Bitcoin mining company IREN has stunned markets with record earnings, massive growth in AI infrastructure and a stock rally that shows no signs of slowing.

Key Takeaways

- IREN posted record quarterly revenue of $187.3 million and $176.9 million in net income, swinging back to profitability

- The company generated $1 billion in annualized Bitcoin mining revenue, beating competitor MARA in July

- AI expansion is underway, with a $200 million investment planned to boost GPU count to 10,900 units

- IREN stock has surged over 312% in four months, reaching a $5.4 billion market cap

What Happened?

Bitcoin miner IREN delivered its strongest quarterly and full-year performance to date, buoyed by surging Bitcoin production and an aggressive pivot into artificial intelligence cloud services. The firm reported $187.3 million in quarterly revenue, $176.9 million in net income, and $241.4 million in EBITDA, pushing its stock up nearly 14% in after-hours trading.

IREN’s Explosive Growth in Bitcoin Mining

IREN, formerly Iris Energy, has become a leading force in the Bitcoin mining industry. The company mined 728 BTC in July, surpassing MARA Holdings’ 703 BTC, and currently operates at 50 exahashes per second in installed capacity. Under current market conditions, that translates to an annualized Bitcoin mining revenue of $1 billion.

Co-CEO Daniel Roberts called fiscal 2025 a “breakout year financially and operationally,” noting the firm achieved more than 10 times EBITDA growth over the prior year.

$IREN today reported its FY25 results.

— IREN (@IREN_Ltd) August 28, 2025

Key highlights:

– Record Revenue of $501m (Including record quarterly revenue of $187m in Q4 FY25)

– Record Net Income of $87m

– Record EBITDA of $278m

– Record Adj. EBITDA of $270m

– Expansion to 10.9k GPUs & $200-250m AI Cloud annualized… pic.twitter.com/zh1qiMYXOR

Key Bitcoin mining highlights:

- 728 BTC mined in July, topping key rival MARA

- Annualized mining revenue now $1 billion

- Over 90% fleet utilization rate

- Mining expansion paused temporarily to support AI focus

Pivot to AI Cloud Computing

IREN is rapidly scaling up its AI capabilities alongside its Bitcoin operations. It became a “Preferred Partner” to Nvidia, giving it direct access to cutting-edge GPUs. The company currently operates 1,900 GPUs, up 132% year-over-year, and is investing $200 million to expand to 10,900 units by year-end.

These GPUs are rented out for high-performance computing tasks including:

- Machine learning workloads

- Training large language models

- Supporting enterprise AI infrastructure

This GPU-based strategy already contributes an estimated $250 million in annualized AI revenue, which could rise eight to ten times by December.

In addition, IREN is developing a liquid-cooled AI data center called Horizon, expected to go live in late 2025, and another site in Sweetwater, due in 2027.

Stock Performance and Market Reaction

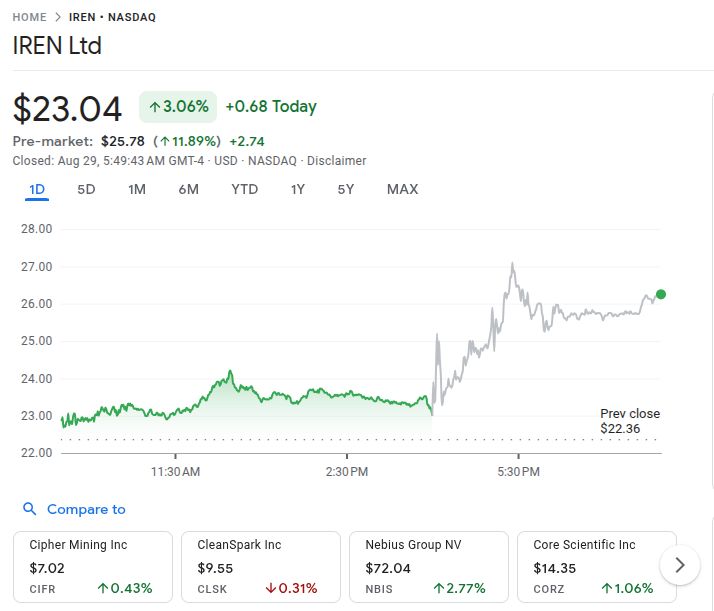

The market has responded with enthusiasm. IREN’s stock, which had dipped as low as $5.59 in April, has rallied 312% over the past four months, and currently trading at $23.04 with a $5.4 billion market cap.

Earlier skepticism from short-seller Culper Research, which once called IREN “wildly overvalued,” has been overshadowed by the company’s recent execution. Culper had mocked IREN’s AI ambitions, but the firm’s newfound Nvidia alliance and accelerated GPU buildout now put it squarely in the high-performance computing race.

IREN also resolved a lingering legal dispute with creditor NYDIG, reaching a confidential settlement over $105 million in defaulted loans tied to around 35,000 mining rigs.

CoinLaw’s Takeaway

Honestly, I’m impressed. IREN isn’t just a crypto miner anymore. It’s quickly becoming a legitimate AI infrastructure player. The Nvidia partnership adds serious credibility, and their results are backing up the ambition. In my experience, when a company nails its execution like this across two high-growth sectors, it tends to catch fire with investors. I was skeptical of the AI talk too, but clearly, they’re not just talking. They’re building. If they pull off that $250 million AI revenue target, they’ll go from a comeback story to an industry leader.