The financial‑technology company Wise plc (formerly TransferWise) has grown from a start‑up to a global player serving millions of customers. Wise isn’t just a money-transfer platform; it’s a global tool that helps people and businesses send, hold, receive, and even grow money across multiple currencies. Many companies rely on Wise for both local and international transactions, thanks to its transparent pricing and lower fees compared to traditional banks. Below, you’ll find key statistics and insights into how many people work at Wise.

How Many People Work At Wise?

- ~6,500 employees globally at Wise as of March 31, 2025.

- Employee count rose by approximately 18 % year‑on‑year from 5,500 in 2024 to 6,500 in 2025.

- Average number of employees during the year ended March 31, 2025: 6,151 (vs 5,499 in 2024) per the company’s report.

- In FY2025, employee benefit expense totalled £412.7 million.

- Breakdown FY2025: Servicing staff ~3,915, Product Development ~1,411, Other functions ~534, Marketing ~291.

- Revenue per employee (as reported) ~£186.2k in 2025.

- The company now states: “We now have over 6,500 people working in 11 key locations around the world.”

Recent Developments

- Wise’s full‑year results for the year ended March 31, 2025, show revenue of £1,211.9 m, up ~15 % from £1,052.0 m in 2024.

- Underlying income in FY2025 was £1,362.3 million, up roughly 16 % over FY2024.

- Based on the FY25 annual report, Wise reports 15.6 million active customers, compared to 12.8 million in FY24.

- Card revenue (primarily interchange & card fees) in FY2025 rose 31 % to £219.8 million.

- The company’s annual report notes expansion of new offices and hiring across regions to support growth.

- Wise suggests dual listing plans in London and the U.S. to broaden capital markets access, and the company has since received shareholder support for the move.

- Marketing and product engineering expenses increased: product engineering costs were expensed at £129.0 million.

- Administrative expenses rose 25 % in FY2025 to £768.6 million, indicating investment in support functions, including the workforce.

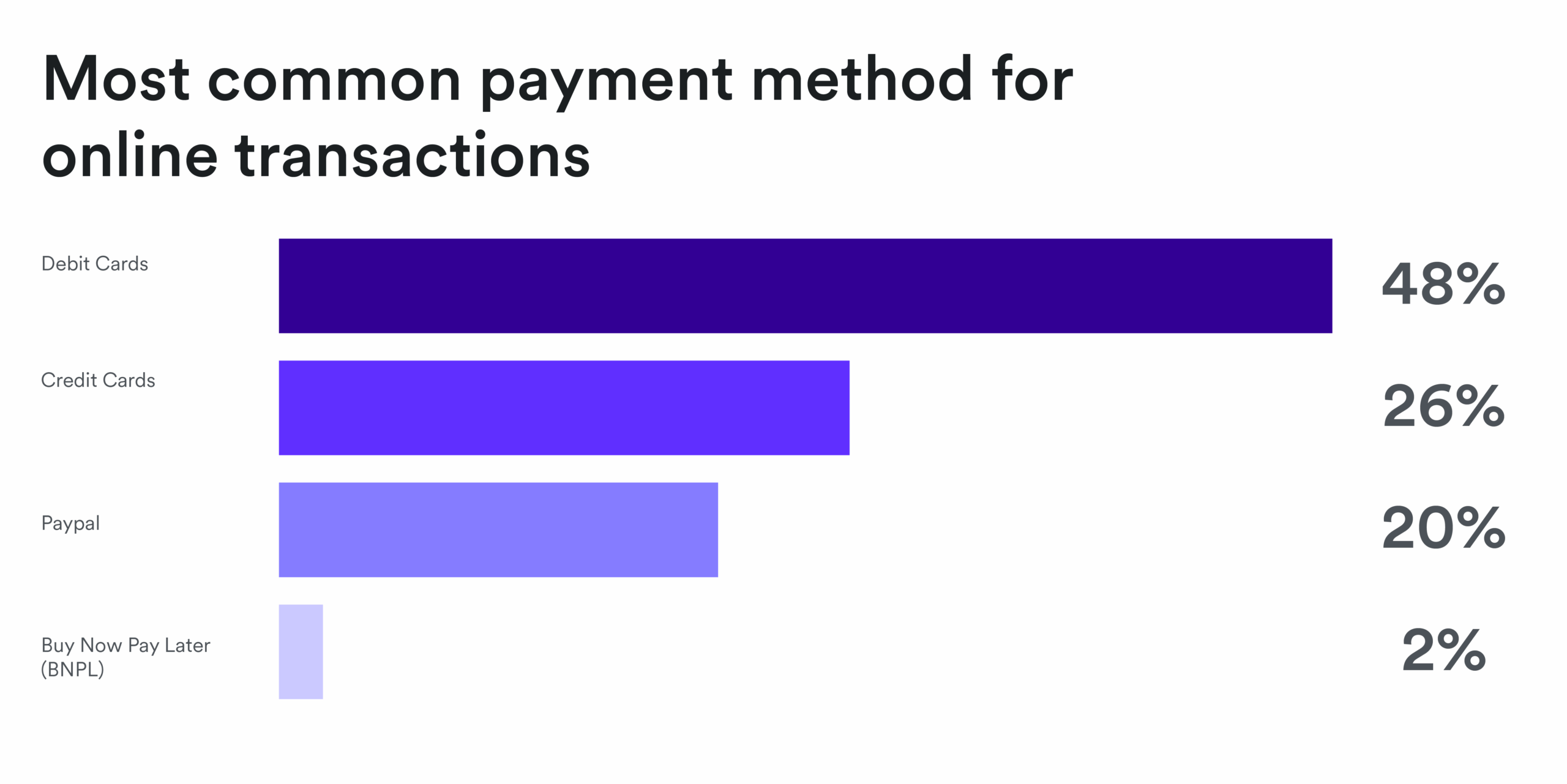

Most Common Online Payment Methods

- Debit cards lead with 48%, making them the dominant choice for online transactions due to low fees and wide availability.

- Credit cards account for 26%, driven by rewards programs, fraud protection, and convenience.

- Paypal captures 20%, reflecting its continued role as a trusted third-party payment option.

- Buy Now Pay Later (BNPL holds just 2%, showing relatively low adoption compared to traditional payment methods.

Wise’s Current Team (Key People)

- Kristo Käärmann is the Co-founder and Chief Executive Officer (CEO) of Wise. He continues to lead the company’s strategic direction and international expansion.

- Harsh Sinha serves as Chief Technology Officer (CTO). He joined Wise from PayPal and plays a key role in platform scalability and engineering innovation.

- Matt Briers, former Chief Financial Officer (CFO), announced his departure in 2024. As of 2025, the CFO role is held by Emmanuel Thomassin, previously CFO at Delivery Hero SE.

- Diana Avila is Wise’s Chief Banking and Expansion Officer and leads the team responsible for expanding Wise’s operations internationally while working closely with financial partners and regulators.

- Isabel Naidoo serves as Chief People Officer and oversees the global people and workforce functions.

- Steve Naudé is the Managing Director of Wise Platform and leads the Wise Platform business globally.

- The Board of Directors includes experienced professionals such as David Wells, former CFO of Netflix, who serves as Chair

- Nilan Peiris, Wise’s Chief Product Officer, leads the customer experience and product teams, focusing on user-driven design and product simplicity.

Year‑by‑Year Wise Employee Numbers

- FY2023 (year ended 31 March 2023): average employees ~4,411.

- FY2024 (year ended 31 March 2024): average employees ~5,499.

- FY2025 (year ended 31 March 2025): average employees ~6,151.

- Headcount as of March 31, 2025: ~6,500 employees.

- Growth from FY2024 to FY2025: ~12 % increase (from 5,499 to 6,151).

- Growth from FY2023 to FY2024: ~25 % (from 4,411 to 5,499).

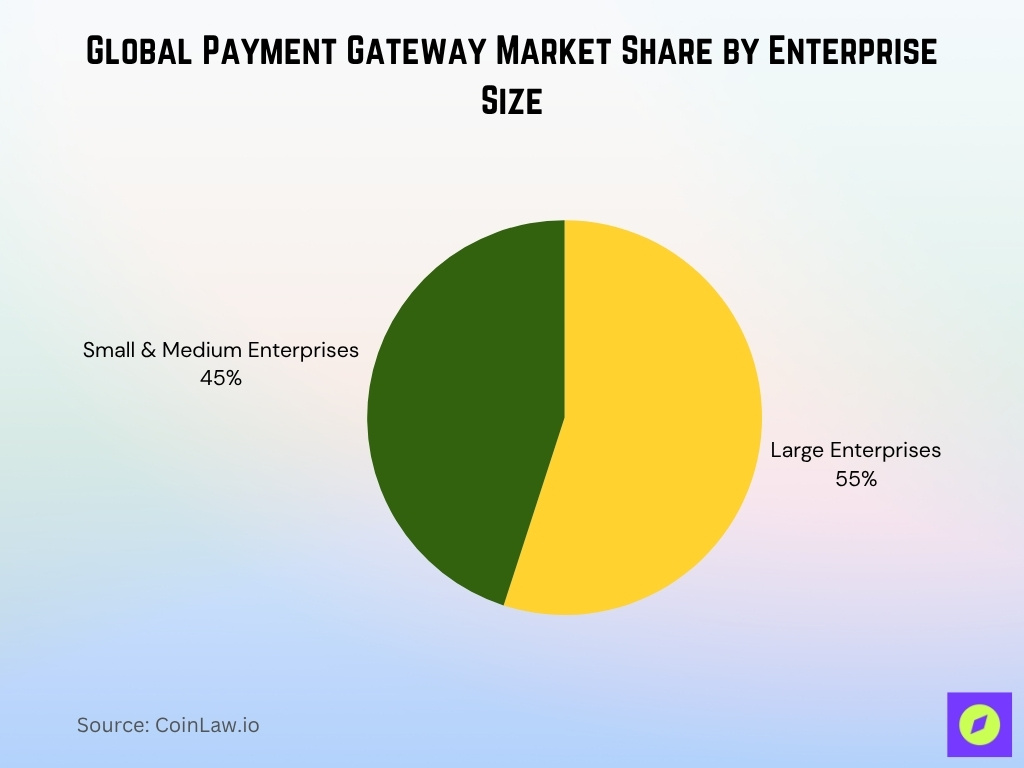

Global Payment Gateway Market Share by Enterprise Size

- Large enterprises hold 55% of the global payment gateway market share, making them the dominant users of payment processing solutions worldwide.

- Small and medium enterprises (SMEs) account for 45%, reflecting their growing adoption of digital payment systems, but still trailing behind larger players.

- This 10% gap highlights the scalability advantage and transaction volume dominance of large corporations in the global payment ecosystem.

- The figures suggest SMEs are rapidly catching up, signaling increased demand for cost-effective and flexible gateway solutions.

- Market strategies should prioritize enterprise-grade reliability for large businesses and affordability and integration for SMEs to address both segments effectively.

Workforce Changes and Layoffs

- The employee benefit expense increased to £412.7 million in FY2025 from £377.3 million in FY2024, supporting the expansion narrative.

- Marked increases in administrative expenses (up 25 % year‑on‑year) suggest additional staff in support, marketing, and engineering.

- The servicing function headcount grew to ~3,915 in FY2025, up from ~3,396 in FY2024.

- Product development headcount rose to ~1,411 in FY2025 from ~1,341 in FY2024.

- Wise’s expansion into new offices globally (11 key locations) likely required new hires rather than layoffs.

- While layoffs are not specifically cited, the focus is on scaling rather than contraction for the period under review.

Hiring and Turnover Statistics

- In the year ended 31 March 2025, Wise plc reported an average of 6,151 employees, up from 5,499 in the prior year.

- Total employee benefit expenses rose to £412.7 million in FY2025 from £377.3 million the previous year, indicating increased compensation and hiring.

- Servicing staff grew to approximately 3,915 employees in FY2025 (from 3,396 in FY2024) according to the departmental breakdown.

- Product development headcount increased to 1,411 in FY2025, up from 1,341 in FY2024.

- Marketing function employees rose to 291 (vs 270 in FY2024), showing growth in go‑to‑market activities.

- The rising employee count alongside rapid business growth suggests that hiring outpaced any net layoffs across the period.

- Wise offers global relocation and flexible working programmes (e.g., “work from anywhere” up to 90 days), which may impact turnover and retention.

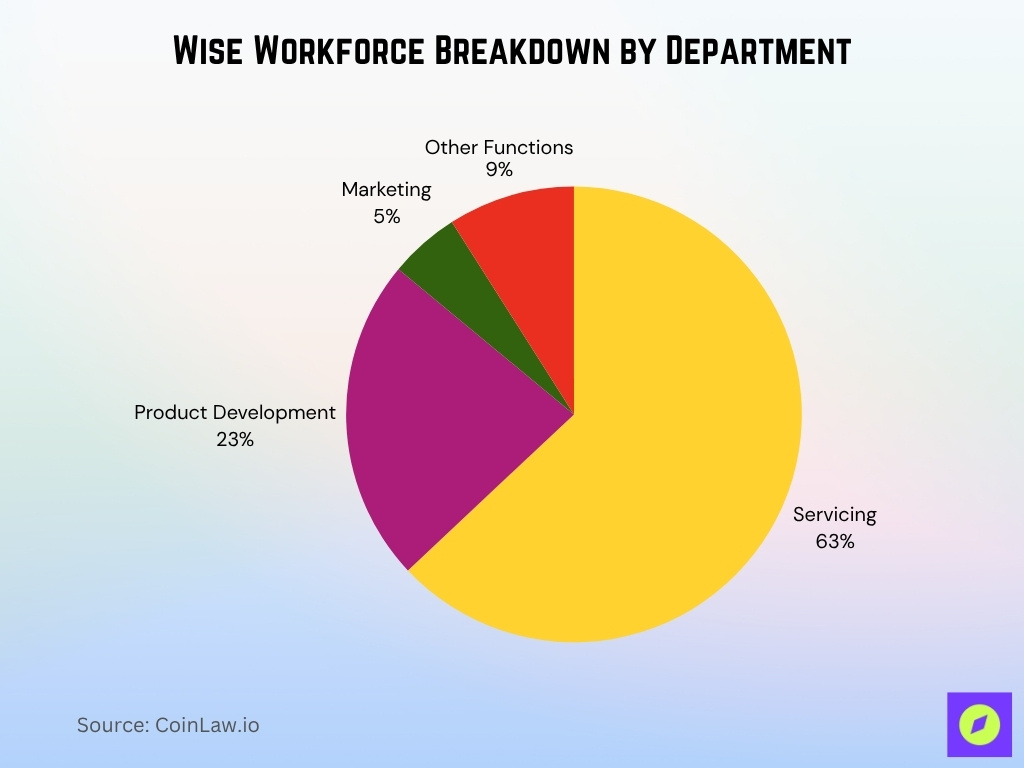

Employee Distribution by Department

- For FY2025, the breakdown is: Servicing ~3,915 employees, Product Development ~1,411, Other functions ~534, Marketing ~291.

- Servicing, therefore, represents approximately 63% of the workforce in the latest year (3,915 of 6,151).

- Product Development accounts for roughly 23% of total headcount (1,411 of 6,151).

- Marketing comprises around 5% of headcount (291 of 6,151) in FY2025.

- “Other functions” (which likely include HR, compliance, and finance) count ~534 or about 9% of the workforce.

- The trend from FY2024 shows servicing headcount increased by ~15% (3,396 to 3,915) while product development increased by ~5%.

- Wise has publicly emphasised strengthening its “product and engineering teams” to support infrastructure and scalability.

Roles and Departments at Wise

- Wise’s workforce includes over 6,500 employees spread across 11 global locations.

- Around 23% of employees work in Product Development roles, including engineering and product teams.

- Customer servicing roles represent approximately 63% of Wise’s workforce, covering customer support, KYC, financial crime, and payment operations.

- Marketing functions constitute roughly 5% of the employee base, supporting growth across new geographies

- Other functions like risk, compliance, finance, HR, and legal account for about 9% of staff.

Employee Locations and Remote Workforce

- Wise states in its FY2025 People & Culture section that its workforce includes employees from over 120 nationalities, supporting its claim of being a globally diverse team.

- The 11 key locations include Austin (Texas), New York, London, Tallinn, Singapore, Tokyo, São Paulo, Budapest, Brussels, Hyderabad, and Kuala Lumpur.

- The company states “work from anywhere (almost) up to 90 days a year”, signifying remote/hybrid workforce flexibility.

- According to FY2025 disclosures, “one‑fifth of our employees are based in the UK”.

- A business news article reports that in September 2025, Wise had more than 700 employees in the US (mainly in Austin).

- Many roles are posted in regions like Asia‑Pacific (Hyderabad, Singapore, Kuala Lumpur), reflecting the spread of operations globally.

- The company’s global hiring model supports cross‑border payments operations and localisation of product and support functions.

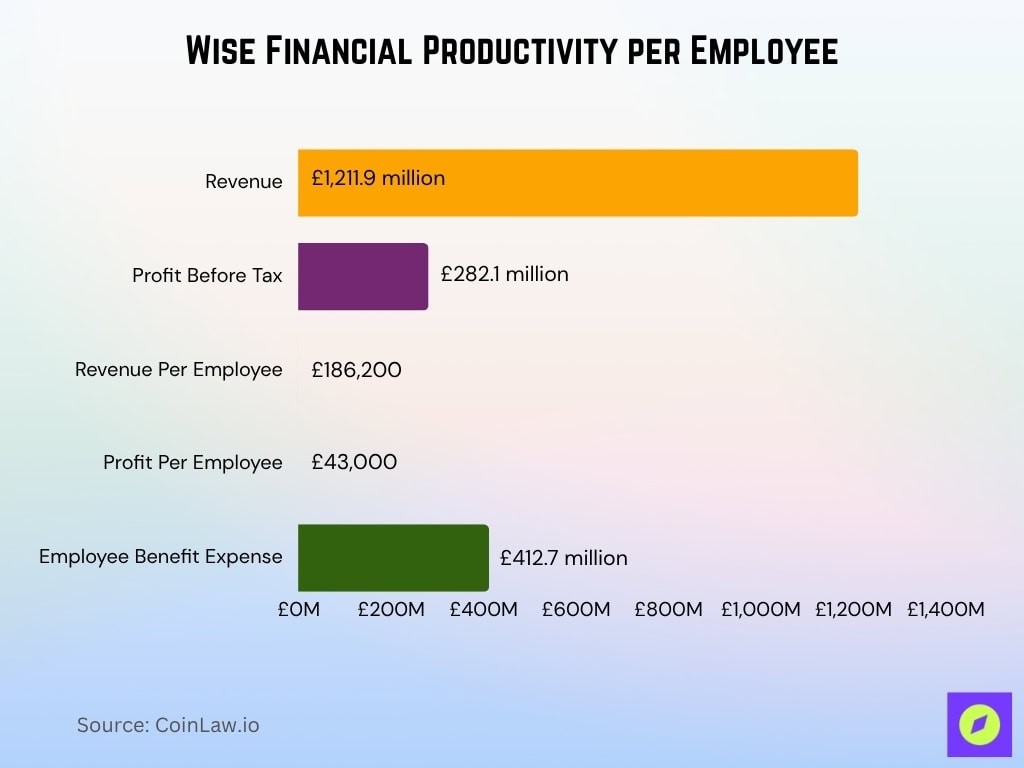

Revenue and Profit Per Employee

- The FY 2025 financial report shows revenue of £1,211.9 million and employee benefit expenses of £412.7 million across roughly 6,500 employees. This implies about £63k spent per employee on benefits.

- The underlying profit before tax margin for FY 2025 was 21%, with an underlying PBT of £282.1 million.

- The company had approximately 6,500 employees and a revenue per employee of about £186,200.

- Using the underlying PBT of £282.1 million and a workforce of 6,500 employees, profit per employee is around £43,000.

- Free cash flow conversion for FY 2025 was 117.9% of underlying profit before tax.

- From FY 2024 to FY 2025, revenue grew ~15% (from £1,052.0 m to £1,211.9 m).

- In a comparison context, the revenue/employee figure (~£264k) helps benchmark productivity in a fintech context.

Notable Hiring Initiatives

- Wise employs over 6,500 people across 11 key global locations as of 2025.

- One-fifth (20%) of Wise’s workforce is based in the UK, with ongoing hiring planned there.

- Wise has more than 700 employees in the US, primarily in Austin, expanding its US footprint in 2025.

- The Wise Austin office footprint has expanded by 200% recently, reinforcing its regional hub status.

- Wise’s London office hosts over 1,000 employees, with office space increasing by 40%.

- The Tallinn office is Wise’s largest, with 2,200 employees as of 2025.

- The company’s flexible working policy allows employees to “work from anywhere” for up to 90 days.

Wise Workforce Distribution by Location

- Wise’s UK workforce accounts for 20% of its total employees as of FY2025.

- The Tallinn office is the largest, with 2,200+ employees relocating to a new site in 2025.

- Wise’s Austin office has expanded its footprint by 200%, with hundreds of employees based there.

- Asia-Pacific hubs include Singapore, Kuala Lumpur, and Hyderabad. Singapore is a full-stack hub that covers product, engineering, operations, customer service, compliance, and more.

- The London office hosts over 1,000 employees, expanding its space by 40% recently.

- The Budapest office includes more than 800 employees, undergoing a redesign to support growth.

- São Paulo is Wise’s key South American location as part of its 11 global hubs.

- The geographic distribution supports Wise operating 24/7 across multiple currencies and jurisdictions.

- Wise processes $185 billion in cross-border payments, backed by its widely distributed workforce.

- The global spread spans 11 key locations, facilitating a distributed model across continents.

Company Culture and Work Environment

- According to Glassdoor data, the company has a rating of 3.9 out of 5 for overall culture and values, with 72% of employees saying they would recommend working at the company.

- On work‑life balance, the rating stands at 3.9/5, and for career opportunities at 3.7/5.

- Their published values emphasize “We get it done”, “Customers > team > ego”, and “No drama. Good karma.”

- A UK‑based survey (Great Place to Work) reported 91% of employees said it is a great place to work, compared with 54% at a typical UK company.

- The company offers flexibility, including remote work “up to 90 days a year” in many roles, reflecting a global distributed model.

- Employee reviews highlight strengths around “great colleagues” and “good culture,” but also mention concerns about compensation and management structure.

- The company emphasises inclusivity, supporting LGBTQ+ employees and monitoring for pay equity.

- A public‑reporting note shows the organisation invests in social events and staff engagement (for example, a “5k run” charity event) to build community.

Employee Demographics

- In the UK survey, 34% of employees had tenure of less than 2 years, 66% had tenure between 2‑5 years.

- Employee review data shows 73% of current and former employees would recommend working at the company.

- Gender equity, the company claims an even male/female split worldwide.

- On inclusion, 100% of UK respondents said “this is a physically safe place to work”, 98% say people are treated fairly regardless of age.

- Glassdoor reviewers rated compensation and benefits at 3.8/5.

- The number of employees globally has grown significantly, for example, to over 6,500 employees as of FY 2025.

- The workforce is heavily global and mobile, with offices and roles spanning Europe, the US, and Asia‑Pacific.

- Employee ratings vary by location, highest ratings noted in Tokyo, Kuala Lumpur, and Tartu.

Comparison With Other Financial Companies

- Wise’s revenue per employee is approximately £186,200.

- The profit per employee at Wise stands around £43,000.

- Wise achieved a robust 21% underlying profit margin in FY2025, exceeding medium-term targets.

- Wise increased revenue by 15% to £1.21 billion and profit before tax by 17% to £565 million in FY2025.

- Active customers grew by 21% to 15.6 million in FY2025, supporting overall growth.

- Cross-border transaction volume rose 23% to £145.2 billion in FY2025.

- Many legacy banks show lower revenue per employee due to higher infrastructure costs compared to Wise’s digital model.

Frequently Asked Questions (FAQs)

Wise had approximately 6,500 employees.

Approximately 20 % of Wise’s employees are based in the UK.

The employee benefit expense was £412.7 million in FY2025.

Conclusion

In summary, the company’s workforce is expanding rapidly, its culture emphasises mission and pace, and its financials reflect strong productivity per employee. The company’s inclusive culture, global talent base, and flexible working model support this growth. That said, challenges remain in scaling sustainably, managing global regulations, and retaining talent across jurisdictions.

For companies, investors, and job‑seekers interested in a global fintech gaining scale, these figures offer a solid benchmark. If you’d like to explore deeper, e.g., employee distribution by department, detailed turnover statistics, and comparisons to specific competing firms, feel free to let me know, and we can dive into those next.