Imagine this: You’re at a bustling café in New York, enjoying your coffee while casually tapping your phone to pay for your order. This seamless experience is no longer a luxury; it’s a global reality. Over the last few years, payment networks have transformed the way we transact, bridging geographical barriers and redefining financial accessibility. The evolution of global payment networks is more significant than ever, with trends like cross-border payments, mobile adoption, and crypto innovations reshaping the financial landscape. Let’s dive into the stats and milestones shaping this dynamic industry.

Editor’s Choice

- Global digital payment revenue is projected to exceed $11.5 trillion in 2025, marking a growth of 15% compared to 2024.

- Visa processes approximately 65 billion transactions per quarter and over 260 billion annually in 2025, remaining the largest payment network globally.

- Mastercard’s net revenue grew by 17% in 2025, totaling $8.1 billion for Q2 alone, reinforcing its expanding footprint.

- In 2025, about 67% of adults globally use digital payments, as digital wallet users surpass 5.5 billion worldwide.

- The adoption of real-time payments increased by 37.2% globally in 2025, reaching a market size of $34.16 billion.

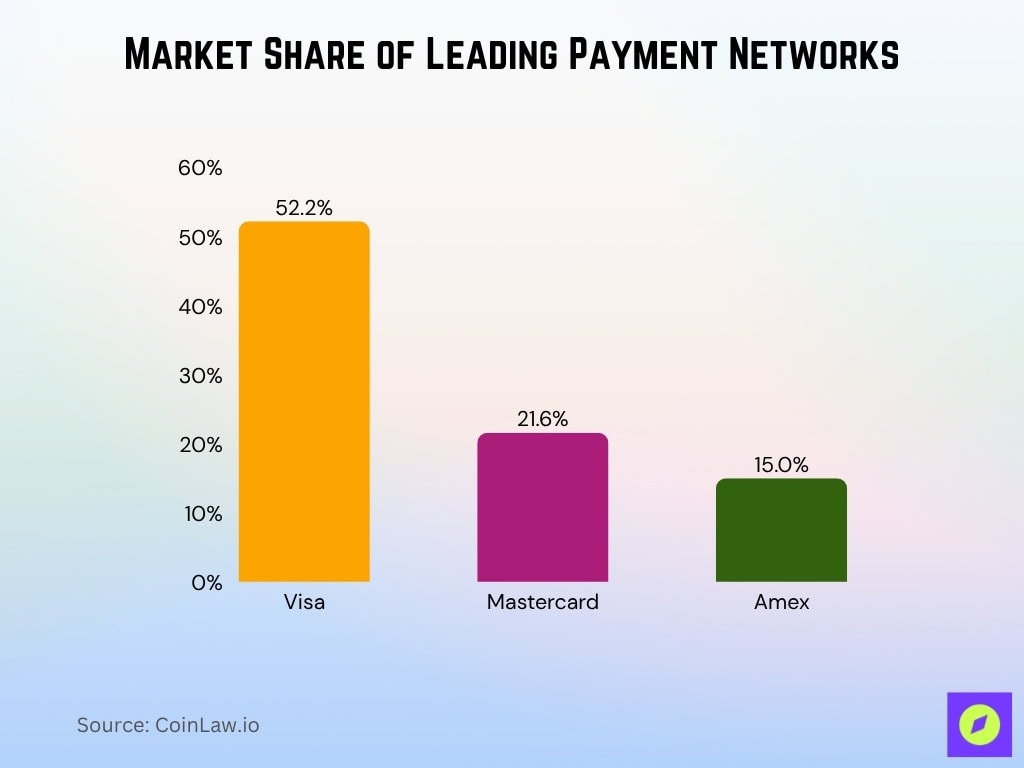

Market Share of Leading Payment Networks

- Visa holds a 52.2% global credit card market share in 2025, with Mastercard at 21.6% and Amex at 15%.

- American Express commands 25.1% of the global premium segment, processing $1.72 trillion in transactions and earning $53.2 billion in revenue for 2025.

- UnionPay accounts for approximately 36% of global card transactions, while M-Pesa dominates Kenya’s domestic mobile money market with over 90.9% share.

- PayPal processed $443.5 billion in total payment volume for Q2 2025, with active accounts climbing to 438 million globally.

- Apple Pay controls 49% of U.S. mobile wallet users and is accepted at 85-90% of U.S. merchants in 2025.

- BitPay processed $1.38 billion in crypto payments and 3.8 million transactions in 2025, with 22 new cryptocurrencies supported.

- In Africa, M-Pesa holds 90.9% of mobile money transactions, while Airtel Money retains 9.1% market share with 47 million users in June 2025.

Revenue and Transaction Volumes

- The global payments industry generated $2.5 trillion in revenue in 2025, with a projected 4% annual growth rate.

- Visa’s transaction volumes reached $14.5 trillion in 2025, securing its position as market leader.

- Mastercard’s gross dollar volume climbed to $9.2 trillion in 2025, supported by a 9% year-over-year increase.

- PayPal’s revenue hit $32.2 billion in 2025, while active accounts surpassed 438 million globally.

- Digital wallets contributed 50% of global e-commerce sales value, totaling over $2.95 trillion in 2025.

- The average value of a retail cross-border transaction is estimated to be in the $600–$720 range in 2025, varying by sector, with higher averages seen in B2B payments.

- Real-time payment systems processed over 107 million transactions in Q2 2025 alone (specifically the U.S. RTP network), with a 195% year-over-year value jump to $481 billion.

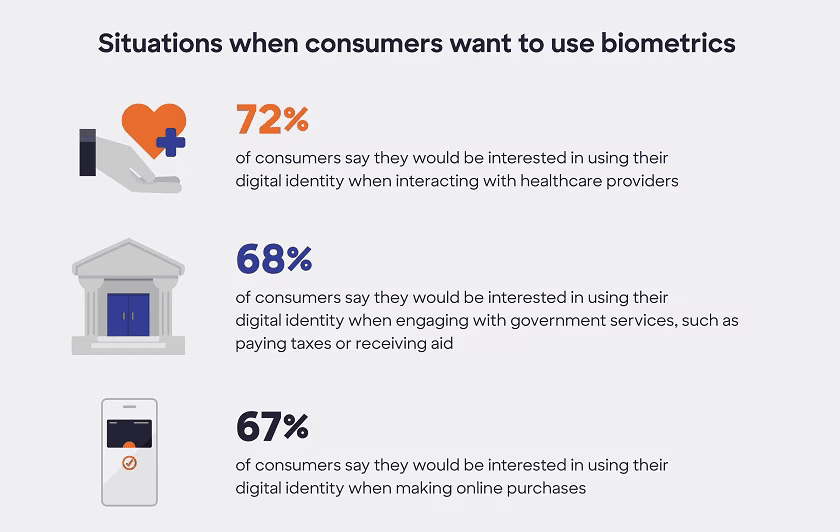

Situations When Consumers Want to Use Biometrics

- 72% of consumers are interested in using their digital identity for healthcare interactions, such as verifying identity with hospitals or clinics.

- 68% of consumers would use their digital identity for government services, including paying taxes or receiving financial aid.

- 67% of consumers are open to using their digital identity for online purchases, enhancing checkout security and convenience.

Regional Analysis of Payment Network Usage

- North America’s digital wallet adoption hit 76% of consumers in 2025, with consistent growth in monthly active users.

- In Europe, 88% of card payments were contactless in 2025, supported by strong regulation and widespread NFC use.

- China captured over 90% of global mobile payment transactions in 2025, with Alipay and WeChat Pay processing $20.1 trillion and holding 95% of the market.

- India’s UPI processed 20.01 billion transactions in August 2025, with the annual FY2025 total reaching 185.8 billion transactions worth ₹199.89 trillion, powering 82% of real-time payments.

- Africa’s mobile money ecosystem reached 562 million users in 2025, handling $495 billion in yearly transactions.

- Latin America saw 60% of consumers adopt digital payments in 2025, while cash use dropped to 31% across the region.

- Southeast Asia’s digital payments market is projected to hit $3 trillion by the end of 2025, expanding at an 18% CAGR.

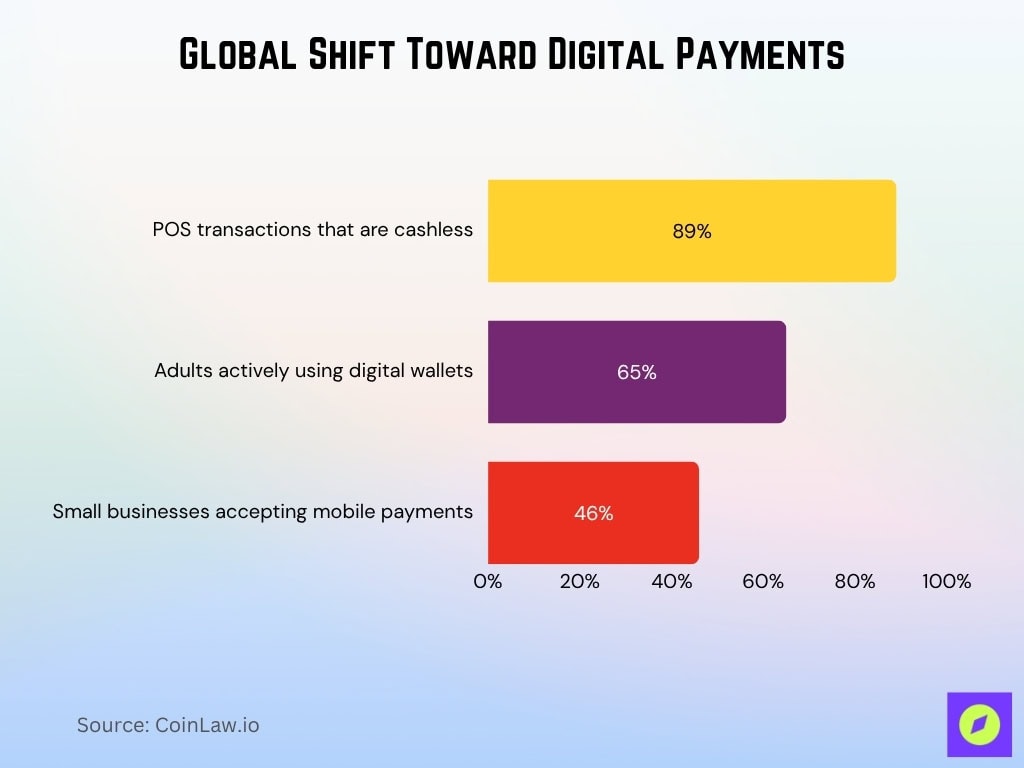

Increasing Use of Digital Payments

- Over 89% of global POS transactions in 2025 are cashless, signifying a sharp move toward digital payment methods.

- In the United States, 65% of adults actively use digital wallets as of mid-2025.

- 46% of small businesses worldwide accept mobile payments in 2025.

- QR code payments reached $3.0 trillion worldwide in 2025, with Asia-Pacific accounting for 60% of total volume.

- Mobile money usage in Sub-Saharan Africa hit 40% of adults in 2025, with regionwide account ownership rising to 58.2%.

- E-commerce payments now constitute over 70% of all digital transactions globally, driven by the ongoing expansion of online shopping.

- Super apps are increasingly popular in the Asia-Pacific region, where 65% of users prefer all-in-one platforms. They significantly contribute to mobile wallet adoption, which is projected to reach $14 trillion globally in 2025.

Security Advancements

- Global payment fraud losses are expected to hit $50 billion in 2025, though AI and biometrics helped merchants cut fraud by 15%.

- Tokenized payments now make up 35% of e-commerce transactions, with ~80% of enterprises and 75% of financial providers using tokenization in 2025.

- Over 60% of large enterprises adopted passwordless or multi-factor authentication in 2025, while 50% use payment tokenization.

- Biometric payments are valued at $46.38 billion in 2025 and are used in an increasing share of in-store and mobile transactions.

- Real-time fraud detection saved businesses $20–22 billion in potential losses in 2025 through instant AI-driven anomaly detection.

- Blockchain cut transaction times by up to 88%, enabling cross-border settlements in under 3 minutes in 2025.

- Cybersecurity spending in financial services hit $212 billion in 2025, rising 15% year-over-year as security remains a top priority.

Cryptocurrencies and Future Trends

- Bitcoin dominates with 42% of global crypto transactions in 2025, maintaining its lead in payment usage.

- Stablecoins (USDT, USDC, FDUSD) processed over $4 trillion in transactions from January to July 2025, making up 40%+ of all crypto payments.

- Visa and Mastercard now support crypto-linked cards for millions of merchants, including over 60 million Bitget Wallet Card users worldwide.

- CBDC development expanded in 2025, with 49 countries in pilot stages and 4 countries (Jamaica, Bahamas, Nigeria, Zimbabwe) fully launched.

- Global crypto ATMs surpassed 45,000 installations in 2025, improving fiat-to-crypto access and convenience.

- Blockchain-based payments cut remittance costs by 40–80%, enabling faster, cheaper global money transfers.

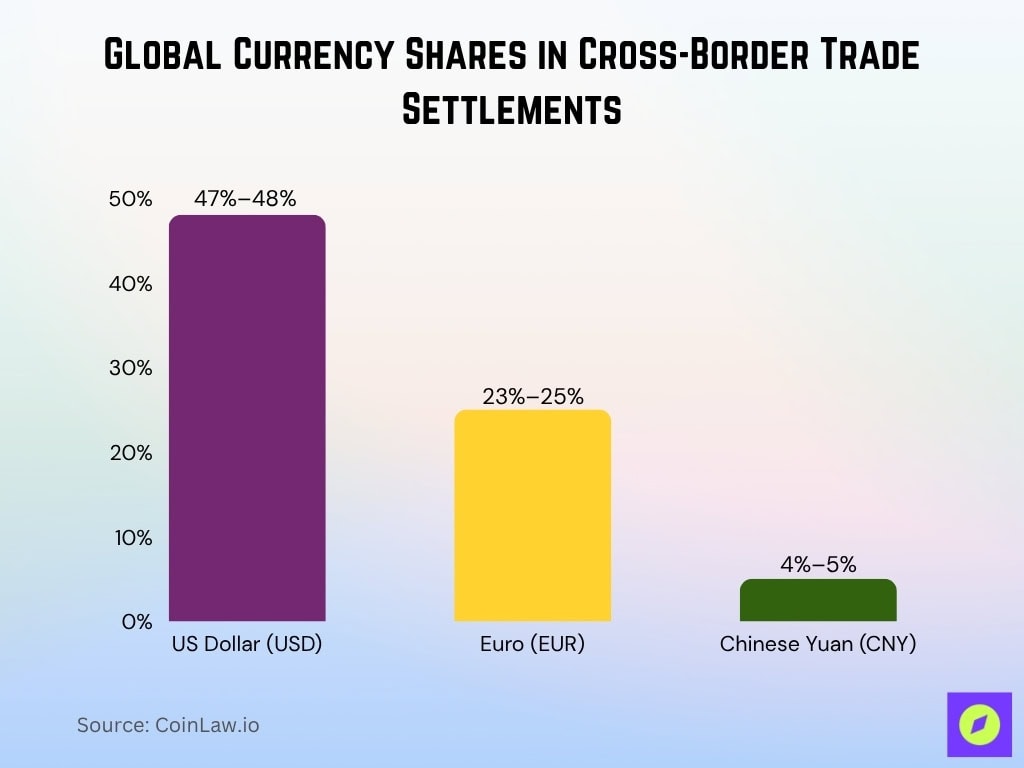

Global Currency Shares in Cross-Border Trade Settlements

- The US Dollar (USD) remains the leading currency for global trade settlements, accounting for approximately 47%–48% of total transactions according to the latest 2025 data from the IMF and Federal Reserve.

- The Euro (EUR) continues as the second most-used currency, holding a share of about 23%–25% in cross-border payments and trade, as reported by the IMF and European Central Bank.

- The Chinese Yuan (CNY) has seen significant growth, now representing around 4%–5% of global cross-border settlements, based on data from the IMF and China’s State Administration of Foreign Exchange.

- These figures confirm that while the dollar’s dominance persists, there is a consistent increase in the use of the yuan and a steady presence of the euro in international trade.

Cross-Border Payments

- Cross-border payment flows are projected to surpass $194 trillion in 2025, driven by expanding global trade and e-commerce.

- Fintechs like Wise and Payoneer cut transaction fees by up to 85%, charging under 1% per transaction compared to traditional banks.

- RippleNet’s On-Demand Liquidity achieved settlement in as fast as 10 seconds for 93% of global transfers in 2025, far ahead of SWIFT’s 1–3 business days.

- Over 70% of businesses in developed markets use digital platforms with embedded finance for international payments.

- The global remittance cost averaged 4.26% in Q1 2025, down from 7.36% in 2020, advancing UN sustainability targets.

- Europe accounted for 46% of global retail cross-border payments in 2024, with B2B outbound volumes forecasted to reach $25.9 trillion by 2032.

- ISO 20022 standards gained universal adoption in 2025, enabling seamless global payment interoperability ahead of the November 2025 deadline.

Mobile Payment Adoption

- Global mobile payment adoption reached 3.2 billion users in 2025, with NFC-enabled mobile wallets projected to surpass 2 billion active users globally by 2025, showing strong growth across Asia, Latin America, and Africa.

- Apple Pay held a 49% US market share in 2025, serving over 65.6 million users and accounting for 53.7% of in-store mobile wallet transactions.

- Alipay and WeChat Pay controlled 95% of China’s mobile payments, serving 1.38 billion WeChat users and 980 million Alipay users.

- India’s UPI-driven mobile payments grew 18% in 2025, surpassing 130 billion transactions and making up over 75% of national volumes.

- Latin America’s mobile payment market grew at a 13–14% CAGR in 2025, led by Brazil and Mexico.

- Contactless payments now represent approximately 45% of all card transactions worldwide, with NFC-based contactless payments accounting for 58–65% of in-store digital transactions in the U.S., exceeding $17 trillion in global transaction value.

- Mobile wallet loyalty programs boosted engagement, with 65% of users preferring apps offering rewards and real-time benefits.

Challenges in the Payment Industry

- Global payment fraud losses are expected to exceed $50 billion in 2025, despite continued investment in fraud prevention technologies.

- Small businesses pay 1.5%–3.5% of revenue in processing fees, with online gateway costs averaging 2.9% + $0.30 per transaction.

- Interoperability challenges persist across 45–50% of cross-border payment corridors due to non-standardized payment protocols.

- Cyberattacks on payment networks rose by 18% year-over-year in early 2025, with ransomware and phishing as the leading threats.

- 42% of businesses cite technology costs and change management as the main barriers to digital payment adoption.

- 73% of global payment providers report ongoing or new compliance issues caused by complex, divergent regulations.

- Blockchain-related energy use remains high at 110–120 terawatt hours annually, driving adoption of Proof-of-Stake and carbon-neutral solutions.

Payment Failures and Their Impact

- Failed payment transactions are expected to cost businesses over $129 billion globally in 2025, driven by abandoned purchases and declined authorizations.

- Real-time payment outages impacted 15% of global financial institutions in 2025, causing transaction delays and operational risks.

- Over 60% of failed transactions result from insufficient funds, expired cards, or incorrect payment details.

- Payment disruptions caused an average of 22 minutes of downtime per incident in 2025, damaging customer trust and retention.

- Refund delays left 34–35% of consumers dissatisfied, increasing complaints and reputational risks for providers.

- Mobile payment platforms saw a 7% failure rate in emerging markets due to poor internet and infrastructure.

- Businesses lost an average of 12% of repeat customers in 2025 because of unresolved payment issues and poor handling.

Recent Developments

- Visa acquired Pismo for $1 billion in July 2025, expanding real-time payment support across Latin America, Asia-Pacific, and Europe.

- Mastercard launched AI-powered fraud detection in 2025, cutting fraud rates by up to 20% and blocking suspicious transactions in under 50 milliseconds.

- PayPal integrated PYUSD stablecoin into the Stellar network in September 2025 to enable global business payments and instant settlements.

- Alipay and Tencent’s Weixin Pay launched China’s Cross-border Interconnection Payment Gateway, linking 31 wallets from 12 regions for tourists and expats.

- The EU advanced its digital euro project in 2025, releasing the “Rulebook” in October and launching a public pilot to promote CBDC adoption.

- Amazon Pay expanded BNPL installment options across thousands of online stores and added biometric palm recognition for in-store payments.

- The UN and fintech partners aimed to cut global remittance costs by 25% in 2025, bringing fees to 4.6% as fintechs handle 60% of all transfers.

Frequently Asked Questions (FAQs)

Global payment network transaction value is expected to reach $157 trillion in 2025.

Visa dominates with a 50.1% global market share in 2025, leading the market.

The number of digital wallet users is set to surpass 5.5 billion globally in 2025.

Digital payment market CAGR is projected at 13.59% from 2025 to 2033.

Contactless payments are forecast to account for approximately 65% of all in-store payments worldwide in 2025.

Conclusion

As global payment networks continue to evolve, they reshape how businesses and consumers interact financially. With digital wallets, real-time payments, and blockchain technology leading the charge, the landscape is becoming more inclusive, secure, and innovative. Despite challenges like cyberattacks and payment failures, industry advancements promise a future of seamless, interconnected financial systems. From the rise of cryptocurrencies to the integration of fintech solutions, today marks a pivotal year for payments worldwide.