Nvidia is investing $5 billion in Intel, becoming one of its largest shareholders and launching a major collaboration to develop AI and PC chips for the future.

Key Takeaways

- Nvidia is investing $5 billion in Intel, buying shares at $23.28 each, giving it a roughly 4% stake in the company

- Intel and Nvidia will jointly develop multiple generations of data center and PC chips, combining Intel’s CPUs and Nvidia’s GPUs with high-speed connections

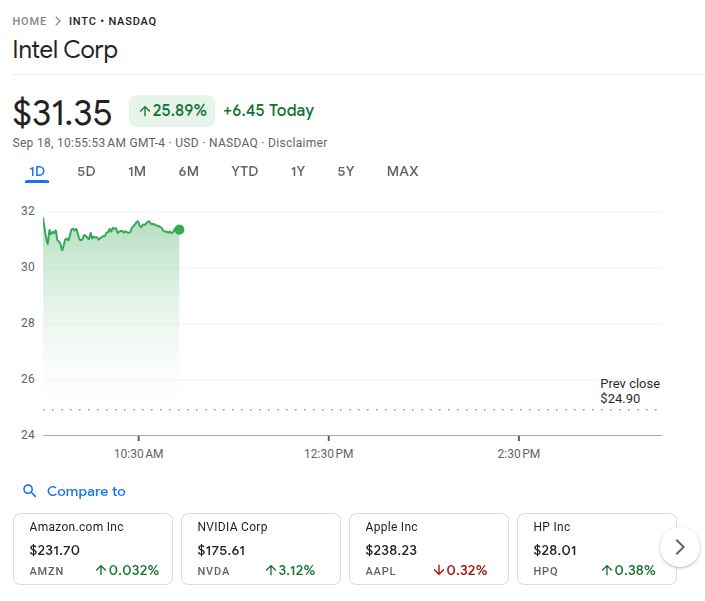

- Intel shares surged over 30%, while AMD dropped 5% as investors reacted to the competitive implications of the new alliance

- The deal boosts Intel’s capital reserves, adding to recent investments from the US government and Softbank, and signals growing US efforts to strengthen domestic chipmaking

What Happened?

Nvidia announced a $5 billion investment in Intel, purchasing common stock at $23.28 per share. The deal instantly made Nvidia one of Intel’s largest shareholders and sent Intel stock soaring over 30% in premarket trading. The investment, which follows a $5.7 billion stake taken by the US government, sets the stage for a long-term partnership to develop next-generation data center and personal computing chips.

NEWS: @NVIDIA and @Intel to develop AI infrastructure and personal computing products.

— NVIDIA Newsroom (@nvidianewsroom) September 18, 2025

Read the announcement: https://t.co/Gl28iWwSZc pic.twitter.com/srOhEnr0Ja

Nvidia and Intel’s Strategic Collaboration

The collaboration will focus on building custom data center and PC chips, combining Nvidia’s AI and accelerated computing technology with Intel’s CPU expertise and x86 ecosystem. While the agreement does not include Intel manufacturing Nvidia chips, it is seen as a deep technical and commercial partnership that could reshape the chip sector.

- Intel will design custom x86 CPUs for Nvidia’s AI servers, with proprietary NVLink technology enabling faster chip-to-chip communication

- For PCs, Intel will build x86 system-on-chips (SoCs) that include Nvidia’s RTX GPU chiplets, aimed at high-performance consumer devices

- Both companies plan to deliver multiple generations of co-developed products, serving hyperscale, enterprise and consumer markets

Financial and Market Impact

Intel’s share price surged over 30% following the announcement, trading around $32.45 in premarket activity. Nvidia also saw a modest bump of 3%, while competitors like AMD and Broadcom reacted with caution. AMD shares fell by approximately 5%, reflecting concern over the competitive threat this alliance poses.

This investment adds to Intel’s growing capital base, including a $2 billion investment from Softbank and a $5.7 billion stake by the US government, which now holds a 10% interest in the company.

Political and Geopolitical Implications

The move comes amid ongoing US-China tensions and broader efforts to strengthen domestic chip capabilities. Nvidia has faced challenges selling its AI chips in China due to US export restrictions, and this partnership aligns it more closely with US policy objectives.

Analysts suggest the collaboration could bolster Nvidia’s political position in the US and potentially ease regulatory barriers. Nvidia CEO Jensen Huang was seen alongside other business leaders during President Trump’s recent state visit to the UK, reinforcing the company’s visibility in US political circles.

Risks to TSMC, AMD, and Industry Landscape

This alliance poses a significant challenge to competitors, particularly Taiwan Semiconductor Manufacturing Company (TSMC), which currently manufactures Nvidia’s flagship chips. While Intel will not manufacture for Nvidia under this deal, the partnership may lay groundwork for future shifts in manufacturing relationships.

AMD, a direct rival in both the data center and PC markets, may face pressure as Intel integrates Nvidia’s technology into products that compete directly with AMD’s offerings.

- TSMC could lose long-term manufacturing contracts if Nvidia eventually moves production to Intel

- AMD risks losing share in the AI server and PC markets, where Nvidia’s GPUs paired with Intel CPUs may offer superior performance

CoinLaw’s Takeaway

In my experience, this is one of the most consequential chip industry deals in recent years. Nvidia is not just investing in a competitor but redefining the boundaries of collaboration in a fiercely competitive space. By fusing their technologies, Intel and Nvidia are building a future-proof platform that could outpace AMD, challenge TSMC, and reinvigorate US dominance in AI and advanced computing.

I found Intel’s recent struggles had many doubting its comeback story, but this partnership along with government backing gives it a powerful new narrative. It also sends a message that tech alliances may now be forged more by geopolitics and long-term strategy than by traditional rivalries.