provide meaningful savings that support mainstream and enterprise‑grade use cases.

Transaction Speed Improvements

- Rollup technology deployment led to a ~60% improvement in throughput in real-world use.

- Real-time transaction capability increased high-frequency DeFi activity by 48%.

- Settlement times on Layer 2 reduced failed transactions by 35% compared to Layer 1.

- Faster, cheaper transactions increased user satisfaction by 42% in 2025.

- Layer 2 speed improvements enabled a 50% rise in gaming and payment volumes.

- Applications requiring instant response reported up to 75% faster performance on Layer 2.

Security and Decentralization Metrics

- Over 98% of Layer 2 security is anchored to Layer 1 blockchains.

- Sequencer centralization affects 42% of optimistic rollups in 2025.

- zk-Rollups increased decentralization participation by 35% using new cryptographic techniques.

- Fraud-proof mechanisms reduced transaction disputes by 28% on Layer 2 in 2025.

- 65% of institutional users cite centralization risks as a top barrier to Layer 2 adoption.

- The average number of independent sequencers per rollup rose to 7 in 2025, improving decentralization.

- Security audits and governance transparency influenced 72% of enterprise Layer 2 deployments.

- Bridge safety protocols prevented over $120 million in potential losses in 2025.

- Validator node counts increased 30% year-over-year across major Layer 2 networks.

- Robust decentralization scored as a decisive factor by 80% of stakeholders for long-term Layer 2 trust.

Challenges and Risks to Layer 2 Adoption

- Cross-chain messaging complexity affects 78% of Layer 2 projects in 2025.

- 62% of users report difficulty managing bridging and wallets on Layer 2.

- Liquidity fragmentation reduced average depth by 40% across L2 networks.

- Withdrawal delays in optimistic rollups average 7 days, causing user friction.

- Sequencer centralization concerns impact 45% of Layer 2 ecosystems.

- Over 55% of Layer 2 tools lack full standardization, hindering adoption.

- Regulatory uncertainty affects 53% of Layer 2 payment and DeFi projects.

- 30% of enterprises still prefer Layer 1 due to maturity and security perceptions.

- And 48% of users cite slow withdrawals as a top Layer 2 risk.

- Overall, 48% of Layer 2 projects report technical and regulatory barriers as major growth challenges.

Future Outlook for Layer 2 Adoption

- Layer 2 adoption is projected to grow by 65% annually through 2026 due to protocol maturity.

- EIP-4844 “blob” transactions expected to cut rollup data costs by up to 70%.

- Layer 3 modular systems could increase throughput by 3x over Layer 2 by 2027.

- Enterprise Layer 2 participation is forecasted to rise by 50% with regulatory clarity.

- Multi-rollup wallet support adoption is set to increase user mobility by 40%.

- IoT and micro-transaction use cases on Layer 2 are expected to grow 80% by 2026.

- Networks with strong security and decentralization see 55% faster user growth.

- Layer 2 is predicted to become the primary Web3 execution layer by 2028.

- Interoperability improvements projected to boost ecosystem activity by 46%.

- UX enhancements will increase mainstream blockchain user adoption by 38% in the next three years.

Frequently Asked Questions (FAQs)

Leading rollups had over $12 billion in TVL (e.g., Arbitrum) and another had about $6 billion in TVL (e.g., Optimism) by early 2025.

Layer 2 blockchain solutions are reported to address throughput in the range of up to 10,000+ TPS.

Developer data indicates that over 65% of new smart contracts in 2025 were deployed directly on Layer 2.

Conclusion

Layer 2 networks have moved from experimental scaling approaches into essential blockchain infrastructure. They offer dramatic cost reductions, faster transactions, improved user experience, and a more accessible environment for both developers and everyday users. At the same time, they face challenges in decentralization, security, governance, and regulatory clarity. If these barriers are addressed, Layer 2 networks could become the backbone of mainstream blockchain applications ranging from payments and gaming to enterprise finance.