Hedera Hashgraph brings a fresh alternative to blockchain‑based networks. Its native token, HBAR, continues to stand out for its scalable performance and energy‑efficient approach. In enterprise settings, Hedera has been piloted for supply chain tracking solutions, such as by Avery Dennison and Atma.io, offering settlement speeds that can be measured in seconds, depending on the specific implementation. In the Web3 space, developers leverage its smart contract service to tokenize assets and build fast, low‑cost applications. Explore the full article to discover how Hedera is shaping the future of distributed ledgers.

Editor’s Choice

- Circulating market cap dropped 32.9 % QoQ, settling at $6.9 billion in Q1.

- Stablecoin market cap on Hedera surged 91.7 % QoQ, reaching $72.6 million.

- Daily transactions climbed 25.8 % QoQ to an average of 708,500.

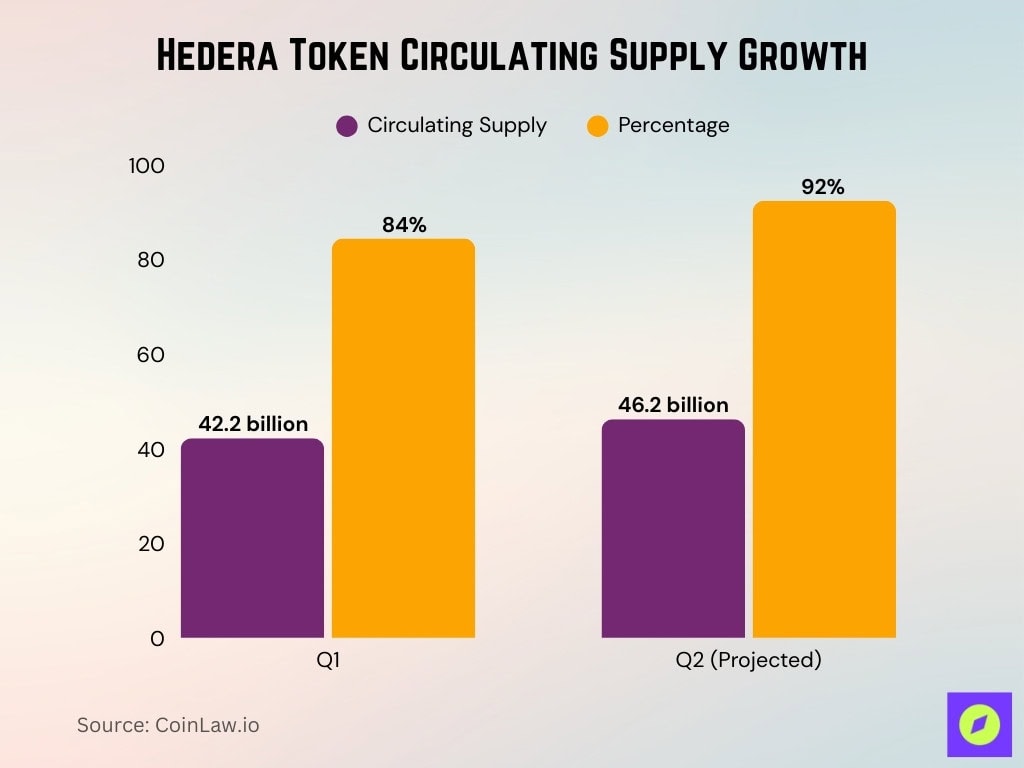

- Circulating supply rose 10.4 % QoQ, reaching 42.2 billion HBAR.

- Protocol revenue in Q1 totaled $232,700, down 5.1 % from the prior quarter.

- Transaction service breakdown: Crypto Service 68.4 %, Smart Contracts 19.7 %, Consensus 8.6 %, Token Service 2.9 % of Q1 activity.

- Max TPS capability exceeds 10,000 transactions per second, with finality under five seconds.

Recent Developments

- Q1 2025 saw a 32.9 % drop in market cap, down from $10.3 billion to $6.9 billion.

- Stablecoin usage rose sharply, with USDC on Hedera doubling its market cap QoQ.

- Performance milestone: Hedera recorded over 708K daily transactions, fueled by a Crypto Service increase of 103.6 % QoQ.

- Protocol revenue dipped slightly to $232,700, with all services registering declines.

- Crypto Service revenue fell 59.2 % QoQ, Smart Contract Service 57.4 %, Token Service 41.7 %, and Consensus Service 87.1 %.

- Ecosystem moves: Extensions via Chainlink’s CCIP and usage by DeFi dApps like SaucerSwap and Bonzo Finance.

- Continued emphasis on interoperability, especially via Hashport with cross‑chain token bridging.

Market Capitalization

- As of mid‑2025, the market cap stands near $10.2 billion, with a circulating supply hovering around 42 billion HBAR.

- CoinMarketCap ranking: #17, with a 24‑hour trading volume of about $319 million.

- CoinGecko reports a similar market cap figure: $10.21 billion.

- Some sources note a decline to $5.8 billion, placing Hedera #21 in rankings.

- These discrepancies suggest variance depending on definitions of circulating vs. released supply.

- Overall, the market cap fluctuates between $5.8 billion and $10+ billion in 2025, depending on the data source.

Token Distribution and Allocation

- Circulating supply rose from 42.2 billion (84.4 %) in Q1 to 46.2 billion (92.4 %) by end-of-Q2 projections.

- Hedera’s total fixed supply is capped at 50 billion HBAR.

- Treasury Management Report outlines supply distinctions and the schedule.

- HBAR is used for transaction fees, network protection, and governance participation.

- Up to 6.5 % APY is available for staking.

- The supply release is managed by the Hedera Council.

- Transparency in future supply reports could enhance confidence.

Price and Value Trends

- Recent trading price hovers around $0.24, up ~4 % in 24 hours but down ~10 % from $0.27 a week ago.

- Historical high: $0.401 on January 17, 2025.

- Recent close data shows ~$0.2415 with fluctuations between ~$0.23 and ~$0.27.

- Year‑to‑date change: +349.4 % growth, indicating strong recovery compared to prior lows.

- Other forecasts anticipate growth to $0.20 by year‑end, even suggesting potential $0.3–$0.9.

Circulating and Total Supply

- Total fixed supply remains at 50 billion HBAR.

- Circulating supply in Q1: 42.2 billion HBAR (84.4 % of total).

- By the end of Q2 2025, projected circulation: 46.2 billion HBAR (92.4 %).

- Current live supply: ~42.39 billion, about 85 % of max supply.

- Hedera’s Treasury Management Report explains the distinction between released vs. circulating supply definitions.

Transaction Volume

- Q1 average daily volume: 708,500 transactions (up 25.8 % QoQ).

- Crypto Service transactions nearly doubled, rising 103.6 % QoQ to 483,100.

- One day hit 114.38 million transactions, vastly outpacing Ethereum (~2 million).

- This indicates Hedera’s capacity for extremely high-throughput use cases.

- Exact daily volume in USD terms isn’t widely tracked, but trading volumes hover around ~$319M daily.

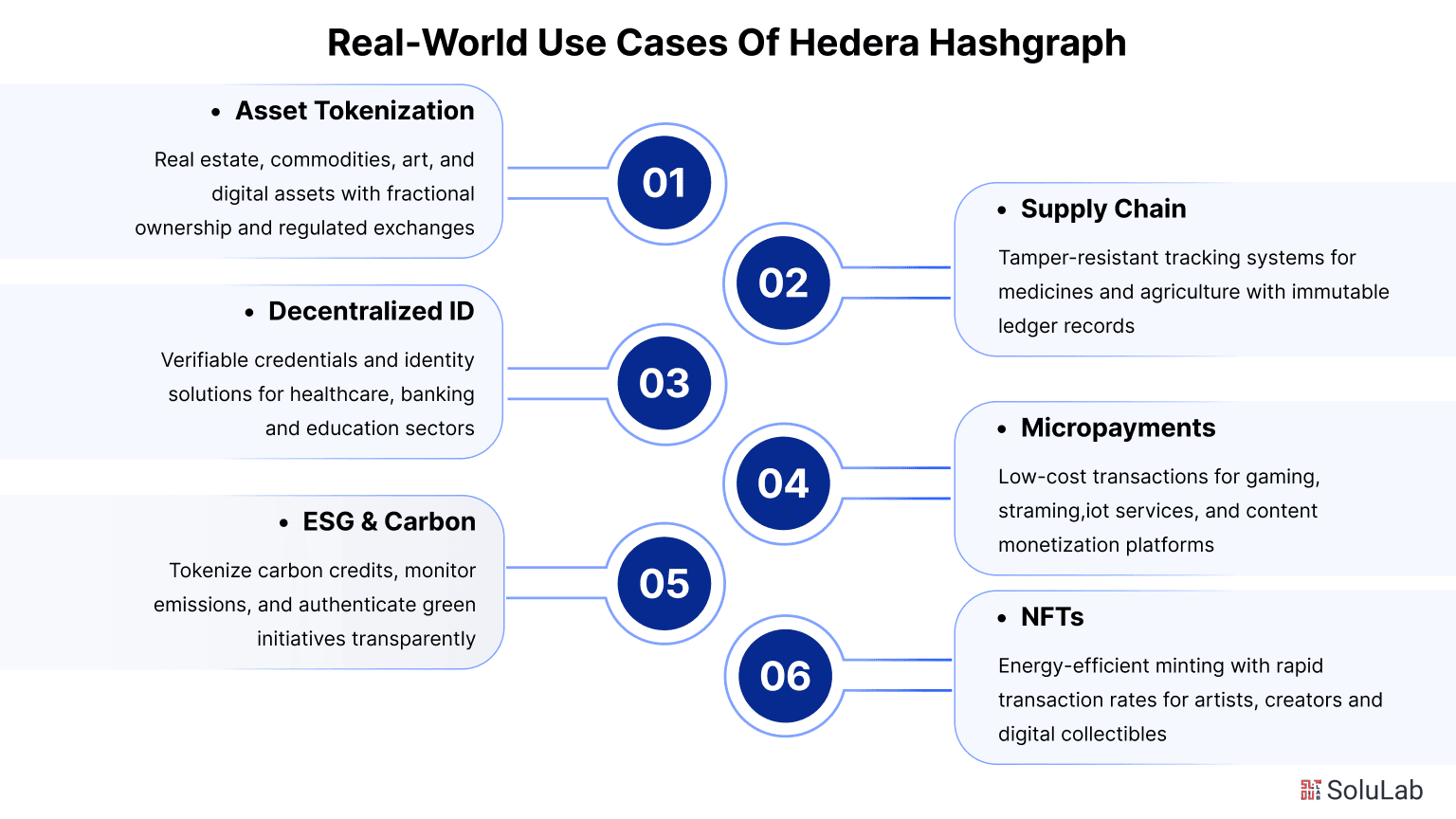

Real-World Use Cases of Hedera Hashgraph

- Asset Tokenization enables fractional ownership of real estate, commodities, art, and digital assets through regulated exchanges.

- Supply Chain solutions provide tamper-resistant tracking for medicines and agriculture using immutable ledger records.

- Decentralized ID delivers verifiable credentials for healthcare, banking, and education sectors.

- Micropayments allow low-cost transactions for gaming, streaming, IoT services, and content monetization platforms.

- ESG & Carbon initiatives use Hedera to tokenize carbon credits, monitor emissions, and ensure transparent green authentication.

- NFTs benefit from energy-efficient minting and rapid transaction rates, supporting artists, creators, and digital collectibles.

Network Transaction Speed

- Hedera reaches up to 10,000 TPS, with finality within 3–5 seconds.

- The network achieves an average finality of 2.9 seconds.

- Real-time observed TPS averages 10.73 transactions per second, reflecting typical activity levels.

- In one successful test, the network recorded a max real TPS of 3,302 within a block batch.

- Real-time TPS observed at 3.85 tx/s, with theoretical capacity at 10,000 tx/s, block time of 2 seconds, and zero finality delay.

- Enterprise comparisons note Hedera’s 10,000 TPS capacity outpaces Bitcoin (7 TPS) and Ethereum (30 TPS).

- Transaction volume recorded at 13,864 txns, block time of 2 seconds.

Transaction Fees

- Standard transaction fees are fixed in USD and paid in HBAR, adjustable via frequent exchange rate updates.

- A basic HBAR or token transfer typically costs around $0.0001 USD, irrespective of transaction size.

- The average fee per HBAR transaction is $0.001 USD, with finality in 3–7 seconds.

- A recent fee update introduced zero-cost successful Ethereum transaction relay fees, enhancing cost-efficiency.

- Fixed-fee structure ensures predictability and shields users from volatility seen on other chains.

- The complexity of smart contract operations can cause slightly higher dynamic gas fees, yet they remain a fraction of Ethereum costs.

- The fee schedule is overseen and approved by the Hedera Council, ensuring governance-aligned updates.

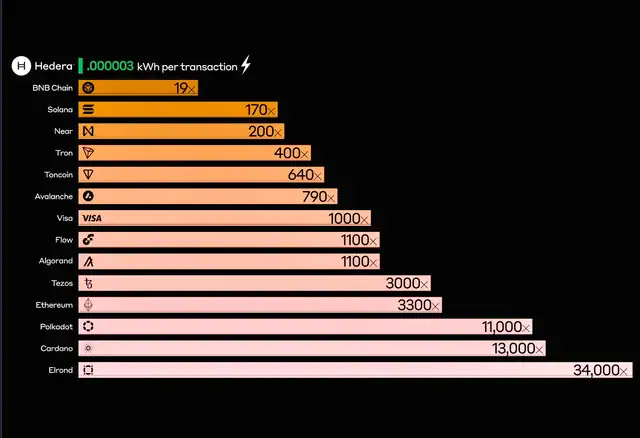

The Efficiency of Hashgraph Consensus

- Hedera consumes only 0.000003 kWh per transaction, making it the most sustainable public network.

- BNB Chain uses 19× more energy per transaction than Hedera.

- Solana consumes 170× more energy, while Near requires 200× more.

- Tron transactions use 400× the energy compared to Hedera.

- Tencoin and Avalanche demand 640× and 790× more energy, respectively.

- Even Visa, a traditional payment network, uses 1000× more energy than Hedera.

- Flow and Algorand both consume 1100× more.

- Tezos is 3000× less efficient, and Ethereum uses a staggering 3300× more energy.

- Polkadot consumes 11,000× more, and Cardano requires 13,000× more.

- At the top, Elrond uses 34,000× more energy per transaction than Hedera.

Active Addresses and Wallets

- Daily active accounts averaged 6,700, marking a 33% drop QoQ from 10,100.

- New account creations rose by 6% QoQ, increasing from 7,800 to 8,200.

- 8,866,897 total accounts registered as of mid-August 2025.

- Wealth distribution on the network remains highly centralized, with a slow trend toward decentralization.

- The Nakamoto coefficient remains low, suggesting limited validator diversity.

- Newly active addresses suggest resilience in user onboarding, despite lower daily usage.

Developer Activity

- Direct quantification of developer activity remains sparse in public stats.

- The introduction of HIP‑1084 indicates active protocol-level development.

- The main documentation portal shows frequent updates and tooling support.

- Partnerships like Google, IBM, Boeing, and others signal enterprise-level development investment.

- Platform growth around stablecoins, tokenization, and AI use cases suggests developer traction.

- Community tools like HashPack and Blade wallets continue to mature.

Staking Statistics

- Q1 2025 saw no public staking metrics, but staking is used for network security under PoS.

- Future plans include enabling permissionless public validator staking.

- No specific figures for total staked HBAR, APY, or delegation data are publicly available.

- Staking is centralized, overseen by council members.

- Additional transparency would benefit ecosystem maturity.

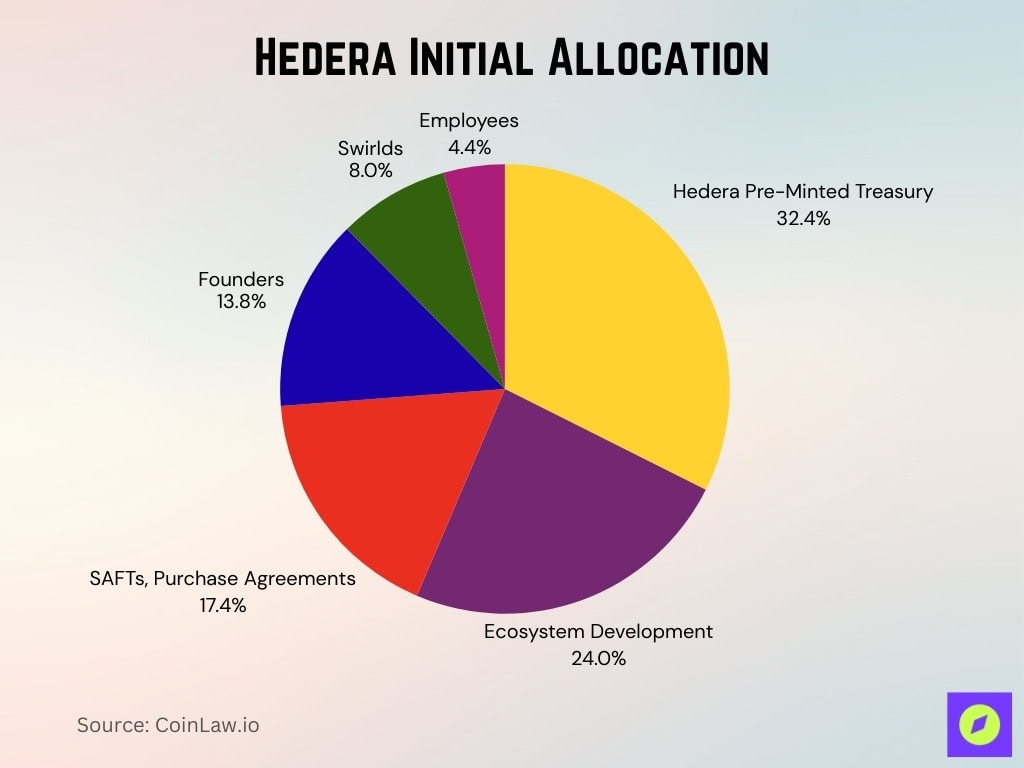

Hedera Initial Allocation

- Hedera Pre-Minted Treasury holds the largest share at 32.4%.

- Ecosystem Development was allocated 24.0% to drive network growth and adoption.

- SAFTs and Purchase Agreements account for 17.4% of the initial supply.

- Founders received 13.8%, reflecting their role in establishing the network.

- Swirlds, the original creator of Hedera’s technology, was allocated 8.0%.

- Employees were given 4.4% to incentivize participation and retention.

Governance and Council Members

- Hedera is overseen by a council of up to 39 global organizations, including Google, IBM, LG, Boeing, and Deutsche Telekom.

- The Council controls network pricing, protocol upgrades, and strategic decisions.

- Governance ensures enterprise-grade stability and accountability, but has limits on decentralization.

- The ABFT consensus and council governance reinforce resilience and fairness.

Smart Contracts Usage

- Daily active contracts surged 213.3 % in Q1, climbing from 200 to 600, and peaked at 6,300 contracts on March 28, 2025.

- Key updates HIP‑755 and HIP‑756 allowed contracts to directly manage scheduled transactions.

- Hedera supports Solidity, ensuring compatibility with familiar Ethereum dev tools like Ethers, HardHat, and Foundry.

- Smart contracts benefit from fixed, low costs and complete MEV resistance.

- All smart contract executions follow fair ordering.

- Developers benefit from Hedera’s carbon-negative status for every deployed contract.

- Tools like the Asset Tokenization Studio extend ERC‑1400 standards, integrating metadata for compliance on-chain.

Security and Consensus Metrics

- Hedera uses aBFT consensus, achieving asynchronous Byzantine Fault Tolerance.

- The network achieves 100 % efficiency, eliminating stale blocks.

- It remains energy-efficient and eco-friendly, avoiding high energy consumption.

- Formal analysis suggests PoS models like Hedera’s can achieve similar guarantees to PoW.

- Virtual voting enhances resistance to Sybil attacks.

- Governance via a diverse council contributes to oversight.

- Hedera shields against manipulation like censorship and centralization, with finality in seconds.

Energy Efficiency

- The network is carbon-negative, absorbing more CO₂ than it emits.

- Its proof-of-stake model reduces energy use compared to PoW chains.

- No specialized mining rigs are required.

- Hedera avoids stale computations by using a 100 % efficiency protocol.

- ESG-focused investors favor Hedera’s sustainable consensus model.

- It aligns with corporate sustainability mandates, strengthening enterprise interest.

- Energy efficiency supports scalability without environmental trade-offs.

Partnerships and Enterprise Adoption

- The Hedera Governing Council includes global brands like Google, IBM, Boeing, LG, and Deutsche Telekom.

- These members influence developments like pricing, upgrades, and protocol direction.

- Adoption spans sectors: supply chain, gaming, finance, NFTs, and climate finance.

- Use cases include stablecoin issuance, tokenized assets, and ESG-compliant applications.

- Enterprise trust is enhanced by predictable fees, high throughput, and a regulatory-friendly design.

- Partnerships support Hedera-based solutions in healthcare, logistics, and retail.

- Hedera is cited as a top DLT platform for 2025.

Conclusion

Hedera Hashgraph stands out with its rapid growth in smart contract activity, innovative governance model, and carbon-negative consensus design. Its blend of speed, predictability, and energy efficiency positions it well for enterprise deployment and ESG-conscious blocks. Council-led governance ensures stability while development efforts signal expanding ecosystem use, particularly in tokenization, stablecoins, and regulated applications. As the circulating supply approaches its cap, the token’s fundamentals and network adoption will shape HBAR’s future trajectory. Overall, Hedera presents a compelling blend of performance, accountability, and sustainability, one worth watching closely as distributed ledger technologies evolve.