The fintech company Square, Inc., now part of Block, Inc., has grown from a mobile card reader startup into one of the major players in payments and financial services. Today, the size and composition of its workforce reflect not only its business ambitions but also how the broader fintech labour market is shifting.

From merchant services to peer‑to‑peer payments, the company supports millions of users and thousands of sellers, so workforce dynamics matter. In the restaurant and retail sector, its merchant‑services team enables SMBs to accept payments and manage operations; in fintech, its Cash App division serves millions of consumers.

How Many People Work At Square?

- 11,372 employees worldwide for Block, Inc. (end of 2024), a roughly 12.4% decline year‑on‑year.

- Workforce peaked at 12,985 employees at end of 2023 before the reduction.

- Employee reduction of 1,613 positions (~12.4%) from 2023 to 2024, with 931 layoffs disclosed in March 2025 and additional roles dropped via attrition and closed openings.

- Headcount growth from 2021 to 2022 was ~45.9%.

- Block placed a cap on headcount at around 12,000 employees as a strategic goal.

- As of 2024, the company disclosed the U.S. racial/ethnic breakdown: White 47.8%, Asian 26.5%, Black/African‑American 13.3%, Hispanic/Latino 7.2%.

- Gender representation remains a focus, with women plus non‑binary representation improving in business roles.

Recent Developments

- In March 2025, Block announced 931 layoffs (~8% of workforce), contributing to the overall reduction from 12,985 employees in 2023 to 11,372 by end of 2024.

- The company cited “strategy and performance” as reasons rather than purely cost‑cutting or AI replacements.

- At the same time, the company closed nearly 800 open roles and reassigned about 200 managers to individual contributor roles.

- The headcount cap of 12,000 employees was reaffirmed as a target to align growth with business improvement.

- Block reported a drop to 11,372 employees at end of 2024, a 1,613 reduction from the 2023 total of 12,985, aligning with both layoffs and additional attrition.

- Prior to that, the company had grown headcount from 8,521 in 2021 to 12,428 in 2022 (increase ~45.9%).

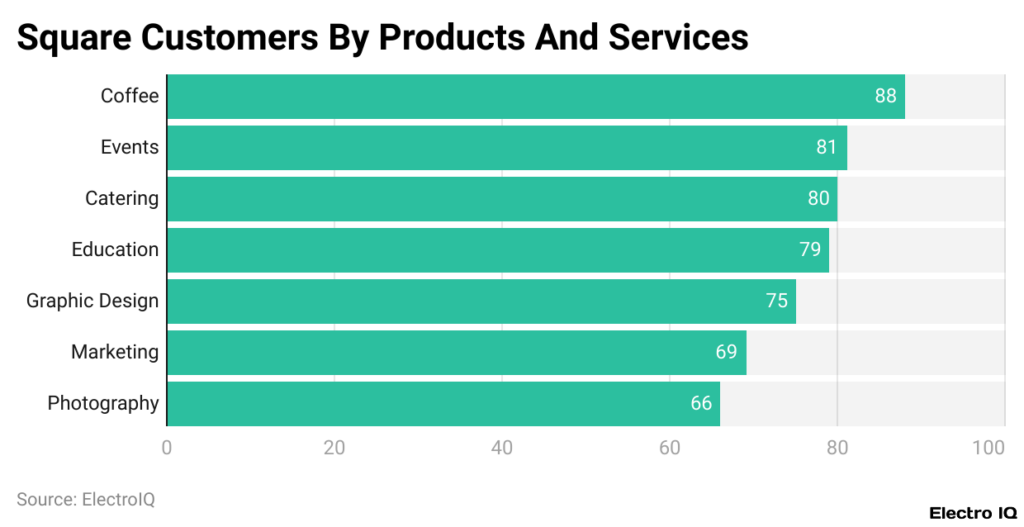

Square Customers by Products and Services

- Coffee businesses make up the largest share of Square’s customer base at 88%, reflecting the platform’s dominance in cafés and small beverage outlets.

- Event organizers account for 81%, showing Square’s popularity among service providers handling ticketing and on-site payments.

- Catering companies represent 80%, emphasizing its role in managing mobile and large-scale food service transactions.

- Education providers make up 79%, using Square for tuition payments, workshops, and institutional events.

- Graphic design firms account for 75%, highlighting adoption among creative freelancers and digital service providers.

- Marketing professionals stand at 69%, relying on Square for client billing and campaign-related transactions.

- Photographers represent 66%, indicating strong use among independent artists and event-based service providers.

Square’s Current Team (Key People)

- Jack Dorsey, Block’s CEO and Co-Founder, remains closely involved with Square’s strategic direction, especially in ensuring continuity across products like Cash App and Square hardware.

- Alyssa Henry, formerly Square CEO, stepped down in October 2023. She played a pivotal role in leading Square’s business unit since 2021 and had overseen major product expansions. Her departure marked a leadership transition phase for the team.

- Jack Dorsey temporarily took over Square’s leadership after Alyssa Henry’s exit, reaffirming the brand’s importance within Block’s ecosystem.

- Brian Grassadonia, one of Square’s earliest employees, has served as Head of Cash App but remains integral in cross-functional leadership influencing Square’s financial ecosystem.

- Amrita Ahuja, Block’s Chief Financial Officer, plays a major role in resourcing and strategic alignment across Square’s business lines, particularly during restructuring phases.

- Carl Anderson, Head of Square Banking, is responsible for growing Square’s financial services offerings such as business loans, savings accounts, and debit card services.

- Jesse Dorogusker, previously Square’s Hardware Lead, has been influential in the design and deployment of Square’s in-store products including POS systems and contactless readers.

- Gokul Rajaram, a former Square Product Lead and board member (now at DoorDash), laid the foundation for many of Square’s early product strategies. Though not currently on the team, his legacy continues to influence Square’s approach to product execution.

- Douglas McCracken, Vice President of Sales, oversees merchant acquisition and channel development across retail and SMB verticals.

- Lauren Weinberg, Head of Marketing for Square, has led branding and communication efforts that shape how Square connects with merchants and the broader fintech market.

Historical Employee Growth at Square

- End of 2021, 8,521 employees.

- End of 2022, 12,428 employees, ~45.9% growth from 2021.

- End of 2024, 11,372 employees, marking a 12.4% decline or 1,613 fewer employees from end of 2023’s 12,985, reflecting layoffs and natural turnover.

- End of 2024, 11,372 employees, ~12.4% decline from 2023.

- The pattern moves from ramp‑up, plateau, reduction, which is often seen in fast‑growing tech or fintech companies.

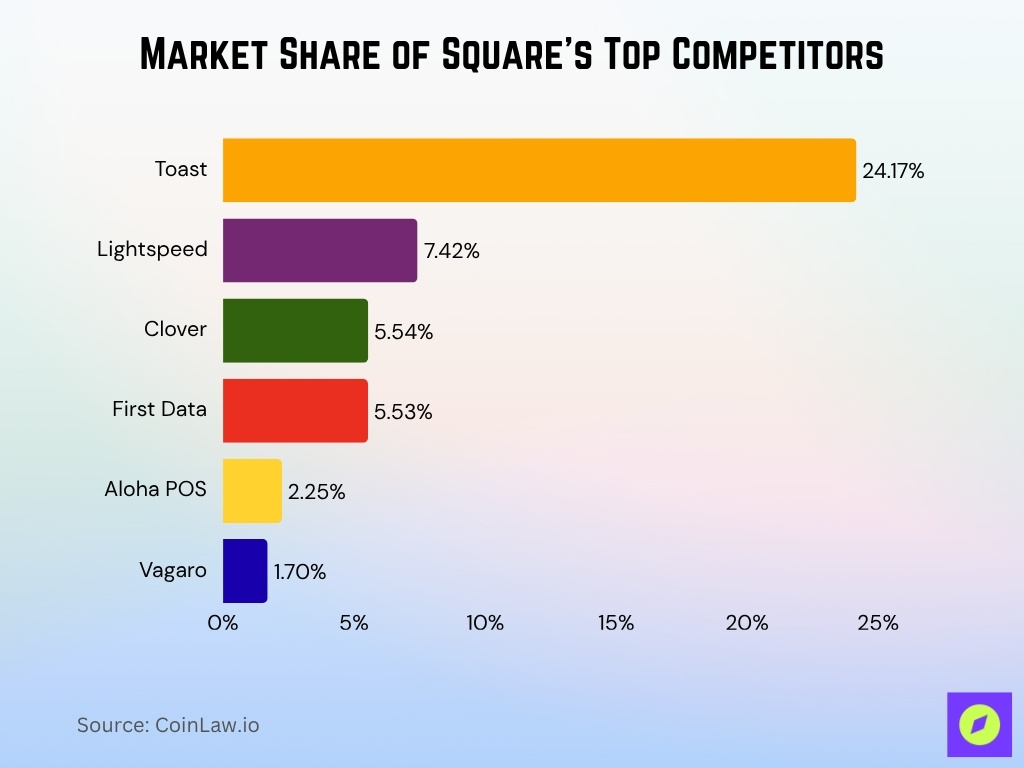

Market Share of Square’s Top Competitors

- Toast leads the U.S. POS (Point-of-Sale) market with a dominant 24.17% share among restaurant and retail operators.

- Lightspeed captures 7.42% of total market share, continuing to expand its presence in hospitality and retail.

- Clover accounts for 5.54%, ranking in the top five POS systems by adoption.

- First Data is estimated at 5.53% market share for North America, slightly higher than some previous estimates.

- Aloha POS represents 2.25% of the U.S. market, favored for its restaurant-focused solutions.

- Vagaro holds 1.70%, serving niche verticals such as salons and wellness businesses.

Employee Count by Department

- Block reportedly has ~12,000 total employees and “8,000 Product + Tech employees.”

- That suggests roughly ~66% of the workforce may be in Engineering, Product, or Tech functions.

- Sales & support, marketing, operations and administrative roles likely comprise the remaining ~34%.

- UnifyGTM estimates Engineering ~932 employees (~36% of workforce) and Marketing & Product ~271 (~11%).

- Using the 11,372 headcount figure, if 36% are engineering that would imply ~4,095 engineers.

- The heavy weighting to technical roles aligns with Block’s product‑driven strategy in fintech and crypto.

- The department breakdown underscores that headcount cuts or adjustments likely hit across functional areas.

- Given limited public departmental data, readers should treat precise figures with caution.

- Nonetheless, the overall trend is clear, technical and engineering functions remain a key portion of the workforce.

Square Engineering and Technical Team Size

- Block has approximately 8,000 Product + Tech employees out of its overall workforce.

- UnifyGTM reports 932 employees in Engineering at Block (≈36% of workforce).

- Using the total employee count of 11,372 as of December 2024, the technical team of ~8,000 implies ~70% of headcount is in product or tech roles.

- An earlier dataset for Square shows ~1,859 engineering roles among ~5,268 employees (~35%).

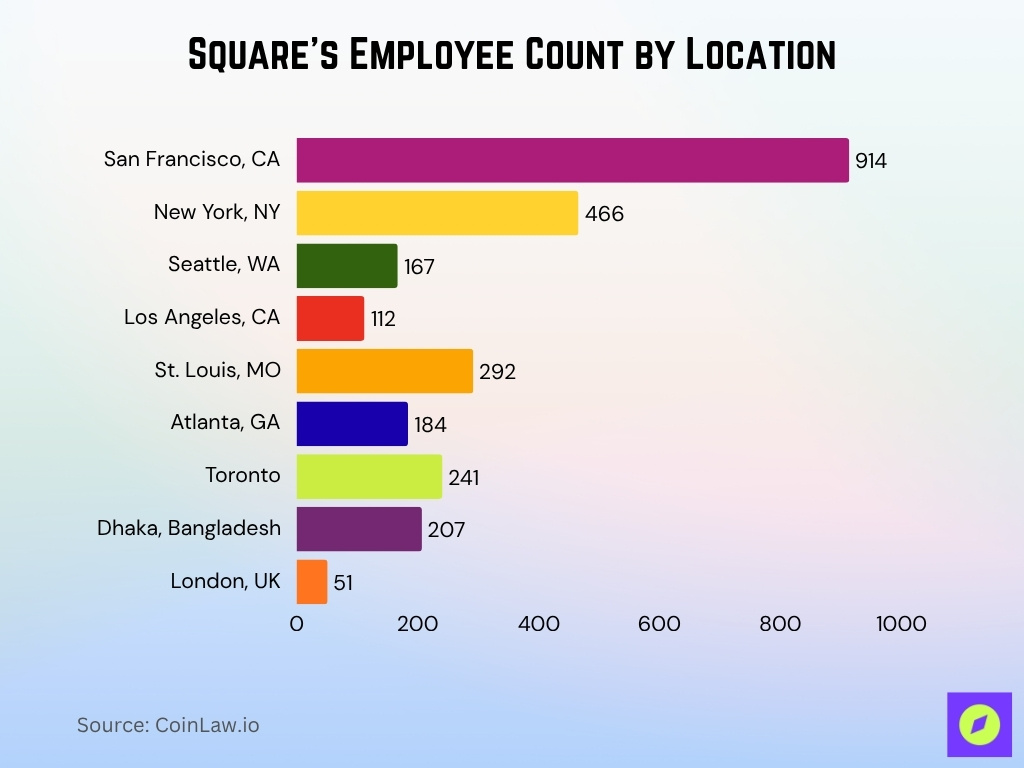

Employee Count by Location

- In 2025, Block lists 914 employees in San Francisco, CA.

- New York, NY has 466 employees.

- Seattle, WA is home to 167 employees.

- Los Angeles, CA reports 112 employees.

- St. Louis, MO has 292 employees, showing reach beyond typical tech hubs.

- Atlanta, GA lists 184 employees, Toronto, 241 employees, Dhaka, Bangladesh (207 employees), London, and UK (51 employees).

Sales and Support Team Size

- For the Square business unit, there are 1,032 Sales & Support employees out of ~5,268 total.

- That figure implies ~19.6% of that business’s workforce is in Sales & Support.

- Given the broader Block headcount of ~11,372, similar ratios would suggest ~2,200–2,300 employees in Sales & Support across the group.

- These teams support merchant services and Cash App user growth, reflecting both growth and maintenance of customer operations.

Marketing and Product Team Size

- Square’s Marketing & Product teams represent ~16.7% of the Square business unit’s workforce with 881 out of 5,268 employees.

- The Block group would likely have ~1,900–2,000 Marketing & Product employees if scaled proportionally across all 11,372 staff.

- In 2025, Block’s overall workforce optimization did not result in disproportionate reductions in Marketing & Product roles.

- The Square Product team oversees feature development, roadmap planning, UX, and payments innovation with dedicated specialists.

- Marketing manages both merchant and consumer brand, growth, and customer acquisition for Square’s platforms.

- These teams help Block prioritize rapid launches of new features and geographic expansion across markets.

- The balance between Product and Marketing is considered crucial in the highly competitive payments and crypto sectors.

- Growth in headcount for Product and Marketing roles suggests Block is ramping up both development capacity and market presence.

- Having ~16.7% of staff in Marketing & Product reflects Block’s focus on both user experience and brand scaling.

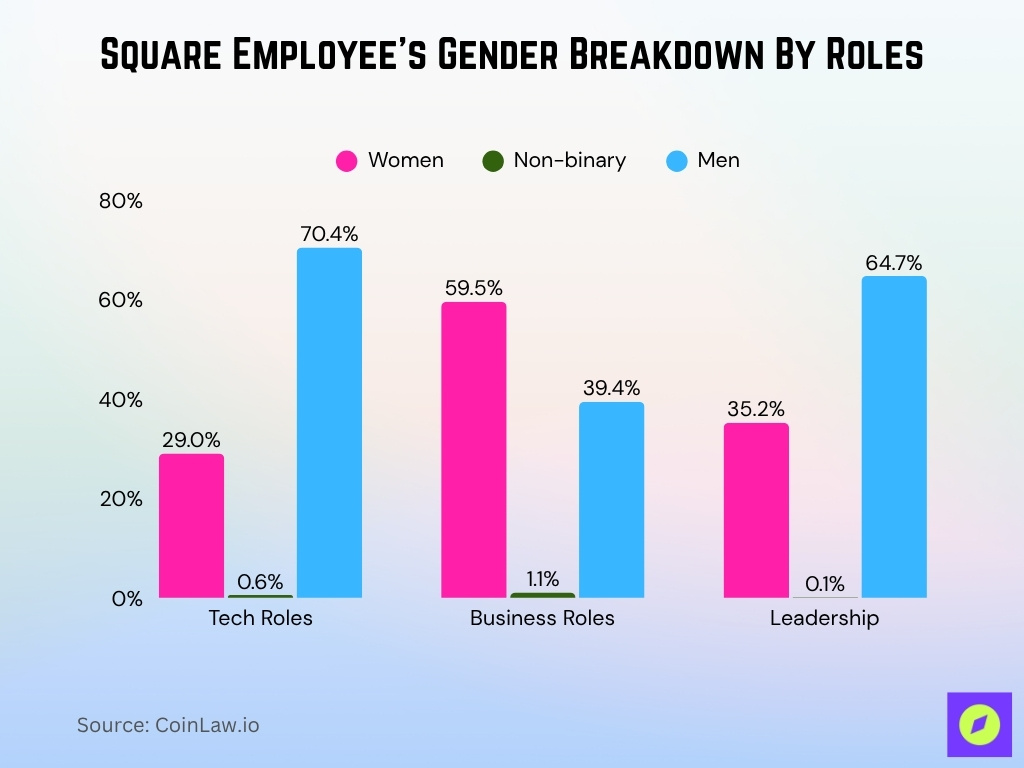

Employee Statistics: Gender Breakdown

- In tech roles, representation was 29% women, ~0.6% non‑binary, ~70.4% men.

- In business roles, 59.5% women, ~1.1% non‑binary, ~39.4% men.

- The benchmark for gender diversity is 50% women, exceeded in business but not yet in tech.

- In leadership roles, 35.2% women, ~0.1% non‑binary, ~64.7% men.

- Year‑over‑year data showed improvement in women’s representation in tech.

- Women represent a higher share within URM employees.

- Even with smaller headcount, gender‑diversity initiatives continue.

- Women remain under‑represented in technical roles compared to general U.S. averages.

Square Remote vs On‑Site Employees

- About 22% of U.S. employees worked remotely in early 2025, roughly 32.6 million people.

- Among remote‑capable employees, ~50% prefer hybrid, ~30% fully remote, ~20% fully on‑site.

- Block’s 23 global offices and a “remote workplace” designation indicate a distributed work policy.

- The company promotes benefits for “Distributed work” and allows employees to work without strict time‑on‑site requirements.

- The “Other or remote” category (1,223 employees) implies many staff work outside major hubs.

- Block likely operates a hybrid‑first or remote‑friendly model.

- Roughly 83% of global employees prefer hybrid arrangements, aligning with Block’s design.

- Block appears to adopt flexible work arrangements with many working remotely or hybrid, following wider fintech trends.

Workforce Diversity Statistics

- Under‑represented people made up 25.6% of the U.S. workforce at Block in 2023.

- URM representation in tech roles was 11.4%, while in business roles it was 36.9%.

- The 2024 diversity update said that, while overall headcount declined, representation remained stable or improved slightly.

- The benchmark for URM was roughly 35% of the U.S. population.

- Women + non‑binary representation in business roles surpassed 50%.

- Women in tech roles in 2022 were 29%, versus 59.5% in business roles.

- Women made up a greater share of URM employees than non‑URM employees.

- Efforts to improve representation in senior leadership and technical roles continued in 2024.

- The broader U.S. high‑tech workforce had about 23% women, showing the industry challenge.

New Hires and Employee Turnover at Square

- Block reported 228 new hires and 200 departures, giving a modest net increase.

- New hires accounted for ~5% of total workforce, departures ~4.4%.

- In March 2025, Block announced layoffs of 931 employees, about 8% of workforce.

- Of those, ~391 were for strategy, ~460 performance issues, ~80 managerial roles cut, ~193 managers reassigned.

- The company also closed 800 open roles as part of restructuring.

- Block’s headcount cap remains ~12,000 employees.

- Turnover is elevated, though Block does not publish full turnover rates.

- Employee reviews note a “high turnover rate.”

- Industry averages show tech turnover around 20–30%, framing Block’s movement in context.

Average Tenure of Square Employees

- Reviews imply many employees stay 2–3 years.

- Industry averages for software engineers are 2–3 years.

- Given growth and adjustments, tenure is likely below corporate averages of 4–5 years.

- Layoffs of 8% in 2025 shortened average tenure.

- Managers and senior technical staff likely have longer tenure.

- Focus on performance and simplification causes greater churn among lower‑tenure staff.

- Recruit‑to‑exit cycle changes in 2024–25 reduced average tenure further.

Square Employment vs Other Block, Inc. Divisions

- Square accounts for 5,268 employees out of Block’s total 11,372 workforce, making up ~46% of all Block staff.

- Within Square, Sales & Support represents 1,032 employees and Marketing & Product totals 881, which is ~36.4% of Square headcount in these two functions alone.

- Block’s workforce dropped by 12.4% year-over-year in 2025, but reductions were spread across divisions, not just Square.

- Engineering is Square’s biggest function representing 1,859 people, more than any other category at Square.

Workforce and Company Size Compared to Competitors

- Block’s headcount of 11,372 at end of 2024 shows a 12.4% drop from 2023.

- Many fintech peers are expanding or stabilising; Block’s reduction stands out.

- Industry‑wide layoff trends show tech firms cutting 5–10% of staff, aligning with Block’s 8% reduction.

- Competitors such as PayPal, Stripe, and Affirm reported smaller changes or growth.

- From 2021 to 2022, Block grew 45.9% (8,521 → 12,428).

- The cap of 12,000 employees marks a shift from growth to efficiency.

- Workforce size signals investment in areas like crypto and merchant services.

- Comparing across competitors helps gauge relative scale, though models differ.

Frequently Asked Questions (FAQs)

931 employees, about 8% of the workforce.

11,372 employees.

A decrease of 12.42%.

12,985 employees.

Conclusion

Block, Inc., formerly Square, Inc., employed approximately 11,372 people, marking a notable contraction from the previous year. The distribution of talent shows a heavy emphasis on engineering and technical roles, while diversity and gender metrics display progress but also significant room for improvement. Turnover and staffing strategies reflect a fintech company transitioning from rapid expansion to a more disciplined growth phase. Investors, job seekers, and industry watchers should monitor how Block’s workforce size, composition, and unit‑specific staffing evolve in response to product shifts and market conditions.