The cryptocurrency exchange Kraken has emerged as a major platform in the digital-asset space, known for its global reach, broad asset support, and focus on security and transparency. From institutional desks trading futures to retail users buying Bitcoin, Kraken plays a role in both advanced and everyday crypto use-cases.

For example, a hedge fund may use Kraken’s derivatives offerings to hedge exposure to Bitcoin, while a U.S. retail investor might use Kraken’s fiat-on-ramp to buy Ethereum. In the sections that follow, we explore detailed statistics on Kraken’s user base, global presence, supported currencies, and more, inviting you to dive into the full picture of a major crypto exchange.

Editor’s Choice

- Kraken reports over 13 million registered users with 4.4 million funded accounts as of Q2 2025.

- Kraken supports over 530 cryptocurrencies and 1,271 trading pairs as of Q3 2025.

- Kraken supports seven major fiat currencies (USD, EUR, GBP, CAD, AUD, CHF, JPY) for deposits and withdrawals, while BRL is available only through the Kraken Pay app.

- In March 2025, Kraken proved reserves of 192,091 BTC against 167,189 BTC owed for a 114.9% reserve ratio.

- Global launch under the Markets in Crypto-Assets Regulation (MiCA) across 30 EEA countries.

- Kraken received a top score of 100, six points ahead of the second-ranked exchange.

Recent Developments

- Kraken’s Q1 2025 revenue was $472 million, representing 19% year-over-year growth.

- Launch of a peer-to-peer payments app, Krak, supporting crypto and fiat transfers in 100+ countries.

- Full rollout of MiCA-regulated services across all 30 EEA countries, enabling unified service under one license.

- Kraken supports over 530 coins and 1,271 trading pairs as of the latest refresh.

- A recognized “Best Crypto Exchange 2025” award acknowledged Kraken’s user base and asset support (13 million+ users)

User Base and Key Kraken User Statistics

- 70% of U.S. crypto holders said they prefer investing in established cryptocurrencies (vs. memecoins, 12% and emerging coins 17%).

- In a Kraken-commissioned survey of 1,000+ U.S. respondents, 73% of crypto holders plan to continue investing in crypto in 2025.

- Of U.S. crypto holders with household income >$175,000, 82% plan to invest in crypto in 2025; for income $0-$24,99,9, the figure was 59%.

- Kraken had a reported 24-hour volume of about $1.35 billion for spot trading.

- Previously, the reported 24-h volume was ~$1.35 billion, showing some variability in daily volumes.

- The survey found that U.S. middle-aged respondents (ages 45-60) had a higher crypto purchase rate (69%) compared to younger respondents (55% for ages 18-29).

- Survey respondents rated positive price movement as the top driver for adoption (31%), followed by institutional adoption (22%) and clearer regulation (22%).

Kraken Global Reach and Market Presence

- Kraken operates in 190+ countries worldwide, enforcing restrictions in 14 jurisdictions to comply with sanctions and regulations.

- Platforms restricted include Russia, Belarus, Iran, North Korea, and Syria, ensuring regulatory alignment and global compliance.

- Kraken supports seven fiat currencies (USD, EUR, GBP, CAD, AUD, CHF, JPY) for deposits and withdrawals across major regions.

- Kraken services span North America, Europe, Asia, and Latin America, excluding sanctioned nations and select high-risk regions.

- Under the MiCA framework, Kraken expanded to all 30 EEA countries in August 2025, strengthening its European presence.

- Kraken held 3.6% global market share in Q3 2025, with $102 billion quarterly volume and a top 3 ranking by trading share.

- As of October 2025, Kraken’s regulatory disclosure lists active licensing status across 12+ regions under FinCEN, FCA, ASIC, and MiCA frameworks.

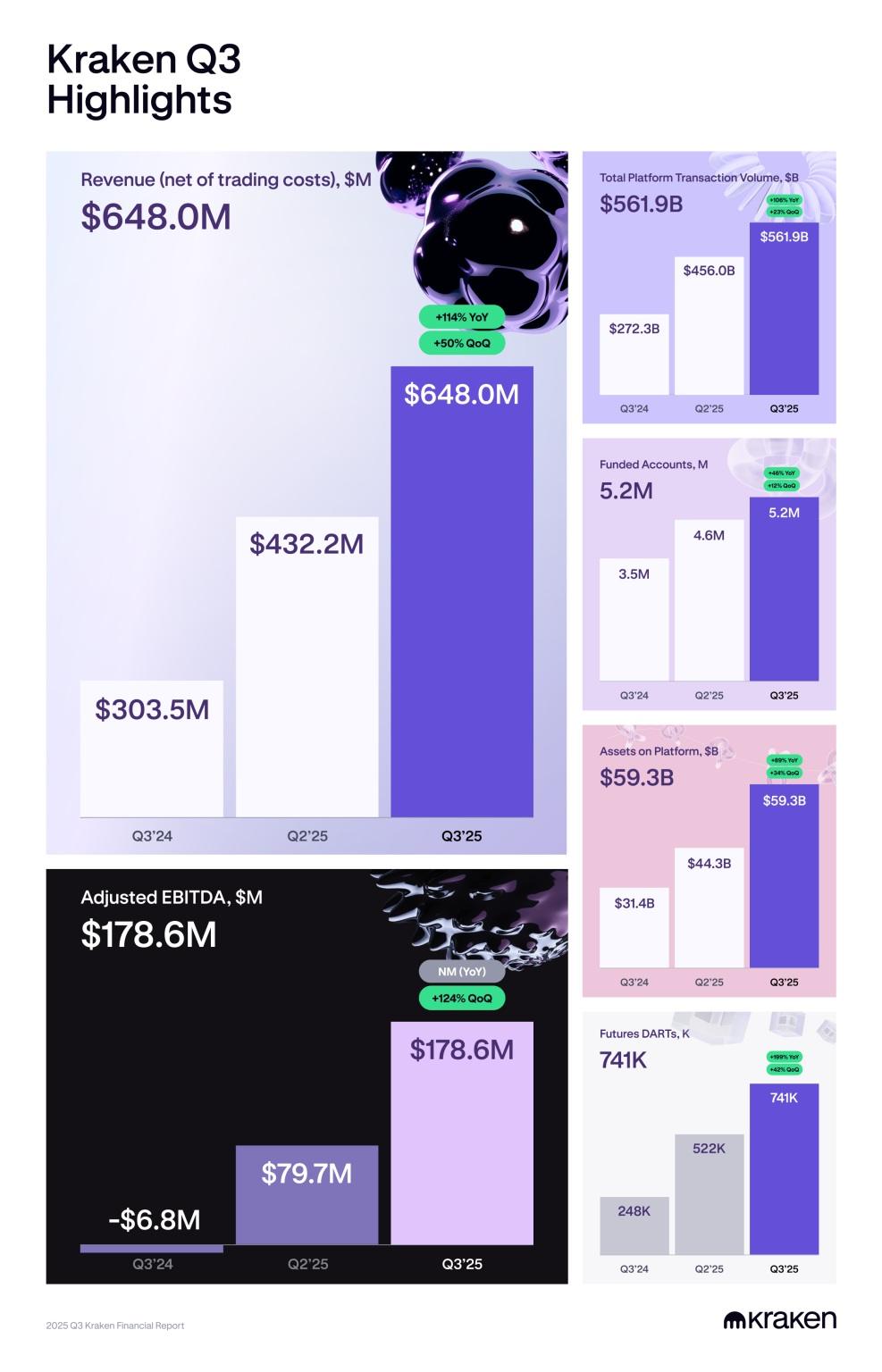

Kraken Q3 2025 Financial Highlights

- Q3 2025 revenue hit $648 million, growing 114% year-over-year and 50% quarter-over-quarter.

- Total platform transaction volume rose to $561.9 billion, up 106% YoY and 23% QoQ, reflecting stronger engagement across users.

- Kraken’s funded accounts reached 5.2 million in Q3 2025, a 49% year-over-year and 13% quarter-over-quarter increase.

- Assets on the platform increased to $59.3 billion, an 89% YoY and 34% QoQ rise, showing stronger user retention and asset inflows.

- Adjusted EBITDA improved to $178.6 million, recovering from a $6.8 million loss in Q3 2024 and highlighting improved profitability.

- Futures DARTs climbed to 741,000, up 199% YoY and 42% QoQ, signaling solid growth in derivatives trading.

Exchange Fees and Fee Structure

- The main platform applies a flat 1% trading fee for basic orders.

- Maker-taker model ranges: maker 0.25% to 0%, taker 0.40% to 0.10%.

- “Convert Small Balances” charges a fixed 3% fee for tiny orders.

- Kraken+ subscription grants zero fees on up to $10,000 monthly trading volume.

- Futures maker fees drop to 0.02%, taker fees to 0.05%.

- Withdrawal fees: 0.01 ETH, 0.02 SOL, 0.5 MATIC per asset.

- Crypto deposits often have zero fees; fiat deposit fees vary by region and method.

- Fees depend on 30-day trading volume and order type.

- All fee details are public and transparent.

- Kraken offers competitive low fees for large institutional volumes.

Number of Employees and Offices

- Kraken’s global employee count is approximately 2,200 after cutting about 400 positions in late 2024.

- Approximately 1,000 employees operate across six continents.

- In 2024, Kraken cut around 15 % of its workforce, roughly 400 of 2,600 staff.

- In 2022, Kraken laid off about 30 % (≈1,100) of its workforce.

- Kraken maintains a remote-first workforce, with staff in 60+ countries.

- Headquarters located at 100 Pine Street, San Francisco, California.

- Offices and business locations include San Francisco, Tortola, Halifax, Milan, Tokyo, and London.

- Kraken’s globally distributed “Krakenites” team supports finance, compliance, trading, and tech.

Demographics of Kraken Users

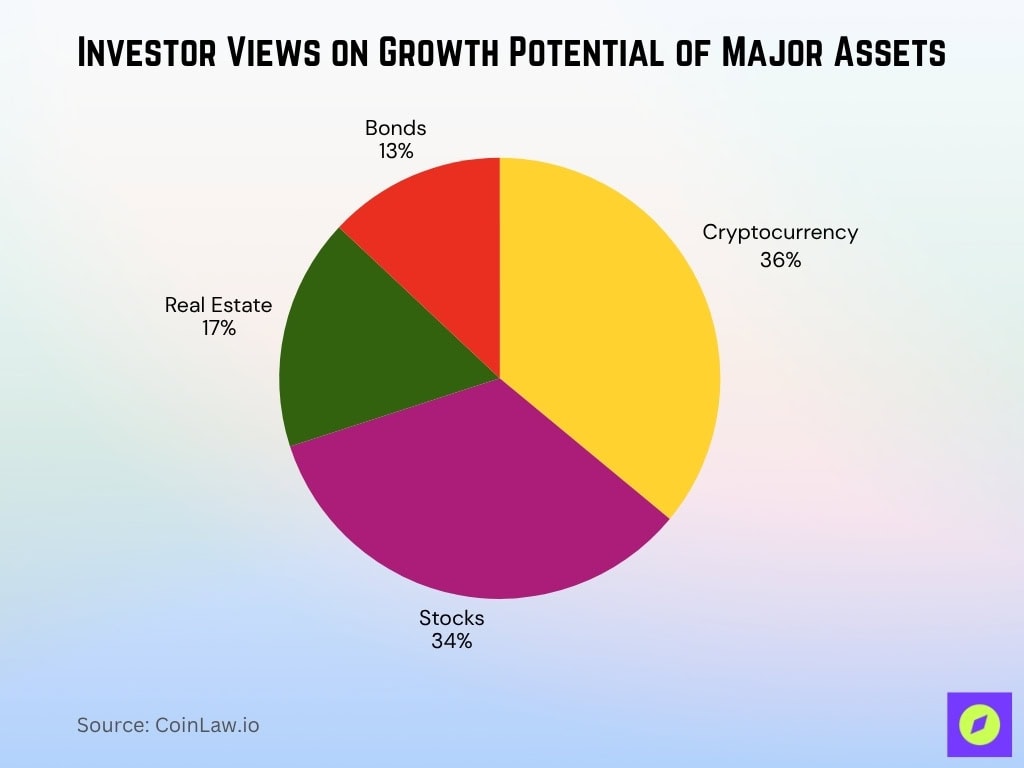

- 36% view crypto as having greater growth potential than stocks (34%), bonds (13%), or real estate (17%).

- 73% of U.S. crypto holders plan to continue investing in crypto in 2025.

- 70% prefer established cryptocurrencies (versus 12% for memecoins and 17% for emerging coins).

- Among incomes above $175,000, 82% plan to invest, and for $0–$24,999, the figure is 59%.

- 69% of ages 45-60 reported having bought crypto, vs 55% of ages 18-29.

- Price movement was the top adoption driver (31%), institutional adoption (22%), and regulation (22%).

Device and Platform Usage Statistics

- Kraken markets its platform via web and mobile to buy, sell, trade, and learn.

- Kraken Pro targets advanced users, offering futures, margin, and OTC trading.

- The basic interface applies a flat 1% trading fee for simple buy/sell orders.

- Kraken Pro uses a 30-day volume-based maker-taker model, with maker fees as low as 0%, taker fees as low as 0.10% for $10 million+ volume.

- “Convert Small Balances” feature fees are fixed at 3% for amounts below the minimum.

- Withdrawal fees include 0.01 ETH for Ethereum, 0.02 SOL for Solana, and 0.5 MATIC for Polygon.

- Kraken provides downloadable market and trade data for all pairs.

- Younger users favor mobile for spot trading, while veteran traders use desktop and APIs.

Security and Compliance Statistics

- Kraken’s infrastructure is secured in monitored facilities with armed guards and surveillance.

- Certified ISO 27001 and SOC 2 Type 1, and achieved SOC 2 Type 2 compliance in 2025.

- Proof of Reserves program verifies that assets are fully backed by on-chain holdings.

- The global transparency report showed a 38.6% increase in law-enforcement requests to 6,826.

- Authorized by the UK FCA as an Electronic Money Institution under Payward Services Limited.

- Fined A$8 million for margin violations in Australia.

- Disclosure notes that some products remain unregulated and not covered by compensation schemes.

- Security and compliance features remain top reasons for institutional client trust.

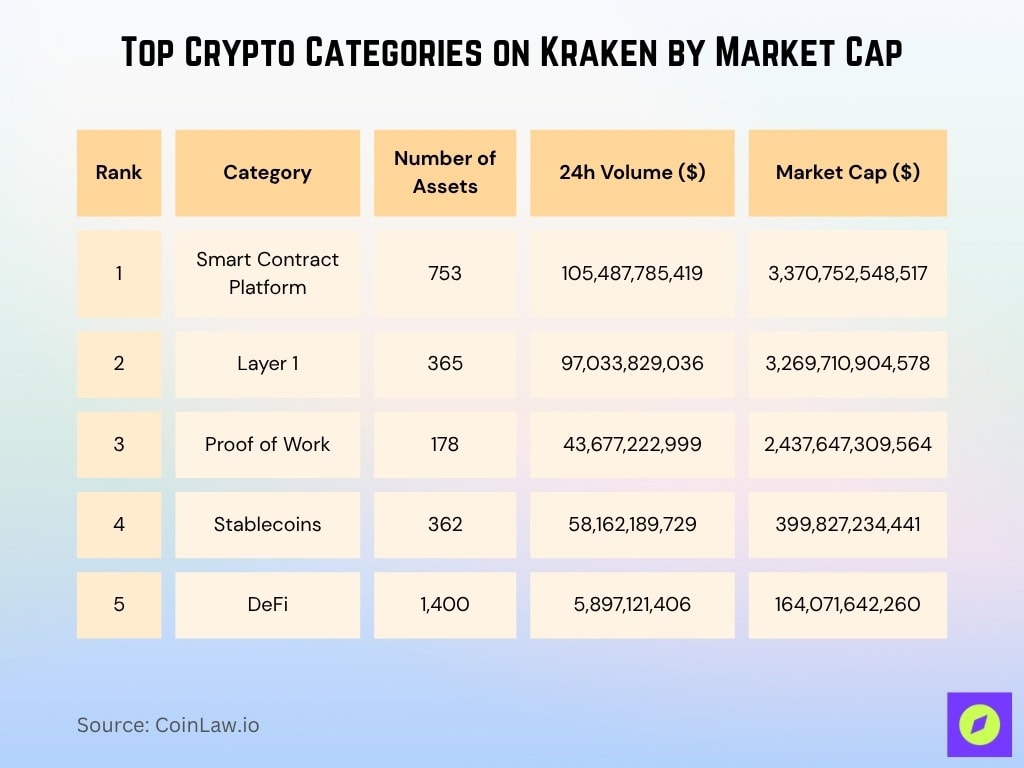

Top Crypto Categories on Kraken (Market Cap Highlights)

- Smart Contract Platform ranks first with 753 assets, a 24h volume of $105.5 billion, and a massive $3.37 trillion market cap.

- Layer 1 is second, featuring 365 assets, $97.0 billion 24h volume, and a total market cap of $3.27 trillion.

- Proof of Work comes third, with 178 listed assets, $43.7 billion 24h volume, and a market cap of $2.44 trillion.

- Stablecoins hold the fourth spot, showing 362 assets, a strong $58.2 billion 24h volume, and an aggregate market cap of $399.8 billion.

- DeFi stands fifth, representing 1,400 assets, $5.9 billion in daily volume, and a market cap of $164.1 billion.

Margin and Futures Trading Data

- Kraken offers margin, futures, and OTC via Kraken Pro.

- Maker fees for futures are as low as 0.02% at high volume.

- Futures and margin support hedging and institutional activity.

- Proof of Reserves includes futures and margin balances.

- Margin and futures volumes bolster liquidity and market-making.

- Rollover and financing fees apply to open positions and are visible in trade exports.

- Kraken plans futures expansion into regulated structures and multi-asset markets.

Growth History and Milestones

- Founded in 2011, it is among the earliest crypto exchanges.

- Q1 2025 revenue $472 million, up 19% YoY.

- Proof of Reserves verified $21.5 billion in client assets (Sept 2024).

- Achieved SOC 2 Type 2 compliance in 2025.

- FCA-approved Electronic Money Institution in the UK.

- Workforce reduction of ~15% in late 2024 for efficiency.

- Expanded remote team across 60+ countries.

- Introduced Kraken Pro and Kraken+ tiers, and exploring stock and ETF trading.

Major Partnerships and Funding

- Investors included Apollo Global Management, Oppenheimer & Co., and Jane Street Capital.

- In talks to raise an additional $200-300 million at a valuation of $20 billion.

- Acquired NinjaTrader for $1.5 billion.

- 4.4 million funded accounts at end-Q2 2025, up 37% YoY.

- Kraken was awarded “Best Crypto Exchange 2025” by Expert Consumers, based on satisfaction ratings exceeding 90%.

- Expanding institutional partnerships and multi-asset offerings.

- Aiming for IPO target in Q1 2026.

Kraken Exchange Rankings

- Earned #3 global exchange ranking from Kaiko in Q1 2025.

- Moved up to #2 ranking in Q2 2025.

- Achieved #1 global exchange ranking in Q3 2025.

- Among the top-10 spot exchanges by traffic and liquidity in 2025.

- Stable-coin spot volume share grew from 43% to 68% in Q2 2025.

- 4.4 million funded accounts support ranking improvement.

Product and Service Offerings

- Provides spot, margin, futures, staking, OTC, and institutional services.

- “Convert Small Balances” feature charges 3% fee.

- Kraken Pro offers maker fees down to 0%, taker fees of 0.10%.

- Q3 2025 recorded 741,000 daily average revenue trades (DARTs), up 42%.

- Stable-fiat spot volume rose to 68% (from 43%).

- Supports multiple fiat deposits and custody services.

- Rolled out regulated derivatives in Europe under MiFID II in May 2025.

- Plans multi-asset trading expansion: “trade anything, anytime, anywhere.”

Customer Support and Satisfaction Metrics

- Kraken achieved a 90% client satisfaction score in its 2025 user experience survey, exceeding the industry average of 81%.

- Independent customer data ranked Kraken’s support responsiveness at 4.6/5, among the top three crypto exchanges globally for service quality.

- The platform employs a 24/7 multilingual support team spanning seven major languages, with average live chat wait times of under 1 minute.

- In 2025, 20% of surveyed crypto users cited previous fraud exposure as a motivation to use Kraken’s educational “Learn” hub for safer trading.

- Kraken’s first-contact resolution rate reached 88%, emphasizing agent training and customer empowerment.

- Its email response time averaged 2.5 hours, improving by 35% year-over-year through automated case routing.

- Transparency and security policies, including Proof of Reserves audits and ISO/IEC 27001 certification, boosted user confidence by 28% versus 2024 data.

- The exchange’s exceptional service earned it the Expert Consumers 2025 Award for “Top Crypto Exchange by Customer Experience”.

- Kraken achieved 90% client satisfaction in 2025, exceeding Coinbase (81%) and Binance (78%).

Frequently Asked Questions (FAQs)

Kraken reports over 13 million registered users with 4.4 million funded accounts as of Q2 2025.

Kraken ranked #1 among global exchanges in Q3 2025, following previous #3 and #2 positions in Q1 and Q2.

4.4 million funded accounts at end-Q2 2025.

Conclusion

Kraken stands out not only for its growing volume and asset metrics but also for its emphasis on regulatory compliance, transparency, and product evolution. The platform is reinforcing its status among serious traders and institutions. Yet the exchange also serves retail users with growing fiat corridors, simplified interfaces, and high-satisfaction support metrics. For U.S. and global audiences alike, Kraken’s mix of scale and service offers tangible value in a complex crypto ecosystem. Explore the full article for a closer look at each metric and its implications for the market.