Golden Visa programs remain pivotal tools for countries seeking foreign investment and global talent. These residency‑by‑investment schemes link capital and economic contribution with long‑term residency, often leading to permanent residency and eventual citizenship. They shape real estate markets, attract high‑net‑worth individuals, and influence migration trends in the US, Europe, and the Gulf. From Portugal’s record investment inflows to the UAE’s growth in long‑term residency grants, this article breaks down the latest figures and trends shaping the Golden Visa landscape. Explore how these statistics reflect shifting investor priorities and policy shifts across key markets.

Editor’s Choice

- Portugal has granted over 17,700 Golden Visas to main applicants since inception.

- UAE Golden Visa issuance rose from ~47,150 in 2021 to ~158,000 by 2023.

- Latvia saw a 51% increase in Golden Visa applications in 2025.

- Portugal recorded a 72% year‑on‑year rise in Golden Visas granted in 2024.

- Greece secured the top spot in the 2025 Global Residence Program Index.

- Indonesia issued 1,012 visas and nearly $3 billion in investment by late 2025.

- Real estate routes for Portugal’s Golden Visa ended in 2023, but alternate routes continue.

Recent Developments

- Portugal’s Golden Visa program remains active in 2025, despite property route closures.

- Portugal’s family inclusion rate exceeds 60% of total applications.

- Greece topped the 2025 Global Residence Program Index, signaling growing investor preference.

- Latvia witnessed a 51% surge in applications compared with 2024.

- Indonesia’s program collected nearly $2.9 billion by September 2025.

- UAE expanded Golden Visa categories in 2025, including professionals such as nurses and creators.

- Greece Golden Visa applications and approvals increased month‑over‑month in 2025.

- Spain eliminated its Golden Visa program in April 2025 amid housing concerns.

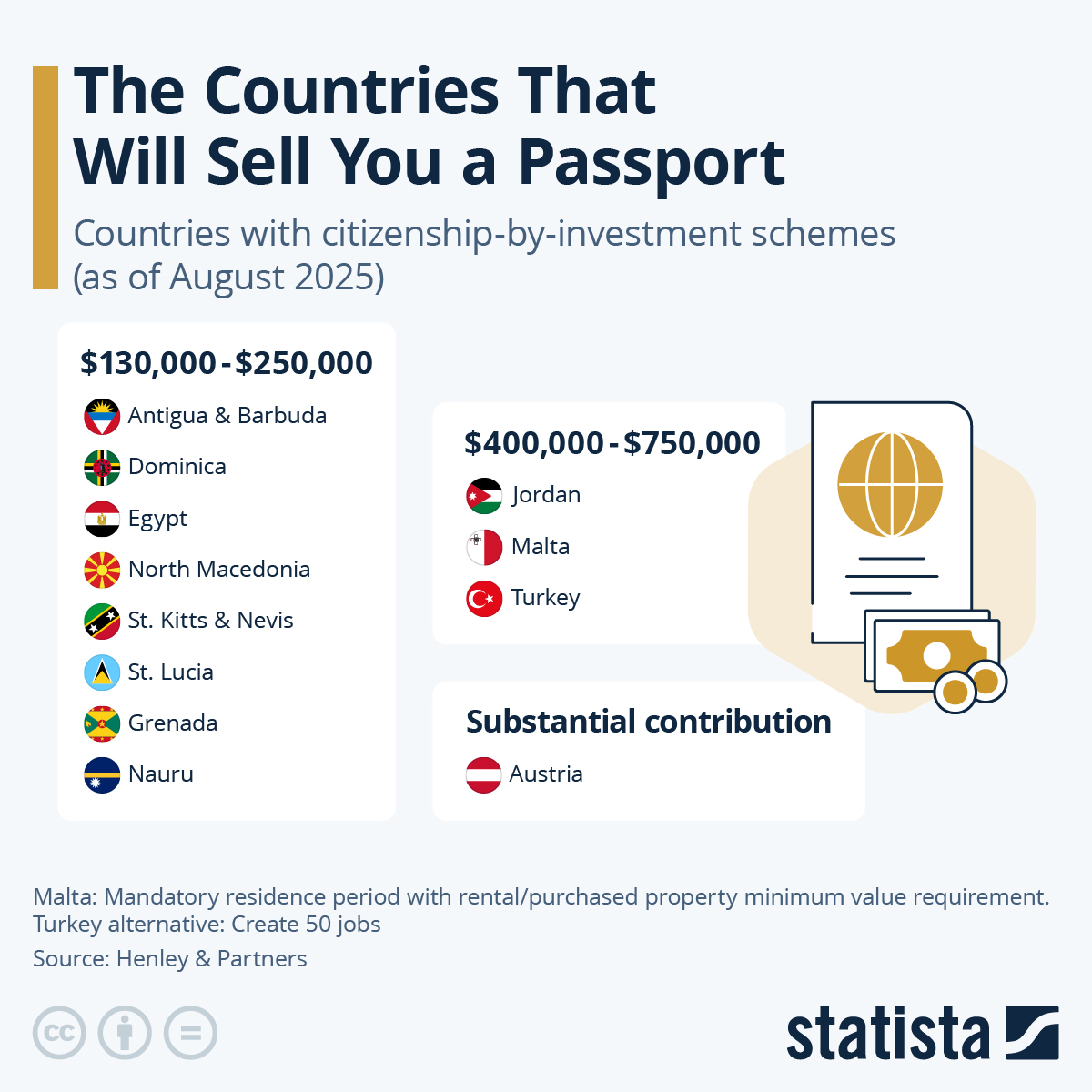

Citizenship by Investment Program Cost Ranges

- Eight countries offer citizenship by investment starting in the $130,000 to $250,000 range, making them the most accessible options globally.

- Antigua and Barbuda, Dominica, Egypt, North Macedonia, St. Kitts and Nevis, St. Lucia, Grenada, and Nauru fall within this lower investment bracket.

- Jordan, Malta, and Turkey require higher investment levels, typically between $400,000 and $750,000, reflecting stricter eligibility and benefits.

- Austria stands apart with no fixed price, requiring a substantial contribution assessed on a case-by-case basis.

- The Caribbean dominates the lower-cost citizenship market, offering faster processing and simplified requirements.

- European programs generally demand higher capital commitments tied to residency, property investment, or economic contribution.

Golden Visa Statistics Overview

- Portugal has issued Golden Visas to approximately 17,700 main applicants, alongside 24,887 family residence permits.

- Portugal’s Golden Visa investments reached over €7.3 billion at the end of 2023.

- 24,887 family residence permits issued in Portugal highlight strong dependent inclusion.

- UAE Golden Visa issuance expanded to around 158,000 in 2023.

- Latvia’s 2025 surge reflects increasing European diversification in investor interest.

- Greece reported 17,254 visas issued in a single month in 2025.

- Global rankings place Greece ahead of Portugal in overall program strength.

- Indonesia issued 1,012 permits between July 2024 and September 2025.

Top Golden Visa Countries by Popularity

- Portugal approved 4,987 Golden Visas in 2024, a 72% year‑on‑year increase that set a new record.

- UAE Golden Visa program projected to issue up to 309,285 visas by the end of 2025.

- Greece topped the 2025 Global Residence Program Index with a score of 73/100.

- Latvia issued 44 main applicant approvals in H1 2025, on track for 51% annual growth.

- Indonesia’s Golden Visa attracted $2.9 billion (Rp 48 trillion) in investments with over 1,000 permits issued.

- Spain fully suspended its Golden Visa program effective April 3, 2025, shifting investor interest elsewhere.

- Italy’s Golden Visa saw the highest net popularity increase with 209 applications and a 62.6% growth rate.

- UAE attracted 9,800 millionaires in 2025, bringing $63 billion in investable wealth.

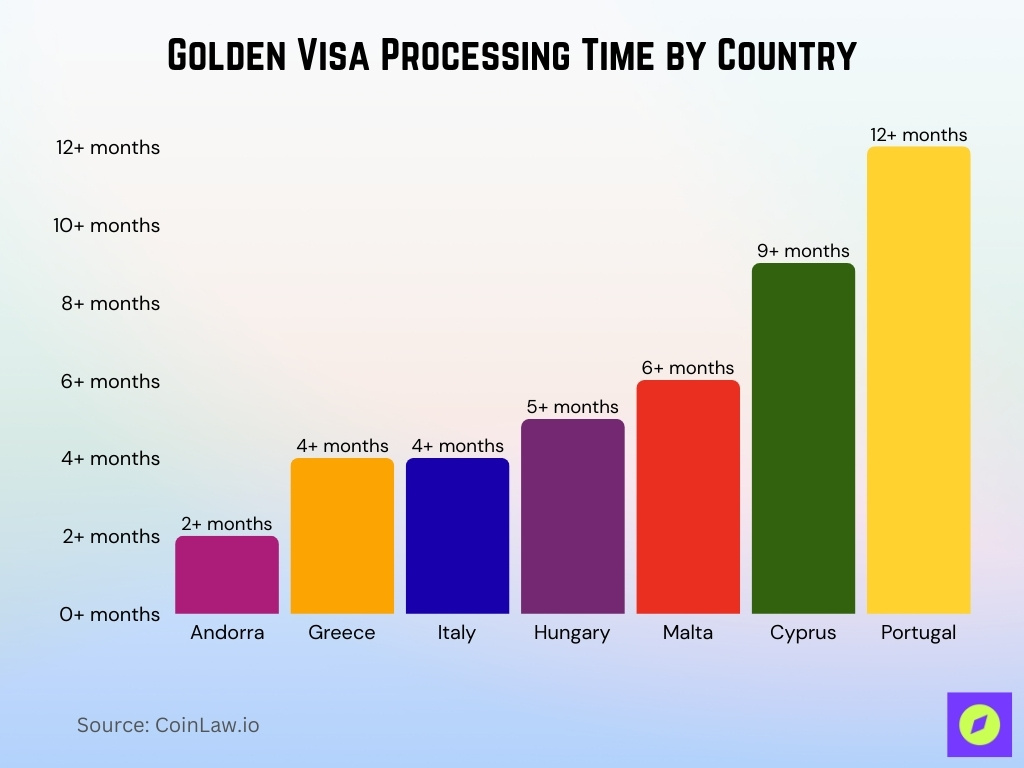

Golden Visa Processing Time by Country

- Andorra offers one of the fastest routes, with Golden Visa approvals typically taking 2+ months.

- Greece and Italy process Golden Visa applications in around 4+ months, making them relatively quick European options.

- Hungary follows closely, with an average processing timeline of 5+ months.

- Malta requires a longer review period, with approvals generally taking 6+ months.

- Cyprus has slower processing, often exceeding 9+ months due to enhanced due diligence.

- Portugal records the longest timelines, with Golden Visa approvals taking 12+ months, reflecting high demand and administrative backlogs.

Golden Visa Investment Inflows

- Portugal investors have injected over €7.3 billion since 2012.

- Capital funds increased their share of Portuguese Golden Visa investments through 2025.

- Indonesia’s Golden Visa generated around Rp48 trillion (~$2.9 billion) by September 2025.

- UAE real estate policy changes in 2024 boosted investment inflows.

- Latvia’s capital inflows align with its 51% application growth.

- Greece continues to rely on real estate and investment funds.

- Spain’s exit redirected investor capital to other European programs.

- EU‑wide competition shapes where Golden Visa capital is allocated.

Residence Permits Issued

- Portugal issued approximately 17,700 Golden Visas to main applicants and 24,887 permits to family members.

- In 2024, Portugal approved nearly 4,987 Golden Visas, a 72% increase from 2023.

- Indonesia issued more than 1,012 permits between July 2024 and September 2025.

- UAE Golden Visa issuance grew from ~47,150 in 2021 to 158,000 by 2023.

- Greece issued 17,254 Golden Visas in July 2025 alone.

- Greece reduced application backlogs by around 10% within three months in 2025.

- EU programs generally include spouses and minor dependents without extra investment.

- Spain issued 22,430 visas before ending the program in April 2025.

Applicants by Nationality

- China historically led with 10,000+ Portugal Golden Visa main applicants since 2012.

- USA received 567 permits in 2023, marking the top nationality for Portugal.

- Brazil secured 200+ Portugal Golden Visa permits, remaining one of the top five nationalities in the program.

- UAE Golden Visa attracted Indians, Pakistanis Russians among the top nationalities.

- Indonesia’s Golden Visa drew applicants from 61 countries.

Investor Demographics

- Family inclusion accounts for over 60% of Portugal applications.

- Americans became a key investor group in Portugal in 2025.

- UAE attracts both investors and skilled professionals.

- Corporate investors represent 96% of Indonesia’s Golden Visa capital.

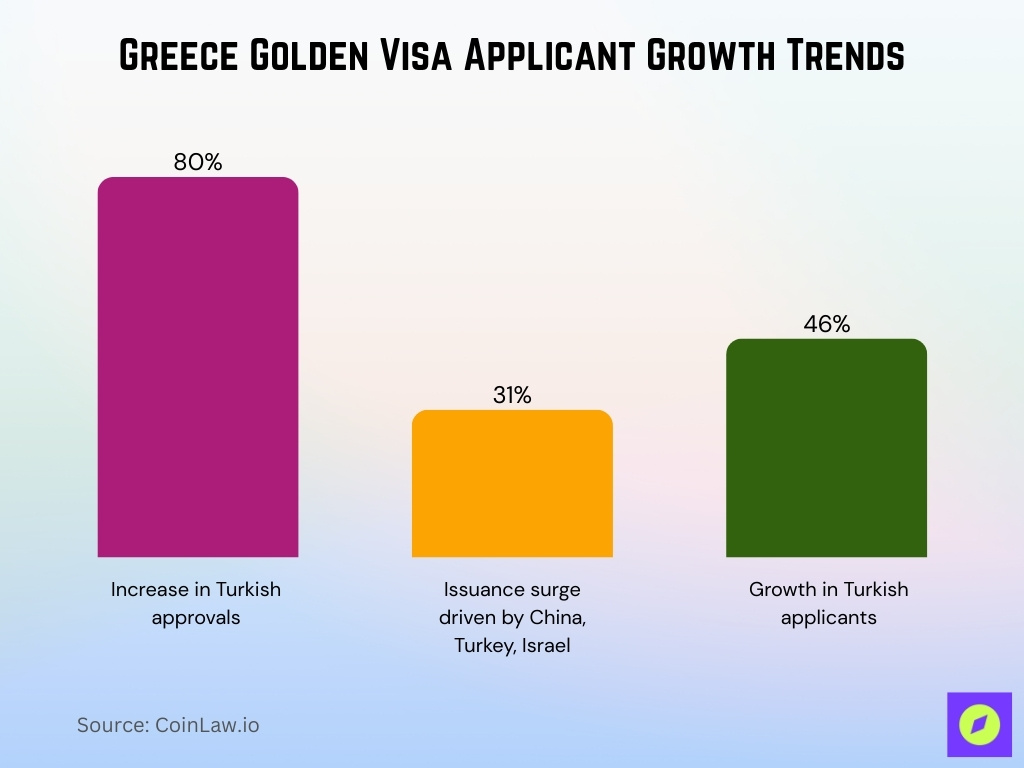

- Greek investor trends reflect regional geopolitical pressures.

- Typical investor age ranges from 35 to 60.

- Talent‑focused programs attract younger professionals.

Approval and Rejection Rates

- Portugal’s Golden Visa approval rate exceeds 90%.

- Portugal approvals increased by 72% year‑on‑year in 2024.

- Administrative transitions in 2025 caused longer processing times in Portugal.

- Indonesia’s early‑stage program shows high approval momentum.

- UAE approval rates remain undisclosed, but issuance volumes suggest strong acceptance.

- Greece approvals rose steadily across 2024–2025.

- EU rejection rates remain relatively low due to broad eligibility.

- Some programs tightened approvals following policy reforms.

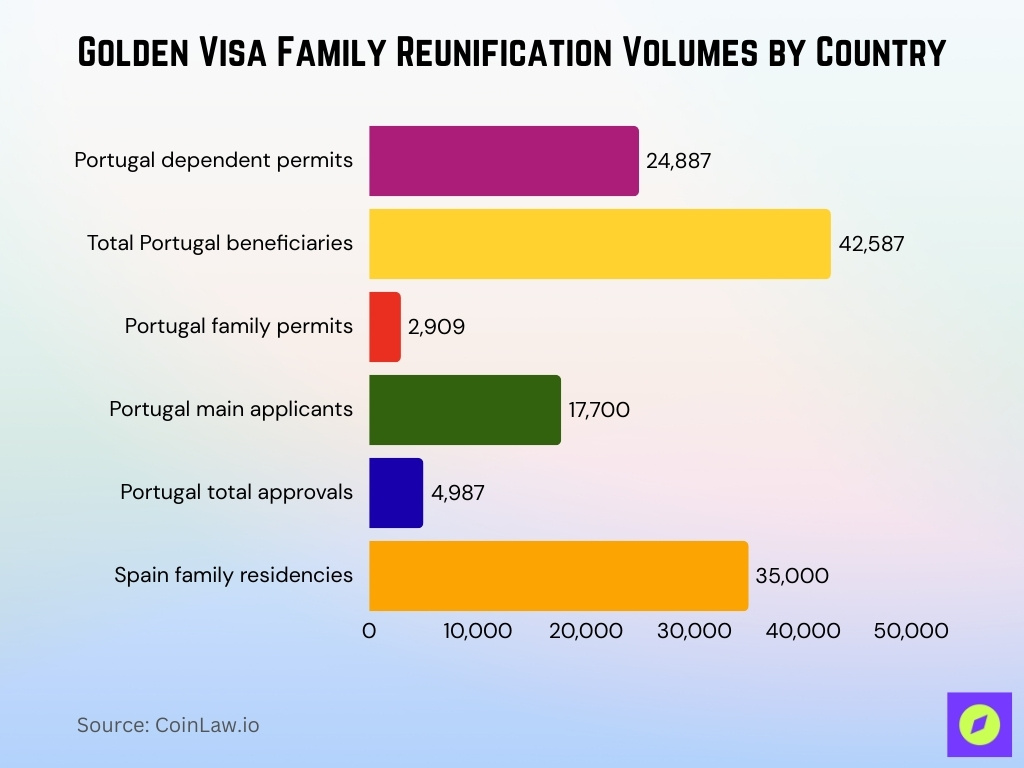

Family Reunification Statistics

- Portugal issued 24,887 permits to Golden Visa dependents since the program’s launch.

- Family members represent 58% of the total 42,587 Portugal Golden Visa beneficiaries.

- Portugal granted 2,909 family reunification permits.

- Portugal’s 17,700 main applicants brought 24,887 dependents, averaging 1.4 per investor.

- Family reunification drove 72% growth in Portugal Golden Visa approvals to 4,987.

- Spain granted nearly 35,000 family member residencies before the program suspension.

Application Volumes by Year

- In 2024, Portugal approved 4,987 Golden Visas, representing a 72% increase in approvals compared with 2023.

- Residence permits increased steadily prior to the real estate route closure.

- UAE issuances rose to 158,000 by 2023, with growth continuing.

- Greece saw year‑on‑year increases through mid‑2025.

- Indonesia surpassed 1,000 permits within its first year.

- Newer investor visas expanded sharply in 2025.

- Spain’s exit reshaped EU application volumes.

- Global demand remains above pre‑pandemic levels.

Golden Visa Contribution to Real Estate Markets

- Real estate once accounted for over 79% of Portugal’s Golden Visa investment.

- Lisbon and Porto saw price pressures linked to Golden Visa demand.

- Spain ended its program in April 2025 over housing concerns.

- Greece maintains property thresholds from €250,000 to €800,000.

- Greece issued 17,254 visas between January and July 2025.

- Turkey, Cyprus, the UAE, and Hungary continue property‑linked programs.

- Investors favor real estate routes with residency benefits.

Investment Types Breakdown

- Portugal fund investments rose to 28.6% of approvals from 0.6% in 2019.

- Real estate accounted for 68.3% of Portugal Golden Visa investments in 2023.

- UAE real estate Golden Visa threshold set at AED 2 million ($545,000).

- UAE business investment demands AED 2,000,000 paid-up capital minimum.

- Greece fund investments start at €350,000 versus €250,000-€800,000 property.

- Portugal’s capital transfer investments totaled €20.8 million in 2023.

- Caribbean Golden Visas blend donations from $100,000 with property options.

Pathways to Permanent Residency and Citizenship

- Portugal requires 10 years of legal residence for citizenship (5 years Golden Visa + 5 years permanent residency).

- Greece grants citizenship after 7 years of continuous residency with 183 days of annual presence.

- Caribbean CBI programs deliver citizenship in 3-6 months of processing time.

- Malta citizenship requires 1 year of residency post-Golden Visa approval.

- St Kitts & Nevis citizenship is obtainable in at least 6 months via investment.

- UAE Golden Visa offers no path to citizenship regardless of residency duration.

- Portugal’s permanent residency is eligible after 5 years of Golden Visa maintenance.

- Greek citizenship demands A2-level Greek language proficiency after 7 years.

Golden Visa Program Changes and Policy Updates

- Portugal eliminated the real estate option effective October 2023, shifting to funds.

- Spain terminated new Golden Visa applications after April 3.

- Bahrain reduced the Golden Residency real estate minimum from BHD 200,000 to BHD 130,000 (35% cut).

- UAE added 5 talent categories (healthcare, education, gaming content maritime) for the Golden Visa.

- Greece captured 8% market share vs Portugal’s 25% in 2025 rankings.

- Portugal extended citizenship residency from 5 to 10 years for non-CPLP nationals.

Future Outlook for Golden Visa Programs

- The investment migration market is projected to reach $100 billion globally.

- UAE expected to attract 9,800 millionaires with $63 billion investable wealth.

- US is forecasted to gain 7,500 high-net-worth individuals.

- UAE Golden Visa issuances projected at 266,625-309,285 total.

- 142,000 high-net-worth individuals expected to relocate worldwide.

- Fund-based models now represent 28.6% of Portugal approvals, driving longevity.

- Middle East wealth inflows surge 36.1% year-over-year.

- Global RCBI revenue growth sustained at a compound annual rate of $100 billion.

Frequently Asked Questions (FAQs)

About 13,000 residence permits have been issued to Portugal Golden Visa investors since the program began.

Portugal Golden Visa investments totaled approximately €654,292,327.91 in the most recent reporting period.

An estimated 31,000+ individuals obtained permanent residence‑by‑investment in Greece, injecting over €2.6 billion into the Greek economy.

Latvia’s Golden Visa program was on track for 51% annual growth as real estate investment rebounded.

Conclusion

Golden Visa programs continue to shape global investment and migration patterns. Real estate‑linked routes are declining in some markets, while funds, business creation, and strategic investment categories rise. Greece and the UAE stand out for sustained demand, even as traditional leaders like Portugal adapt their frameworks. Policy shifts aim to balance economic gains with housing and social equity concerns. Looking forward, investor mobility, diversified investment models, and tailored residency‑to‑citizenship pathways will define this dynamic space for years to come.