Picture this: bustling cities expanding, rural roads turning into smooth highways, and data zipping through cutting-edge fiber-optic cables. The world is transforming rapidly, and at the heart of this evolution lies infrastructure investment. From transportation to telecommunications, strategic funding shapes the backbone of modern economies, enabling growth, connectivity, and resilience.

Editor’s Choice

- Global infrastructure investment is projected to approach $3.4–$3.8 trillion by 2025, depending on methodology and investment definitions.

- The United States is projecting $1.3 trillion in infrastructure commitments for 2025 under ongoing programs.

- China is expected to invest between $1.4 and $1.6 trillion in infrastructure in 2025, with a large share allocated to renewable energy, digital infrastructure, and transportation, consistent with the 14th Five-Year Plan priorities.

- Europe’s green infrastructure allocation is about $370 billion in 2025, with ~42% directed toward renewable energy.

- Private sector contributions to infrastructure are projected to surpass $850 billion in 2025.

- The global digital infrastructure market, including 5G, fiber optics, and data centers, is forecasted to surpass $180 billion in 2025, based on projections from GSMA and Deloitte.

- Governments worldwide are channeling an average of ~2.6% of GDP into infrastructure in 2025, with emerging economies targeting ~3.6%.

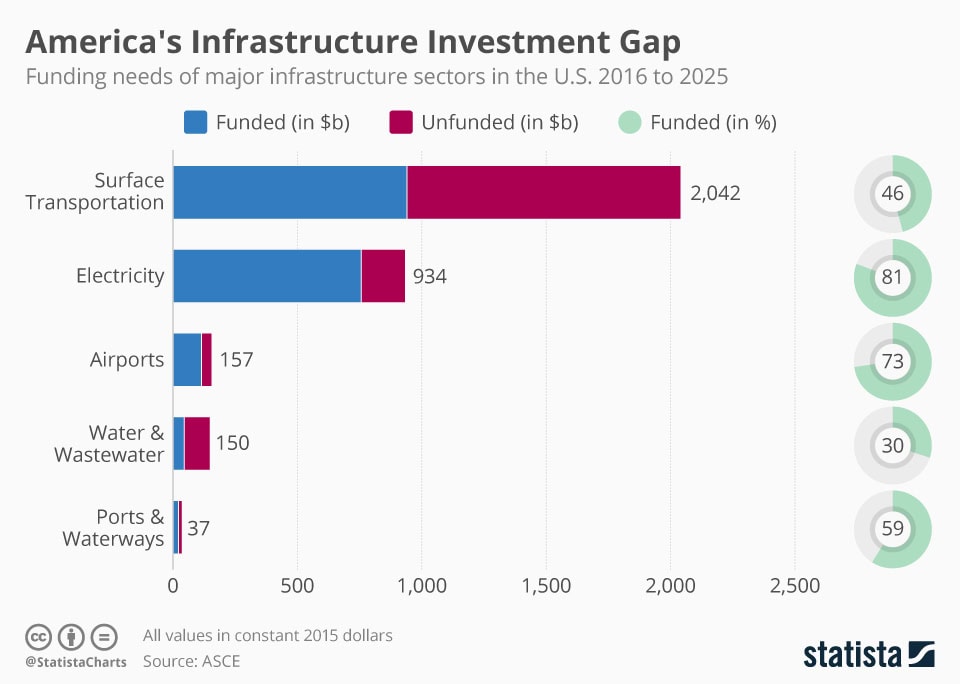

America’s Infrastructure Investment Gap

- Surface transportation requires $2.04 trillion, with only 46% funded and a gap of about $1.1 trillion.

- Electricity infrastructure needs $934 billion, of which 81% is funded, leaving around $177 billion unfunded.

- Airports face a funding demand of $157 billion, with 73% covered and an unmet need of about $42 billion.

- Water and wastewater systems require $150 billion, but only 30% is funded, creating a $105 billion shortfall.

- Ports and waterways need $37 billion, with 59% secured and about $15 billion unfunded.

Global Infrastructure Investment Trends

- Asia-Pacific will account for ~ 60 % of global infrastructure spending in 2025.

- The global renewable energy infrastructure market will reach ~ $1.2 trillion in 2025, growing ~ 8 % year-on-year.

- Digital transformation (cloud, 5G, data centers) will grow ~ 15 % to ~ $185 billion in 2025.

- Emerging markets such as India, Brazil, and Indonesia will see ~ 22 % growth in infrastructure investment in 2025.

- The Middle East will allocate ~ $130 billion in 2025 to water management and smart urban planning.

- Public-private partnerships (PPPs) will make up ~ 32 % of global infrastructure funding in 2025.

- Policymakers will face an infrastructure investment gap of ~ $15 trillion by 2040, driving continued efforts to close it.

Regional Investment Statistics

- North America will allocate $650 billion in 2025 toward infrastructure, focusing on roads, bridges, and broadband.

- Europe will dedicate $375 billion in 2025 to energy efficiency and climate resilience under its Green Deal.

- Latin America will boost infrastructure spending by ~ 14 %, reaching $92 billion in 2025 for transportation upgrades.

- Africa will increase investment to $90 billion in 2025 for energy access and urban transport projects.

- Asia-Pacific will lead with $2.2 trillion in infrastructure spending in 2025, driven by megaprojects in China and India.

- The Middle East will commit $55 billion in 2025 to water security and urban development, including projects like NEOM.

- Central & Eastern Europe will invest $50 billion in 2025 in rail and road connectivity.

Country-Specific Infrastructure Analysis

- The United States will allocate $1.3 trillion in 2025, including $120 billion for roads & bridges and $70 billion for broadband expansion.

- China will spend $1.6 trillion in 2025, directing 50 % toward renewable energy and 30 % toward transportation and rail.

- India will invest $110 billion in 2025 in urban development, dedicating ~ 20 % to renewable energy capacity.

- Germany will commit $65 billion in 2025 to green infrastructure, allocating ~ 25 % to EV charging and sustainable transport.

- Brazil will allocate $85 billion in 2025 for transport corridors and export-hub connectivity improvements.

- The United Kingdom will devote $45 billion in 2025 to housing and transport, emphasizing the High-Speed 2 rail project.

- Japan will spend $210 billion in 2025 on infrastructure upgrades focused on disaster resilience and smart city technologies.

Sector-Specific Infrastructure Analysis

- Investors will channel ~ $1.2 trillion into Renewable Energy in 2025, fueled by accelerating decarbonization.

- Transportation will command ~ 30 % of global infrastructure investment, about $1.3 trillion in 2025.

- Telecommunications will reach ~ $105 billion in investments in 2025, driven by strong growth in 5G networks.

- Water Management will attract ~ $275 billion in 2025 to strengthen water security and infrastructure resilience.

- Healthcare Infrastructure will secure $220 billion in 2025, with a global push for modernization.

- Education Facilities will draw $115 billion in 2025 to expand digital classrooms and remote learning.

- Logistics & Warehousing will receive ~ $330 billion in 2025, propelled by continued e-commerce growth.

Telecommunications Infrastructure Investment

- Investors will pour ~ $140 billion into the global 5G rollout in 2025, with the US and China still leading the push.

- Global fiber-optic investment is expected to grow by 18–22% in 2025, reaching ~$35–$40 billion, driven by rural broadband initiatives and national digital strategies in countries like the U.S., India, and the EU.

- Europe will direct ~ $28 billion in 2025 toward 5G expansion for both urban and rural digital access.

- India will modernize its telecom sector with ~ $12 billion in 2025, allocating ~ 60 % to 5G deployment.

- Middle East & Africa will invest ~ $6 billion in 2025 to bridge telecom coverage gaps.

- Global players will channel ~ $12 billion into satellite broadband funding in 2025, driving key projects worldwide.

- Companies will boost data center investments to ~ $170 billion in 2025 to support expanding cloud and AI infrastructure.

Spending on Transportation Infrastructure

- Governments will invest ~ $900 billion in global roads and highways in 2025, targeting congestion relief and improved connectivity.

- The US will spend ~ $110 billion in 2025 on bridges and replacements, marking its largest allocation in decades.

- Europe will channel ~ $85 billion in 2025 into high-speed rail, with major expansions in France and Germany.

- China will allocate ~ $550 billion in 2025 to transportation, directing ~ 50 % toward high-speed rail.

- India will invest ~ $65 billion in 2025 to expand metro systems across major cities.

- Latin America will receive ~ $25 billion in 2025 for highway expansions in Brazil, Mexico, and Argentina.

- Africa will invest ~ $12 billion in 2025 in urban transit systems, including metro and BRT projects in major cities.

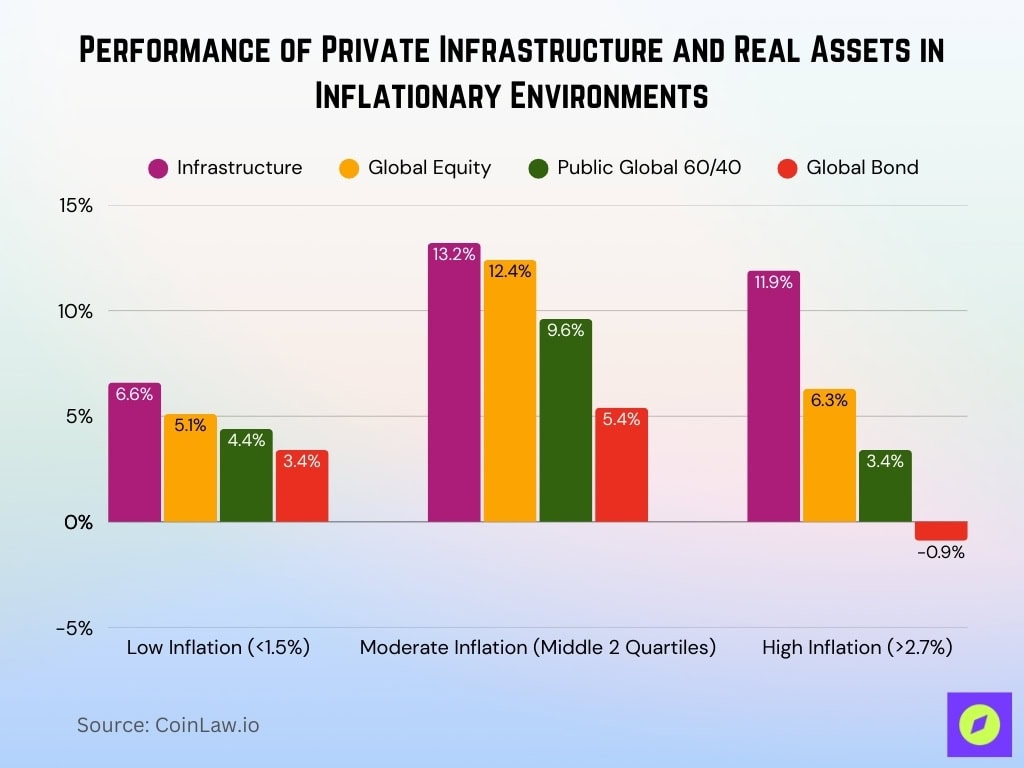

Performance of Private Infrastructure and Real Assets in Inflationary Environments

- Under low inflation (<1.5%), infrastructure returned 6.6%, outperforming global equity (5.1%), 60/40 portfolios (4.4%), and global bonds (3.4%).

- During moderate inflation, infrastructure achieved 13.2%, ahead of global equity (12.4%), 60/40 portfolios (9.6%), and global bonds (5.4%).

- In high inflation (>2.7%), infrastructure delivered 11.9%, compared to global equity (6.3%), 60/40 portfolios (3.4%), while global bonds dropped to -0.9%.

Rail Infrastructure Investment

- Global spending on rail systems is estimated at ~ $550 billion in 2025, with Asia-Pacific leading with ~ $350 billion.

- China’s high-speed rail network receives ~ $300 billion in 2025 for further expansion.

- Europe’s rail investments under green initiatives reach ~ $100 billion in 2025, focusing on electrification and cross-border links.

- The US allocates ~ $80 billion in 2025 for rail upgrades, including Amtrak modernization and freight improvements.

- India invests ~ $20 billion in 2025 in rail electrification to boost efficiency and reduce emissions.

- Japan dedicates ~ $25 billion in 2025 toward Shinkansen upgrades with emphasis on speed and safety.

- Africa received ~ $8 billion in 2025 in rail investments to enhance connectivity and trade.

Public vs. Private Investment Shares

- Public sector funding is expected to account for ~ 68 % of global infrastructure investments in 2025.

- Private sector contributions are projected to exceed $900 billion in 2025, especially in renewables and digital infrastructure.

- Public-private partnerships (PPPs) may finance ~ 34 % of global infrastructure projects in 2025.

- The United States is estimated to allocate $180 billion via PPPs in 2025.

- Emerging markets such as Brazil and India are likely to attract $120 billion in private investment in 2025, targeting telecoms and logistics.

- Institutional investors (pension funds, sovereign wealth funds, etc.) are channeling ~ $800 billion into infrastructure in 2025.

- Governments continue to incentivize private participation through tax breaks and relaxed regulation, with programs like “InvestEU” targeting $25 billion in co-financing in 2025.

Impact of Government Policies and Initiatives

- The United States, under the Inflation Reduction Act, directs $400 billion toward clean energy infrastructure (2025–2035) as a central climate policy.

- China’s 14th Five-Year Plan extends through 2025 with ~ $2.2 trillion allocated to transportation & digital infrastructure.

- The EU Green Deal requires ~ 40 % of infrastructure funding in 2025 to support climate-resilient projects and smart grid integration.

- India’s National Infrastructure Pipeline aims for ~ $1.4 trillion in investment by 2025, focusing on smart cities, transport, and energy.

- The African Union’s Agenda 2063 earmarks ~ $120 billion by 2025 for energy and transport development.

- Carbon reduction goals influence global infrastructure policy, with many nations targeting net-zero by 2050 in project planning.

- US federal & local governments emphasize equity by channeling ~ $50 billion in 2025 into underserved areas for broadband & infrastructure access.

Recent Developments

- The US Department of Energy launches a $25 billion fund in 2025 to support clean energy infrastructure (hydrogen hubs, grid modernization).

- China unveils an evolved “Digital Silk Road” initiative with ~ $120 billion in 2025 for expanding cross-border digital infrastructure.

- Europe’s “Connecting Europe Facility” receives ~ $38 billion in 2025 for cross-border transport and energy integration.

- India approves a $20 billion Gati Shakti plan in 2025 to slash logistics costs via infrastructure integration.

- The private sector sees landmark deals such as BlackRock’s $7 billion renewable energy fund in 2025, targeting solar and wind assets.

- Innovations like autonomous transport corridors in Japan, Germany, and elsewhere drew ≈ $15 billion in 2025 in initial investments.

- African nations collectively raised $30 billion in 2025 for energy infrastructure focused on off-grid solar and hydropower.

Frequently Asked Questions (FAQs)

Global energy investment is $3.3 trillion in 2025, with $2.2 trillion going to clean energy, up about 2% from 2024.

The world faces a $15 trillion infrastructure investment gap by 2040.

Mobile operator capex is $1.3 trillion for 2024–2030, which averages roughly $185 billion per year.

Global renewable energy investment reached $386 billion in H1 2025, about 10% higher than H1 2024.

Conclusion

Infrastructure investment is not just about bridges, roads, or power grids; it’s about creating the foundation for a sustainable and inclusive future. The blend of public and private investments, policy-driven initiatives, and regional adaptations underscores the dynamic nature of this critical sector. With governments and corporations aligning efforts to address both present and future challenges, the global infrastructure ecosystem is poised for remarkable growth and transformation.