Crypto exchange HTX, linked to Justin Sun, moved over $1 billion in Ethereum and Wrapped Bitcoin to Binance this week, sparking market speculation.

Key Takeaways

- 1HTX transferred 166,000 ETH worth $518 million to Binance through Aave, raising concerns over potential market impact

- 2HTX also redeemed 5,182 WBTC worth $500 million, despite no WBTC listed in its proof-of-reserves

- 3Whales and institutions like BlackRock continue accumulating Ethereum amid a 20% price surge

- 4Questions remain over HTX’s asset transparency and its aggressive, fast-paced crypto movements

Did Justin Sun just shake up the crypto world again? With over $1 billion in digital assets moved in just days, HTX’s large Ethereum and Wrapped Bitcoin transactions are making waves. Investors are watching closely as whales load up while Sun’s exchange quietly shifts coins off the books.

HTX Moves $518M in Ethereum to Binance

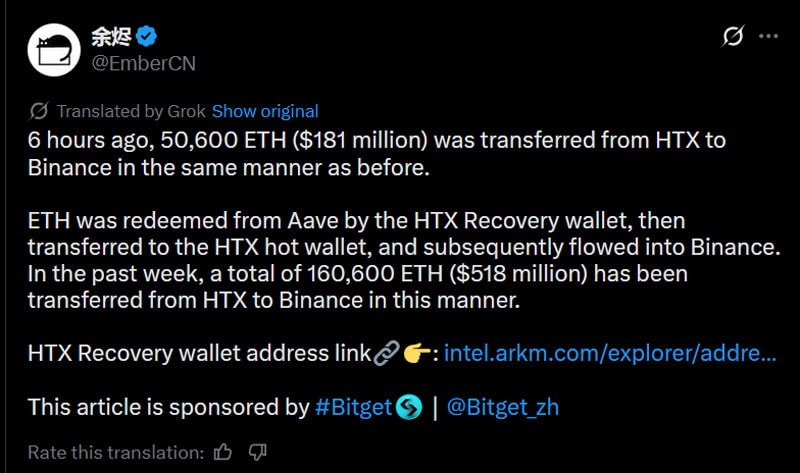

HTX, the crypto exchange advised by TRON founder Justin Sun, has been steadily moving Ethereum from DeFi platform Aave to Binance over the past week. On July 19, data from AmberCN confirmed another 56,000 ETH (about $181 million) was transferred to Binance.

These transactions follow a repeatable pattern:

- Ethereum is redeemed from Aave using HTX Recovery wallet

- Funds are routed to HTX’s hot wallet

- ETH is then transferred to Binance

This pattern has been ongoing all week. In total, 166,000 ETH worth approximately $518 million has been moved via this process, sparking speculation that HTX may be preparing for significant market action or liquidity events.

Whale Accumulation Counters Exchange Outflows

Despite the hefty outflows from HTX, Ethereum is seeing strong accumulation from whales and institutional players:

- Whale SharpLink added 4,904 ETH worth $17.45 million, bringing their holdings since July 1 to 157,140 ETH

- Another whale wallet, 0x9684, withdrew 19,550 ETH worth $70.7 million from FalconX

- In a major institutional move, BlackRock purchased 307,461 ETH valued at $1.11 billion over two days

Ethereum’s 20% price surge in the last week may have triggered both the whale interest and the strategic exchange activity from HTX.

HTX Quietly Redeems $500M in Wrapped Bitcoin

In addition to the ETH movements, HTX redeemed 5,182 Wrapped Bitcoin (WBTC) worth about $500 million from the WBTC protocol. The redemption is the sixth-largest in WBTC history and the biggest in nearly two years.

What raised eyebrows was:

- HTX isn’t known for trading WBTC and showed 0 volume in the last 24 hours

- The wallet that redeemed the WBTC is not listed in HTX’s proof-of-reserves

- The redeemed WBTC equals over 25% of all Bitcoin supposedly held on HTX

Taylor Monahan pointed out that HTX also changed its deposit address right before the redemption. Even more curiously, HTX’s proof-of-reserves doesn’t list any WBTC at all, prompting questions about hidden reserves or off-balance-sheet asset management.

Justin Sun’s Bitcoin Transparency Issues

This WBTC redemption highlights a broader pattern tied to Sun’s crypto empire. Notably:

- Nearly half of all Bitcoin held at HTX is in Bitcoin-on-Tron, a Sun-controlled token lacking proof-of-reserves

- Sun’s USDD stablecoin recently removed 12,000 BTC from its reserves with no DAO oversight

- HTX also continued receiving hundreds of BTC from Binance even after the WBTC redemption

Meanwhile, Coinbase is challenging WBTC with its own token, prompting Sun to criticize the move, even as his operations appear less transparent.

CoinLaw’s Takeaway

Let me be real with you, this looks shady. HTX moved half a billion in ETH, then redeemed another half a billion in WBTC, and none of it shows up in its reserve audits. When institutions like BlackRock are scooping up Ethereum, and Sun’s network is secretly juggling billions across exchanges, it raises real concerns. For the average crypto investor, this is a reminder that transparency still matters. We need clearer books and better accountability, especially from high-profile figures like Justin Sun.