The decentralized exchange dYdX has rapidly become a notable player in the cryptocurrency derivatives market, raising questions about just how many people work at the company. From servicing high-volume traders to pushing the boundaries of decentralized finance, dYdX’s workforce size reflects its evolving strategy. In one industry scenario, dYdX’s team size impacts how fast they can roll out new products for institutional clients; in another, it affects how the protocol can scale and support community-driven governance. Let’s dig deeper into the numbers and trends behind dYdX’s people ecosystem.

How Many People Work At dYdX?

- As of August 2025, dYdX employs ~79 people globally across 5 continents, based on current directory records and recent analyst calls.

- The company’s $85 million total funding with minimal headcount suggests capital efficiency focused on technology over human resources.

- Female representation in crypto averages 26%, with leadership roles under 10%, indicating sector-wide diversity gaps likely mirrored at dYdX.

- Benefits include 100% covered health insurance for employees, spouses, and children in some roles.

- The hybrid model mirrors 2025 trends, with about 52% of U.S. remote-capable employees working hybrid.

Recent Developments

- In October 2024, dYdX’s founder and CEO, Antonio Juliano, returned from a sabbatical and announced a workforce reduction to reshape the organisation.

- The layoff decision came amid pressure from a competitive DeFi environment and the need for the company to realign its focus.

- At the same time, dYdX published its 2024 Ecosystem Report, which shows strong product and community growth, suggesting internal shifts in staffing to match new priorities.

- The company also continues hiring engineering and design roles, indicating that workforce reduction was strategic rather than purely budget-cutting.

dYdX Token Price Analysis

- Current Price: dYdX trades at $0.3714, showing a −4.89% decline in the latest 4-hour session.

- Intraday Range: Price fluctuated between $0.3711 (Low) and $0.3917 (High) during the period.

- Short-Term Momentum: The EMA 20 sits at $0.3949, slightly above the current price, suggesting short-term bearish pressure.

- Medium-Term Trend: The EMA 50 at $0.4641 and EMA 100 at $0.5222 indicate a continued downward trend over recent weeks.

- Long-Term Outlook: The EMA 200 stands at $0.5663, highlighting a significant drop from previous stability levels.

- Market Sentiment: The Balance of Power (−0.93) confirms strong seller dominance, pointing to negative market sentiment.

- Technical Indicator: MACD readings show a line at 0.0107, signal at −0.0314, and histogram at −0.0422, implying a potential weak bullish crossover but still in bearish territory.

dYdX’s Current Team (Key People)

- Antonio Juliano – Founder & Chief Executive Officer: After a six-month hiatus, Antonio returned to the CEO role in October 2024 and now focuses on steering the company’s vision and strategic execution.

- Rashan Colbert – Head of Policy: With a background working for Senator Cory Booker and extensive experience in crypto regulation, Rashan joined dYdX to shape policy and regulatory engagement.

- Charles d’Haussy – CEO of the dYdX Foundation: Based in Switzerland, Charles leads the ecosystem-governance arm of dYdX, focusing on community growth, protocol decentralization, and developer engagement.

- Leadership Team & Key Roles – The broader team includes individuals in roles such as Chief Operating Officer, Chief of Staff, Head of Operations, Director of Engineering, and Head of Talent & People.

- Operational Structure – The company now balances global distributed talent (spanning North America, Europe, Asia, and Latin America) with core hub functions, indicating a hybrid leadership and team model designed for scale yet lean execution.

- Leadership Focus – The company’s stated values (“Think 10× bigger, A players only, Ruthlessly prioritise, One level deeper”) reflect the leadership’s ambition and the calibre of talent they engage with at senior levels.

- Signal to Stakeholders – The return of the founder-CEO, the consolidation of policy/regulatory leadership, and the establishment of a foundation arm all signal that dYdX is entering a phase of strategic maturity and ecosystem-driven growth.

dYdX Workforce Growth Statistics

- According to the 2024 report, dYdX increased active traders by 52% from Q1 to Q4 2024, suggesting support-staff needs likely rose alongside platform growth.

- The number of DYDX token holders climbed by ≈290% in 2024, indicative of ecosystem expansion requiring internal staffing alignment.

- The global spread of employees (five continents) suggests growth in geographic footprint as well as headcount.

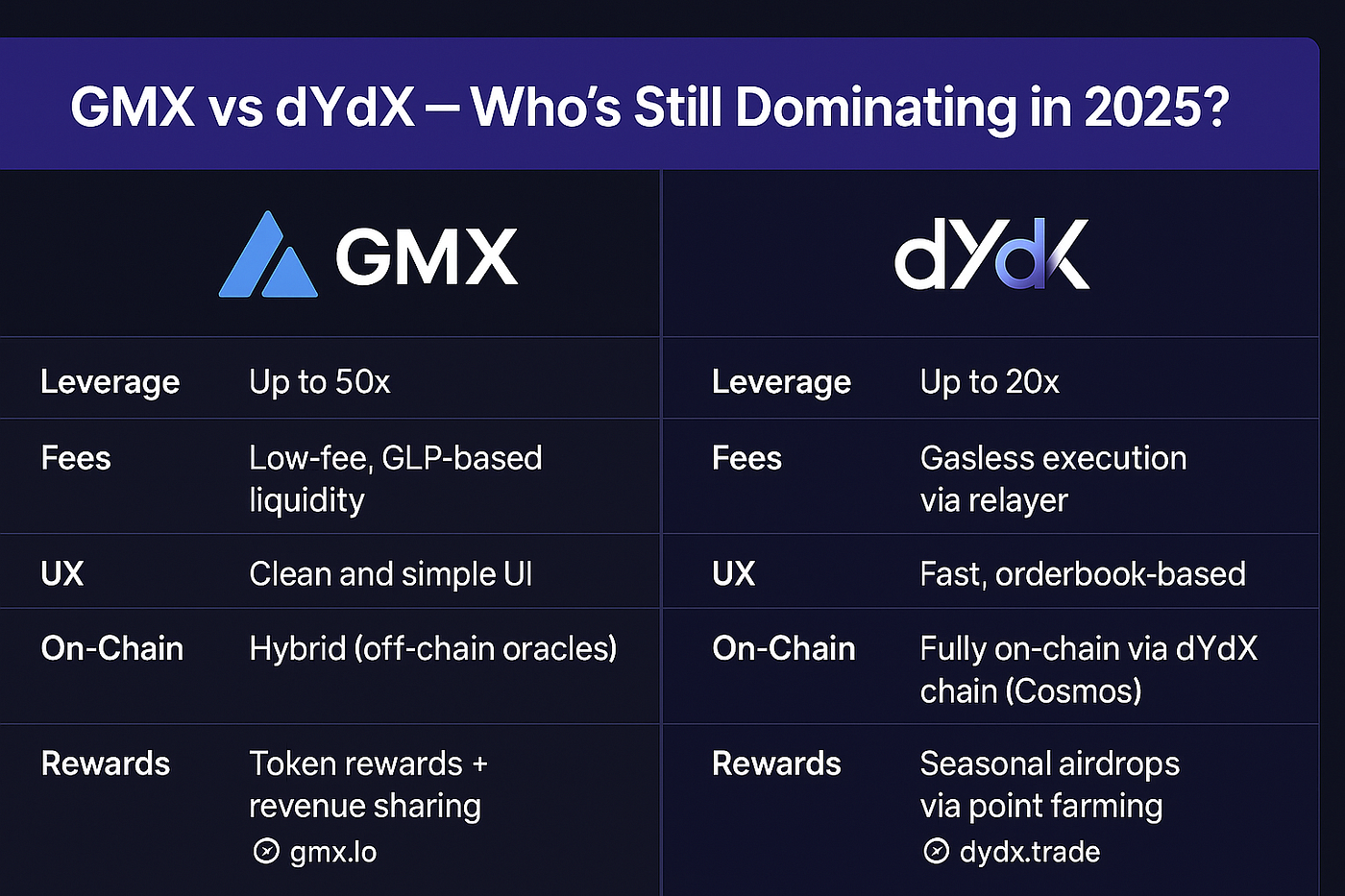

GMX vs dYdX: Feature Comparison

- Leverage Advantage: GMX offers up to 50x leverage, more than double dYdX’s 20x, appealing to high-risk traders.

- Fee Model: GMX runs on low-fee, GLP-based liquidity, while dYdX features gasless execution through a relayer, making trades more efficient.

- User Experience (UX): GMX focuses on a clean, beginner-friendly UI, while dYdX provides a fast, orderbook-based interface preferred by professionals.

- On-Chain Design: GMX uses a hybrid model relying on off-chain oracles, whereas dYdX operates fully on-chain via the dYdX chain (Cosmos) for enhanced transparency.

- Reward System: GMX distributes token rewards and revenue sharing, while dYdX offers seasonal airdrops tied to point farming incentives.

Breakdown by Department or Role

- Engineering roles at dYdX range from Staff to Senior Software Engineer (Frontend/Backend), emphasizing strong product and platform development.

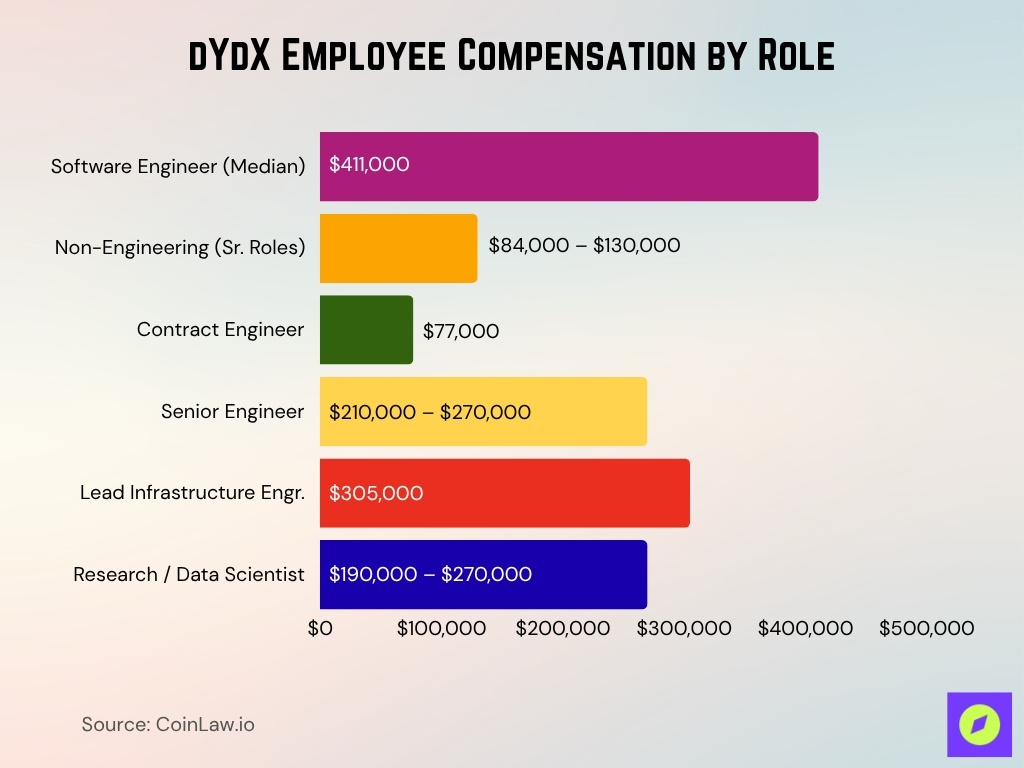

- A Software Engineer in the U.S. earns a median total compensation of about $411,000 per year.

- Open roles such as Data Scientist and Research Lead show focus on data, analytics, and market insights.

- Job postings mention “meaningful equity and competitive compensation,” reflecting token/equity-linked pay.

- Listings indicate an in-office focus in New York and San Francisco, centralizing core teams like engineering and trading.

- Overall, dYdX positions itself as a high-skill, high-compensation employer in the crypto and fintech sectors.

Employee Backgrounds and Expertise

- The median total compensation for software engineers at dYdX is $411,000 per year, ranking among the highest in DeFi compensation packages.

- Non-engineering roles, like recruiting or business development, show lower pay, around $84,000–$130,000 for senior recruiting.

- Senior software engineers earn between $210,000–$270,000 annually, while lead trading infrastructure engineers can reach $305,000.

- Typical job requirements list 5+ years of professional experience in blockchain infrastructure, low-latency trading, and distributed systems.

- Research Lead and Data Scientist postings list salary bands of $190,000–$270,000, targeting quantitative and market-structure specialists.

- Engineers at the senior level manage billions in daily trading volume through their software infrastructure, requiring advanced trading system expertise.

- Equity and token-incentive packages make total compensation up to 3.5× the U.S. fintech median, emphasizing retention through ownership.

Office Locations and Work Model

- dYdX operates 2 physical offices, HQ in San Francisco and one in SoHo, New York City, with a 3-day in-office schedule for local staff.

- The New York City office spans 21,400 sq. ft. across 3 floors at 38 Greene Street under a 10-year lease.

- Internal policy promotes hybrid collaboration, mixing on-site teamwork with remote flexibility for productivity.

- Job listings often note “In-Office (New York, NY)” to show structured office expectations for specific teams.

- Remote workers receive a home-office stipend and travel support, following hybrid benefit models.

- dYdX hosts periodic off-site gatherings and team retreats to strengthen team connection.

- Its global setup ensures near 24-hour platform oversight for worldwide traders.

Hiring Trends and Open Positions

- As of early 2025, dYdX lists open roles for Senior Software Engineer – Backend, Staff Software Engineer, and Research Lead in New York, NY.

- Salary range listings for senior software engineers: ~$210,000-$270,000 per year for various engineer positions in NYC.

- The careers page emphasises “meaningful equity and competitive compensation”.

- Job boards list technical roles in infrastructure, blockchain, and fintech, indicating prioritisation of foundational engineering hires.

- The mix of open positions suggests a focus on product and platform growth, rather than large-scale hiring across all functions.

- Active job postings in R&D and data science suggest investment in deeper analytics capabilities.

Compensation and Benefits Overview

- The average annual salary at dYdX in the U.S. is reported at $111,566 as of October 2025, with typical ranges from ~$97,857 to $126,414 for many non-senior roles.

- Senior engineer compensation: The median total for a Software Engineer is ~$411,000 per year.

- Salary listings show Senior Software Engineer – Blockchain roles at ~$210,000-$270,000 per year in NYC.

- Benefits data: The company offers fully covered medical/vision/dental insurance, a home office stipend, 401(k) match, and wellness reimbursement.

- Office perks include free lunches and snacks, team off-sites, and fitness/wellness stipends ($200/month fitness/wellness reimbursement).

- Equity: Listings emphasize “meaningful equity”, suggesting that employees receive token or equity grants as part of compensation.

- Retirement/Matching: A 401(k) match of 50% up to 4% of employee contribution is available.

Comparison With Competitors’ Workforce Size

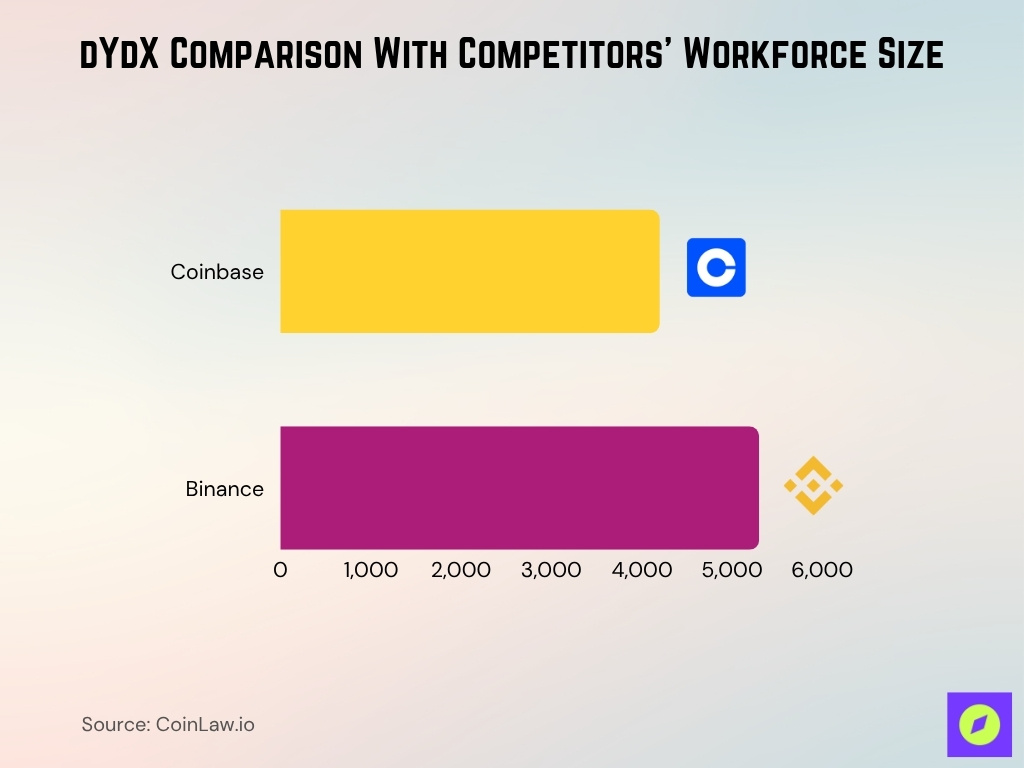

- Coinbase maintains a workforce of over 4,200 employees as of June 2025, while Binance operates with over 5,300 employees worldwide.

- dYdX’s $143,000 revenue per employee suggests high productivity efficiency compared to larger exchanges with broader operational overhead.

- Coinbase plans to add 1,000 U.S. jobs in 2025, while dYdX grew its employee count last year from a much smaller base.

- Binance’s compliance team alone employs 645 full-time staff, which is 25x larger than dYdX’s entire workforce.

Employee Allocation: Tokenomics and Incentives

- The $DYDX token has a total supply of 1,000,000,000 tokens, minted Aug 3, 2021.

- An additional 7.0% (~70 million) is reserved for future employees & consultants.

- Employee/consultant tokens are subject to vesting and transfer restrictions through June 2026.

- Incentives align with core values: leadership emphasises “meaningful equity” and competitive compensation.

- Tokenomics design suggests employees participate both through direct compensation and governance-capable tokens.

- Because allocation to employees is fixed, a smaller headcount means higher per-capita potential.

- Incentives extend beyond traditional salary, token holding, and long-term value creation play a meaningful role in retention.

Notable Employee Departures

- The layoffs occurred just two weeks after founder Antonio Juliano returned as CEO, resuming control in “Founder Mode™”.

- The post titled “Letting Go” stated the move aimed to align “the company we’ve built vs. the company dYdX must be,” marking a strategic reset.

- Despite the layoffs, the DYDX token price rose 8% that week, showing minimal investor concern.

- The company’s Total Value Locked (TVL) fell from $500 million in March 2024 to $287 million by October, reflecting ecosystem contraction.

- In contrast, rival Hyperliquid’s TVL grew 250% to $860 million, tripling dYdX’s same-period value.

- The episode followed similar crypto layoffs, with ConsenSys slashing 20% (162 employees) the same week.

dYdX Hiring Policies and Diversity

- About 70% of roles advertised are labeled In-Office (New York, NY), while 30% are remote or hybrid across 5 continents.

- Positions span categories like Software Engineer, Data Scientist, and Research Lead, with pay scaling up to $305K annually.

- Average salary for software engineers at dYdX is $194,000 per year, about 18% higher than the U.S. fintech average.

- The company describes its hiring ethos as “A players only”, seeking candidates with 2–5+ years of technical experience.

- 67% of job seekers prioritize workplace diversity, while 79% review DEI initiatives before applying, key for global candidates assessing dYdX.

Analyst and Industry Workforce Benchmarks

- The global crypto workforce reached ~190,000 employees in 2023, with over 52% based in Western countries.

- By 2025, the global crypto talent pool is expected to have grown 50% since 2020, with hiring expected to rise another 30% in the next two years.

- Average annual crypto wages are projected to hit $94 billion by 2025, reflecting a 66.2% annual growth rate in employment spending.

- The decentralized finance (DeFi) technology market is valued at $97.2 billion in 2025, projected to grow at a 28.1% CAGR to $1.15 trillion by 2035.

- Senior blockchain engineers earn between $220K–$400K+, while experienced DeFi analysts average $150K–$220K per year.

- Crypto companies operate with 87% remote roles, emphasizing distributed teams and cross-border efficiency in hiring.

- Employment across exchanges dropped 5% year-over-year in 2024 as firms optimized for automation and efficiency.

- The crypto exchange market recorded $9.36 trillion in volume in H1 2025, reflecting high throughput relative to workforce size.

- Average blockchain job postings rose 118% year-over-year from 2023 to 2025, driven by DeFi and Web3 ecosystem demand.

Organisational Structure

- The ecosystem is composed of 3 core entities: dYdX Labs, dYdX Foundation, and dYdX Operations Trust, forming a multi-layer governance framework.

- dYdX Foundation is headquartered in Zug, Switzerland, operating as an independent non-profit coordinating grants and governance.

- The v4 governance model requires a 10,000 DYDX minimum deposit, 33.4% quorum, and a 4-day voting period, with 50%+ yes votes needed to pass proposals.

Frequently Asked Questions (FAQs)

dYdX reported about $21.6 million in annual revenue for 2025.

Its Q2 2025 earnings fell by 84% compared to Q2 2024, dropping from $20.1 million to $3.2 million.

Its market cap stands at $268 million.

The platform’s TVL is approximately $312 million, down from $1.1 billion in 2021.

Conclusion

dYdX is a lean, evolving company after a reduction, led by its founder’s return to refocus strategy. Its globally distributed, skilled team aligns incentives through $DYDX tokens, reinforcing long-term goals. Compared to larger crypto firms, dYdX’s compact structure signals efficiency, engineering focus, and a mature operating model.